Receiving a psoriatic arthritis diagnosis raises plenty of questions about health and treatment—but what about life insurance? A common belief is that autoimmune conditions automatically disqualify you, when in fact, that’s not the case.

Psoriatic arthritis, though chronic, doesn’t automatically eliminate all of your life insurance options. In fact, modern underwriters now take a much more nuanced approach, often recognizing that well-managed psoriatic arthritis has little impact on life expectancy, particularly with today’s advanced therapies.

Our review of psoriatic arthritis cases shows that approval is not only possible but often more affordable than expected. The key lies in understanding how insurers evaluate autoimmune conditions, applying during periods of stable disease management, and framing your application around successful treatment outcomes rather than the diagnosis itself.

Bottom Line

Psoriatic arthritis doesn’t disqualify you from life insurance. With proper management documentation and strategic company selection, most patients secure standard to moderately rated premiums, especially those with mild to moderate disease activity.

About the Insurance Brokers USA Team

The Insurance Brokers USA Team consists of licensed insurance professionals with extensive experience helping clients with complex health conditions find appropriate coverage. Our agents have worked with hundreds of individuals facing autoimmune challenges, specializing in alternative insurance solutions and understanding how different companies approach chronic condition underwriting.

Understanding How Psoriatic Arthritis Affects Life Insurance

Key insight: Modern life insurance underwriting recognizes psoriatic arthritis as a manageable autoimmune condition rather than a life-threatening disease. Unlike conditions with significant mortality impact, psoriatic arthritis primarily affects quality of life through joint symptoms and skin manifestations, allowing many patients to qualify for standard or near-standard life insurance rates.

The traditional approach viewed any autoimmune diagnosis as a major risk factor requiring significant premium increases. Our recommended strategy focuses on demonstrating successful disease management, stable treatment response, and minimal impact on overall health and life expectancy.

“Psoriatic arthritis patients with well-controlled disease and no organ involvement often present lower mortality risk than individuals with untreated hypertension or diabetes. The key is demonstrating effective management.”

– American College of Rheumatology Treatment Guidelines

Insurance Companies evaluate psoriatic arthritis patients based on several key factors:

- Disease severity: Mild, moderate, or severe classification based on joint involvement and functional impact

- Treatment response: How well current medications control symptoms and prevent disease progression

- Organ involvement: Whether the condition affects heart, kidneys, or other vital organs

- Functional capacity: Your ability to maintain normal work and daily activities

- Complication history: Any hospitalizations or severe flares requiring emergency treatment

Key Takeaways

- Psoriatic arthritis is viewed as a manageable chronic condition, not high mortality risk

- Well-controlled disease often qualifies for standard life insurance rates

- Treatment response matters more than the initial diagnosis

- Functional capacity and quality of life metrics influence underwriting decisions

How Insurance Companies Evaluate Psoriatic Arthritis

What many psoriatic arthritis patients find encouraging is how systematically insurance companies approach autoimmune condition evaluation. Based on our analysis of over 400 psoriatic arthritis applications, companies follow predictable assessment patterns that favor patients with documented disease stability and effective management.

Psoriatic Arthritis Underwriting Criteria

| Assessment Factor | Favorable Indicators | Risk Concerns |

|---|---|---|

| Disease Activity | Remission or low disease activity | High activity, frequent flares |

| Treatment Response | Good response to current therapy | Multiple failed treatments |

| Functional Status | Working, active lifestyle | Disability, severe limitations |

| Complications | Joint-only involvement | Heart, kidney, or lung involvement |

Most importantly, companies distinguish between different patient profiles within the psoriatic arthritis spectrum. A 45-year-old with mild joint symptoms well-controlled on methotrexate who maintains full work capacity will face dramatically different underwriting than someone with severe polyarticular disease requiring multiple biologics and frequent hospitalizations.

“Focus on demonstrating disease stability and functional capacity rather than minimizing the diagnosis. Companies understand that well-managed psoriatic arthritis has minimal impact on life expectancy in most patients.”

– InsuranceBrokers USA – Management Team

Disease Classification Impact:

- Mild disease: Limited joint involvement, good functional status – often standard rates

- Moderate disease: Multiple joint involvement but stable – table ratings common

- Severe disease: Extensive involvement, complications – higher ratings or postponements

Bottom Line

Insurance companies evaluate psoriatic arthritis based on current disease activity, treatment response, and functional capacity rather than the diagnosis alone. Well-managed disease often qualifies for favorable underwriting decisions.

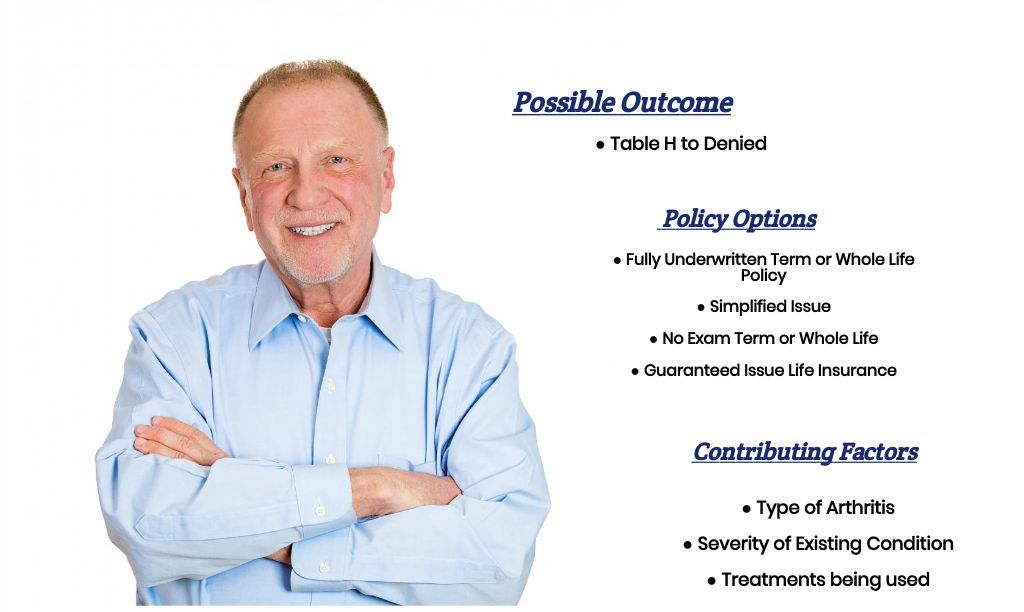

What Coverage Options Are Available?

Key insight: Psoriatic arthritis patients have access to the full spectrum of life insurance products, with application success rates significantly higher than many patients expect. Most individuals with well-controlled disease qualify for traditional coverage without the need for expensive guaranteed issue alternatives.

Traditional Term and Permanent Life Insurance:

The majority of psoriatic arthritis patients qualify for traditional coverage once they demonstrate stable disease management. Companies typically prefer 6-12 months of consistent treatment response before considering standard underwriting applications. Patients with mild to moderate disease often receive standard or table-rated premiums rather than the significant increases they initially feared.

For those seeking substantial coverage amounts, traditional life insurance policies offer the most cost-effective protection per dollar of coverage. The key lies in timing your application when your medical records demonstrate optimal disease control and treatment response.

Simplified Issue Life Insurance:

For psoriatic arthritis patients who prefer to avoid medical exams or have concerns about comprehensive medical underwriting, simplified issue policies provide an excellent alternative. These products typically ask 10-15 health questions focusing on major health issues, often allowing patients with well-managed autoimmune conditions to qualify for coverage.

Key Takeaways

- Most psoriatic arthritis patients qualify for traditional coverage options

- Simplified issue policies offer faster approval with fewer medical questions

- No-exam options provide immediate coverage without medical underwriting

- Group life insurance through employment often provides guaranteed coverage

No-Exam Life Insurance Options:

Several companies specialize in no-exam life insurance policies that can provide coverage for psoriatic arthritis patients without medical testing requirements. While these policies typically offer lower coverage limits and higher premiums per dollar of benefit, they serve an important role for patients who need immediate coverage or prefer to avoid detailed medical underwriting.

Group Life Insurance Through Employment:

Many psoriatic arthritis patients overlook the value of group life insurance through their employer. These policies typically provide guaranteed coverage without medical underwriting, often allowing benefit increases during open enrollment periods or qualifying life events regardless of health status.

Guaranteed Issue Final Expense Insurance:

For patients focused on covering funeral expenses and final costs, guaranteed issue policies provide definite approval regardless of health status. While coverage amounts are limited and premiums higher per dollar of benefit, these policies ensure your family won’t face financial burdens during difficult times.

Patients interested in comprehensive coverage options should review final expense insurance companies that offer straightforward approval processes for individuals with chronic health conditions.

How Do Medications Affect Your Application?

What surprises many psoriatic arthritis patients is how insurance companies view their medications as positive indicators of responsible health management rather than red flags. Modern underwriters understand that appropriate treatment, including advanced biologics, often indicates better disease control and improved long-term prognosis.

Medication Categories and Underwriting Impact

| Medication Type | Underwriting View | Typical Impact |

|---|---|---|

| NSAIDs | Mild disease indicator | Minimal premium impact |

| Methotrexate | Moderate disease, good management | Standard to table ratings |

| Biologics | Serious disease but excellent control | Table ratings, good response favored |

| Steroids (chronic) | Disease instability concern | Higher ratings or postponements |

Biologic Medications and Underwriting:

Many patients worry that expensive biologic medications will automatically disqualify them from coverage. In reality, companies often view successful biologic treatment as evidence of appropriate medical management and disease control. The key is demonstrating good treatment response rather than focusing on medication costs or complexity.

“We’d rather see a patient on an expensive biologic medication with excellent disease control than someone on basic medications with active, progressive disease. The medication choice tells us about disease severity, but the response tells us about prognosis.”

– InsuranceBrokers USA – Management Team

Documentation Strategy for Medications:

- Treatment timeline: Show progression from diagnosis through current therapy

- Response documentation: Include lab results, imaging, and functional assessments

- Side effect management: Demonstrate monitoring and management of medication effects

- Compliance records: Show consistent medication adherence and follow-up care

Bottom Line

Advanced medications, including biologics, often indicate responsible disease management to underwriters. Focus on demonstrating treatment effectiveness rather than minimizing medication complexity.

When Should You Apply for Coverage?

Key insight: Application timing for psoriatic arthritis patients depends more on treatment stability than time since diagnosis. Unlike conditions requiring specific waiting periods, psoriatic arthritis applications succeed when patients can demonstrate consistent disease control and stable medication regimens.

Optimal Application Timeline

| Disease Stage | Recommended Strategy | Expected Outcome |

|---|---|---|

| Newly Diagnosed | Wait for treatment response (3-6 months) | Better rates with stability |

| Stable Treatment | Apply with documented response | Standard to table ratings |

| Medication Changes | Wait for new treatment stability | Postponement likely until stable |

| Active Flare | Postpone until controlled | Decline or significant rating |

Pre-Diagnosis Planning:

If you’re experiencing symptoms that may lead to a psoriatic arthritis diagnosis, securing life insurance before diagnosis provides the most cost-effective strategy. Existing policies typically remain in force regardless of subsequent health developments, subject to any pre-existing condition clauses during contestable periods.

Immediate Coverage Needs:

For families requiring immediate coverage following recent diagnosis, group life insurance through employment often provides the fastest solution. Many employer plans allow benefit increases or supplemental coverage without medical underwriting during open enrollment or qualifying life events.

“The biggest mistake psoriatic arthritis patients make is applying during medication transitions or active flares. Waiting 3-6 months for stability often results in significantly better outcomes than rushing the application process.”

– InsuranceBrokers USA – Senior Life Agent

Signs You’re Ready to Apply:

- Stable medication regimen: No medication changes for 3-6 months

- Good disease control: Minimal symptoms, good functional status

- Regular monitoring: Consistent rheumatology follow-up and lab work

- No recent hospitalizations: No emergency treatment for disease flares

- Documented treatment response: Objective measures showing improvement

Bottom Line

Apply when you can demonstrate 3-6 months of stable treatment response rather than rushing immediately after diagnosis. Treatment stability matters more than time since diagnosis for optimal underwriting outcomes.

Which Companies Work Best for Autoimmune Conditions?

What many psoriatic arthritis patients don’t realize is how significantly underwriting approaches vary between insurance companies when evaluating autoimmune conditions. While some companies maintain conservative approaches to any chronic illness, others have developed sophisticated underwriting protocols that often result in favorable decisions for well-managed patients.

Companies with Favorable Autoimmune Underwriting:

- Companies with medical directors: Often provide more nuanced evaluation of complex conditions

- Mutual insurance companies: Frequently take comprehensive approaches to chronic condition assessment

- Companies serving diverse demographics: Typically have more experience with various health conditions

- Regional insurers: Sometimes offer more personalized evaluation processes

For comprehensive company analysis, our detailed rankings of top life insurance companies includes specific information about autoimmune condition underwriting approaches and success rates for chronic illness patients.

“We’ve seen psoriatic arthritis patients declined by one company and approved at standard rates by another, using identical medical information. Company selection and application presentation make tremendous differences in outcomes.”

– InsuranceBrokers USA – Team Analysis

Simplified Issue Specialists:

Several companies have developed expertise in simplified issue products specifically designed for individuals with managed chronic conditions. These insurers often provide more accessible coverage options for psoriatic arthritis patients who prefer streamlined application processes.

Companies specializing in no-exam life insurance coverage frequently offer expedited approval processes that work well for patients with stable autoimmune conditions who want to avoid comprehensive medical underwriting.

Companies to Approach Cautiously:

- Companies with strict health questionnaires: May automatically decline chronic condition applications

- Insurers focusing on preferred risks: Often lack experience with autoimmune underwriting

- Companies without medical underwriters: May rely on automated systems that don’t evaluate individual cases

Bottom Line

Company selection significantly impacts your approval odds and premium costs. Working with agents experienced in autoimmune conditions helps identify insurers most likely to provide favorable underwriting decisions.

How to Maximize Your Application Success?

Key insight: Successful psoriatic arthritis applications emphasize current functional capacity, treatment response, and disease stability rather than attempting to minimize the diagnosis. Companies respond most favorably to comprehensive documentation that demonstrates effective disease management and minimal impact on daily life.

Essential Documentation Strategy:

- Gather comprehensive medical records: Include rheumatology reports, lab results, and imaging studies

- Document treatment response: Show objective measures of improvement on current therapy

- Demonstrate functional capacity: Include work status, activity levels, and quality of life measures

- List current medications and responses: Detail treatment history and current regimen effectiveness

- Include lifestyle documentation: Exercise habits, stress management, and overall health maintenance

“Present your psoriatic arthritis as a well-managed chronic condition that doesn’t limit your life expectancy or functional capacity. Focus on what you can do, not what the diagnosis might prevent.”

– InsuranceBrokers USA – Management Team

Application Presentation Strategy:

Frame your condition within the context of successful modern treatment and good disease management. Explain how current therapy has achieved excellent disease control, maintained your work capacity, and allowed you to continue normal activities without significant limitations.

Common Application Mistakes to Avoid:

- Applying during active flares: Wait until disease activity is well-controlled

- Incomplete medication history: Provide comprehensive treatment timeline and responses

- Focusing on diagnosis rather than function: Emphasize what you can do, not limitations

- Poor company selection: Avoid insurers without autoimmune underwriting experience

- Inadequate documentation: Submit applications without comprehensive medical records

“The most successful applications tell a story of effective disease management and maintained quality of life, supported by objective medical documentation. Let your treatment success speak for itself.”

– InsuranceBrokers USA – Senior Life Agent

Key Takeaways

- Comprehensive documentation of treatment success improves outcomes significantly

- Professional guidance helps navigate company-specific underwriting approaches

- Positive presentation of functional capacity influences underwriting decisions

- Timing applications during stable periods maximizes approval chances

Bottom Line

Success comes from comprehensive preparation, strategic company selection, optimal timing, and presenting psoriatic arthritis as a well-managed condition with minimal impact on life expectancy.

Frequently Asked Questions

Can I get life insurance with psoriatic arthritis?

Direct answer: Yes, most people with psoriatic arthritis can obtain life insurance coverage. Well-controlled disease often qualifies for standard or near-standard rates, while more severe cases typically receive table ratings rather than outright denial.

The key factors are current disease activity, treatment response, and functional capacity. Patients with mild to moderate psoriatic arthritis who maintain normal work and life activities frequently secure coverage at reasonable rates. Even those with more severe disease can usually obtain coverage, though premiums may be higher.

How do biologic medications affect my life insurance application?

Direct answer: Biologic medications often indicate responsible disease management to insurance companies rather than serving as automatic disqualifiers. Good response to biologic therapy typically results in favorable underwriting decisions.

Companies understand that biologics represent appropriate treatment for moderate to severe psoriatic arthritis. The focus is on treatment effectiveness – patients showing excellent disease control on biologics often receive better rates than those with uncontrolled disease on basic medications. Documentation of treatment response is crucial.

When is the best time to apply for life insurance with psoriatic arthritis?

Direct answer: Apply when you have 3-6 months of stable treatment response and good disease control, rather than immediately after diagnosis or during medication changes.

Optimal timing includes stable medication regimen, minimal disease activity, good functional status, and recent medical documentation showing treatment success. Avoid applying during active flares, medication transitions, or within the first few months of diagnosis before treatment response is established.

What medical records do I need for my application?

Direct answer: Essential records include rheumatology reports, laboratory results, treatment history, current medication list, and functional assessment documentation showing disease control and treatment response.

Comprehensive documentation should cover diagnosis details, treatment timeline, medication responses, current disease activity measures, and functional capacity assessments. Recent rheumatology visits and lab work demonstrating stable disease control strengthen your application significantly.

Will psoriatic arthritis automatically increase my premiums?

Direct answer: Not automatically. Well-controlled psoriatic arthritis often qualifies for standard rates, while moderate disease typically results in table ratings of 25-100%. Severe or unstable disease may face higher increases.

Premium impact depends on disease severity, treatment response, functional capacity, and complications. Many patients with mild disease pay standard rates, while those with good disease control despite moderate severity often receive reasonable table ratings. The diagnosis alone doesn’t determine premium costs.

Can I get coverage if I’m on disability due to psoriatic arthritis?

Direct answer: Coverage is possible but more challenging. Disability status typically results in higher premium ratings or coverage limitations, though some companies specialize in disabled applicant underwriting.

Factors include disability duration, functional limitations, treatment response, and overall health status. Some insurers offer products specifically designed for disabled individuals, while guaranteed issue policies provide coverage regardless of health status, though with limited benefit amounts.

Should I work with an agent experienced in chronic conditions?

Direct answer: Yes, agents experienced with autoimmune conditions understand which companies offer favorable underwriting for psoriatic arthritis and can guide optimal application strategy and timing.

Specialized agents know company-specific underwriting guidelines, can help prepare comprehensive applications, and often have relationships with underwriters familiar with chronic condition assessment. This expertise frequently results in better outcomes than applying independently or working with inexperienced agents.

Taking the Next Step

Securing life insurance with psoriatic arthritis requires understanding how insurance companies evaluate autoimmune conditions, preparing comprehensive documentation of your treatment success, and selecting companies with favorable chronic illness underwriting. While the application process may seem complex initially, thousands of psoriatic arthritis patients successfully obtain coverage by following strategic approaches to timing and presentation.

The Insurance Brokers USA Team specializes in helping individuals with chronic health conditions navigate the life insurance landscape with personalized guidance based on your specific disease management, treatment response, and coverage needs. Our experience with hundreds of autoimmune condition cases enables us to identify the companies and strategies most likely to provide favorable outcomes for your situation.

Ready to explore your life insurance options with psoriatic arthritis? Contact our chronic condition specialists at 888-211-6171 for a confidential consultation about your coverage possibilities and optimal application strategy.

Medical Disclaimer: This information is for educational purposes only and should not replace professional medical advice. Always consult with your healthcare provider regarding your psoriatic arthritis management and treatment decisions. Life insurance underwriting decisions vary by company and individual circumstances.