In this article, we wanted to take a moment and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Tramadol (or one of the familiar brand names it often sold under, including ConZip and Ultram) to treat moderate to severe pain.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Tramadol?

- Why do life insurance companies care if I’ve been prescribed Tramadol?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Tramadol?

Yes, individuals who have been prescribed Tramadol can and often will qualify for a traditional term or whole life insurance policy. In fact, they may even be eligible for a no-medical-exam life insurance policy at a Preferred rate!

This is mainly because of how it is used; it will either significantly affect the outcome of one’s life insurance application or have essentially zero effect.

Why do life insurance companies care if I’ve been prescribed Tramadol?

Life insurance companies “care” if an individual has been prescribed Tramadol for two reasons. First, it is a prescription medication categorized as a narcotic used to treat moderate to severe pain, which is undoubtedly going to interest a life insurance underwriter. After all, it only makes sense that a life insurance underwriter might want to know more about “why” an applicant suffers from pain… right?

The second reason why…

A life insurance company would be interested in the fact that an individual has been prescribed Tramadol Because of the high risk of addiction and dependence medications like these inherently have. This is why, before getting approved for a traditional term or whole life insurance policy, most (if not all) life insurance companies will want to know more about your Tramadol prescription and “what” warranted its prescription from the get-go!

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first prescribed Tramadol?

- Who prescribed your Tramadol? A general practitioner or a specialist?

- Why have you been prescribed Tramadol?

- Are you still taking your Tramadol? If so, when do you expect to need it no longer?

- Are you taking any other prescription medications?

- In the past 12 months, have any of your prescription medications changed in any way?

- Do you have any history of drug or alcohol abuse?

- Do you have any issues with your driving record, such as multiple moving violations, DUIs, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

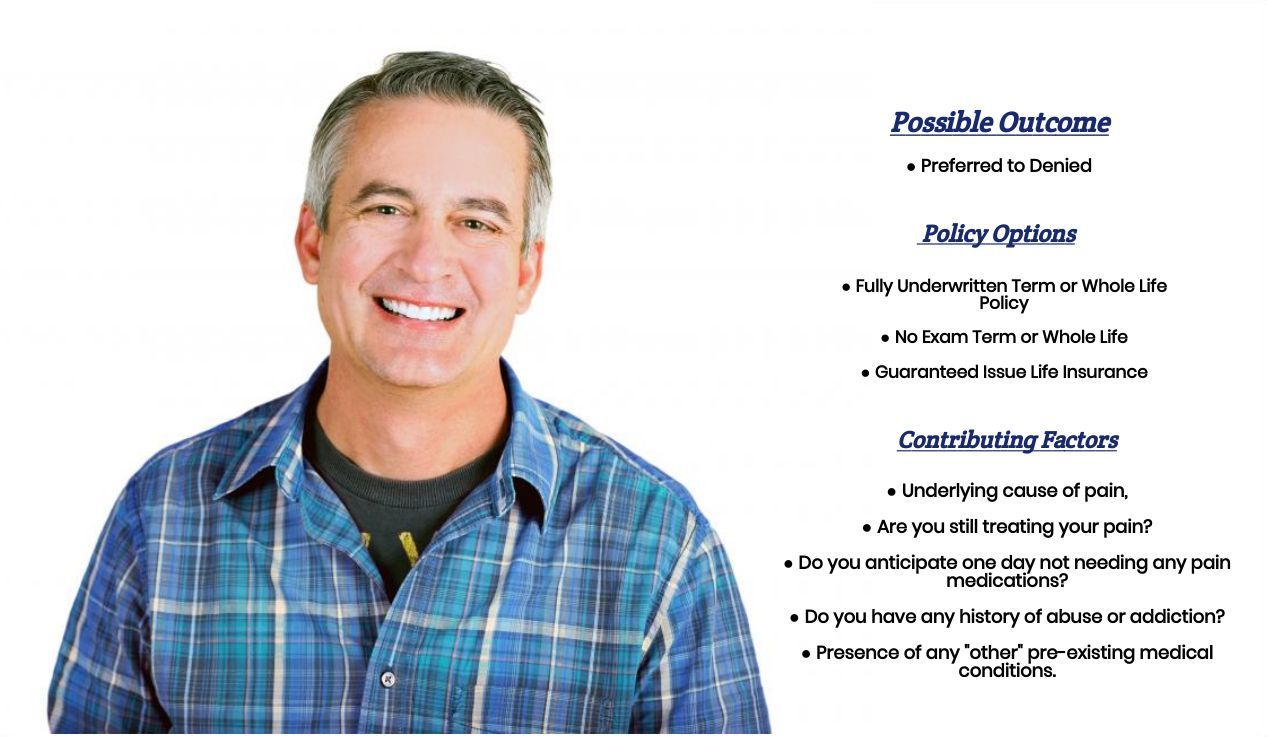

What rate (or price) can I qualify for?

Generally, what we here at IBUSA have found to be the case is that if you’ve been prescribed Tramadol in the past but are no longer taking it now. You don’t show any lingering signs of illness or injury that warranted its use. It doesn’t appear that you are suffering from a dependency or addiction. Having been prescribed Tramadol in the past should not affect the future outcome of your life insurance application.

Unless the previous medical condition is one that insurance companies may consider chronic or have the possibility of reoccurring, the underlying pre-existing medical condition will likely be the main driving force behind the rate you’re ultimately able to qualify for.

We should note, however, that there will be those who are currently taking Tramadol at the time of their life insurance application and may be asked to wait until they no longer need to take It (if possible) before actually applying for a traditional term or whole life insurance (in which case, see above).

For those…

Who may not be sure when they won’t need to take a prescription pain medication like Tramadol? Qualifying for a traditional term or whole life insurance policy may still be possible. Still, now your life insurance application is sure to become much more complicated than the “average Joe’s. ” Applicants like these will almost certainly need to provide a life insurance company with their complete medical records and show absolutely zero signs that they may be abusing their pain medications.

Which brings us to…

Our last group of applicants may exhibit signs of dependency or abuse. In cases where addiction or dependency is suspected, it’s almost certain that a life insurance company will immediately deny one’s life insurance application and not be willing to consider one eligible for coverage for a minimum of two years.

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true life insurance professional who will work as an advocate for them. Such an agent should be able to help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

Before applying, it would be best to be honest with your life insurance agent. Before doing so, you will help them narrow down what options might be the “best. “

Now, can we help out everyone who has been prescribed Tramadol?

No, probably not. But we can tell you that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies.

This way…

If someone can’t qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, call us!