In this article, we aim to answer some of the most common questions that we receive from individuals who are applying for life insurance with Peripheral Vascular Disease (PVD).

The questions we will address include:

- Can I qualify for life insurance if I have been diagnosed with Peripheral Vascular Disease?

- Why do life insurance companies care if I have been diagnosed with Peripheral Vascular Disease?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to ensure that I get the best life insurance for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Peripheral Vascular Disease?

Yes, individuals who have been diagnosed with Peripheral Vascular Disease can and often will be able to qualify for a traditional term or whole life insurance policy.

The only problem is…

That the symptoms of this disease can vary significantly from one patient to the next, which is why just “knowing” that someone has been diagnosed with PVD isn’t going to be enough information to know whether or not someone will be able to qualify for a traditional life insurance policy.

It’s also why, you may want to consider avoiding applying for a no medical exam term life insurance policy as well, seeing how these policies tend to be more difficult to qualify for after someone has been diagnosed with a pre-existing medical condition like Peripheral Vascular Disease.

Why do life insurance companies care if I’ve been diagnosed with Peripheral Vascular Disease?

Life insurance companies care if you have been diagnosed with Peripheral Vascular Disease (PVD) because it can affect your life expectancy and increase the risk of premature death or disability. PVD is a condition that affects the blood vessels outside the heart and brain, often causing narrowing or blockages that can lead to reduced blood flow to the limbs or organs.

The severity and progression of PVD can vary widely among individuals, but in more severe cases, it can increase the risk of heart attack, stroke, amputation, and other health complications. Therefore, it is considered a risk factor by life insurance companies when evaluating your application.

For this reason…

We wanted to take a moment and just briefly discuss what Peripheral Vascular Disease is as well as highlight some of the most common symptoms/complications so that we can gain a better understanding of what a life insurance underwriter will be looking for when making his or her decision about your life insurance application.

Peripheral Vascular Disease Defined:

Peripheral Vascular Disease is a disease that occurs when blood flow to one’s arms, legs, or other body parts becomes restricted as a result of narrowing, blockage, or spams of the veins or arteries supplying these body parts.

The most common cause…

Of Peripheral Vascular Disease is due to atherosclerosis, which is a separate disease that is characterized by the deposition of fatty plaques along the inner walls of one’s arteries. Complications associated with atherosclerosis may include an increased risk of:

- Aneurysms,

- Angina,

- Kidney disease,

- Heart disease,

- Stroke,

- Heart attack and/or heart failure.

Common symptoms of Peripheral Vascular Disease may include:

- Hair loss on one’s lower extremities,

- Intermittent claudication,

- Leg weakness,

- Numbness in the legs,

- Brittle or fragile toenails.

Serious complications of Peripheral Vascular Disease may include:

- Severe pain,

- Wounds that won’t heal,

- Increased risk of infections,

- Tissue death, potentially requiring limb amputation,

Fortunately…

Peripheral Vascular Disease is a condition that can often be treated and/or improved by several methods, including assuming a healthy diet, moderate exercise, and the cessation of any tobacco or nicotine use (if applicable). Medications, as well as certain surgical procedures, can also help in some cases as well.

Now at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like this one, find and qualify for the life insurance coverage that they are looking for.

But…

Not so great if you’re looking for answers to any specific medical questions. In cases like these, we would recommend that you contact a true medical professional who has the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

When you apply for life insurance with Peripheral Vascular Disease (PVD), the insurance company will likely ask you questions about your medical history, including your PVD diagnosis and any treatments you have received. Some specific information they may ask about your PVD includes:

- When were you diagnosed with PVD?

- What symptoms have you experienced, if any?

- Have you undergone any treatments for PVD, such as surgery or medication?

- Have you experienced any complications or hospitalizations related to your PVD?

- Do you have any other health conditions that may affect your PVD, such as diabetes or high blood pressure?

- Have you had any diagnostic tests related to your PVD, such as angiography or ultrasound?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you been diagnosed with heart disease or diabetes?

- Have you ever suffered from a heart attack or a stroke?

- What are your current height and weight?

- Are you currently taking any prescription medications right now?

- In the past 12 months, have you used any tobacco or nicotine products?

- In the past two years, have you been admitted into a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

The insurance company may also ask for additional medical records, such as test results or reports from your healthcare provider. They may use this information to assess your risk of premature death or disability and determine your risk classification or “rating class” for life insurance purposes.

It’s important to answer these questions truthfully and to the best of your knowledge. Providing inaccurate or incomplete information could result in your application being denied or your policy being invalidated later on. Working with a knowledgeable insurance agent can help you navigate the application process and ensure that you provide all the necessary information to the insurance company.

What rate (or price) can I qualify for?

As you can see, there are many variables that can come into play when trying to determine what kind of “rate” an individual diagnosed with Peripheral Vascular Disease. This is why it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you directly.

That said, however…

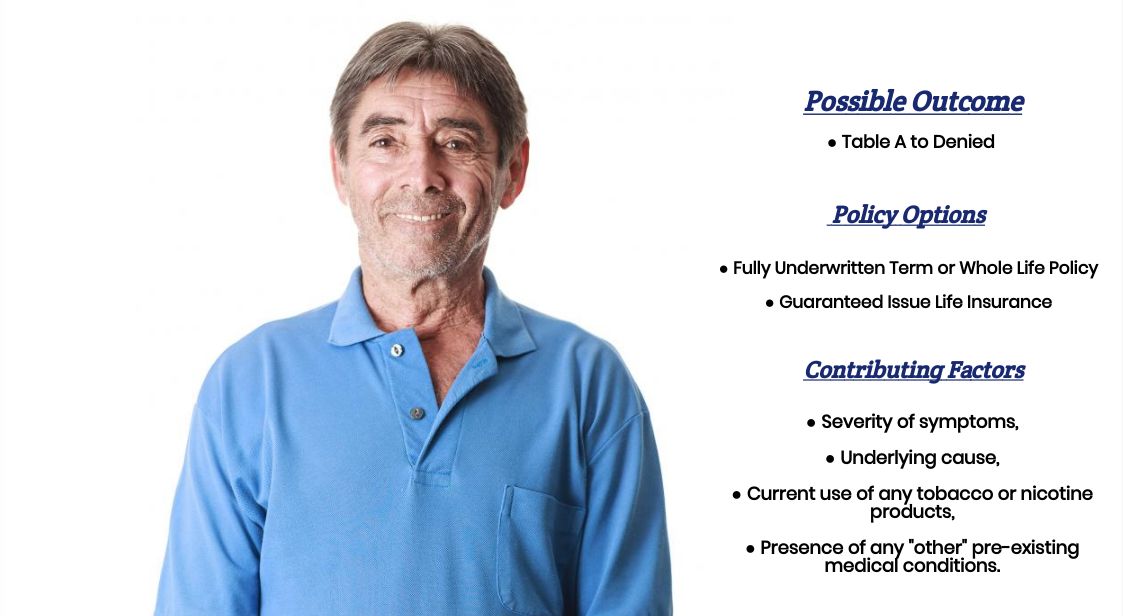

Most individuals who have been diagnosed with Peripheral Vascular Disease will usually fall into one of four different categories that we can make some “assumptions” about that will generally hold true.

Category #1.

Individuals in this first category that we want to discuss will be those who have been diagnosed with Peripheral Vascular Disease absent any other “serious” pre-existing medical conditions. Individuals that fall into this category will still be considered “high risk” but will usually be able to qualify for a traditional term or whole life insurance policy, usually at a Table A to D rate.

Category #2.

Individuals in this category will be those who have been diagnosed with Peripheral Vascular disease along with some other “kind” of serious pre-existing medical condition. In most cases like these, what you’re generally going to find is that most life insurance companies are going to treat one’s PVD as a symptom of this other disorder which will ultimately be the determinate regarding what “kind” of life insurance policy an individual will be able to qualify for.

The next two categories…

Will be reserved for those who are currently using some form of tobacco or nicotine or have quite some form of tobacco or nicotine less than one year ago.

Category #3.

Will be reserved for those who have been diagnosed with Peripheral Vascular Disease absent any “other” pre-existing medical condition while currently using some “type” of tobacco or nicotine products. These “types” of individuals will theoretically still be eligible for a traditional term or whole life insurance policy like their “non-smoking” equivalents only in their case they will most likely need to pay 3 to 4 times more for their coverage!

Category #4.

The last group of individuals that we’ll encounter will be those who have been diagnosed with Peripheral Vascular Disease, in addition to some other “type” of pre-existing medical condition, while simultaneously using some form of tobacco or nicotine. In cases like these, what you’re likely going to find is that if an individual is able to qualify for a traditional term or whole life insurance policy, chances are it’s going to be VERY expensive.

For this reason…

So, folks may elect to pursue a Guaranteed Issue Life Insurance policy instead or wait until they have been tobacco-free for a minimum of one year so that they can qualify for a lower rate. The danger here is that during this time, they won’t have any insurance in place (assuming that they don’t have any life insurance in place elsewhere).

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

If you have been diagnosed with Peripheral Vascular Disease (PVD) and are looking for the best life insurance coverage, there are a few steps you can take to improve your chances of getting approved and securing the most favorable rates:

- Work with a knowledgeable insurance agent: An experienced insurance agent can help you understand your options and find a policy that fits your needs and budget. They can also help you navigate the application process and provide tips for improving your chances of getting approved for life insurance.

- Manage your PVD and other health conditions: Taking steps to manage your PVD and any other health conditions can improve your overall health and reduce your risk of complications. This may include following a healthy diet, exercising regularly, taking prescribed medications, and managing any other underlying health conditions, such as diabetes or high blood pressure.

- Quit smoking: If you smoke, quitting can have a significant impact on your health and life insurance rates. Smoking is a major risk factor for PVD and other health conditions, and quitting can lower your risk of complications and improve your overall health.

- Be honest and complete when providing information: When you apply for life insurance, it’s important to be truthful and accurate when providing information about your health, including your PVD diagnosis and any treatments you have received. Providing inaccurate or incomplete information could result in your application being denied or your policy being invalidated later on.

- Shop around for rates: Different insurance companies may evaluate PVD differently and offer different rates for coverage. It’s important to shop around and compare rates from multiple insurance companies to find the most favorable policy for your needs and budget.

By taking these steps and working with a knowledgeable insurance agent, you can increase your chances of getting approved for life insurance with PVD and securing the most favorable rates for your coverage.