In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Microzide or its generic form to Hydrochlorothiazide to treat high blood pressure (hypertension) and fluid retention (edema).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Microzide?

- Why do life insurance companies care if I’ve been prescribed Microzide?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Microzide?

Yes, individuals who have been prescribed Microzide can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred rating! The only problem is that because Microzide isn’t ONLY used to help folks reduce their blood pressure levels, insurance companies will be on the “lookout” for individuals who may be suffering from more serious pre-existing medical conditions once they see that an individual has been prescribed Microzide, which is why you’re probably going to be asked a few questions specifically about your Microzide prescription prior to getting approved for coverage.

Why do life insurance companies care if I’ve been prescribed Microzide?

In general, most life insurance companies aren’t going to spend too much time focusing on the fact that an individual applicant has been prescribed a medication to help them treat their blood pressure levels. In fact, it’s probably safe to say that most life insurance companies would probably prefer to insure someone who is using prescription medication like Microzide to control their blood pressure vs. insuring someone who has borderline high blood pressure and isn’t on medications.

After all…

At least with the individual who is taking their medications, they know that this person is aware of their hypertension and is doing something to fix it! The only problem that we run into with Microzide is that in addition to being a quality medication to help one lower their blood pressure it’s also quite effective at helping one treat symptoms of edema as well.

And…

While experiencing the occasional bouts of edema isn’t something that is going to worry a life insurance underwriter too much, experiencing chronic edema resulting from so “other” pre-existing medical condition could. This is why before getting approved for a traditional term or whole life insurance policy after having been prescribed a medication like Microzide, you should be prepared to be asked a series of questions designed to learn more about “why” you’ve been prescribed Microzide and whether there is some “other” pre-existing medical condition in addition to your hypertension that they (the insurance company) should be worried about.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first prescribed Microzide?

- Who prescribed your Microzide? A general practitioner? Or a cardiologist?

- Why have you been prescribed Microzide?

- Do you ever experience symptoms of water retention or edema?

- Is Microzide the only prescription medication that you’re currently taking?

- Have any of your prescription medications changed in any way in the past 12 months?

- Have you been diagnosed with any serious pre-existing medical conditions such as heart disease or respiratory conditions?

- Have you ever suffered from a heart attack or stroke?

- In the past 2 years, have you been admitted to a hospital?

- What is your current height and weight?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

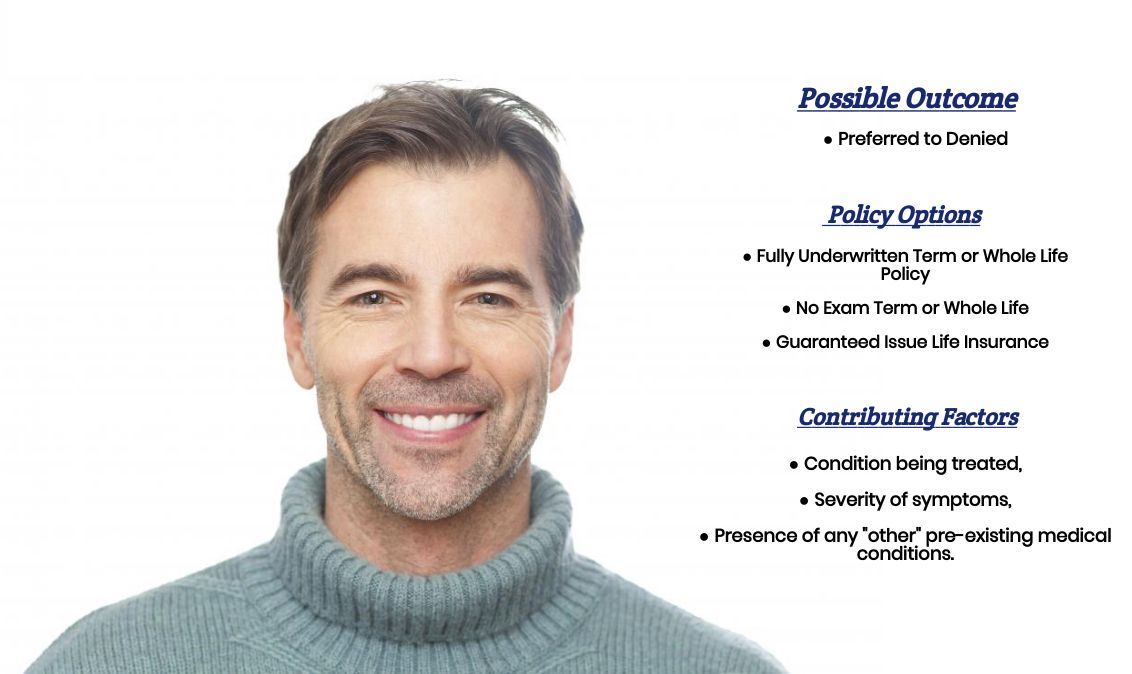

Here at IBUSA, what we have found is that if you have been prescribed Hydrochlorothiazide to help you treat your hypertension. You aren’t really experiencing symptoms of edema as a result of some other “kind” of a pre-existing medical condition; in theory, you still ought to be able to qualify for a Preferred rate, assuming that you would otherwise be eligible.

Where we run into trouble is when an individual has been prescribed Hydrochlorothiazide to treat their hypertension but also has symptoms of or has been diagnosed with some “other” more serious medical condition, which will ultimately be the deciding factor in determining what “kind” of rate an individual might be able to qualify for.

The good news is that…

Here at IBUSA, in addition to being able to help folks who are generally pretty healthy, we take particular pride in helping folks who may have been previously told that they can’t qualify for a “particular” life insurance rate or may have even been told that they can’t qualify for a traditional life insurance policy all together!

This is why, in addition to doing all that we can do on our side, we also like to let folks know what they can do to improve their chances at being able to qualify for the “best” life insurance policy for themselves. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients are able to find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see, by only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBSA truly do offer a one-stop shop for folks looking to protect their family.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So what are you waiting for? Give us a call today, and let us earn the right to protect your family today!