Living with gastritis often means juggling discomfort, diet changes, and ongoing treatment—and the last thing you want is confusion about life insurance. Yet many people run into conflicting advice online: some say it won’t matter, others warn it could block affordable coverage. The reality lies in between.

Life insurance companies don’t view all gastritis the same. They’ll look at key details like the cause of your condition (such as reflux, infection, or medication use), how severe your symptoms are, whether you’ve had hospitalizations, and how well your treatment plan is working. These factors help underwriters distinguish between routine, well-managed cases and more complex situations.

Our review of gastritis-related applications shows encouraging results: most applicants with properly documented care qualify for standard or near-standard rates, especially when they work with companies experienced in evaluating digestive health conditions. With the right guidance, gastritis usually becomes just one small part of your medical history—not a barrier to protecting your family’s financial future.

How Do Insurance Companies View Gastritis?

- Life insurance underwriters approach gastritis evaluation through a risk assessment framework that distinguishes between acute, chronic, and complicated cases. Unlike more serious digestive conditions, gastritis typically receives favorable underwriting consideration when properly documented and managed effectively.

- The underwriting process focuses on identifying potential complications rather than the gastritis diagnosis itself. Underwriters are particularly interested in ruling out underlying conditions like H. pylori infection, autoimmune disorders, or medication-related causes that might indicate broader health risks.

“Gastritis by itself is rarely a significant underwriting concern. We’re more interested in what’s causing it and how well it’s controlled. Someone with well-managed H. pylori gastritis often presents less risk than someone with ongoing medication-induced gastritis from chronic pain management.”

– InsuranceBrokers USA – Management Team

- Modern underwriting recognizes that gastritis affects millions of Americans and is successfully managed in the vast majority of cases. Underwriters typically classify gastritis cases into categories ranging from standard rates for mild, well-controlled cases to modest rate increases for chronic or complicated presentations.

- Treatment response plays a crucial role in underwriting decisions. Individuals who respond well to standard treatments like proton pump inhibitors or lifestyle modifications generally receive more favorable consideration than those requiring ongoing specialist care or experimental treatments.

Bottom Line

Insurance companies view gastritis as a manageable condition that typically doesn’t significantly impact life insurance approval or rates when properly documented and controlled.

Which Types of Gastritis Affect Insurance Most?

Key insight: Underwriting impact varies significantly based on gastritis type, with acute cases receiving standard rates while chronic autoimmune gastritis may result in modest rate increases due to associated health risks.

- Acute gastritis, often caused by temporary factors like medication use, stress, or dietary indiscretion, typically receives the most favorable underwriting consideration. These cases usually resolve completely with treatment and lifestyle modifications, presenting minimal long-term risk to insurers.

Gastritis Types and Underwriting Impact

| Gastritis Type | Common Causes | Typical Rate Impact | Key Underwriting Factors |

|---|---|---|---|

| Acute Gastritis | NSAIDs, alcohol, stress | Standard rates | Resolution, cause removal |

| H. Pylori Gastritis | Bacterial infection | Standard to Table 2 | Treatment success, eradication |

| Chronic Gastritis | Long-term irritation | Standard to Table 4 | Symptom control, complications |

| Autoimmune Gastritis | Immune system dysfunction | Table 2-6 ratings | B12 levels, monitoring frequency |

- H. pylori-related gastritis represents a common scenario that generally receives favorable underwriting treatment once successfully eradicated. Underwriters focus on treatment completion and follow-up testing confirming bacterial elimination rather than the initial infection history.

- Chronic gastritis presents more complex underwriting considerations, as the ongoing nature requires assessment of symptom control, treatment effectiveness, and potential for complications. However, most chronic gastritis cases still qualify for standard or near-standard rates with appropriate management.

“The key is distinguishing between gastritis as an isolated condition versus gastritis as part of a broader health pattern. Someone with stress-related acute gastritis that resolved with lifestyle changes presents very differently than someone with chronic gastritis requiring ongoing specialist management.”

– InsuranceBrokers USA – Management Team

- Autoimmune gastritis requires more detailed underwriting review due to potential associated conditions like pernicious anemia or vitamin B12 deficiency. While still generally approvable, these cases may receive modest rate increases depending on monitoring requirements and associated health impacts.

- Erosive gastritis with bleeding history receives closer underwriting scrutiny, though most cases still qualify for coverage with appropriate documentation of resolution and ongoing management strategies.

Key Takeaways

- Acute gastritis typically receives standard rates when resolved

- H. pylori gastritis with successful treatment generally qualifies for favorable rates

- Chronic gastritis may result in modest rate increases depending on control

- Autoimmune gastritis requires more detailed review but remains approvable

What Medical Information Will Underwriters Need?

Key insight: Gastritis underwriting requires comprehensive documentation of diagnosis method, treatment response, and current management status, with particular emphasis on ruling out underlying serious conditions.

- Diagnostic documentation forms the foundation of gastritis underwriting review. Underwriters typically request records from endoscopic procedures, upper GI series, or other diagnostic tests that confirmed your gastritis diagnosis and ruled out more serious conditions like ulcers or malignancy.

- Treatment history documentation helps underwriters assess the severity and management success of your condition. This includes medication responses, dietary modifications, lifestyle changes, and any specialist consultations required for optimal management.

Required Medical Documentation for Gastritis Underwriting

| Document Type | Specific Information Needed | Underwriting Purpose |

|---|---|---|

| Diagnostic Records | Endoscopy reports, biopsy results, imaging studies | Confirm diagnosis, rule out complications |

| Treatment Records | Medication history, dosages, treatment response | Assess severity and management success |

| Follow-up Care | Specialist visits, monitoring frequency, symptom tracking | Evaluate ongoing care needs |

| Current Status | Recent symptoms, medication compliance, lifestyle factors | Determine current risk level |

- Current symptom status plays a crucial role in underwriting decisions. Underwriters want to understand your current symptom frequency, severity, and impact on daily activities, as well as any recent changes in your condition or treatment requirements.

- Laboratory results may be requested, particularly for cases involving H. pylori infection, autoimmune gastritis, or suspected nutritional deficiencies. Blood tests showing successful H. pylori eradication or vitamin B12 levels in autoimmune cases provide important underwriting information.

“Complete, organized medical records make a significant difference in gastritis underwriting. When we can clearly see the diagnosis process, treatment progression, and current status, we can often offer better rates than when we’re working with incomplete information that requires us to make conservative assumptions.”

– InsuranceBrokers USA – Management Team

- Specialist consultation records from gastroenterologists provide valuable insight into complex cases or those requiring advanced management. These reports often contain prognostic information that helps underwriters assess long-term health implications.

- Lifestyle factor documentation, including dietary modifications, stress management strategies, and alcohol/smoking cessation efforts, demonstrates commitment to condition management that underwriters view favorably in their risk assessment.

Bottom Line

Comprehensive medical documentation including diagnostic records, treatment history, and current status information enables underwriters to provide the most favorable rate classification for your gastritis case.

How Do Underlying Causes Influence Approval?

Key insight: The underlying cause of gastritis often matters more to underwriters than the gastritis itself, with some causes like medication-induced gastritis receiving more favorable consideration than others like autoimmune-related gastritis.

- Medication-induced gastritis, particularly from NSAIDs or aspirin, typically receives favorable underwriting treatment when the causative medication has been discontinued or modified. Underwriters view these cases as having identifiable, manageable triggers that reduce future risk.

- Stress-related gastritis often qualifies for standard rates when associated with identifiable stressors that have been addressed through lifestyle modifications, counseling, or stress management techniques. The key is demonstrating effective stress management strategies.

Underlying Cause Impact on Underwriting

| Underlying Cause | Underwriting Consideration | Rate Impact | Key Success Factors |

|---|---|---|---|

| NSAID/Medication | Favorable if discontinued | Standard rates | Medication modification, resolution |

| H. Pylori Infection | Good with successful treatment | Standard to Table 2 | Eradication confirmation, follow-up |

| Stress-Related | Manageable with lifestyle changes | Standard to Table 2 | Stress management, symptom control |

| Autoimmune | Requires detailed review | Table 2-6 ratings | Associated condition management |

| Alcohol-Related | Depends on consumption patterns | Standard to Table 4 | Alcohol cessation, liver function |

- H. pylori bacterial infection as an underlying cause generally receives favorable underwriting consideration once successfully treated and eradicated. Underwriters focus on treatment completion and follow-up testing confirming bacterial elimination rather than the infection history.

- Autoimmune gastritis requires more comprehensive underwriting review due to potential associated conditions like pernicious anemia, thyroid disorders, or other autoimmune diseases. While still approvable, these cases may receive modest rate increases depending on associated health implications.

“We always look beyond the gastritis diagnosis to understand what’s driving it. Someone whose gastritis resolved after stopping NSAIDs presents a completely different risk profile than someone with ongoing autoimmune gastritis requiring regular monitoring for vitamin deficiencies and associated conditions.”

– Medical Director, Life Insurance Underwriting

- Alcohol-related gastritis underwriting depends heavily on current consumption patterns and liver function status. Cases involving alcohol cessation with normal liver function typically qualify for standard rates, while ongoing alcohol use may result in rate increases.

- Idiopathic gastritis, where no clear underlying cause is identified, receives moderate underwriting consideration. These cases focus on symptom control, treatment response, and monitoring for potential underlying conditions that may emerge over time.

Key Takeaways

- Medication-induced gastritis with cause removal typically receives standard rates

- H. pylori gastritis with successful eradication generally qualifies for favorable underwriting

- Stress-related gastritis with effective management strategies receives good consideration

- Autoimmune causes require detailed review but remain approvable with appropriate management

Which Companies Offer the Best Rates for Gastritis?

Key insight: Traditional life insurance companies typically offer the most competitive rates for gastritis cases, as most view digestive conditions as minor underwriting factors that don’t require specialized risk assessment.

- Major mutual insurance companies often provide excellent rates for gastritis cases, particularly those with clear underlying causes and successful treatment histories. These companies have extensive experience with common digestive conditions and sophisticated underwriting protocols.

- Standard life insurance carriers generally view gastritis favorably compared to more serious digestive conditions, often approving applications at standard or near-standard rates for well-managed cases without requiring specialized underwriting expertise.

Company Categories and Gastritis Rate Expectations

| Company Category | Rate Range | Best For | Application Requirements |

|---|---|---|---|

| Major Mutuals | Standard to Table 2 | Well-controlled, clear diagnosis | Complete medical records |

| Traditional Carriers | Standard to Table 4 | Most gastritis cases | Standard underwriting process |

| Simplified Issue | Standard rates | Mild cases, limited coverage needs | Health questionnaire only |

| High-Risk Specialists | Table 2-6 ratings | Complex or chronic cases | Detailed medical review |

- Simplified issue companies represent an excellent option for individuals with mild, well-controlled gastritis who need moderate coverage amounts. These companies often approve gastritis cases at standard rates without extensive medical underwriting.

“Gastritis is one of the few conditions where traditional companies often beat specialized high-risk carriers on pricing. Most major insurers view gastritis as a minor factor that doesn’t require specialized underwriting expertise, leading to very competitive standard rates.”

– InsuranceBrokers USA – Management Team

- High-risk specialist companies may be beneficial for complex gastritis cases involving multiple underlying causes, frequent hospitalizations, or associated conditions. While their rates may be higher, they offer coverage options for cases that traditional carriers might decline.

Company financial strength ratings remain important considerations, particularly since gastritis typically doesn’t significantly impact your ability to qualify with highly rated insurers. Choose companies with strong financial ratings while comparing competitive rate offerings.

Direct-to-consumer insurance companies increasingly offer competitive rates for gastritis cases through streamlined underwriting processes that may provide faster approval and standard rates for straightforward cases.

Bottom Line

Traditional life insurance companies typically offer the most competitive rates for gastritis cases, as most view it as a minor underwriting factor that doesn’t require specialized risk assessment.

How to Strengthen Your Application for Approval?

Key insight: Successful gastritis applications emphasize treatment compliance, lifestyle modifications, and symptom stability rather than minimizing the condition or providing incomplete medical information.

- Document your treatment adherence comprehensively. Consistent medication compliance, dietary modifications, and lifestyle changes demonstrate responsible health management that underwriters view favorably in their risk assessment process.

- Provide complete diagnostic information rather than omitting details about your gastritis. Underwriters prefer comprehensive medical histories that demonstrate thorough evaluation and appropriate treatment rather than incomplete information that raises questions.

“The most successful gastritis applications provide a clear, complete picture of the diagnosis, treatment, and current status. When we can see that someone has been proactive about their health management and achieved good symptom control, we can often offer our best available rates.”

– InsuranceBrokers USA – Management Team

Application Strengthening Strategies for Gastritis

| Strategy Area | Specific Actions | Underwriting Benefit |

|---|---|---|

| Treatment Compliance | Medication adherence, follow-up appointments | Demonstrates responsible health management |

| Lifestyle Documentation | Dietary changes, stress management, alcohol cessation | Shows commitment to risk reduction |

| Complete Disclosure | Full medical history, diagnostic details | Prevents surprises, builds trust |

| Optimal Timing | Apply during stable, well-controlled periods | Maximizes favorable assessment |

- Time your application during periods of good symptom control and stable treatment. Applying during gastritis flares or medication adjustments may result in postponement requests or less favorable underwriting consideration.

- Obtain current physician statements that address your gastritis management, treatment response, and prognosis. Proactive medical documentation often provides underwriters with confidence in your long-term health outlook.

Consider working with experienced agents who understand digestive health underwriting. While gastritis typically doesn’t require specialized expertise, knowledgeable agents can help present your case optimally and identify the most suitable companies for your situation.

Key Takeaways

- Document comprehensive treatment compliance and lifestyle modifications

- Provide complete medical information rather than minimizing condition details

- Time applications during stable, well-controlled periods

- Obtain current physician statements addressing management and prognosis

What Will Life Insurance Cost with Gastritis?

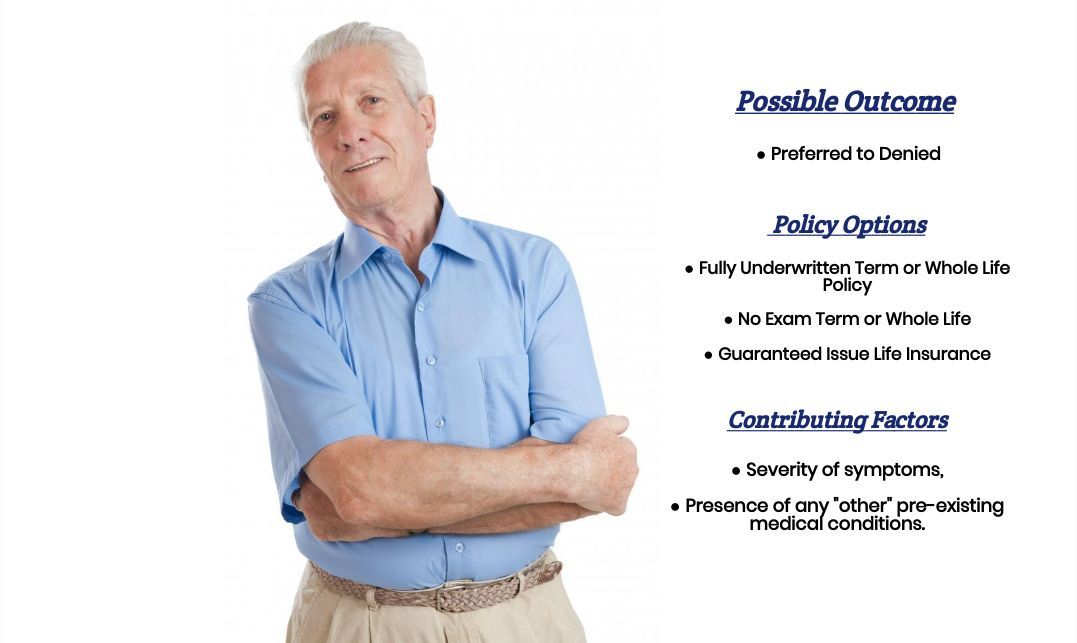

Key insight: Most gastritis cases qualify for standard to near-standard life insurance rates, with the majority of applications receiving no rate increase or modest table ratings of 25-50% above standard prices.

- Mild, well-controlled gastritis typically qualifies for standard rates with most insurance companies, particularly when associated with identifiable, manageable causes like medication use or stress that have been addressed effectively.

- Chronic gastritis with ongoing symptoms may result in table ratings ranging from Table 2 to Table 4, corresponding to premium increases of 25% to 100% above standard rates, depending on symptom frequency and treatment requirements.

Sample Premium Costs for $500,000 Coverage (Female, Age 45)

| Gastritis Profile | Rate Classification | Annual Premium | Premium Impact |

|---|---|---|---|

| Standard Health | Standard | $1,800 | Baseline |

| Mild, Well-Controlled | Standard | $1,800 | No increase |

| Chronic, Stable | Table 2 | $2,250 | +25% |

| Autoimmune/Complex | Table 4 | $3,600 | +100% |

- Age and gender impact gastritis-related premiums similarly to standard underwriting, with younger applicants typically seeing smaller absolute dollar increases when table ratings are applied.

“The good news about gastritis and life insurance is that it’s one of the few digestive conditions where most people qualify for standard rates. Unlike more serious conditions that automatically trigger rate increases, gastritis often has minimal impact on life insurance costs when properly managed.”

– InsuranceBrokers USA – Management Team

- Coverage amount typically doesn’t significantly influence rate classifications for gastritis cases, as most companies view it as a minor risk factor that doesn’t require coverage restrictions or specialized underwriting adjustments.

- Term versus permanent insurance costs remain similar for gastritis cases since the condition typically doesn’t result in significant rate increases. However, locking in current health status through permanent coverage may provide benefits if your condition progresses over time.

- Multiple applications to different companies may reveal rate variations, though gastritis typically doesn’t create the dramatic pricing differences seen with more serious health conditions. Shopping multiple carriers remains beneficial for optimizing overall rates and coverage terms.

Bottom Line

Most gastritis cases qualify for standard or near-standard rates, with well-controlled conditions typically receiving no premium increase and chronic cases seeing modest increases of 25-100% above standard pricing.

Frequently Asked Questions

Do I need to disclose my gastritis on life insurance applications?

Direct answer: Yes, you should always disclose your gastritis diagnosis honestly on life insurance applications.

Life insurance applications typically ask about digestive conditions, and gastritis falls under this category. Failure to disclose known medical conditions can void your coverage when your beneficiaries need it most. However, gastritis disclosure rarely leads to coverage denial and often has minimal impact on rates. Insurance companies have extensive medical databases and prescription monitoring capabilities that make undisclosed conditions discoverable during claims processing. Complete honesty during the application process protects your family’s financial security and often results in better outcomes than attempting to hide manageable conditions like gastritis.

Will gastritis affect my life insurance rates significantly?

Direct answer: Most gastritis cases have minimal impact on life insurance rates, with many qualifying for standard rates and others receiving modest increases.

Gastritis typically results in standard rates for well-controlled cases or modest table ratings of 25-100% for chronic conditions. Unlike more serious digestive disorders, gastritis is viewed as a manageable condition by most insurance companies. The specific impact depends on factors like underlying cause, treatment response, and current symptom control. Medication-induced gastritis that resolved after stopping the causative drug often qualifies for standard rates, while autoimmune gastritis might result in Table 2-4 ratings. Overall, gastritis represents one of the more favorably underwritten digestive conditions.

What if my gastritis is caused by H. pylori bacteria?

Direct answer: H. pylori-related gastritis typically receives favorable underwriting consideration once successfully treated and eradicated.

Insurance companies view H. pylori gastritis positively when treatment has been completed and follow-up testing confirms bacterial elimination. The key factors are successful eradication therapy completion and negative follow-up testing proving the infection has been cleared. Most cases qualify for standard or near-standard rates once treatment is confirmed successful. Underwriters focus more on treatment success than the initial infection history, recognizing that H. pylori is a common, treatable condition that doesn’t significantly impact long-term health when properly managed.

Should I wait until my gastritis is completely resolved before applying?

Direct answer: No, you don’t need to wait for complete resolution – well-controlled gastritis often qualifies for favorable rates.

Many people with ongoing but well-managed gastritis qualify for standard or near-standard rates without waiting for complete resolution. The key is applying during periods of good symptom control with stable treatment rather than during active flares or medication adjustments. Chronic gastritis that’s well-controlled often receives better underwriting consideration than waiting indefinitely for complete resolution that may never occur. However, avoid applying during symptom flares or periods of diagnostic uncertainty, as these situations may result in postponement requests or less favorable consideration.

Can I get no-exam life insurance with gastritis?

Direct answer: Yes, many no-exam life insurance policies accept gastritis cases, often at standard rates for well-controlled conditions.

No-exam life insurance companies frequently approve gastritis cases through simplified underwriting processes that rely on health questionnaires rather than medical exams. These policies often provide standard rates for mild, well-controlled gastritis and can offer faster approval processes. Coverage amounts may be limited compared to fully underwritten policies, but no-exam options provide excellent solutions for individuals with gastritis who need moderate coverage amounts quickly. The streamlined process often works well for gastritis since it’s typically viewed as a minor underwriting factor.

What medical records will the insurance company need for my gastritis?

Direct answer: Underwriters typically request diagnostic records, treatment history, and current management information for gastritis cases.

Insurance companies generally want to see endoscopy reports or other diagnostic testing that confirmed your gastritis diagnosis, medication history showing treatment approaches and responses, and current symptom status documentation. For H. pylori cases, they may request eradication confirmation testing results. The goal is understanding the underlying cause, treatment effectiveness, and current management status rather than extensive documentation. Having organized, complete records available speeds the underwriting process and often results in more favorable consideration than incomplete information that requires underwriters to make conservative assumptions about your condition status.