In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with a Seminoma or Testicular Cancer.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with a Seminoma or Testicular Cancer?

- Why do life insurance companies care if I’ve been diagnosed with a Seminoma or Testicular Cancer?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with a Seminoma or Testicular Cancer?

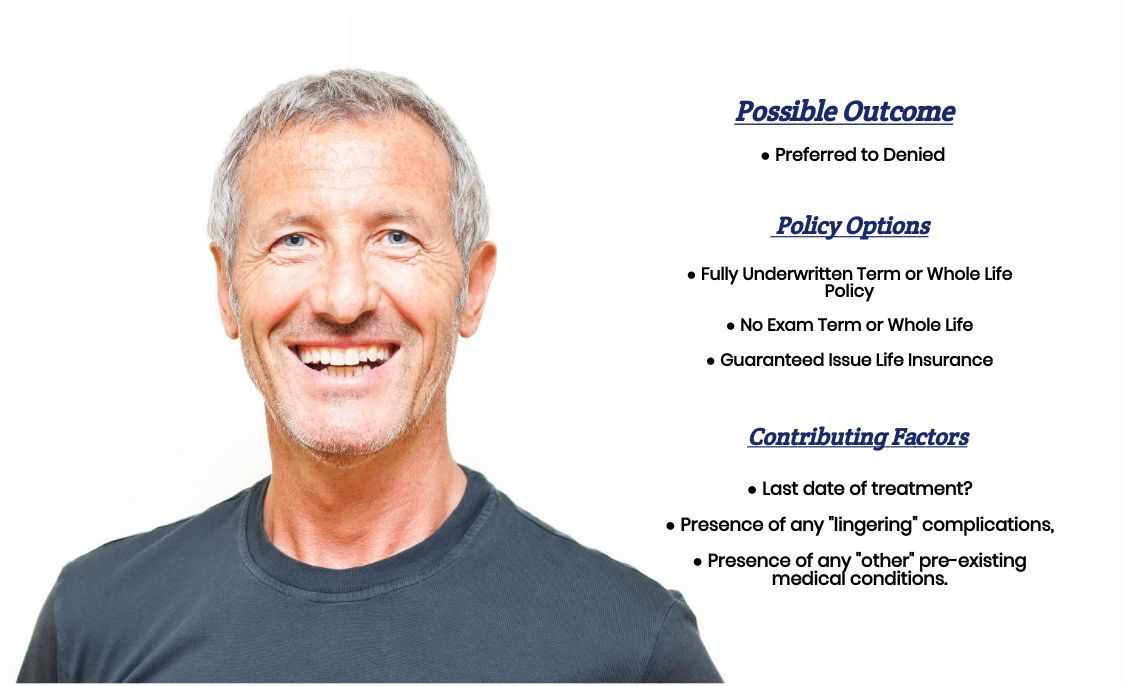

Yes, individuals who have been diagnosed with a Seminoma can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for a Preferred rate!

The only problem is…

That in order to be able to qualify for such a rate, most of the top life insurance companies are going to want to ask you a series of medical questions about your Seminoma and require one to be in remission (cancer-free) for a pretty significant amount of time.

It’s also why…

You may want to consider avoiding applying for a no medical exam term life insurance policy and seeing how these policies tend to be more difficult to qualify for after someone has been diagnosed with a pre-existing medical condition like a previous cancer diagnosis.

Why do life insurance companies care if I’ve been diagnosed with a Seminoma or Testicular Cancer?

Any time an individual is applying for a traditional life insurance policy after having been diagnosed with CANCER, it’s safe to say that most life insurance companies are going to “care” about it. In fact, with a lot of different types of cancer, simply having been diagnosed with it the past can potentially eliminate one’s ability to ever be able to qualify for a traditional life insurance policy at any rate!

Fortunately…

This simply isn’t the case when it comes to those who have been diagnosed with Testicular Cancer. It isn’t because Seminomas remain one of the most treatable and curable types of cancer that an individual can be diagnosed with, which is why some may frequently qualify for a traditional life insurance policy even be able to qualify at a Preferred rate.

For this reason…

We wanted to take a moment and discuss what a Seminoma is as well as highlight some of the most common symptoms/complications that can occur with this “type” of cancer so that we can gain a better understanding of what a life insurance underwriter will be looking for when making his or her decision about your life insurance application.

Seminoma Defined:

In most cases, a Seminoma is a germ cell tumor that is located within the testicle. In some cases, it may actually form within the mediastinum or other gonadal location. Fortunately, this malignant neoplasm is one of the most treatable/curable types of cancer that a male can develop, with survival rates exceeding 95% when diagnosed early. Symptoms may include the development of a painless mass within the scrotum itself, usually in males between the ages of 30 to 40.

In some cases…

These malignant cells can go on to invade the bloodstream and lymph system, spreading tumors to other parts of the body. This is why it is important to have a true medical professional check you out even if you suspect anything might be wrong.

Potential causes of Testicular Cancer may include:

- Abnormal testicular development,

- Exposure to certain toxins or chemicals,

- Previous family history or testicular cancer,

- Klinefelter syndrome,

- HIV infection,

- Etc…

Treatment options may include:

- Radiotherapy,

- Chemotherapy,

- Inguinal Orchiectomy,

Or your doctor may choose to just monitor the situation if it appears that your tumor may be benign.

“Which brings us to an important point that we think we ought to mention.”

First…

If you think you have a medical issue, don’t use the internet to try and diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being your own doctor could really harm yourself!

Second…

Nobody here at IBUSA is medically trained, and we’re certainly not doctors. All we ware is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance that they’re looking for. So please don’t mistake any of the medical information that we talk about as medical advice because it’s not!

We’re just…

Trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with a Seminoma or Testicular Cancer… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

If you are applying for life insurance coverage and have a history of testicular cancer, the insurance company will likely request detailed information about your diagnosis and treatment history. The specific information that the insurance company will ask for can vary depending on the insurer’s underwriting guidelines, but it may include:

- Date of diagnosis: The insurance company will want to know when you were diagnosed with testicular cancer and the stage of the disease at the time of diagnosis.

- Treatment history: The insurance company will want to know what types of treatments you received for testicular cancer, such as surgery, radiation therapy, or chemotherapy.

- Current health status: The insurance company will want to know about your current health status and whether you are in remission or have experienced a recurrence of the cancer.

- Prognosis: The insurance company may request information about your prognosis and your risk of experiencing a recurrence of the cancer.

- Follow-up care: The insurance company may ask about your follow-up care plan, including how often you see your doctor for check-ups and whether you are undergoing any ongoing treatment.

- Family history: The insurance company may also ask about your family history of cancer to assess your overall risk.

Additionally, the insurance company may request access to your medical records and may require you to undergo a medical exam to assess your current health status. Providing accurate and complete information to the insurance company can help ensure that you receive an accurate quote and that your policy provides the coverage you need.

What rate (or price) can I qualify for?

As you can see, there are many variables that can come into play when trying to determine what kind of “rate” an individual diagnosed with a Seminoma. This is why it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you directly.

That said, however…

Most individuals who have been diagnosed with a Seminoma will usually fall into one of three categories that we can make some “assumptions” about that will generally hold true.

Category #1.

The first group of folks that well encounter will be those who have just recently been diagnosed with a Seminoma and are currently treating it. In cases like these, what you’ll typically find is that most (if not all) life insurance companies will want to POSTPONE or DENY one’s application until which point that they are officially declared “cancer-free”. From there, they typically want to wait a minimum of six months just to make sure that an individual doesn’t develop any residual complications due to their previous diagnosis.

Category #2.

The second group of folks that we’ll commonly encounter will be those who have been previously diagnosed with a Seminoma but has subsequently been declared cancer-free for more than six months but less than ten years. In cases like these, we’ll commonly find that an individual will be able to qualify for a traditional term or whole life insurance policy however they probably won’t be able to qualify for anything better than a “Standard” rate and in all likelihood only be able to qualify for a “high risk” or “table rate”.

Table rates…

Are life insurance rates that are typically reserved for “higher risk” applicants and range from Table A, which would be considered the “best” or least expensive table rate, all the way to Table J which would be considered the “worst” or most expensive table rate.

Category #3.

The last group that we’ll commonly encounter will be those who have been diagnosed with and cure of a Seminoma over ten years ago. In cases like these, what we’ll commonly find is that provided an individual hasn’t suffered from multiple Seminoma or developed any other “kind” or pre-existing medical conditions, many life insurance companies will be willing to approve an individual for a Preferred rate provide they are able to meet all other requirements for such a rate.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss which is…

What can I do to help ensure that I get the “best life insurance” for me?

If you have been diagnosed with testicular cancer and are looking for life insurance coverage, there are a few things you can do to help ensure that you get the best policy for your needs:

- Work with an experienced agent: An experienced agent who specializes in working with individuals with health conditions like testicular cancer can help you navigate the application process and find the best policy to fit your needs. They can also provide guidance on the underwriting process and help you understand what factors may impact your ability to qualify for coverage.

- Be upfront about your medical history: When applying for life insurance, it’s important to be honest and upfront about your medical history, including your diagnosis of testicular cancer. Providing accurate and complete information can help the insurance company assess the level of risk involved in insuring you and ensure that you receive an accurate quote.

- Gather and provide medical records: In addition to disclosing your medical history on the application, you may need to provide medical records to the insurance company to help them better understand your health status. This can include information about your diagnosis, treatment history, and current health status.

- Consider a guaranteed issue policy: If you have been diagnosed with testicular cancer and are having trouble finding traditional life insurance coverage, a guaranteed issue policy may be an option to consider. These policies typically do not require a medical exam and are available to individuals with certain health conditions, but they may have higher premiums and lower coverage amounts than traditional policies.

- Improve your overall health: Making positive lifestyle changes, such as eating a healthy diet, exercising regularly, and quitting smoking, can help improve your overall health and may make it easier to qualify for life insurance coverage. Additionally, following your doctor’s recommended treatment plan for testicular cancer can help you manage the condition and may improve your chances of qualifying for coverage.

Now, will we be able to help out everyone who has been previously diagnosed with a Seminoma?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!