In this article, we wanted to take a moment and try to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Hemophilia.

Questions that will be directly addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Hemophilia?

- Why do life insurance companies care if I have been diagnosed with Hemophilia?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What Can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Hemophilia?

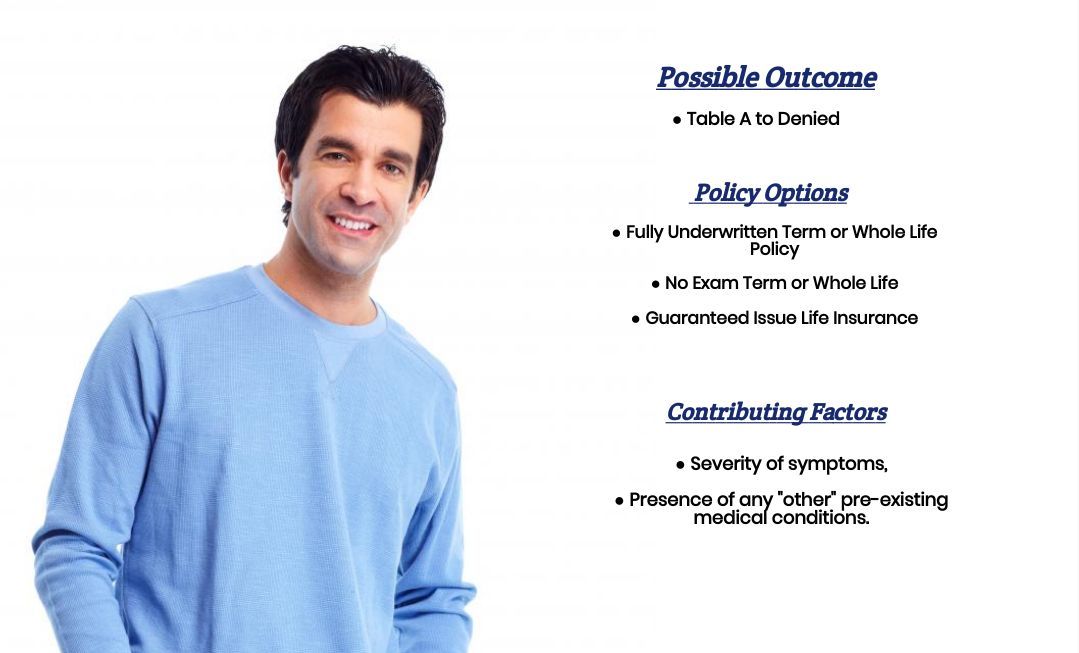

Yes, individuals who have been diagnosed with Hemophilia can and often will be able to qualify for a traditional term or whole life insurance policy. That said, however, we should note that even in the “best” of situations, most individuals who have been diagnosed with Hemophilia are only going to be able to qualify for a “high-risk” or “sub-standard” rating. Those suffering from a “severe” case may only be able to qualify for a Guaranteed Issue Life Insurance policy at best.

Why do life insurance companies care if I have been diagnosed with Hemophilia?

Probably the main reason “why” a life insurance company is to “care” if an individual has been diagnosed with Hemophilia is because of the potential risk for deep internal bleeding within the brain that could occur in people with “severe” cases of Hemophilia.

The good news is that only about 50% of individuals who are diagnosed with Hemophilia will be diagnosed with “severe” cases, which is why even though Hemophilia can be a potentially dangerous pre-existing medical condition, most life insurance companies will still be willing to ensure someone after they have had an opportunity to learn more about their particular situation.

Which is why…

We wanted to take a moment and briefly discuss Hemophilia and highlight some of the most common symptoms so that we’ll have a better idea of what a life insurance underwriter will look for when deciding on your life insurance application.

Hemophilia Defined:

Hemophilia is a hereditary medical condition defined by the inability of one’s blood to clot properly. As a result, individuals who have Hemophilia tend to bleed severely from even the slightest injury. The cause of this condition is linked to the gene that determines how the body produces factors VIII, IX, or XI.

Common symptoms may include:

- Blood in one’s urine or stool,

- Bruising easily,

- Excessive bleeding after minor cuts,

- Bleeding gums,

- Frequent nosebleeds,

- Joint pain,

- “spontaneous bleeding” in children.

Unfortunately, there is no “cure” for Hemophilia; however, various therapies do exist to help folks either treat or minimize the severity of their condition; these include administering certain clotting factors directly into the blood or using medications like Desmopressin to help stimulate one’s body into naturally producing more “clotting” factors.

The main concern for…

Most life insurance companies state that some individuals with more “severe” cases of Hemophilia may go on to develop more serious complications as a result of their disease, including but not limited to:

- Deep internal bleeding, which can cause swelling within one’s extremities,

- Physical damage to one’s joints,

- Increased risk of infection,

- Potential risk for intracranial bleeding or bleeding into the brain.

Now, before anyone gets upset or begins to complain about the simplicity of the definitions we’re using here, it’s essential to understand that we here at IBUSA aren’t medical experts or doctors. All we are is a bunch of life insurance agents who happen to be good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

Which means that…

Because we won’t be “diagnosing” or treating your condition, we must understand how a life insurance underwriter will consider it when determining what kind of “potential” risk you may pose to them as a client. The good news is that despite how simple the definition we’re using to describe Hemophilia is, we know how a life insurance company will “treat” you when you apply for a traditional term or whole life insurance policy!

This is why when we’re approached by an individual diagnosed with any of these “kinds” of conditions, we’ll know right away what questions a life insurance underwriter will want to know the answers to before deciding about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Hemophilia?

- Who diagnosed your Hemophilia? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- How are you treating your Hemophilia today?

- How would you “rate” your condition? Mild, moderate, or severe?

- How often do you see your primary care physician?

- Have you been diagnosed with any other pre-existing medical conditions?

- In the past two years, have you been admitted to a hospital for any reason?

- Do you actively participate in any dangerous hobbies or activities?

- Are you currently working now?

- In the past 12 months, have you applied for or received any disability benefits?

What rate (or price) can I qualify for?

As you can see, various factors can come into play when determining what kind of “rate” you might qualify for. This is why it’s impossible to know for sure without first speaking with you for a few minutes.

That said, however…

We can make a few “assumptions” about individuals applying for a traditional term or whole life insurance policy after they have been diagnosed with Hemophilia that will generally hold true. For example, regardless of how “mild” your Hemophilia may be, it’s safe that most individuals will be considered a “higher-risk” applicant! This means that you will want to make sure you know “which” life insurance companies offer the best pricing for “higher-risk” applicants before applying for coverage.

It’s also…

Pretty safe to assume that if you are someone who seems to be routinely suffering from some of the more “serious” complications of Hemophilia, such as internal bleeding or bleeding on the brain, most list insurance companies aren’t going to be willing to approve you for a “traditional” life insurance policy which means that you may need to consider taking a look at some “alternative” products such as a Guaranteed Issue Life Insurance Policy or an Accidental Death policy.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!