In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed the combination of Hydrocodone and Paracetamol or one of the common brand names its sold under including:

- Hycet,

- Lortab Elixor,

- Verdocet,

- Vicodin

And/or Xodol to help treat and manage pain.

Hydrocodone can also be combined with a variety of other chemicals to form other medications such as:

- Anexsia,

- Dicodid,

- Hycodan,

- Hycomine,

- Lorcet,

And Norco will typically receive the same type of treatment by most life insurance underwriters.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Vicodin?

- Why do life insurance companies care if I’ve been prescribed Vicodin?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Vicodin?

Yes, individuals who have been prescribed Vicodin in the past can and often will qualify for a traditional term or whole life insurance policy. Some may even qualify for a no medical exam life insurance policy at a Preferred rate!

This is because…

In many situations, an individual may be prescribed Vicodin for a very short period of time, after which the patient will have made a full recovery and can apply for a traditional term or whole life insurance policy as though they were never prescribed. Vicodin in the first place!

Why do life insurance companies care if I’ve been prescribed Vicodin?

There are two main reasons why most top-rated life insurance companies are going to “care” if any individual has been prescribed Vicodin in the past, particularly if they are still taking their Vicodin at the time of their life insurance application.

The first reason is because…

Vicodin is a prescription medication that is typically reserved for folks who are suffering from a pretty significant injury or are experiencing somewhat moderate pain due to a procedure that may have received. For this reason, it only makes sense for a life insurance underwriter to want to know more about “why” you’ve been prescribed Vicodin and whether or not the pain that it is being used to treat will one day go away or at least decrease in intensity.

The second reason why…

A life insurance company is going to “care” if you’ve been prescribed Vicodin because Vicodin is considered a narcotic and carries a very high risk for individuals to become addicted to it. Additionally, it can cause some individuals to suffer from respiratory distress so severe that it could actually cause death when combined with other substances such as alcohol.

Which is why…

Once a life insurance company learns that you have been prescribed Vicodin the past, chances are they’re going to want to know a little bit more about “why” you were prescribed it and whether or not this underlying cause should be something that they (the insurance company) should be worried about.

What kind of information will the insurance companies ask me or be interested in?

- When were your first prescribed Vicodin?

- Who prescribed your Vicodin? A general practitioner? A specialist?

- How many doctors have prescribed you Vicodin?

- Why have you been prescribed Vicodin?

- Are you still taking Vicodin?

- Is Vicodin the only prescription pain killer that you’re taking?

- If you are still taking Vicodin, how long do you anticipate needing to continue taking Vicodin?

- Do you have any history of drug or alcohol abuse?

- Do you have any issues with your driver’s license? Issue such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

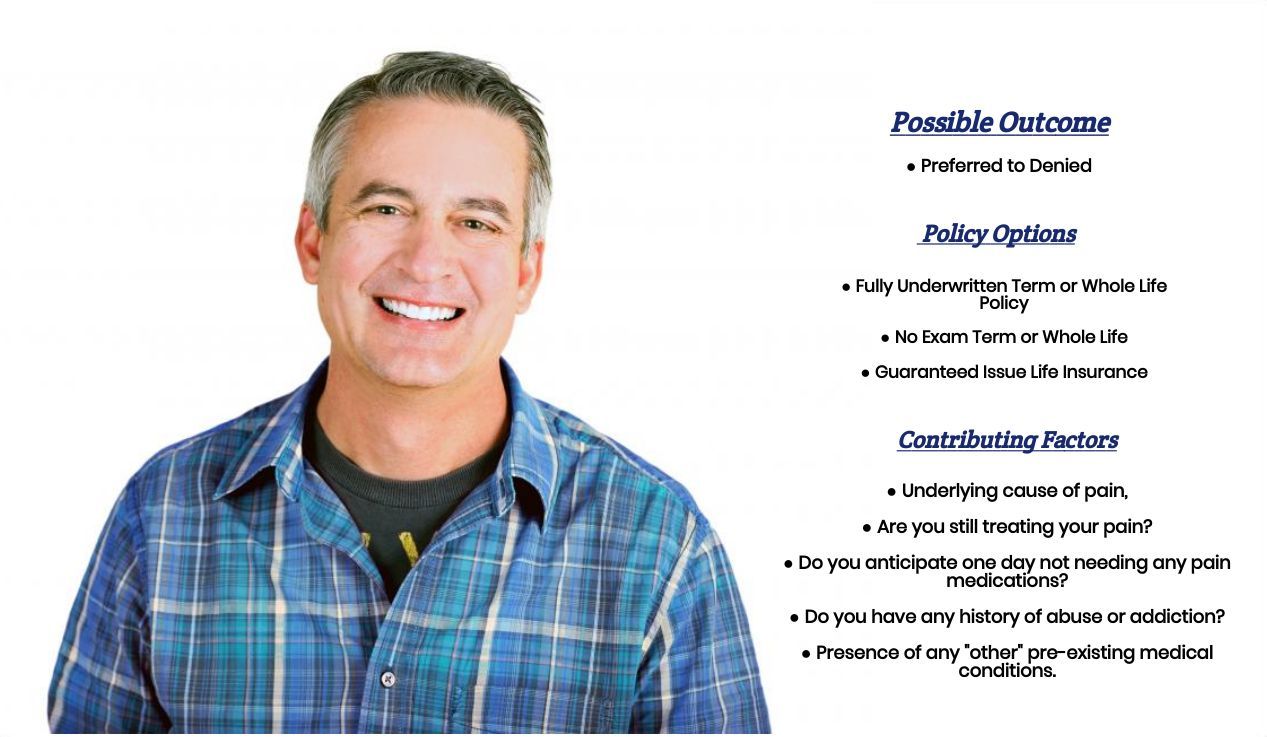

What rate (or price) can I qualify for?

In our experiences here at IBUSA, what we have found to typically be the case is that when it comes to helping an individual who has been prescribed Vicodin in the past, the application process is either super EASY, or super DIFFICULT!

This is because…

For those who have been prescribed Vicodin in the past, and are no longer currently taking it and have no history of abusing this medication most life insurance companies won’t factor it’s use into the application process assuming that the underlying medical condition which warranted itself has been resolved (with several exceptions related to certain chronic or potentially recurring diseases).

For cases like these…

We’ve typically found that whatever rate you would have been able to qualify for PRIOR to being prescribed Vicodin should be the same rate that you would qualify for AFTER having been prescribed Vicodin.

Examples of an easy case might be being prescribed Vicodin immediately after:

- Having your wisdom teeth removed.

- Laser eye surgery.

- A soft tissue accident such as a sports injury or motor vehicle accident.

- Etc, etc…

Where things…

Become a “bit” trickier is when an individual is currently taking Vicodin during a life insurance application where it “appears” like they won’t need to take Vicodin for an extended period, but for now, they are still taking it, or when an individual has either experienced an injury where he or she may end up suffering from chronic pain which may prevent them from ever being able to stop taking Vicodin or similar pain medication.

In cases like these…

Insurance companies may choose to “Postpone” one’s life insurance application until an applicant isn’t taking Vicodin any longer or requesting the complete medical records of an applicant before they will be willing to make a decision.

This is where…

Working with a true, life insurance professionals will pay off because it is with difficult cases like these that have years of experience combined with dozens of different options where an individual who may have been told that they can’t qualify for a traditional life insurance policy suddenly finds themselves fully approved!

This brings us to the last topic that we wanted to take a moment and discuss with you here today in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best.”

Now will we be able to help out everyone who has been prescribed Vicodin?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well.

This way…

If someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!