In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have received an artificial heart valve.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve received an artificial heart valve?

- Why do life insurance companies care if I’ve received an artificial heart valve?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve received an artificial heart valve?

Yes, it is possible to qualify for life insurance after receiving an artificial heart valve, but the type and amount of coverage available to you may be affected by several factors related to your health and medical history. Insurance companies may ask you several questions related to your artificial heart valve, including:

- Type of valve: The type of artificial heart valve you have received can impact the insurance company’s decision-making process. Generally, mechanical valves are considered to be more durable than biological valves, but they require lifelong use of blood thinners.

- Date of implantation: The date of your artificial heart valve implantation can affect the type and amount of coverage available to you. In general, the longer you have had the valve, the more favorable the insurance company may view your application.

- Underlying health conditions: Insurance companies may be interested in any underlying health conditions that led to the need for an artificial heart valve. Conditions such as heart disease or a history of heart attacks may impact your eligibility for coverage.

- Current health status: Your current health status, including your blood pressure, cholesterol levels, and other risk factors, can also impact your eligibility for coverage. Insurance companies may require medical exams and review your medical records to assess your overall health.

Based on this information, insurance companies will determine the type and amount of coverage available to you and the premium you will have to pay.

Why do life insurance companies care if I’ve received an artificial heart valve?

Unlike many other pre-existing medical conditions, most folks can understand why a life insurance company is likely to “care” if an individual has needed to receive an artificial heart valve. After all, even though replacement heart valve surgery has become relatively routine, it’s still sort of scary to think about or go through.

But…

Where we usually run into trouble is when we have to explain to someone who is not entirely healthy as a result of their surgery that most of the top rated life insurance companies are still going to have their concerns. So much so, that in most cases, we won’t even recommend that someone consider applying for a No Medical Exam Term Life Insurance Policy because most of these companies will automatically deny someone who has received an artificial simply out of an abundance of caution.

Even though…

Many will argue that the long-term survival rate of folks who do end up receiving an artificial heart valve is quite high. The only problem is there are still some potentially serious consequences that might also arise. Consequences such as:

- Prosthetic valve obstruction which can cause thrombosis and pannus formation,

- Patient-prosthesis mismatch,

- Internal bleeding,

- Prosthetic heart valve regurgitation,

As well as endocarditis.

Which is why….

Even though an applicant with an artificial heart valve may be considered “eligible” for coverage, most (if not all) life insurance underwriters are going to want to learn a lot more about an individuals situation before making any decisions about their life insurance application.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance after receiving an artificial heart valve, insurance companies will likely ask you for detailed information about your medical history, including the reason for receiving the valve, the type of valve you have, and the date of your surgery. They will also want to know about any ongoing medical treatment you are receiving, such as medications or regular check-ups with your doctor. Additionally, they may request access to your medical records to review the specifics of your condition and treatment.

Insurance companies will also want to know about your current health status and any lifestyle factors that could impact your health, such as smoking or a history of high blood pressure or cholesterol. They may ask you to undergo a medical exam, which could include blood tests, EKGs, and other diagnostic tests to assess your overall health.

Specific questions you’ll likely be asked may include:

- When did you receive your artificial heart valve?

- What symptoms (if any) led you to believe you needed to receive an artificial heart valve?

- Who originally diagnosed your condition? A general practitioner or a cardiologist?

- What valve was replaced?

- Have you been diagnosed with any other pre-existing medical condition or cardiovascular diseases?

- Have you ever suffered from a heart attack or stroke?

- Are you currently taking any prescription medications?

- If so, have any of these medications changed in the past 12 months?

- In that past 2 years, have you been hospitalized for any reason?

- What are your current height and weight?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

All of this information will be used to determine your risk level and eligibility for coverage. Depending on the severity of your condition and other risk factors, you may be classified as high-risk and face higher premiums or other limitations on your coverage. However, with proper management of your condition and a healthy lifestyle, it is still possible to obtain life insurance coverage after receiving an artificial heart valve.

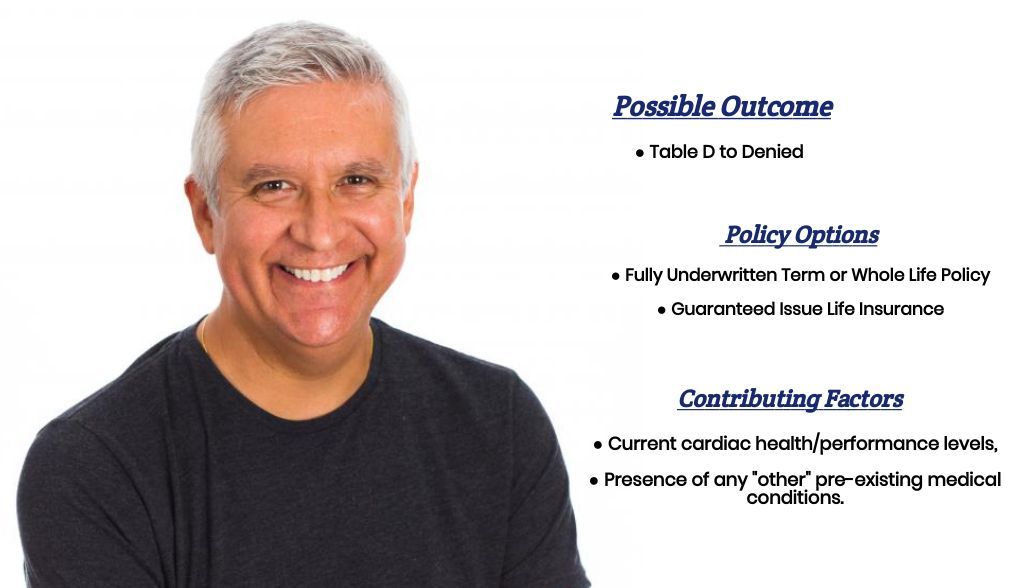

What rate (or price) can I qualify for?

You’re generally going to find that once you have received an artificial heart valve, no matter how “great” your health may become, in the eyes of the life insurance industry, you’re always going to remain an “at-risk” applicant!

Which means that…

It’s now going to be more important than ever that you do your research and know “which” life insurance companies are going to tend to be more “lenient” towards those that have received an artificial heart valve.

And which of “those” life insurance companies are going to have the most competitive pricing for “at-risk” applicants.

The good news…

This is the approach that we take every day here at IBUSA when working with individuals diagnosed with any kind of “serious” pre-existing medical condition or have undergone any kind of procedure like receiving an artificial heart valve.

This brings us to the last topic that we wanted to take a moment to discuss with you…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now does it.

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent before applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”!

Now, will we be able to help out everyone who has been previously diagnosed with an Artificial Heart Valve?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!