In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Legionnaire’s Disease.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Legionnaire’s Disease?

- Why do life insurance companies care if I have been diagnosed with Legionnaire’s Disease?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Legionnaire’s Disease?

Yes, individuals who have been previously diagnosed with Legionnaire’s Disease can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for some of the best no medical exam life insurance companies at a Preferred rate!

The problem is…

That because Legionnaire’s Disease can be a life-threatening medical condition, most (if not all) life insurance companies are going want to make sure that you have made a full recovery from your infection and that you don’t have any kind of pre-existing medical conditions which may have made you more susceptible to Legionnaire’s disease.

Why do life insurance companies care if I have been diagnosed with Legionnaire’s Disease?

Most top-rated life insurance companies are going to “care” if you have been previously diagnosed with Legionnaire’s Disease for a couple of reasons. The first reason is that Legionnaire’s Disease can be deadly. The second reason is that not many people get Legionnaire’s Disease, which is why if you have contracted it, most (if not all) life insurance companies are going to want to know “why.”

This is why…

We wanted to take a moment and describe what Legionnaire’s Disease is as well as highlight some of the most common symptoms of this disease so that we can gain a better understanding of exactly what a life insurance underwriter will be looking for when making his or her decision about you life insurance application.

Legionnaire’s Disease Defined:

Legionnaire’s disease, also known as Legionellosis is a type of pneumonia that is caused by breathing in just about any type of Legionella bacteria. People usually contract this disease by breathing in contaminated water particles from hot tubs, showers, or air conditioning units found in large buildings.

Common symptoms may include:

- Flu-like symptoms,

- Extremely high fevers 104+,

- Muscle pains,

- Nausea and vomiting,

- Diarrhea.

Serious Complications may include:

- Respiratory failure,

- Kidney failure,

- Septic shock,

- Death.

At risk population would include:

- People over the age of 50,

- Current or former smokers,

- People who have been diagnosed with Chronic Obstructive Pulmonary Disease (COPD),

- Anyone diagnosed with a compromised immune system.

Fortunately…

Because a well known and treatable bacteria cause Legionnaire’s Disease, this disease can usually be treated and cured with the administration of two different “types” of antibiotics called macrolides and quinolones. This is why once a life insurance company has determined that you have made a full recovery, most of their additional questions about your Legionnaire’s Disease will be focused on determining whether or not you may be at risk of developing this condition again.

“Which brings us to an important point that we think we ought to mention.”

First…

If you think you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being your own doctor could really harm yourself!

Second…

Nobody here at IBUSA is medically trained, and we’re certainly not doctors. All we ware is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance that they’re looking for. So please don’t mistake any of the medical information that we talk about as medical advice because it’s not!

We’re just…

Trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Legionnaire’s Disease… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Legionnaire’s Disease or Legionellosis?

- Who diagnosed your Legionnaire’s Disease? A general practitioner or a specialist?

- What symptoms led to your diagnosis?

- Do you know “how” you were exposed to the Legionella bacteria?

- Have you fully recovered from your infection?

- How many times have you ever suffered from this disease?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications now?

- In the past 12 months, have you used any tobacco or nicotine products?

- In the past two years, have you been admitted into a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

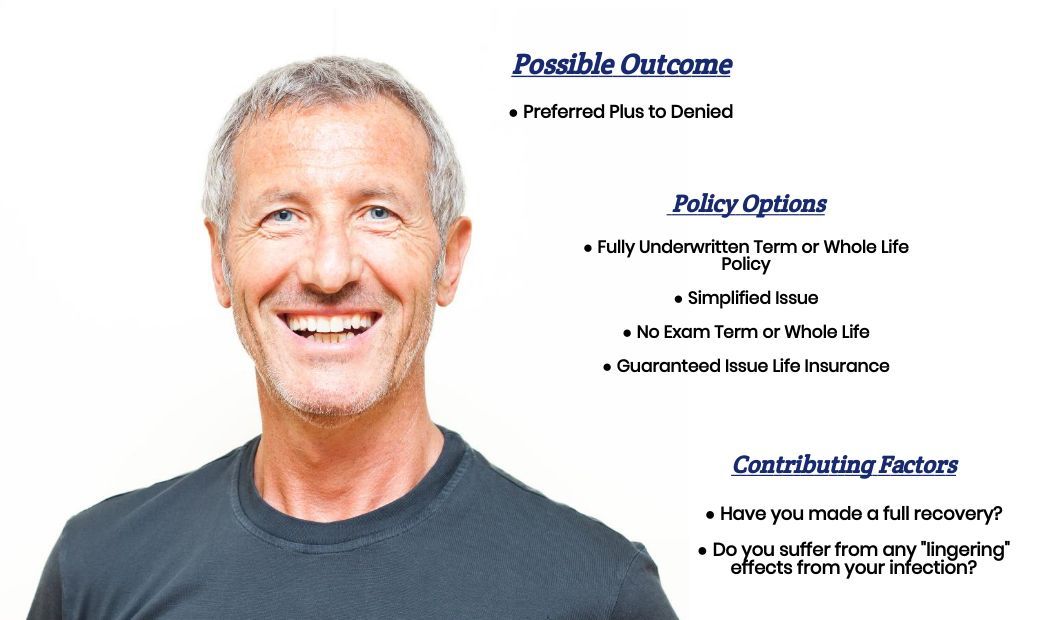

What rate (or price) can I qualify for?

As you can see by the questions above, once a life insurance company has learned that you have been previously diagnosed with Legionnaire’s Disease and subsequently made a full recovery, the focus of the life insurance underwriter will then turn to whether or not you represent an increased risk of suffering from this condition again or have some other “type” of pre-existing medical condition which they should focus their attention on.

If not…

What you’re generally going to find is that your previous Legionnaire’s Disease diagnosis most likely won’t be used against you. This means that whatever “rate” you would have been able to qualify for PRIOR to be diagnosed with Legionnaire’s Disease should be the same “rate” that you would be able to qualify for AFTER having been diagnosed with Legionnaire’s Disease.

As for the rest…

Of folks who may have some other “kind” of pre-existing medical condition to contend with, what you’re most likely going to find is that this “other” pre-existing medical condition will ultimately be what determines your outcome life insurance application. In cases like these, we would invite you to check out our Pre-Existing Medical Conditions page, where we may have more details on this “other” condition which you have been diagnosed with.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Legionnaire’s Disease?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!