In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Paxil or its generic form Paroxetine HCL.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Paxil?

- Why do life insurance companies care if I’ve been prescribed Paxil?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help insure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Paxil?

Nothing would make us happier here at IBUSA than to be able to answer this question with a simply “yes” or “No” response, but the problem is, Paxil is a bit of a “wonder drug”! And by “wonder drug” we mean that it is used to treat a wide range of conditions including:

- Depression,

- Panic attacks,

- Obsessive-compulsive disorders (OCD),

- Anxiety disorders,

- Post-traumatic stress disorder (PTSD),

And even severed forms of premenstrual syndrome (Premenstrual dysphoric disorder).

And the problem is…

That a lot of these conditions can vary significantly from one individual. Which is why you’re going to find that some folks you have been prescribed Paxil in the past can and will be able to qualify for coverage while others simply may not be eligible.

Why do life insurance companies care if I’ve been prescribed Paxil?

In general, most life insurance companies aren’t necessarily worried about the fact that you’ve been prescribed Paxil to treat your condition. Rather what concerns them more is the fact that you’ve been diagnosed with your pre-existing medical condition in the first place.

This is mainly because…

While it may not be much fun to experience one of the common side effects of Paxil such as:

- Vision changes,

- Sleep difficulties,

- Loss of appetite,

- Constipation,

- Etc…

Truth be told, none of these side effects are really considered “life-threatening” which is why most (if not all) life insurance underwriters aren’t going to be all that concerned about them. What they will be concerned about is “why” have you been prescribed Paxil, and how serious is the condition being treated by Paxil.

This is why…

Prior to making any kind of decisions about your life insurance application, most (if not all) life insurance underwriters are going to want to ask you a series of questions about your Paxil usage. Which brings us to the next segment of our Paxil discussion which is…

What kind of information will the insurance companies ask me or be interested in?

The first thing that the insurance companies are going to want to know about with regards to your Paxil use is “why” has it been prescribed to you. The answer to this question will then help guide them as to what additional questions they’ll want to know the answers to. Which is we want to take a moment and discuss each individual medical condition Paxil can be used to treat so that you can get a better idea about what kind of questions you might be asked.

For those diagnosed with Depression:

- When where you first diagnosed with depression?

- Who diagnosed your depression? A general practitioner or a psychiatrist?

- Have you received a specific diagnosis with regards to your depression?

- Is Paxil the only medication that your using to treat your depression?

- How often do you take your Paxil?

- Aside from medications, are you receiving any other forms of treatment?

- Within the past 12 months have any of your medications (including Paxil) changed in any way?

- Have you ever been hospitalized due to your depression?

- Do you suffer from a history of drug or alcohol abuse?

- Are you currently working now?

- In the past 12 months have you applied for or received any form of disability benefits?

For those diagnosed with Panic Attacks:

- When did you first experience your first panic attack?

- How often do you suffer from panic attacks?

- When was the last time you suffered from a panic attack?

- How severe are the attacks?

- Have you ever been hospitalized due to a panic attack?

- Is Paxil the only medication that you are taking to treat your panic attacks?

- Do you have a known “trigger” for your attacks?

- How often do you take your Paxil?

- How well is Paxil managing your symptoms?

- Are you currently working now?

- In the past 12 months have you applied for or received any forms of disability benefits?

For those diagnosed with obsessive compulsive disorder (OCD):

- When were you first diagnosed with OCD?

- Who diagnosed your OCD? A general practitioner or a psychiatrist?

- How does your OCD manifest itself?

- Does your OCD prevent you from living a “normal” life?

- Is Paxil the only medication that you’re using to control your OCD?

- How often to you take your Paxil?

- How well is Paxil managing your symptoms?

- Are you currently working now?

- In the past 12 months have you applied for or received any form of disability benefits?

For those diagnosed with an anxiety disorder:

- What “kind” of anxiety disorder do you have?

- Who diagnosed your anxiety disorder? A general practitioner or a psychiatrist?

- When were you first diagnosed?

- Does your anxiety prevent you from being able to live a “normal” life?

- How often do you take your Paxil?

- Are you taking any other medications or receiving any other treatment options for your anxiety?

- In the past 12 months, has your Paxil prescription changed at all?

- Have you ever been hospitalized due to your anxiety?

- Are you currently working now?

- In the past 12 months have you applied for or received any form of disability benefits?

For those diagnosed with post-traumatic stress disorder (PTSD):

- When were you first diagnosed with PTSD?

- Who diagnosed your PTSD?

- Is Paxil the only medication your using to treat your PTSD?

- Are you receiving any other treatment options for your PTSD?

- How severe is your PTSD, does it prevent you from being able to live a “normal” life?

- Have you ever been hospitalized due to your PTSD?

- Do you suffer from a history of drug or alcohol abuse?

- Are you currently working now?

- In the past 12 months have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

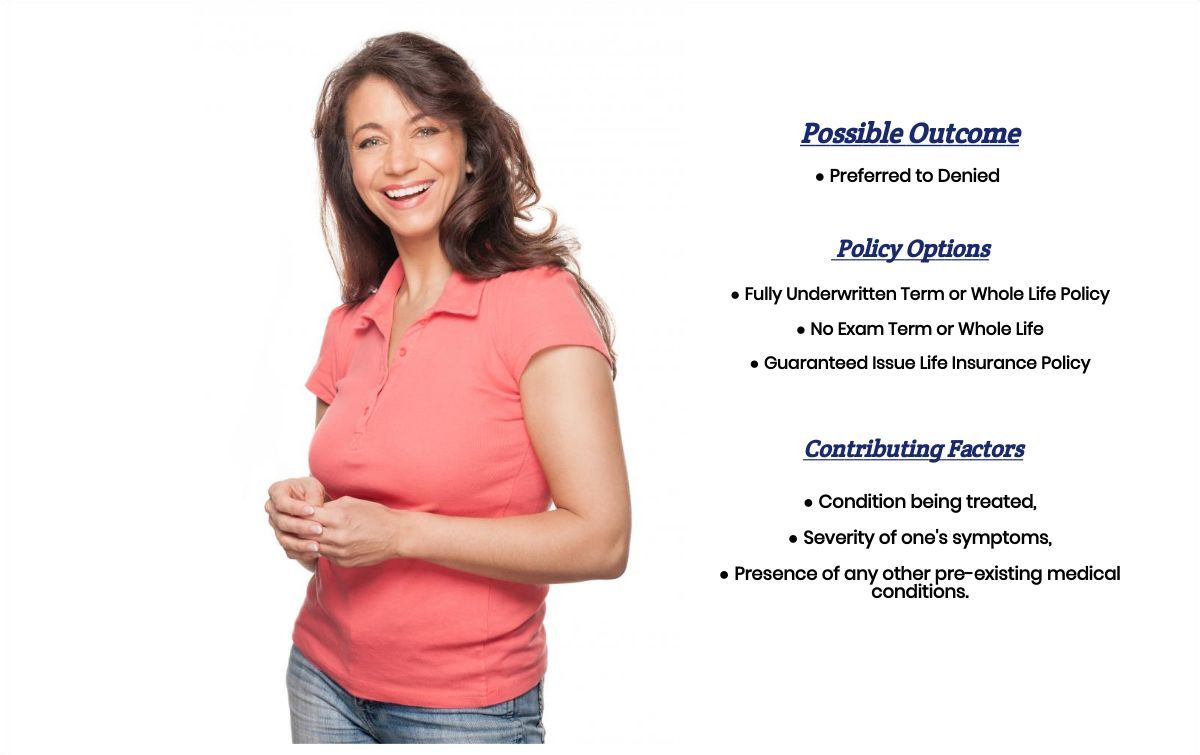

Unfortunately, from a “diagnostic perspective”, none of these pre-existing medical conditions have a “Test” which will indicate how severe one case is vs another. As a result, it will be up to a life insurance underwriter to take a look at how your treatment schedule has changed and clues into your “lifestyle” in order to determine whether or not someone will be able to qualify for a traditional term or whole life insurance policy.

That being said however…

What we her at IBUSA have found is that for folks suffering from mild cases of:

- Depression,

- Anxiety,

- And obsessive-compulsive disorder,

Whereby an individual’s treatment strategies have remained constant, there hasn’t been any hospitalizations and they are currently working a full-time job, in “theory” they should still be able to qualify for a Preferred rate. Or in other words, the underlying cause for why they have been prescribed Paxil shouldn’t have any affect on the outcome of their life insurance application once the insurance underwriter has been able to confirm that it is not too serious.

Now if…

You suffer from a more severe case of depression, anxiety or OCD, well then being able to qualify for a Preferred rating will certainly be off the table, but you may still be able to qualify for a Standard or Standard Plus rating. It’s really all going to come down to how “severe” your situation is and if it is preventing you from being able to live a so called “normal” life.

The same applies…

To those suffering from panic attacks and PTSD. In cases like these because they are generally considered more serious than your more common cases of depression and/or anxiety folks suffering from panic attacks and PTSD will usually only be able to qualify for a Standard rate at best.

Which isn’t…

That big of a deal when you consider the fact that a “standard” rate is a rate that is applied to someone who is considered a “normal” health risk. The real trick however is to know “which” life insurance companies are going to be lenient enough to allow one who has been diagnosed with panic attacks and/or PTSD to be allowed to qualify for a Standard rate. Which brings us to the next segment of this article which is…

What can I do to help insure that I get the “best life insurance” for me?

Basically aside from making sure that you’re working with a life insurance professional who fully understands your pre-existing medical condition whether it be depression, anxiety, OCD, PTSD or panic attacks and who also has access to plenty of different insurance companies, there’s not a whole lot one can do to help increase their chances at qualifying for the “best” life insurance policy for them.

This is because…

With all of these pre-existing medical conditions, there’s really not much one can do to improve their condition from a life insurance application standpoint other than being sure to apply with a company that will be most “lenient” for your particular condition.

The good news is…

That here at IBUSA, we have plenty of experience helping folks like yourself qualify for traditional life insurance coverage and because we work with so many different life insurance companies you won’t need to spend days and days calling different insurance companies because we can do that for you simultaneously!

So, what are you waiting for? Give us a call today and see what we can do for you!