A hydrocephalus diagnosis brings immediate concerns about medical treatment and long-term management, but families often find themselves unprepared for the secondary challenge of securing life insurance coverage. The complexity deepens when initial online research yields conflicting information – some sources suggesting neurological conditions create insurmountable barriers, while others claim coverage remains accessible with the right approach.

The good news is that the life insurance landscape for individuals with hydrocephalus has evolved significantly over the past decade. While traditional underwriting approaches once resulted in automatic declines for many neurological conditions, such as hydrocephalus, today’s medical underwriters possess a much more sophisticated understanding of these conditions, their treatment outcomes, and long-term prognoses. And as such, individuals with well-managed hydrocephalus can now frequently secure meaningful coverage, though the path may require strategic navigation.

Our comprehensive analysis of coverage options reveals that success depends heavily on several key factors: the type and cause of hydrocephalus, treatment effectiveness, current symptom management, and, most importantly, choosing insurance companies with expertise in neurological condition underwriting. Understanding these elements transforms what initially appears to be an impossible task into a manageable process with realistic expectations.

About the Author

The Insurance Brokers USA Team consists of licensed insurance professionals with extensive experience helping clients with complex neurological conditions find appropriate coverage. Our agents have worked with hundreds of individuals facing hydrocephalus and other brain-related conditions, specializing in alternative insurance solutions when traditional coverage presents unique challenges.

What is Hydrocephalus?

Hydrocephalus occurs when cerebrospinal fluid accumulates in the brain’s ventricles, creating increased intracranial pressure that can damage brain tissue if left untreated. This condition affects approximately 1 million Americans according to the Hydrocephalus Association, with causes ranging from congenital abnormalities to acquired conditions such as brain tumors, infections, or traumatic injuries.

Key insight: The condition presents in various forms – congenital hydrocephalus present at birth, acquired hydrocephalus developing later in life, and normal pressure hydrocephalus typically affecting older adults. Each type carries different implications for insurance underwriting, with treatment success rates and long-term prognoses varying significantly.

Bottom Line

Modern treatment for hydrocephalus, primarily through shunt systems or endoscopic procedures, has dramatically improved outcomes. Many individuals with properly functioning shunts live normal, productive lives, which progressive insurance companies now recognize in their underwriting processes.

From an insurance perspective, underwriters focus on several critical factors: the underlying cause of hydrocephalus, treatment effectiveness, shunt functionality, frequency of revisions, cognitive function, and overall quality of life. These elements help insurers assess both current risk and long-term prognosis.

Understanding your specific type of hydrocephalus and treatment history becomes essential when navigating insurance applications, as different presentations carry vastly different risk profiles in underwriting evaluation.

Why is Life Insurance Challenging with Hydrocephalus?

Life insurance companies approach neurological conditions like hydrocephalus with heightened caution due to the potential for complications, cognitive impacts, and unpredictable disease progression. Traditional underwriting guidelines often resulted in automatic declines, as early insurance models lacked sophisticated methods for evaluating complex neurological conditions.

The primary concerns insurers evaluate include shunt malfunction risks, infection possibilities, cognitive deterioration, seizure development, and the underlying condition that caused the hydrocephalus. Additionally, the need for ongoing medical monitoring and potential surgical interventions creates what underwriters perceive as elevated long-term risk.

“Hydrocephalus cases require individual evaluation based on multiple factors. We’ve moved away from blanket declines toward comprehensive medical review, recognizing that many individuals with well-managed hydrocephalus have excellent long-term outcomes.”

– Insurance Brokers USA Case Management Team

However, the landscape has improved as medical advances demonstrate better outcomes and more predictable prognoses for many individuals with hydrocephalus. Insurance companies with sophisticated medical departments now distinguish between high-risk and manageable cases, opening coverage opportunities that didn’t exist previously.

Most importantly, the key lies in understanding which companies have developed expertise in neurological conditions and how to present your specific case in the most favorable light possible during the underwriting process.

Key Takeaways

- Traditional underwriting often resulted in automatic declines

- Modern insurers evaluate cases individually based on specific factors

- Well-functioning shunts and stable conditions improve approval odds

- Company selection significantly impacts application outcomes

- Professional guidance helps navigate complex underwriting requirements

What Coverage Options Are Available?

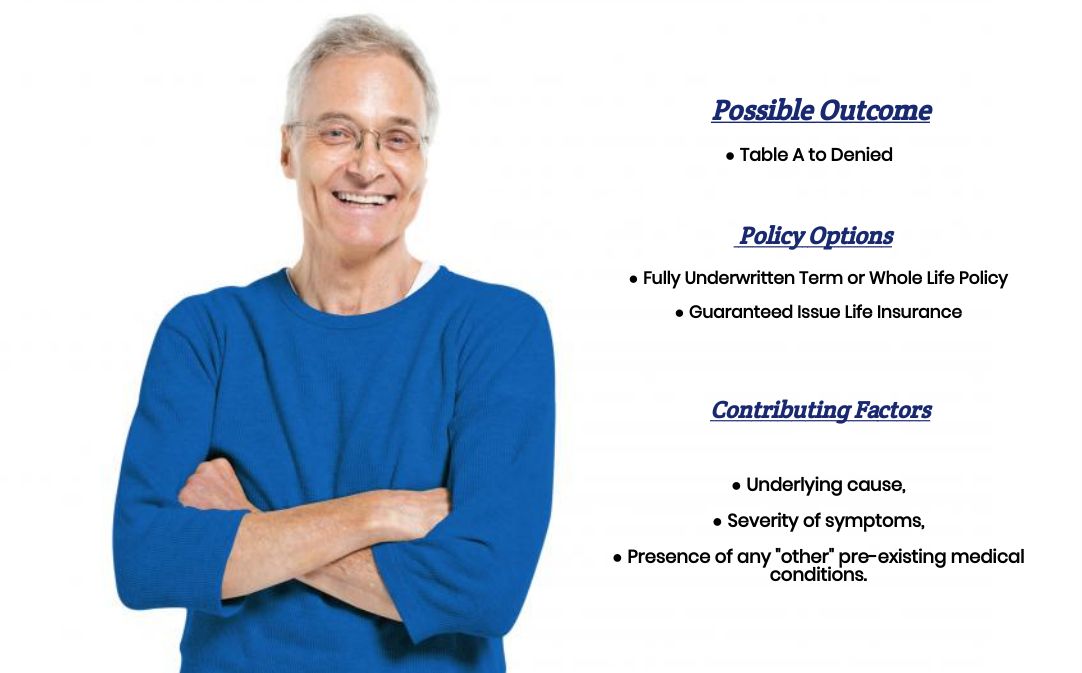

Coverage options for individuals with hydrocephalus span a spectrum from traditional fully underwritten policies to specialized products designed for high-risk applicants. The appropriate option depends on your specific medical situation, coverage needs, and risk tolerance regarding premiums and benefits.

Key insight: Many people assume they’re limited to guaranteed issue products, but individuals with stable, well-managed hydrocephalus may qualify for simplified issue or even fully underwritten policies, particularly when working with companies experienced in neurological conditions.

Coverage Options by Risk Profile

| Risk Level | Available Products | Coverage Limits | Premium Level |

|---|---|---|---|

| Stable, Well-Managed | Simplified issue, some fully underwritten | Up to $500,000 | Moderate to High |

| Recent Diagnosis | Guaranteed issue, limited simplified | Up to $50,000 | High |

| Complex/Unstable | Guaranteed issue only | Up to $25,000 | Very High |

Traditional term and whole life insurance policies remain possibilities for individuals with excellent long-term management and minimal complications. These policies offer the highest coverage amounts and most competitive premiums when available, making them worth pursuing despite potentially higher decline rates.

For those facing coverage limitations, final expense insurance options provide meaningful financial protection for burial costs and final expenses, ensuring families aren’t burdened with these immediate financial pressures during difficult times.

Most importantly, the strategy involves applying to multiple product types simultaneously when appropriate, as approval from any category provides valuable coverage while you explore other options or wait for your medical situation to stabilize further.

What Do Insurance Companies Evaluate?

Insurance underwriters evaluate hydrocephalus cases through a comprehensive medical review focusing on specific risk factors that correlate with long-term outcomes. Understanding these evaluation criteria helps you prepare stronger applications and set appropriate expectations for the underwriting process.

The primary factors include the underlying cause of hydrocephalus, as congenital cases often have different prognoses than those caused by trauma, tumors, or infections. Age at diagnosis also matters significantly, with childhood-onset cases potentially having longer track records of management success.

Key insight: Shunt functionality and revision history carry enormous weight in underwriting decisions. Individuals with stable shunts requiring no recent revisions demonstrate lower risk profiles than those with frequent shunt complications or recent surgical interventions.

Critical Underwriting Factors

- Underlying Cause: Congenital vs. acquired, specific etiology

- Shunt Status: Type, functionality, revision history, complications

- Cognitive Function: Current intellectual capacity, any deterioration

- Neurological Symptoms: Seizures, motor deficits, coordination issues

- Treatment Response: Surgical outcomes, symptom improvement

- Complications: Infections, shunt malfunctions, additional surgeries

- Current Status: Stability, functional capacity, independence level

Underwriters also evaluate your current functional capacity, employment status, and independence level as indicators of overall health and stability. Individuals maintaining employment, driving, and living independently demonstrate favorable risk profiles compared to those requiring extensive assistance or supervision. For additional context on how functional status affects insurance decisions, see our guide on disability and its insurance implications.

“We look for patterns of stability over time. A patient with a well-functioning shunt, stable imaging, and normal daily activities presents much differently than someone with recent complications or declining function.”

– Senior Medical Underwriter, Specialty Insurance Company

Documentation quality significantly impacts underwriting outcomes. Comprehensive medical records from neurosurgeons, current imaging studies, cognitive assessments, and functional evaluations provide underwriters with the detailed information needed to make informed decisions rather than defaulting to automatic declines.

How Should You Approach Applications?

Strategic application approaches for hydrocephalus cases require careful timing, comprehensive preparation, and realistic expectations about the process. Success often depends more on preparation and presentation than on the specific medical details of your condition.

Most importantly, timing your application appropriately can dramatically impact outcomes. If you’ve had recent shunt revisions, infections, or other complications, waiting for stability often results in better coverage options and lower premiums than applying immediately after medical events.

Bottom Line

Preparation and professional guidance often matter more than the specific medical details. A well-prepared application with comprehensive documentation can succeed where a hastily submitted application fails, even with identical medical histories.

The application strategy should involve gathering complete medical records, obtaining current physician assessments, and preparing detailed explanations of your condition management and current functional status. This documentation helps underwriters understand your specific situation rather than relying on general assumptions about hydrocephalus.

Working with brokers who specialize in life insurance approvals with pre-existing medical conditions often yields significantly better results than self-directed applications, as these professionals understand which companies have the most favorable underwriting for neurological conditions.

Consider applying to multiple companies simultaneously when appropriate, as underwriting decisions can vary dramatically between insurers. What results in a decline from one company might generate an approval from another with different medical underwriting philosophies.

Key Takeaways

- Timing applications after medical stability improves outcomes

- Comprehensive documentation supports favorable underwriting

- Professional guidance significantly impacts approval rates

- Multiple applications may be necessary to find coverage

- Realistic expectations help maintain focus on achievable goals

What Alternative Solutions Exist?

When traditional life insurance proves challenging or unavailable, several alternative financial protection strategies can provide meaningful coverage for families dealing with hydrocephalus. These solutions often require different approaches but can deliver essential financial security.

Guaranteed issue life insurance products accept all applicants regardless of health status, though with limitations including graded death benefits, lower coverage amounts, and higher premiums. These policies ensure some coverage is available when other options aren’t accessible.

Key insight: Group life insurance through employment often provides coverage without medical underwriting, making it valuable supplemental protection. Many people overlook maximizing these benefits, which can provide substantial coverage at reasonable costs.

Alternative Coverage Solutions

| Solution Type | Coverage Amount | Key Benefits |

|---|---|---|

| Guaranteed Issue | $5,000 – $25,000 | No medical questions, guaranteed approval |

| Group Life | 1-5x annual salary | No medical underwriting, employer-subsidized |

| Accidental Death | $50,000 – $500,000 | Higher coverage limits, lower premiums |

Accidental death insurance provides higher coverage amounts at lower premiums, though benefits only apply to accidental deaths. While this limitation is significant, these policies can provide substantial financial protection for families at affordable rates.

State-sponsored high-risk pools and specialty insurance programs sometimes offer coverage for individuals who cannot obtain traditional insurance. These programs vary by state but may provide options when commercial insurance isn’t available.

Financial planning strategies beyond insurance, such as establishing special needs trusts, maximizing savings accounts, and utilizing government benefit programs, create comprehensive financial protection that doesn’t depend solely on insurance coverage.

Which Companies Offer the Best Options?

Company selection proves critical for hydrocephalus cases, as insurers vary dramatically in their approach to neurological conditions. Some companies maintain conservative underwriting guidelines that result in automatic declines, while others have developed specialized expertise in complex medical cases.

Insurance companies with sophisticated medical departments and experience in neurological conditions often provide the most favorable underwriting. These companies employ medical directors and underwriters who understand the nuances of conditions like hydrocephalus and can evaluate cases individually rather than applying blanket restrictions.

Key insight: Best life insurance companies aren’t always the best choice for complex medical cases. Smaller or specialty insurers sometimes offer more flexible underwriting and innovative products designed specifically for high-risk applicants.

“We’ve seen dramatic differences in underwriting decisions between companies for identical cases. Company selection often matters more than the specific medical details when dealing with complex neurological conditions.”

– Insurance Brokers USA Case Management Team

Companies offering no-exam life insurance sometimes provide better options for hydrocephalus cases, as the simplified underwriting process may focus less on detailed medical history and more on current functional capacity and overall health status.

Working with brokers who maintain relationships with multiple insurers and understand each company’s specific underwriting guidelines often produces better results than applying directly to insurance companies or working with agents representing single companies.

The strategy involves identifying 3-5 companies with favorable neurological condition underwriting and applying strategically, understanding that different companies may offer different products and coverage levels based on their specific risk assessment criteria.

How to Maximize Your Approval Chances?

Maximizing approval chances for life insurance with hydrocephalus requires a comprehensive strategy combining medical preparation, strategic timing, professional guidance, and realistic expectations about the process and outcomes.

The foundation of success lies in comprehensive medical documentation that tells your complete story. This includes not just diagnosis and treatment records, but also functional assessments, cognitive evaluations, and evidence of stability over time. Underwriters need to understand your current status and prognosis, not just your medical history.

Most importantly, working with professionals who understand neurological condition underwriting significantly improves both approval rates and coverage quality. These specialists know which companies to approach, how to present your case favorably, and when to apply for optimal results.

Bottom Line

Success requires patience, preparation, and professional guidance. While the process may be more complex than traditional applications, many individuals with hydrocephalus do secure meaningful life insurance coverage with the right approach.

Timing considerations include applying when your medical condition is stable, ideally with at least 6-12 months of consistent management and no recent complications. If you’ve had recent shunt revisions or other medical events, waiting for stability often produces better outcomes.

For personalized guidance on your specific situation, our team specializes in helping individuals with complex neurological conditions secure appropriate life insurance coverage. We understand the unique challenges and have relationships with companies experienced in these cases. Contact us at 888-211-6171 to discuss your options and develop a strategy tailored to your circumstances.

Key Takeaways

- Comprehensive medical documentation strengthens applications

- Professional guidance significantly improves approval rates

- Timing applications during stable periods optimizes outcomes

- Multiple application strategies may be necessary

- Alternative coverage options provide valuable backup plans

- Patience and persistence often lead to successful coverage

Frequently Asked Questions

Can I get life insurance if I have hydrocephalus with a shunt?

Yes, coverage is possible, but it depends on your specific situation. Individuals with well-functioning shunts, stable conditions, and good functional capacity often qualify for coverage. The key factors include shunt stability, minimal complications, and overall health management.

Will I automatically be declined for life insurance with hydrocephalus?

Not necessarily, though many companies may decline. While traditional underwriting often results in declines, some companies specialize in neurological conditions and evaluate cases individually. Success depends on finding the right company and presenting your case effectively.

What type of life insurance is most likely to approve someone with hydrocephalus?

Guaranteed issue and simplified issue policies offer the highest approval rates. While coverage amounts are limited and premiums are higher, these products ensure some coverage is available. Group life insurance through employment also provides excellent coverage without medical underwriting.

How does shunt revision history affect life insurance applications?

Revision history significantly impacts underwriting decisions. Frequent revisions or recent complications may result in declines or postponements. Stable shunts with minimal revision history demonstrate better risk profiles and improve approval chances.

Should I wait after a shunt revision before applying for life insurance?

Yes, waiting for stability often improves outcomes. Most experts recommend waiting 6-12 months after major procedures to demonstrate stable recovery and shunt function. This patience often results in better coverage options and lower premiums.

What medical documentation do I need for a life insurance application with hydrocephalus?

Comprehensive records from your neurological team are essential. This includes surgical reports, current imaging studies, shunt function assessments, cognitive evaluations, and evidence of current functional capacity. Complete documentation helps underwriters understand your specific situation.

Are there any life insurance companies that specialize in neurological conditions?

Yes, some companies have developed expertise in complex medical cases. These insurers often provide more favorable underwriting and innovative products for neurological conditions. Working with brokers who know these companies significantly improves your chances of finding coverage.

Important Medical Disclaimer

This information is for educational purposes only and does not constitute medical advice. Always consult with your neurologist, neurosurgeon, and other healthcare providers regarding your specific medical condition and treatment. Individual cases of hydrocephalus vary significantly, and insurance decisions depend on your unique medical circumstances.

need insurance for preexisting hydrocephalus

Mona,

We would be happy to see what kind of life insurance policy you may be able to qualify for, we’ll just need to speak with you first. So, please give us a call at your earliest convenience.

Thanks,

InsuranceBrokersUSA.

I have pre-existing hydrocephalus and I had it since I was 3 weeks old and I don’t know if my previous neurologist has all my medical records due to I have been homeless since 2017.

Cristina,

It sounds like you may need to apply for a guaranteed issue life insurance policy that won’t require you to take a medical exam or answer any health related questions. Our suggestion would be to give us a call when you have a chance this way we can see what types of life insurance policies you may be able to qualify for.

Thanks,

InsuranceBrokersUSA.

I have lived my entire life with hydrocephalus. I also have generalized idiopathic epilepsy.

I haven’t had surgery or a seizure since 2005.

Can I qualify for life insurance?

Douglas,

Insurance companies consider various factors to assess an applicant’s eligibility and premium rates. These factors typically include your medical history, current health status, and the underwriting guidelines of the insurance company you approach.

In your case, having a medical history of hydrocephalus and epilepsy may impact your eligibility for life insurance. However, the fact that you haven’t had surgery or a seizure since 2005 could work in your favor. Insurance companies may consider the stability and control of your medical conditions when evaluating your application.

To determine your eligibility and obtain accurate information, it’s best to just give us a call so that we can learn more about your situation and assist you in finding the right insurance options for your needs.

Thanks,

InsuranceBrokersUSA

Good Afternoon! I was born with hydrocephalus. As a baby they placed a shunt in my brain to remove the excess fluid. The only thing I experienced thru my 35 years of existence is headaches. But that’s about it. Would I be able to get a Whole Life policy with a built in cash value account?

Thank You!

Frank R.

Frank,

We will have an agent reach out to you via email to discuss what options may be available to you.

Thanks,

InsuranceBrokersUSA