In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Gilbert’s Syndrome.

Questions that will be directly addressed will include:

- Can I qualify for life insurance if diagnosed with Gilbert’s Syndrome?

- Why do life insurance companies care if I’ve been diagnosed with Gilbert’s Syndrome?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if diagnosed with Gilbert’s Syndrome?

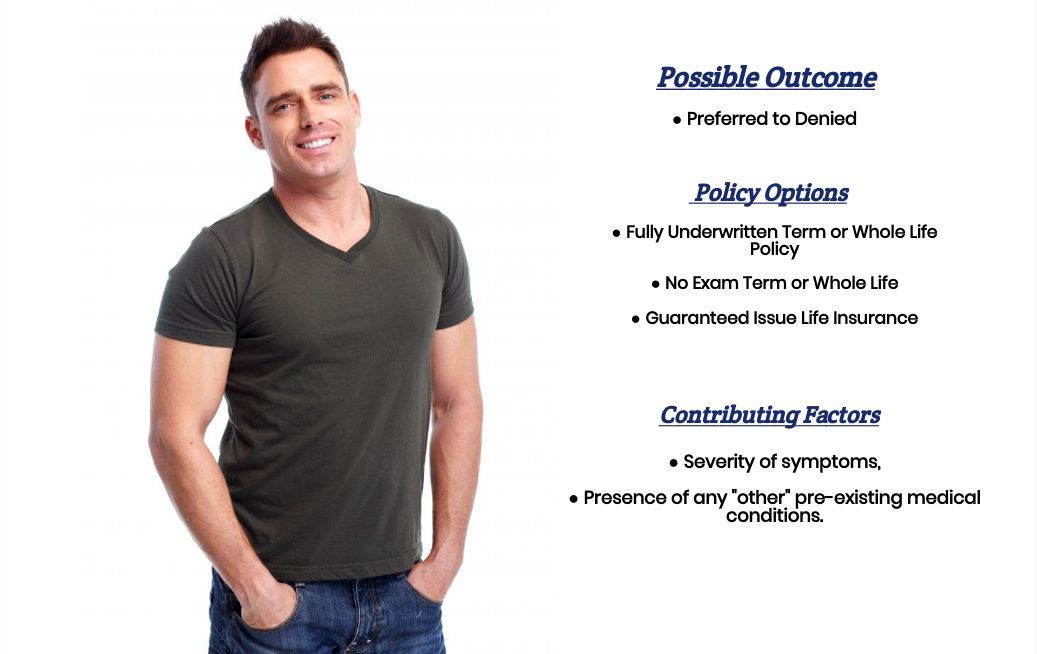

Yes, individuals who have been diagnosed with Gilbert’s Syndrome can and often will qualify for a traditional term or whole life insurance policy. Some may even be eligible for a preferred rate when applying for a no-exam term life insurance policy!

The only problem is that because the primary symptom of Gilbert’s Disease is jaundice, which is a condition that can also be caused by many other much more severe pre-existing medical conditions, most (if not all) of the best life insurance companies will want to make sure that any individual who is suffering from jaundice is only suffering from it due to Gilbert’s Disease and not because of some other “kind” of pre-existing medical condition.

Why do life insurance companies care if I’ve been diagnosed with Gilbert’s Syndrome?

As we just stated, most life insurance companies aren’t going to care all that much about the fact that an individual has been diagnosed with a pre-existing medical condition like Gilbert’s Syndrome simply because Gilbert’s Syndrome is something that is going to cause anyone to suffer from any “serious” consequences.

In fact…

The only symptom that someone might cause someone to think that they may have a condition like Gilbert’s Syndrome is jaundice. And here is where we may run into a “bit” of trouble because suffering from jaundice as a result of having Gilbert’s Syndrome may not be a problem.

But…

Suffering from jaundice as a symptom of some other “kind” of a pre-existing condition like hepatitis, a gallstone attack, or some tumor could become a problem. This is why, even though an insurance underwriter might not be worried that you have been diagnosed with Gilbert’s Syndrome, they’ll probably want to ask you some questions about your condition.

Which is why we want to take a moment and briefly describe Guilbert’s Syndrome so that we’ll all be on the same page when we proceed with our discussion.

Gilbert’s Syndrome Defined.

Gilbert’s Syndrome is an inherited condition caused by a gene that alters the liver’s ability to process bilirubin. As a result, those suffering from this condition may experience symptoms of jaundice from time to time.

The good news is…

In spite of this genetic defect, many individuals who “technically” have Gilbert’s Syndrome may go their whole lives without realizing it because, in many cases, this defect does not keep the liver from being able to process bilirubin completely. Hence, someone may live their entire life symptom-free.

As for those who do go on and develop jaundice from time to time will likely experience feelings of:

- Fatigue,

- Abdominal pain,

- Unexplained weight loss,

- Nausea and/or vomiting,

- Flu-like symptoms, including fevers and chills,

- Pale stools,

- Dark urine,

- Etc…

Fortunately these cases are not typically the “norm” for those diagnosed with Gilbert’s Syndrome, which is why, in most cases, someone with this condition won’t require any medical treatment.

Now, at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s it’s not so great if you’re looking for answers to any specific medical questions. In cases like these, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you might be asked may include:

- When were you first diagnosed with Gilbert’s Syndrome?

- Who diagnosed your Gilbert’s Syndrome?

- What symptoms (if any) led to your diagnosis?

- Have you been diagnosed with any other pre-existing medical conditions?

- If you are prone to developing jaundice, how often does it occur?

- Are you currently taking any prescription medications?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see from the questions above, when determining what kind of “rate” an individual might qualify for after being diagnosed with Gilbert’s Syndrome, most life insurance companies will focus on “why” your condition was discovered. And do you suffer from any other conditions that might have led to the “accidental” discovery.

This is because…

At the end of the day, most life insurance companies aren’t going to care all that much that you have been diagnosed with Gilbert’s Syndrome. Or, to put it another way, when it comes time to determine what kind of “rate” you might be able to qualify for after having been diagnosed with Gilbert’s Syndrome, it’s reasonable to assume that whatever “rate” you would have been able to prepare for before being diagnosed with Gilbert’s Syndrome should be the same “rate” that you will be able to qualify for AFTER having been diagnosed with Gilbert’s Syndrome!

This segues very nicely into the last topic, which we wanted to take a moment and discuss with you today, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true life insurance professional who will work as an advocate for them. Such an agent will be able to help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, before applying, it would be best to be honest with your life insurance agent. This will help them narrow down the best options.

So, what are you waiting for? Give us a call today and see what we can do for you!

Now, will we be able to help out everyone who has been previously diagnosed with Gilbert’s Syndrome?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.