In this article, we wanted to take a moment and try to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Leukemia.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Leukemia?

- Why do life insurance companies care if I have been diagnosed with Leukemia?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance”?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Leukemia?

Yes, individuals who have been previously diagnosed with Leukemia can and often will be able to qualify for a traditional term or whole life insurance policy. However, your approval can depend on several factors, including the type of Leukemia, the stage of the disease, and your overall health.

Why do life insurance companies care if I have been diagnosed with it?

Life insurance companies care if you have been diagnosed with Leukemia because it is a severe health condition that can impact your life expectancy. As a result, they consider individuals with a history of Leukemia to be at a higher risk to insure than those without the condition.

The insurance company’s primary goal is to manage risk and ensure that their pricing policies are appropriately based on the likelihood of a claim. If an individual has been diagnosed with Leukemia, the insurance company may charge a higher premium to cover the increased risk of a claim being made.

Additionally…

The insurance company may need to request additional medical information or conduct a medical exam to understand your health status better and assess the level of risk involved in insuring you. The underwriting process for individuals with a history of Leukemia may take longer than it would for someone without the condition, and additional requirements or restrictions may be placed on the policy. Ultimately, the insurance company’s goal is to strike a balance between providing coverage to individuals who need it and managing risk to ensure their financial stability.

Leukemia Defined:

Leukemia is a type of cancer that affects the areas of the body and is responsible for producing one’s blood. This would include the bone marrow and regions located throughout the lymphatic system. While there are many different types of Leukemia, there are four types that tend to be the most common, which will just be briefly mentioned below:

- Acute Lymphocytic Leukemia (AML)

- Acute Lymphocytic Leukemia is the most common type in children and typically begins within the B or T lymphocytes. From there, this form of Leukemia can spread to ones:

-

-

- Lymph nodes,

- Liver,

- Spleen.

-

-

- Acute Lymphocytic Leukemia is the most common type in children and typically begins within the B or T lymphocytes. From there, this form of Leukemia can spread to ones:

The good news regarding Acute Lymphocytic Leukemia is that the cure rate for AML is approaching 90%.

- Acute Myeloid Leukemia (AML)

- Acute Myeloid Leukemia is the most common type of Leukemia found in adults. This “type” of Leukemia can progress quickly and literally affect nearly any component of the blood. As a result, there are many different “sub-types” of AML that an individual can be diagnosed with.

- Survival rates for this “type” of Leukemia will vary significantly based on the age at which one is first diagnosed, with children fairing much better than adults with close to a 90% remission rate. As for adults, averages show that those diagnosed before 60 will tend to fare better than those older than 60, with a 27.4% five-year survival rate.

- Chronic Lymphocytic Leukemia (CLL)

- Chronic Lymphocytic Leukemia accounts for about 1/3 of all Leukemia cases and is usually more common in older adults. Chronic Lymphocytic Leukemia can present itself as either a slow and progressive disease or as a rapid, more aggressive form.

The good news is that with this type of cancer, the five-year survival rate is right around 83%; however, we should note that those over the age of 75 will see a drop in the five-year survival rate to around 70%.

- Chronic Myeloid Leukemia (CML)

- Chronic Myeloid Leukemia is the rarest form of Leukemia that we’re going to discuss here in this article and typically only represents about 10% of all new Leukemia diagnosed per year. These types of Leukemia occur when myeloid cells become genetically mutated into cancer cells, and unfortunately, this particular type of Leukemia can prove quite difficult to treat.

The good news is that even though this “type” of Leukemia can prove challenging to treat, the five-year survival rate is generally still above 70% across the board for all ages.

Common symptoms of Leukemia

Symptoms of Leukemia can vary depending on the “type” of Leukemia one might be suffering from. However, most will share many of the same symptoms, which we have chosen to list below:

- Fever or chills,

- Fatigue,

- Increased susceptibility to infections,

- Swollen lymph nodes,

- Enlarged liver or spleen,

- Easy to bleed,

- Frequent nosebleeds,

- Etc…

Now before anyone gets upset or complains about the simplicity of the definitions we’re using here, it’s essential to understand that we here at IBUSA aren’t medical experts or doctors. All we are is a bunch of life insurance agents who happen to be good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

Which means that…

Because we’re not going to be “diagnosing” your condition, all we need to do is understand the differences between these pre-existing medical conditions. Those differences are going to affect how a life insurance underwriter is going to consider you as a potential “risk.” The good news is that despite how simple our definitions of this disease may be, this is something we have down pat!

Which is why…

When we are approached by an individual who has been diagnosed with any of these “kinds” of conditions, we’re going to know right away what questions a life insurance underwriter is going to want to know the answers to before they will be willing to make any decision about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

If you have been diagnosed with Leukemia, the insurance company may ask for additional information about your diagnosis, such as:

- The type of Leukemia you have: There are several different types, including acute and chronic forms, and the insurance company may want to know which type you have.

- The stage of the disease: The insurance company may want to know how advanced Leukemia is and whether it is in remission.

- Any treatments you have received or are currently receiving: The insurance company may want to know what treatments you have received for your Leukemia, such as chemotherapy or a bone marrow transplant, and how effective they have been.

- Any other medical conditions: The insurance company may want to know if you have any other medical conditions related to your Leukemia or impact your overall health.

It is important to be honest and forthcoming when answering these questions, as the insurance company will use this information to assess your overall health and determine the terms of your policy.

What rate (or price) can I qualify for?

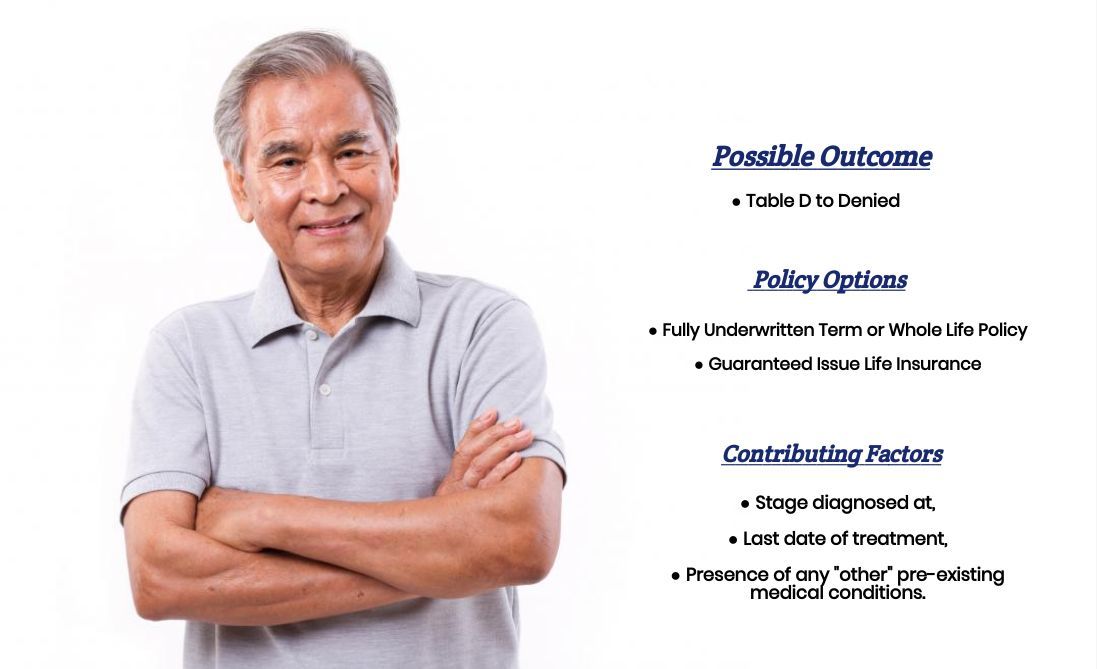

As you can see, many factors will come into play when determining what kind of “rate” an individual might qualify for after being diagnosed with Leukemia. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without speaking with you directly. That said, however we can make a few “assumptions” that will hold true and might give you a “general” idea about what rate you may qualify for.

For example, it’s pretty safe to say that if you are still actively treating your Leukemia (regardless of what kind it is) or you’ve just recently gone into remission (less than six months ago), chances are you’re not going to be able to qualify for a traditional term or whole life insurance policy.

This is because…

Most life insurance companies (if not all) are going to want to see that you have thoroughly gone into remission and that you can demonstrate that you have been cancer/symptom-free for a minimum of one year before they will begin to consider you “potentially” eligible for a traditional life insurance policy.

In the meantime, you may consider purchasing a Guaranteed Issue Life Insurance Policy or an Accidental Death Policy until you become eligible for a traditional life insurance policy.

But remember…

Just because an individual has gone into remission and has been “cancer-free” for one year, this does not automatically mean that an individual will be able to qualify for a traditional life insurance policy. All this means is that some life insurance companies will begin to consider you “potentially” eligible for an “At-risk” or “High-risk” classification.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance”?

If you have been diagnosed with Leukemia and are looking for life insurance coverage, there are a few things you can do to help ensure that you get the best policy for your needs:

- Work with an experienced agent: An experienced agent who works with individuals with health conditions like Leukemia can help you navigate the application process and find the best policy to fit your needs. They can also guide the underwriting process and help you understand what factors may impact your eligibility for coverage.

- Be upfront about your medical history: When applying for life insurance, it’s important to be honest and upfront about your medical history, including your Leukemia diagLeukemiaroviding accurate and complete information can help the insurance company assess the level of risk involved in insuring you and ensure that you receive an accurate quote.

- Gather and provide medical records: In addition to disclosing your medical history on the application, you may need to provide medical records to the insurance company to help them better understand your health status. This can include information about your diagnosis, treatment history, and current health status.

- Consider a guaranteed issue policy: If you have been diagnosed with leuLeukemiad and are having trouble finding traditional life insurance coverage, a guaranteed issue policy may be an option. These policies typically do not require a medical exam. They are available to individuals with certain health conditions but may have higher premiums and lower coverage amounts than traditional policies.

- Improve your overall health: Making positive lifestyle changes, such as eating a healthy diet, exercising regularly, and quitting smoking, can help improve your overall health and may make it easier to qualify for life insurance coverage. Additionally, following your doctor’s recommended treatment plan for leuLeukemian enables you to manage the condition and may improve your chances of qualifying for coverage.

I’ve been a Type 1 Diabetic for 36 years. I’m 37 years old. I haven’t been diagnosed with Leukimia but initial blood work taken shows that I have it, I should be diagnosed in the next week.

Tony,

Given your complex medical history, our best advice would be to call us when you have a chance so that we can discuss what options might be available to you.

Thanks,

InsuranceBrokersUSA