In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Luvox or its generic form Fluvoxamine to help treat for a variety of different medical conditions including:

As well as any feeling of anxiety which may be caused by suffering from OCD.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Luvox?

- Why do life insurance companies care if I’ve been prescribed Luvox?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help insure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Luvox?

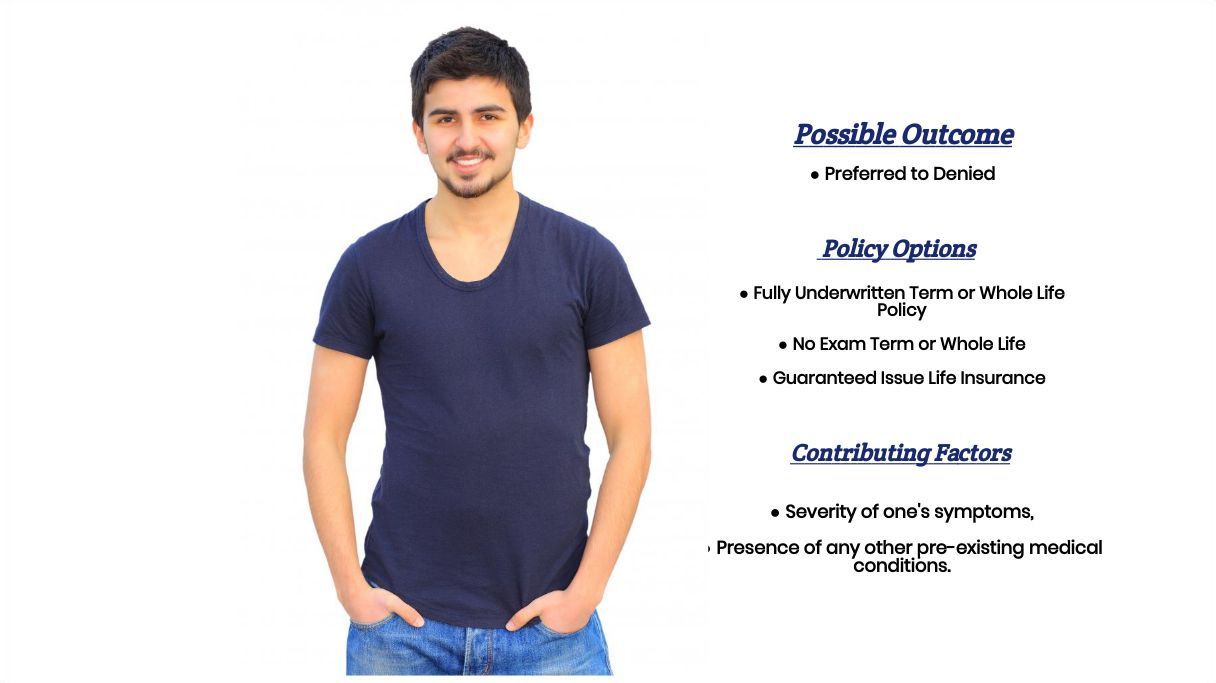

Because Luvox is a prescription medication which is primarily used to treat pre-existing medical conditions which in “theory” are insurable, having been prescribed Luvox shouldn’t prevent you from being able to qualify for a traditional term or whole life insurance policy.

In fact…

You may even be able to qualify for a Preferred rate in certain situations. That said however, because Luvox is commonly used to treat folks who suffer from depression or obsessive-compulsive disorder (OCD) insurance companies are going to want to know more about your particular situation prior to making any kind of definitive decision about your life insurance application.

Why do life insurance companies care if I’ve been prescribed Luvox?

Despite some of the negative stories you may encounter online about Luvox, conventional wisdom seems to indicate that Luvox itself is a relatively safe medication. And please don’t read too much into our use of the word “relative” because here at IBUSA, we always advice folks to follow their doctor’s advice and always take caution whenever taking any prescription medication including Luvox.

With this in mind…

What we can tell you is that as a general rule of thumb, most (if not all) life insurance underwriters aren’t all that concerned with the fact that you’ve been prescribed Luvox. Instead, their much more concerned with the fact that you needed to be prescribed Luvox. Or to say it another way, their much more concerned with the fact that you’ve been diagnosed with OCD and/or depression. For this reason, what you’re typically going to find is that prior to you being approved or denied coverage, most (if not all) life insurance companies are going to want to ask you a series of questions about “why” you’ve been prescribed Luvox.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked by the insurance companies about your Luvox prescription will likely look something like this:

- When where you first prescribed Luvox?

- Who prescribed your Luvox? A general practitioner or a psychiatrist?

- Have you been given a definitive diagnosis?

- How long have you been taking Luvox?

- Is Luvox the only medication that your taking to treat your condition?

- In the past 12 months has your Luvox prescription changed at all?

- Have you ever been hospitalized for you condition?

- Have you ever attempted suicide or contemplated suicide?

- Do you have an active driver’s license?

- Do you have any issues with your driver’s license such as multiple moving violations or Dui’s?

- Are you currently working now?

- In the past 12 months have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

Now as we’ve previously stated, just because you’ve been prescribed Luvox in the past doesn’t mean that you won’t be able to qualify for a traditional term or whole life insurance policy. All that it really means is that you may have to answer a few additional questions before you do.

Now…

If the answers to those questions hint that you may be suffering from other than just a mild case of depression or OCD chances are you will not be able to qualify for a Preferred rate. That said however you may still be able to qualify for coverage at a Standard or Standard Plus rate.

Where we begin to run into trouble…

Is when your pre-existing condition is preventing you from being able to live a “normal” life. Signs that this may be the case could include the fact that you’ve been hospitalized as a result of your medical condition or that you are unable to maintain full time employment (or have qualified for disability insurance).

If this is the case…

It’s quite possible that you may not be able to qualify for a traditional term or whole life insurance policy and that you may need to seek out an “alternative product” such as a guaranteed issue life insurance policy or an accidental death policy. Which brings us to the next topic which we want to focus on which is…

What can I do to help insure that I get the “best life insurance” for me?

In our experiences here at IBUSA, what we’ve found is that any time we’re trying to help someone with a pre-existing medical condition qualify for a traditional term or whole life insurance policy, what helps us the most is first fully understanding their condition. From there, once we have an understanding of what they are going through, having tons of options becomes essential.

You see…

Here at IBUSA, we have worked very hard to maintain relationships with dozens of the top life insurance companies in the industry right now so that when it comes time to helping one of our clients find the “best” insurance that they can qualify for, we don’t have to rely on just one or two different options. Instead, we can simultaneously “shop” dozens of different insurance carrier and make them “compete” for your business.

Which means that…

Other than being completely honest with us about your condition from the get go, there really isn’t much you need to do! This is because once we know the facts, we’ll take it from there. So, what are you waiting for? Give us a call today and let us show you what we can do for you!