In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Pristiq, Khedezla, or its generic form, Desvenlafaxine Succinate to treat symptoms of depression.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Pristiq?

- Why do life insurance companies care if I’ve been prescribed Pristiq?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Pristiq?

Short answer: Maybe.

Long answer: It depends.

While we would love to give someone a definitive answer with regards to whether or not they will be able to qualify for a traditional term or whole life insurance after they’ve been prescribed Pristiq, it is just not possible when dealing with treating a condition like depression especially because Pristiq is a medication that is not often prescribed to folks who are simply suffering from a mild case of depression.

Instead…

Pristiq is typically reserved for folks who are suffering from a more “serious” case of depression, one which will typically be diagnosed as major depression or major depressive disorder. Unfortunately, most folks suffering from this disorder will not qualify for a traditional term or whole life insurance policy.

Why do life insurance companies care if I’ve been prescribed Pristiq?

Pristiq is one of those “kinds” of medications that insurance underwriters use as a “clue” that they’ll ask additional questions about its usage before making any decisions about an individual’s life insurance application.

This is mainly because…

Pristiq is a prescription medication that is “typically” reserved for individuals suffering from “severe” depression.

As a result, in some cases, the current use of this medication can be all that an insurance underwriter may need to deny one’s life insurance application, particularly in cases where an individual is applying for a “no medical exam” life insurance policy. That said, however, you’ll likely find that if you are currently taking Pristiq, you may not be immediately denied coverage. Still, you will undoubtedly be asked a series of medical questions about your condition.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked about your Pristiq usage will typically look something like this:

- When were you first prescribed Pristiq?

- Who prescribed your Pristiq? A general practitioner or a psychiatrist?

- Have you received an “official” diagnosis other than suffering from depression?

- Are you taking any other prescription medications in addition to Pristiq?

- What (if any) medications did you take to treat your depression before Pristiq?

- In the past 12 months, has your prescription for Pristiq changed at all?

- How has your depression affected your life?

- Have you ever been hospitalized due to your depression?

- Have you ever considered or attempted suicide?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

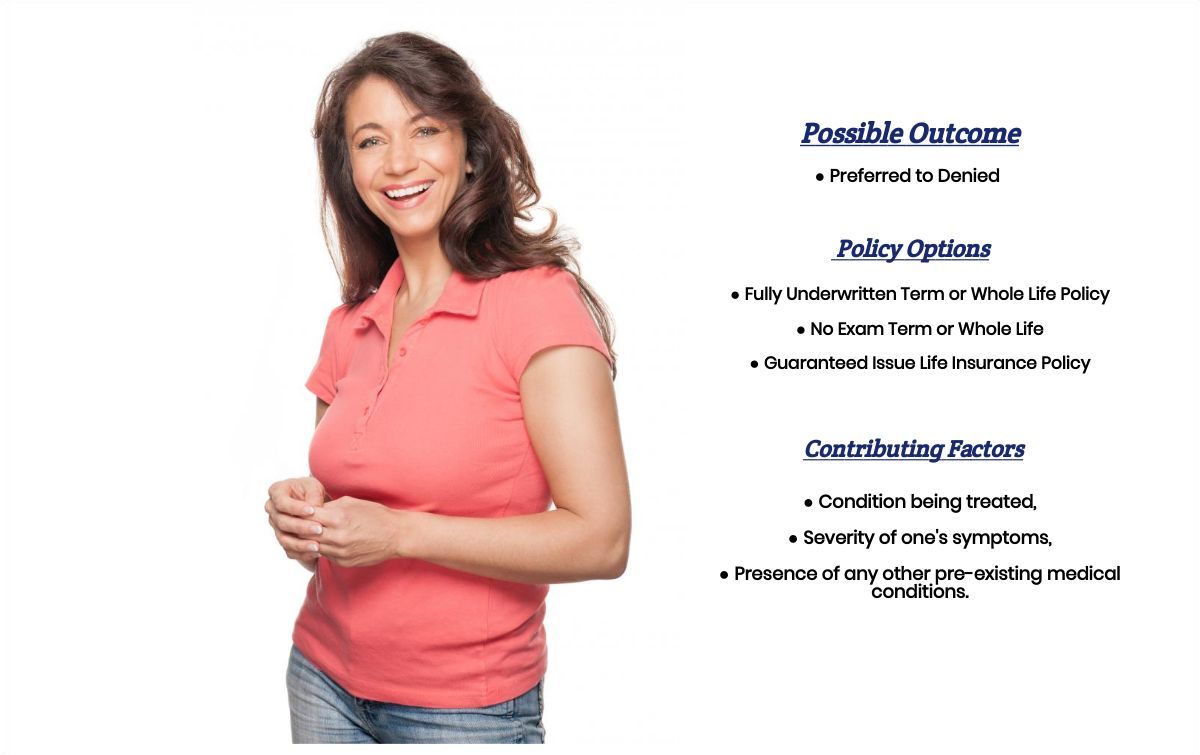

Unfortunately, when it comes to determining the “severity” of one’s depression, there isn’t any “test” a life insurance underwriter can request to get an idea of how “serious” your situation may or may not be. As a result, all they can do is rely on what treatment options are being employed to help you and look to see if your pre-existing medical condition is somehow affecting the quality of your life.

This is why, we at IBUSA have found that once Pristiq has been prescribed, the chances of qualifying for anything better than a Standard rate pretty much disappear. Now, that’s not such a bad thing because Standard is considered “normal, ” so being able to qualify for a Standard rate isn’t all that bad.

The problem is…

Typically, when we encounter folks who are taking Pristiq, they’re also exhibiting some significant signs that their depression is a serious one. It’s so serious that it’s unlikely that they will be able to qualify for a traditional term or whole life insurance policy. For example, these folks may have to be hospitalized for their condition, or they may be currently receiving disability benefits due to their condition. Two situations where it would be doubtful that they would also be able to qualify for a traditional term or whole life insurance policy.

In cases like these…

We typically recommend that these individuals pursue an alternative product, such as a guaranteed-issue life insurance or accidental death policy.

The good news is that we at IBUSA offer these “types” of policies in addition to traditional terms or whole lives, so we can discuss any options you may qualify for. This brings us to the next segment of this article, which is…

How can I help ensure I get the “best life insurance” for me?

Unfortunately, aside from making sure that you’re working with a life insurance professional who fully understands what the different insurance companies will be looking for when making their decision, there’s not a whole lot one can do to help increase their chances at qualifying for the “best” life insurance policy from them. This is because there’s not much one can do to improve their condition from a life insurance application standpoint other than being sure to apply for coverage with a company that will be most “lenient” when it comes to those applying for coverage after being diagnosed with depression.

The good news is…

Here at IBUSA, we have plenty of experience helping folks like yourself qualify for traditional life insurance coverage. Because we work with so many different life insurance companies, you won’t need to spend days and days calling different insurance companies because we can do that for you simultaneously!

So, what are you waiting for? Give us a call today and see what we can do for you!