Life Insurance for Klonopin users.

In this article, we wanted to take a moment and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Klonopin or its generic form, Clonazepam, to help treat folks suffering from epilepsy or some other “type” of seizure disorder.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Klonopin?

- Why do life insurance companies care if I’ve been prescribed Klonopin?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Klonopin?

Short answer: Yes, probably.

Long answer: It’s going to depend.

You see, what you’re generally going to find is that anytime you’ve been diagnosed with a pre-existing medical condition, the process of applying for life insurance will inevitably become more complicated. The good news is that for folks who have been prescribed Klonopin, you’re not going to find that insurance underwriters are going to “automatically” discriminate against you.

Still, you’re going to find that they will still want to know a little more about “why” you’ve been prescribed Klonopin before making any decisions about your life insurance application.

Why do life insurance companies care if I’ve been prescribed Klonopin?

When it comes to Klonopin, most life insurance companies (if not all) aren’t all that worried about the fact that you’re using Klonopin to manage your seizures; what they’re more worried about is the fact that you suffer from seizures in the first place. This is mainly because at the end of the day, while Klonopin may have some side effects associated with its use that may not be the most comfortable to deal with, few (if any) would be considered “life-threatening” by a life insurance underwriter (excluding possible symptoms of depression).

This is why…

What you’re typically going to find is that most life insurance underwriters will direct most of their questions about your underlying pre-existing medical condition rather than your actual Klonopin usage.

What kind of information will the insurance companies ask me or be interested in?

Before being able to make any decisions about your life insurance application, most (if not all) life insurance underwriters are going to want to ask you a series of questions about your Klonopin usage and exactly what kind of “seizure. ” disorder” you have been diagnosed with. This way they can better understand the “risk” you will pose to them should they ultimately decide to offer you coverage.

Typical questions you’d like to be asked may include:

- How old were you when you first suffered from a seizure?

- What “type” of seizures do you suffer from?

- Have you been given a definite diagnosis?

- How frequently do you suffer from seizures?

- When was the last time you suffered from a seizure?

- How many seizures have you suffered from in the previous 12 months?

- Is Klonopin the only medication that you are using to treat your seizures?

- In the past 12 months, has your Klonopin prescription changed?

- Have you ever been hospitalized due to a seizure?

- Have you been diagnosed, treated, or suffered from symptoms of depression or anxiety?

- Do you currently hold an active driver’s license?

- Has your driver’s license ever been suspended as a result of your seizures?

- Are you currently working now?

- In the past 12 months, have you applied for or received any disability benefits?

What rate (or price) can I qualify for?

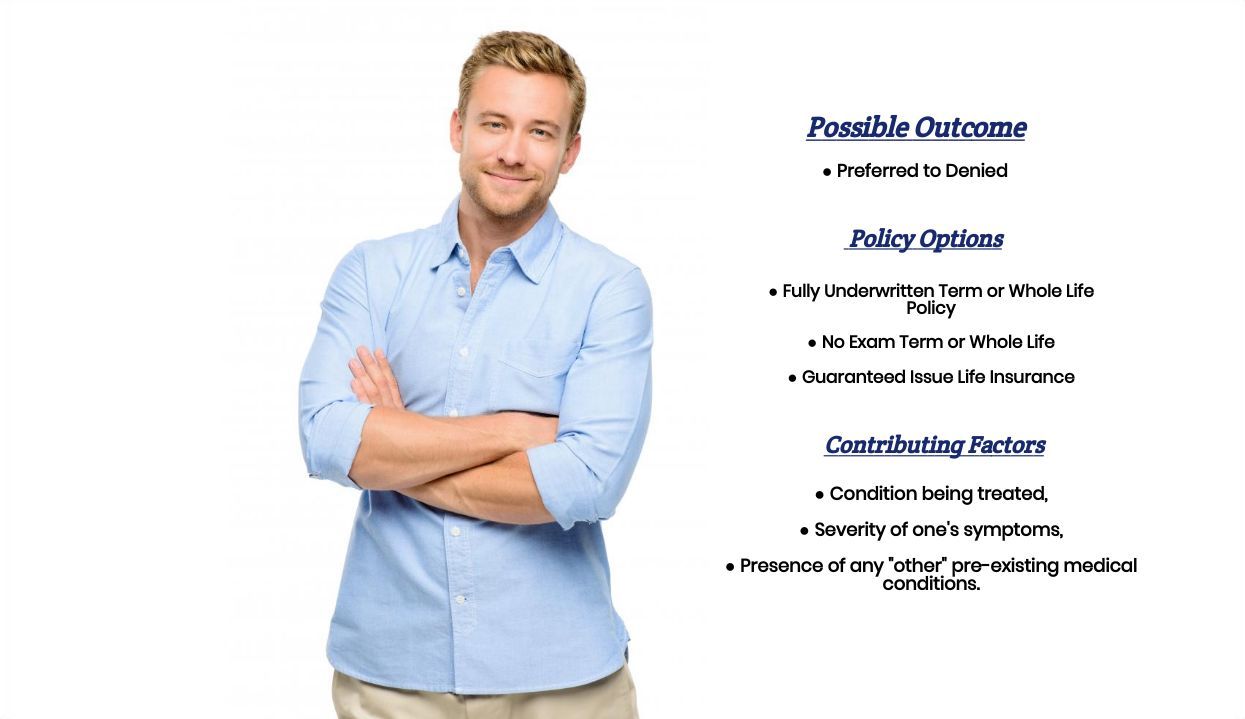

Now, when it comes to what rate one might be expected to pay for a traditional term or whole life insurance policy after being prescribed Klonopin to treat a seizure-related illness, you’ll usually find that provided that you haven’t suffered from a seizure within the past 12 months, you should “theoretically” be eligible for a Preferred rate.

That said, however, we should remind folks that a Preferred rate is typically reserved for only the healthiest among us. An individual who has been diagnosed with a pre-existing medical condition like seizures can theoretically qualify. Assuming that they haven’t had a seizure in the past 12 months, it’s unusual for this to occur.

In most cases…

You will find that a Standard or Standard Plus rate is much more common. Additionally, for those who have suffered from a seizure within the past 12 months, we usually like to shoot for a Standard rating, which can frequently be achieved provided that you choose to apply for coverage with the “right” life insurance company right from the start.

Lastly…

There will be those who may not be able to qualify for a traditional term or whole life insurance policy due to their pre-existing seizure condition largely because it is considered too “severe” to insure. In such cases, the applicant will usually not be able to hold down a full-time job, may have lost their ability to drive, and may have applied for or are currently receiving some disability benefit. In cases like these, we’ll often have to pursue some other type of “alternative” product, such as a guaranteed issue life insurance policy or an accidental death policy if the client still wants to pursue coverage. This brings us to the last topic we want to discuss here in this article, which is…

How can I help ensure I get the “best life insurance” for me?

Now, there are three things an individual can do to try and improve their chances of qualifying for the “best” life insurance policy they can. First, they want to ensure that they are working with a proper life insurance professional with the experience needed to help someone like themselves find the coverage they need.

Second…

They need to ensure that the agent they choose also has access to a wide variety of insurance products so that they are “dependent” on the verdict of just one or two different companies.

And lastly…

They need to be as honest as possible with their life insurance agent to have all the pertinent facts to try and determine “which” life insurance company will provide them with the best opportunity for success.

The good news is…

Here at IBUSA, we only hire the best. We work extremely hard to ensure that our agents have access to products from dozens of highly rated life insurance companies so that when it comes time to help you find the “best” life insurance company that you can qualify for, you don’t have to spend hours and hours searching on your own. Instead, we’ll help you simultaneously “shop” dozens of companies instantaneously and allow you to decide which is best for you!

Now, can we help out everyone who has been prescribed Kolopin?

No, probably not. But we can tell you that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies.

This way, if someone can’t qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for. So, if you’re ready to explore your options, call us!