In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Levitra or its generic form, Vardenafil, to help treat erectile dysfunction (ED).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Levitra?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Levitra?

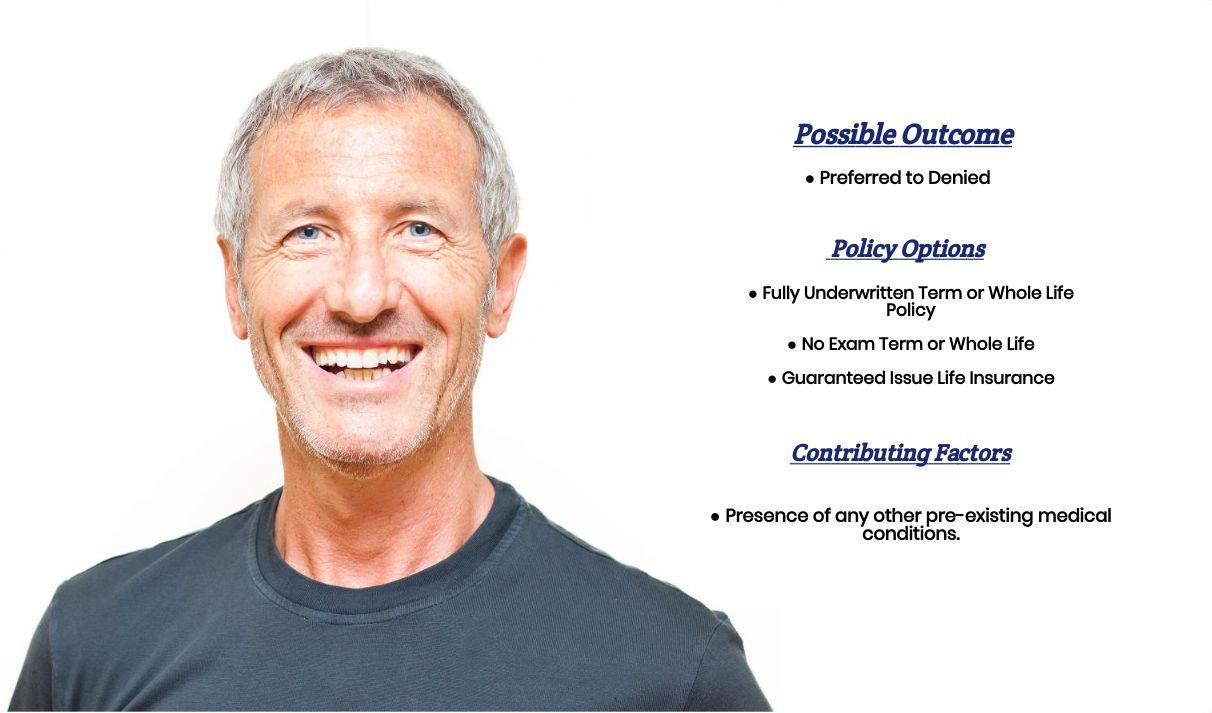

Yes, individuals who have been prescribed Levitra can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred Plus because other than simply helping individuals treat their erectile dysfunction (which isn’t a major concern for the life insurance industry), Levitra really doesn’t have any other applicable uses.

That said, however…

Just because your Levitra prescription isn’t going to have an effect on the outcome of your life insurance application, there are a wide variety of other factors that could come into play. And while you may be thinking to yourself…

“That’s fine; I am in great health!”

The truth is that there are many “non-medical” factors that could come into play, which is why we want to take a moment and list just some of the questions you might be asked when “officially” applying for a traditional term or whole life insurance policy.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- What is your gender?

- When were you born?

- Are you a US citizen?

- What is your current height and weight?

- Have you been diagnosed with any serious pre-existing medical conditions?

- Have you ever been diagnosed with cancer, diabetes, heart disease or depression?

- Have you ever suffered from a heart attack or a stroke?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with cancer, heart disease, or diabetes? Have any of them suffered from a heart attack or stroke?

- Aside from Levitra, are there any other prescription medications that you are taking?

- Have any of your prescription medications changed in any way over the past 12 months?

- Have you used any tobacco or nicotine products in the past 12 months?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or a misdemeanor?

- Do you have any set plans to travel outside of the United States?

- Do you currently participate or plan on participating in any dangerous hobbies?

- In the past 2 years, have you applied for bankruptcy?

- Are you currently working now?

- And in the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see, there are a lot of potential factors that can come into play when determining what kind of “rate” an individual can qualify for. This is why, without actually speaking with an individual, it’s pretty much impossible to make any kind of “educated guess” about what they will or won’t be able to qualify for.

That said, however…

What we can say is that in the vast majority of cases, the fact that an individual has been prescribed Levitra isn’t going to be a factor. In other words, the “rate” that an individual would have been able to qualify for PRIOR to being prescribed Levitra should be the same “rate” that an individual will be able to qualify for AFTER having been prescribed Levitra. This brings us to the last topic that we wanted to take a moment and discuss here in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients are able to find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see…

By only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBUSA truly do offer a one-stop shop for folks looking to protect their families.

Which is why our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So, what are you waiting for? Give us a call today, and let us earn the right to protect your family today!