In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Metoprolol or one of the common brand names that is sold under, including Toprol XR and Lopressor to help one manage their high blood pressure (hypertension).

Metoprolol can also be used to help treat those suffering from angina and/or heart failure, as well as lower the risk of death immediately following a heart attack.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Toprol XR?

- Why do life insurance companies care if I’ve been prescribed Toprol XR?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Toprol XR?

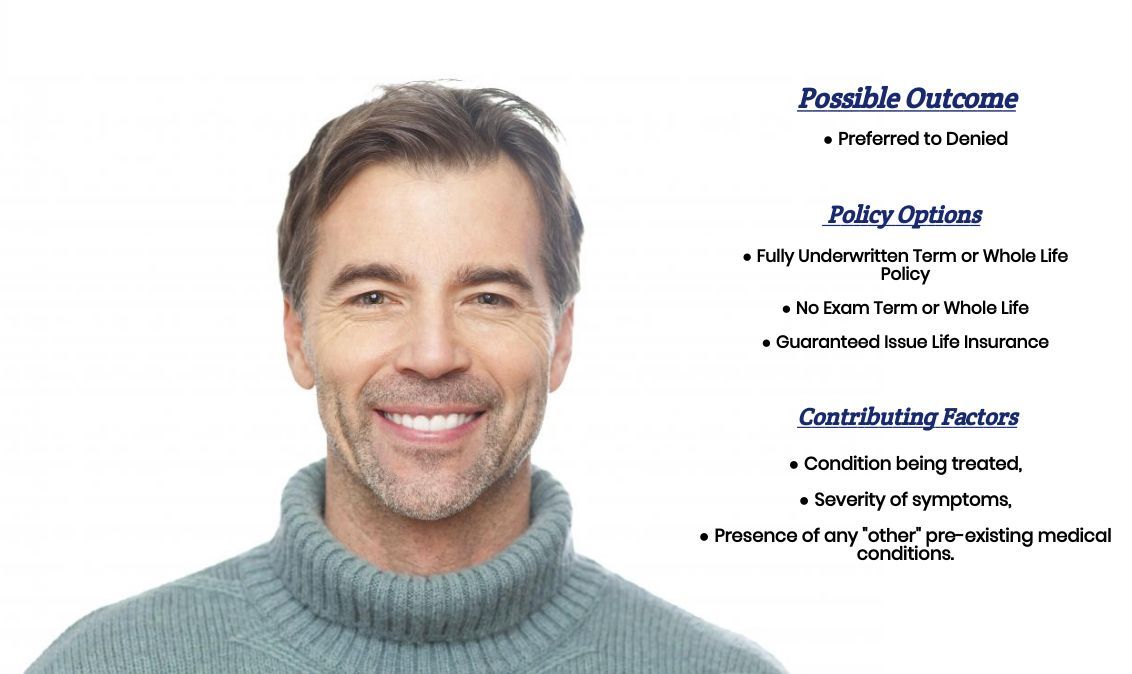

Yes, individuals who have been prescribed Toprol XR or Lopressor can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred rate! The problem is that while some people may be able to qualify for a “great” rate after being prescribed Toprol XR, others may not be able to qualify for coverage at all!

Why do life insurance companies care if I’ve been prescribed Toprol XR?

The main reason why life insurance companies “care” if an individual has been prescribed Toprol XR is because it’s not only used to help folks lower their blood pressure levels. Sure, most life insurance companies are going to “care” if an individual has been diagnosed with hypertension, it’s not like that “diagnosis” is going to be too earth shattering!

Instead…

What most life insurance underwriters are going to be more focused on is whether or not you’re using your Toprol XR as a way to treat some other kind of cardiovascular condition, such as angina or heart failure. Or, if you were prescribed Toprol XR immediately after suffering from a heart attack, which is not going to be looked upon too fondly if this “just occurred” recently.

Which is why prior to being approved for a traditional life insurance policy after having been prescribed Toprol XR, most (if not all) life insurance companies are going to want to ask you a series of medical questions about “why” you have been prescribed Toprol XR and how “serious” this pre-existing medical condition actually is.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first prescribed Toprol XR?

- Who prescribed your Toprol XR? A general practitioner or a cardiologist?

- Why have you been prescribed Toprol XR?

- Have you been diagnosed with Angina?

- If so:

- How old were you when you were first diagnosed with Angina?

- What “kind” of Angina do you suffer from? Prinzmetal? Crescendo?

- Have you ever had an angiography taken? If so, what were the results?

- Have you been diagnosed with Heart Failure?

- Have you ever suffered from a heart attack or stroke?

- If so:

- When did it occur?

- Have you suffered from multiple?

- Have you had a cardiac stress test performed?

- Aside from Toprol XR, are you taking any other prescription medications?

- Have any of your prescription medications changed in any way?

- How often do you see your primary care physician?

- In the past two years, have you been hospitalized for any reason?

- What is your current height and weight?

- In the past two years, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

- If so:

- If so:

What rate (or price) can I qualify for?

Now as you can see, there are a lot of factors that can come into play when trying to determine what kind of “rate” an individual may be able to qualify for. We haven’t even mentioned any of the multiple “lifestyle” factors that can also come into play as well. This is why it’s pretty much impossible to know for sure what kind of rate an individual might be able to qualify for, only knowing that in the past, they have been prescribed Toprol XR.

That said, however…

What we can tell you is that if you’re simply using your Toprol XR to help you manage your hypertension, you haven’t been diagnosed with angina or heart failure. If you’ve never suffered from a heart attack or a stroke, chances are you’re Toprol XR prescription isn’t going to play a major role in the outcome of your life insurance application.

What will probably make a much BIGGER impact on the outcome of your life insurance application is your choice when deciding “which” life insurance company to choose. You see, not all life insurance companies are bound by the same rules when it comes time to decide who they will and won’t insure, as well as what “rate” they might decide to give someone.

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients are able to find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see, by employing only true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBUSA truly do offer a one-stop shop for folks looking to protect their families.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So what are you waiting for? Give us a call today, and let us earn the right to protect your family today!