In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Hydrocephalus.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Hydrocephalus?

- Why do life insurance companies care if I have been diagnosed with Hydrocephalus?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Hydrocephalus?

Yes, individuals who have been diagnosed with Hydrocephalus can often qualify for a traditional term or whole life insurance policy provided that their “Hydrocephalus” first occurred as an adult and not as an infant or young child.

Additionally…

We should also point out that while adult-onset Hydrocephalus applicants may be able to qualify for a traditional life insurance policy, getting approved for coverage will not be a foregone conclusion because there are a lot of factors that a life insurance underwriter is going to want to examine before they are willing to make any “definitive” decision about your life insurance application.

This is also why you may want to consider avoiding applying for a no medical exam term life insurance policy as well, seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a pre-existing medical condition like Hydrocephalus.

Why do life insurance companies care if I have been diagnosed with Hydrocephalus?

It’s pretty safe to say that anytime an individual has been diagnosed with a pre-existing medical condition that directly affects the brain, most (if not all) of the best life insurance companies are going to want to learn more about that “condition” before making any decision about an individual’s life insurance application.

Which is exactly…

What we see when working with an individual who has been diagnosed with Hydrocephalus as an adult. This is why it only makes sense for us to briefly describe Hydrocephalus and highlight some of the most common symptoms to understand better what a life insurance underwriter will look for to decide on your application.

Hydrocephalus Defined:

Hydrocephalus is a condition caused by a “buildup” of fluids within the cavities (ventricles) located deep within the brain tissue. This excess fluid then begins to increase the “size” of the ventricle, causing pressure to develop within the skull.

At this point…

We want to focus our attention on adult-onset Hydrocephalus simply because most (if not all) life insurance companies aren’t going to be willing to insure anyone who suffered from infant or early childhood hydrocephalus.

Common symptoms associated with adult-onset Hydrocephalus may include:

- Nausea,

- Vomiting,

- Insomnia,

- Irritability,

- A decrease in appetite,

- Seizures,

- Etc…

Common causes of adult-onset Hydrocephalus may include:

- Internal brain hemorrhaging,

- Infections,

- Traumatic brain injury,

- Stoke,

- Or a tumor.

Fortunately, while it is true that Hydrocephalus will generally be considered a “chronic” condition absent any cure, it can be treated by either directly removing the cause of the Hydrocephalus or by providing a way of diverting the “excess” fluid within the brain to some “other” location with the brain.

This is why…

Even though adult-onset Hydrocephalus will be considered a severe pre-existing medical condition by most (if not all) life insurance companies, it will still be one that many will be willing to provide coverage to, provided that you are seeking the proper care and management for your condition.

Now, before anyone gets upset or begins to complain about the simplicity of the definitions we’re using here, it’s important to understand that we here at IBUSA aren’t medical experts or doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like Hydrocephalus find and qualify for coverage.

Which means that…

Because we’re not going to be the one “diagnosing” your condition, and we’re certainly not going to try to treat your condition, we need to understand how a life insurance underwriter will consider you a potential “risk.” The good news is that despite how simple our definition of Hydrocephalus is, this is something we have down pat! This is why when we are approached by an individual who has been diagnosed with any of these “kinds” of conditions, we’re going to know right away what questions a life insurance underwriter is going to want to know the answers to before they will be willing to make any decision about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Hydrocephalus?

- Who diagnosed your Hydrocephalus?

- What symptoms (if any) led to your diagnosis?

- What kind of Hydrocephaly have you been diagnosed with?

- Do you know why you have developed Hydrocephalus?

- Internal brain hemorrhaging?

- Infections?

- Traumatic brain injury?

- Stoke?

- Or a tumor?

- How have you treated your Hydrocephalus?

- Are you currently experiencing any symptoms due to your Hydrocephalus?

- In the past two years, have you been admitted into a hospital for any reason?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

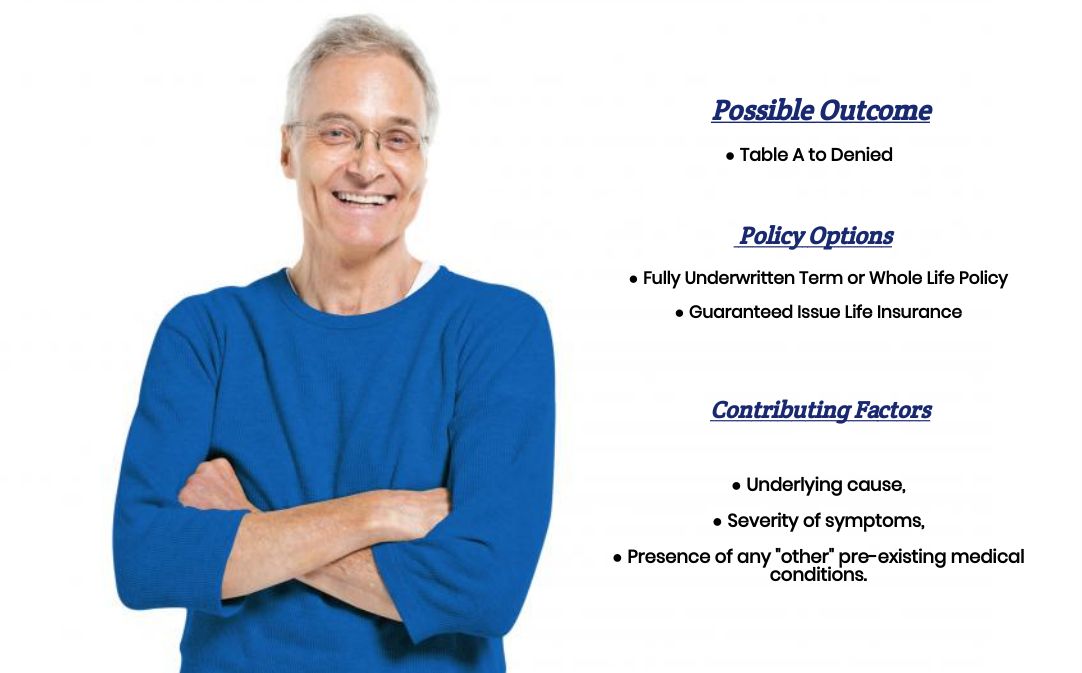

What rate (or price) can I qualify for?

As you can see, many factors can come into play when determining what kind of “rate” an individual might qualify for after being diagnosed with Hydrocephalus. This is particularly true because when it comes time to “determine” the “severity” of one’s case, much of that decision-making process will be based on very “subjective” evidence.

For this reason…

It’s pretty much impossible to know what kind of “rate” you might qualify for without first speaking with you for a few minutes so that we can get a better idea about how well you are “coping” with your disease. That said, however, we can make a few “assumptions” that will generally hold true when trying to help someone diagnosed with Hydrocephalus qualify for a traditional life insurance policy.

For example, it’s pretty safe to say that while it is true that individuals diagnosed with Hydrocephalus will “potentially” qualify for a traditional life insurance policy, it’s not always going to be an easy thing to do! And most of the time, when an individual can qualify for coverage, it will usually be at a “sub-standard” rate!

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

need insurance for preexisting hydrocephalus

Mona,

We would be happy to see what kind of life insurance policy you may be able to qualify for, we’ll just need to speak with you first. So, please give us a call at your earliest convenience.

Thanks,

InsuranceBrokersUSA.

I have pre-existing hydrocephalus and I had it since I was 3 weeks old and I don’t know if my previous neurologist has all my medical records due to I have been homeless since 2017.

Cristina,

It sounds like you may need to apply for a guaranteed issue life insurance policy that won’t require you to take a medical exam or answer any health related questions. Our suggestion would be to give us a call when you have a chance this way we can see what types of life insurance policies you may be able to qualify for.

Thanks,

InsuranceBrokersUSA.

I have lived my entire life with hydrocephalus. I also have generalized idiopathic epilepsy.

I haven’t had surgery or a seizure since 2005.

Can I qualify for life insurance?

Douglas,

Insurance companies consider various factors to assess an applicant’s eligibility and premium rates. These factors typically include your medical history, current health status, and the underwriting guidelines of the insurance company you approach.

In your case, having a medical history of hydrocephalus and epilepsy may impact your eligibility for life insurance. However, the fact that you haven’t had surgery or a seizure since 2005 could work in your favor. Insurance companies may consider the stability and control of your medical conditions when evaluating your application.

To determine your eligibility and obtain accurate information, it’s best to just give us a call so that we can learn more about your situation and assist you in finding the right insurance options for your needs.

Thanks,

InsuranceBrokersUSA

Good Afternoon! I was born with hydrocephalus. As a baby they placed a shunt in my brain to remove the excess fluid. The only thing I experienced thru my 35 years of existence is headaches. But that’s about it. Would I be able to get a Whole Life policy with a built in cash value account?

Thank You!

Frank R.

Frank,

We will have an agent reach out to you via email to discuss what options may be available to you.

Thanks,

InsuranceBrokersUSA