In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Asbestosis.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with an Asbestosis?

- Why do life insurance companies care if I’ve been diagnosed with an Asbestosis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been diagnosed with an Asbestosis?

Yes, individuals who have been diagnosed with Asbestosis can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is, that prior to being approved for coverage, most of the top-rated life insurance companies are going to want to make sure that the “cause” of your exposure has been eliminated and that you don’t currently show any symptoms of a larger or “problematic” medical condition.

This is why…

Some folks may not be able to qualify for a no medical exam term life insurance policy, particularly if they also suffer from some other “type” of a pre-existing medical condition as well.

Why do life insurance companies care if I’ve been diagnosed with an Asbestosis?

The main reason why life insurance companies are going to “care” if you have been diagnosed with Asbestosis is that this “diagnosis” is going to indicate that you have been exposed to Asbestos, which is a known carcinogen!

Asbestosis Defined.

Asbestosis is a medical term used to describe a lung disease that occurs as a direct result of inhaling asbestos particles. As a result, patients will develop serious fibrosis within the lungs and become high-risk candidates for later developing mesothelioma.

The good news is…

Being diagnosed with Asbestosis does not mean that one will “automatically” develop mesothelioma, and for many, their Asbestosis may simply become a “chronic” lung condition, which they will ultimately end up living decades with.

Which is why…

Many individuals who have been diagnosed with Asbestosis will still be able to qualify for a traditional term or whole life insurance policy after a life insurance underwriter has been able to determine that you’re “asbestosis” condition is not a “significant,” your exposure to Asbestos has ceased, and you obviously haven’t been diagnosed with mesothelioma.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Asbestosis?

- Who diagnosed your Asbestosis? A general practitioner or a specialist?

- Do you know where you came into contact with Asbestos?

- Do you still continue to have contact with Asbestos?

- What symptoms (if any) led to your Asbestosis diagnosis?

- Shortness of breath?

- Tightness in your chest?

- A consistent cough?

- Chest pain?

- Digital clubbing (enlarged fingertips)?

- Deformed finger or toenails?

- What treatment options are you utilizing?

- Have you been prescribed any prescription medications?

- Have any of your medications changed in any way within the past 12 months?

- Has your doctor suggested that you may need a lung transplant?

- Have you been diagnosed with any other serious medical conditions?

- Have you been diagnosed with heart disease, cancer, or diabetes?

- Have you ever suffered from a heart attack or stroke?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now at this point…

We do like to remind folks that nobody here at IBUSA is a medical profession, and we’re certainly not doctors. If you have any specific medical questions about your condition, we would strongly encourage you to give a medical professional a call!

That said however…

If all you’re looking for is life insurance advice and all you’re looking to do is find help locating a life insurance policy that will meet your needs and be one that you can qualify for, we’ll then you’re in luck because that’s what we’re really good at!

What rate (or price) can I qualify for?

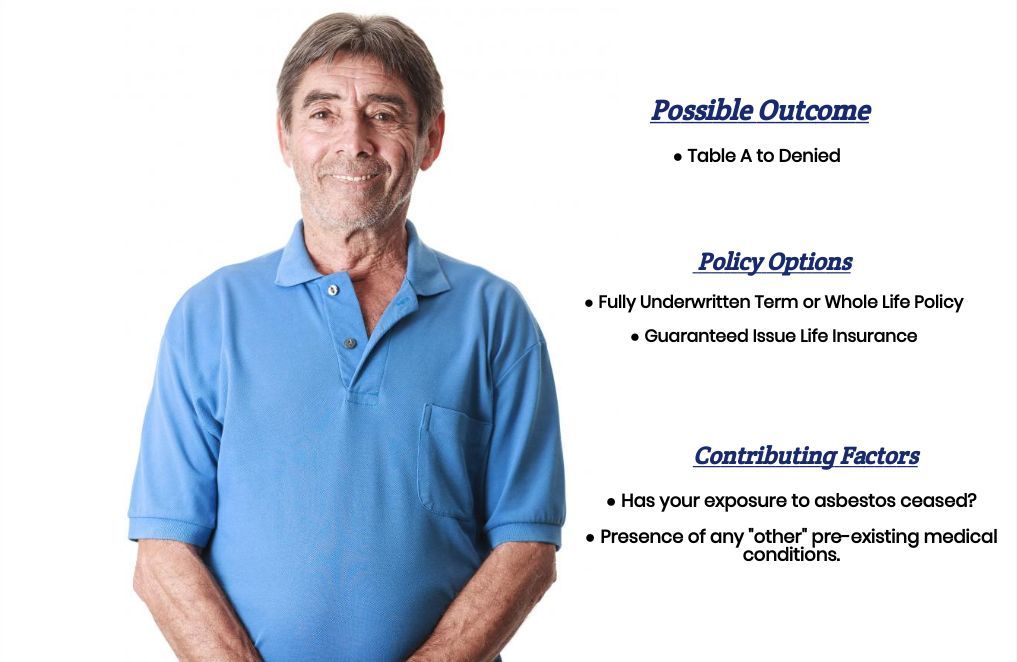

As you can see, there are quite a few variables that can come into play when determining what kind of rate that an individual may or may not be able to qualify for after having been diagnosed with Asbestosis. This is why it’s almost impossible to know for sure what kind of “rate” you might qualify for or whether or not you’ll even be able to qualify for a traditional term or whole life insurance policy without actually speaking to you.

That said however…

What we can say for sure is that unless you have eliminated your exposure to Asbestos and only suffer from mild symptoms related to your Asbestosis, chances are you’re not going to be able to qualify for a traditional term or whole life insurance policies.

This is mainly because…

Even those who can qualify for coverage will only be able to do so at a “high risk” category, and even then, they pretty much need to be in perfect health otherwise. The good news is that here at IBUSA, we have a ton of experience helping folks with all sorts of pre-existing medical conditions, so it there is a chance that you might be able to qualify for coverage, we should know which company will be the one.

And if not…

We also offer a wide variety of “alternative” products such as guaranteed issue life insurance policies as well as accidental death policies that may meet your needs. Which brings us to the last topic that we wanted to take a moment and discuss with you, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent before applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”.

So, what are you waiting for? Give us a call today and see what we can do for you!