In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with Psoriatic Arthritis.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Psoriatic Arthritis?

- Why do life insurance companies care if I’ve been diagnosed with Psoriatic Arthritis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Psoriatic Arthritis?

Yes, individuals who have been diagnosed with Psoriatic Arthritis can and often will be able to qualify for a traditional term or whole life insurance policy. The problem is simply knowing that someone has been diagnosed with Psoriatic Arthritis isn’t going to be enough information for a life insurance underwriter to be able to make their decision about how they should “treat” your life insurance application.

This is why…

Suppose you have been diagnosed with Psoriatic Arthritis. In that case, you should be prepared to answer a series of medical questions about your condition and possibly allow a life insurance company to access your complete medical records to understand better how “mild” or “serious” your condition may be. It’s also why you may want to consider avoiding applying for a no-medical exam term life insurance policy and seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a medical condition like Psoriatic Arthritis.

Why do life insurance companies care if I’ve been diagnosed with Psoriatic Arthritis?

The main reason a life insurance company is going to “care” if you have been diagnosed with Psoriatic Arthritis is that, according to the Nation Psoriasis Foundation (NPF), individuals suffering from Psoriatic Arthritis are a 43% greater risk of suffering from a stroke and a 58% greater risk of suffering from some other “type” of cardiovascular issue, which is something that is going to cause a life insurance company to become a “bit” nervous.

For this reason, we wanted to take a moment to discuss Psoriatic Arthritis and highlight some of its most common symptoms/complications to understand better what a life insurance underwriter will be looking for when deciding on your life insurance application.

Psoriatic Arthritis Defined:

Psoriatic Arthritis is a type of Arthritis that will only affect someone who has also been diagnosed with Psoriasis (a skin disorder characterized by red patches of skin topped with silvery scales). In fact, most folks (but not all) who end up being diagnosed with Psoriatic Arthritis will first develop Psoriasis and then only later begin to suffer from joint problems.

Symptoms of Psoriatic Arthritis may include:

- Swollen, painful joints,

- Muscle stiffness,

- Sausage-like fingers and/or toes,

- Tendon and ligament pain,

- Classic Psoriasis skin rashes,

- Fatigue,

- Finger and toenail “changes”

- Eye problems,

Serious complications may include an increased risk of cardiovascular disease, including suffering from a heart attack or stroke.

Treatment options may include:

- Nonsteroidal anti-inflammatory drugs (NSAIDs),

- Disease-modifying antirheumatic drugs (DMARDs)

- Immunosuppressants,

- Etc…

Now, at this point, we usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s not so great if you’re seeking answers to specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Psoriatic Arthritis?

- Who diagnosed your Psoriatic Arthritis?

- What symptoms led to your diagnosis?

- Do you also suffer from physical symptoms of Psoriasis?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you ever suffered from a heart attack or stroke?

- How are you treating your Psoriatic Arthritis?

- Are you treating with any NSAIDs?

- Have you been prescribed Methotrexate or Prednisone?

- What symptoms do you suffer from now?

- Over the past 12 months, how has your condition changed (if at all)?

- In the past two years, have you been admitted to a hospital for any reason?

- Do you currently hold a valid driver’s license? If so, do you have any issues with your driving record, such as multiple moving violations, a DUI, or a suspended license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see, many variables can come into play when trying to determine what kind of “rate” an individual who has been diagnosed with Psoriatic Arthritis. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first speaking with you directly.

That said, however…

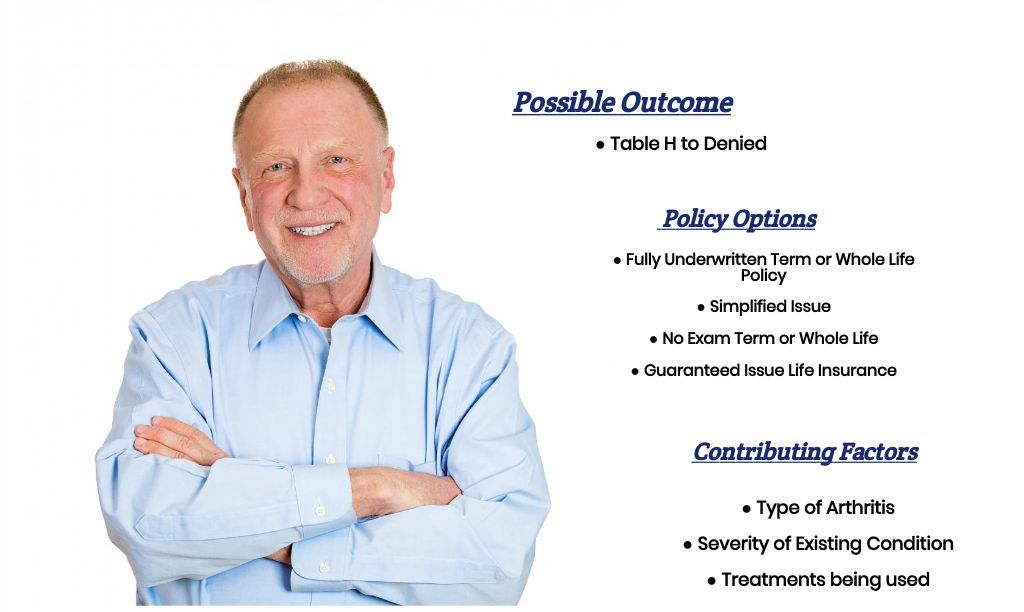

Most individuals who have been diagnosed with Psoriatic Arthritis will fall into one of three different categories, which are usually determined by the “severity” of the symptoms and the medications that you’re using to help treat your condition. While there will undoubtedly be some “subjectivity” when determining what kind of “rate” you might be able to qualify for, the following “assumptions” will generally hold.

Category #1.

Folks in this category will be those who have been diagnosed with Psoriatic Arthritis and may be using some kind of NSAIDs to help manage their inflammation but do not suffer from any other “significant” pre-existing medical condition and have been “totally” disabled due to their condition.

In cases like these…

We commonly find that qualifying for a traditional life insurance policy is possible; however, they will probably need to settle for a “sub-standard” table rate, usually somewhere between an A-C.

Category #2.

Individuals who fall into this category will be those who, in addition to possibly using some type of NSAID medication, may also be taking either Methotrexate or Prednisone to help them treat their Psoriatic Arthritis.

In cases like these, we’ll usually find that these clients may also qualify for a traditional term or whole life insurance policy, provided they don’t suffer from some other more “significant” pre-existing medical condition that may or may not be related to their Psoriatic Arthritis. The only real difference is that these folks may not qualify for a Table A-C rate and may have to settle for a Table rate somewhere between D and H,

Category #3.

The last group that we’ll commonly encounter when trying to help someone who has been diagnosed with Psoriatic Arthritis will be those who, in addition to taking one of the medications mentioned above, may also be considered somewhat disabled or incapable of performing the same tasks that they were before being diagnosed with Psoriatic Arthritis. The most common way that a life insurance underwriter will make this determination is if you currently receive some “type” of disability benefit.

In cases like these…

It still may be possible to qualify for a traditional life insurance policy. Some folks may need to consider a Guaranteed Issue Life Insurance Policy if they aren’t eligible for a conventional life insurance policy.

The good news is…

Regardless of your situation, we at IBUSA can help because we have extensive experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!