In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Gabapentin or one of the common brand names which it is sold under, including:

- Gralise,

- Neuraptine,

- Neurontin,

- Gaborone,

- Fuse Paq Fanatrex,

To help treat seizures or nerve pain caused explicitly by shingles.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Gabapentin?

- Why do life insurance companies care if I’ve been prescribed Gabapentin?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Gabapentin?

Yes, individuals who have been prescribed Gabapentin can and often will be able to qualify for a traditional term or whole life insurance policy. They may even be able to qualify for a Preferred Plus. The only problem is that because Gabapentin can be used to treat several different pre-existing conditions that aren’t necessarily related to one another, most (if not all) life insurance companies are going to need to know more about “why” you’ve been prescribed Gabapentin before being able to make any decision about your life insurance application.

Why do life insurance companies care if I’ve been prescribed Gabapentin?

Life insurance companies “care” if an individual has been prescribed Gabapentin in the past because it’s only used to help folks who have been diagnosed with some “type” of seizure disorder (which most life insurance companies will undoubtedly be interested in) and to help treat pain associated with a shingle outbreak.

And while…

It may be true that most life insurance companies aren’t going to be all that interested in the fact that someone has suffered from Shingles in the past; it could be a condition that could cause a life insurance underwriter to “postpone” one’s life insurance application until which point the outbreak has been resolved.

Additionally…

Suppose an individual is believed to suffer from a shingles outbreak due to a compromised immune system. In cases like these, most (if not all) life insurance companies will want to know the complete story about the outbreak before making any decision about your life insurance application. This is why, before being approved for coverage, one should expect to be asked a series of questions all about their Gabapentin prescription and the underlying pre-existing medical condition which has warranted its use.

What kind of information will the insurance companies ask me or be interested in?

- When were you first prescribed Gabapentin?

- Who prescribed your Gabapentin? A general practitioner or a specialist?

- Why were you prescribed Gabapentin?

- Was it to treat seizures?

- If so:

- When was the last time you suffered from a seizure?

- How many seizures have you suffered from in the past 12 months?

- What kind of seizures do you suffer from?

- Have you ever been hospitalized due to your seizures?

- Do you have a valid driver’s license right now?

- Was it to treat for pain related to a shingles outbreak?

- If so:

- Are you currently receiving treatment?

- Do you suffer from any lingering effects from your shingles outbreak?

- How many times have you suffered from shingles?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you taking any other prescription medications?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

- If so:

- If so:

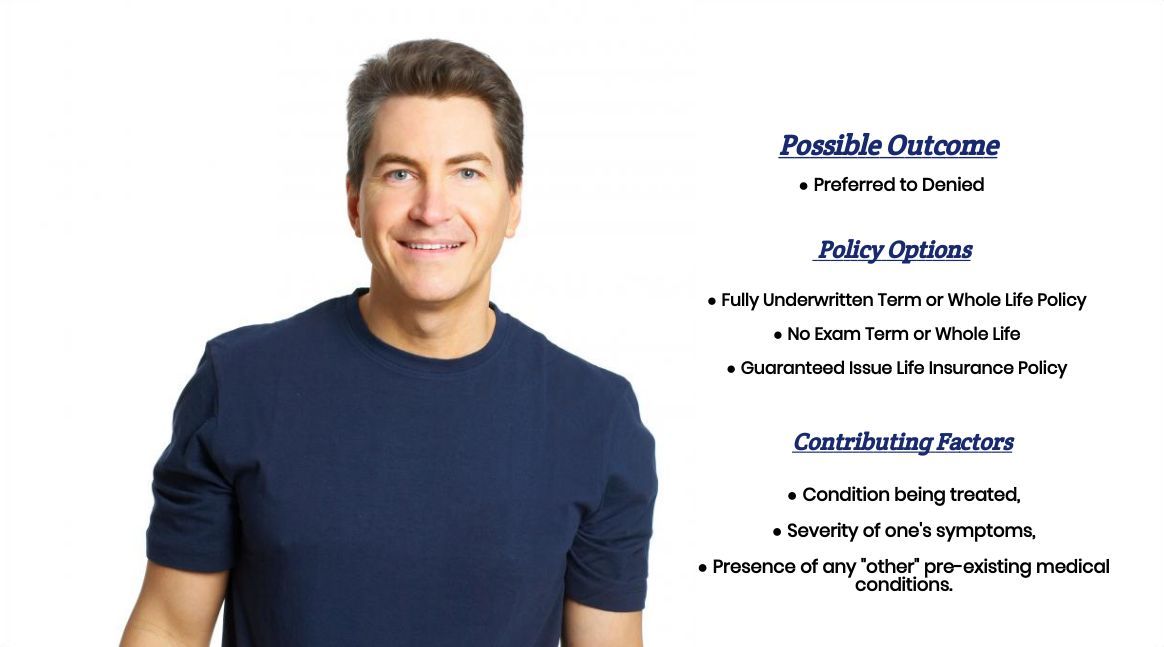

What rate (or price) can I qualify for?

Generally, what you’re going to find is that if you have been prescribed Gabapentin, what is really going to matter is “why” you’ve been prescribed Gabapentin rather than just the fact that you “have” been prescribed Gabapentin.

This is why you are going to find that folks who have been prescribed Gabapentin to help manage pain associated with a Shingles outbreak can and often will be able to qualify for a Preferred or Preferred Plus rate because once they have recovered from their attack, most (if not all) life insurance companies won’t consider this a factor in the outcome of their life insurance application.

Now…

As for those who have been prescribed Gabapentin to help them treat or manage their Seizures, what you’re generally going to find is that most folks will be able to qualify for coverage only now. The rate that they might be able to qualify for could range from Preferred to a “high risk” table rate ranging from Table A (the “best” and most affordable table rate) all the way to Table J (the “worst” or most expensive table rate).

Factors that will come into play will include:

- The date of your last seizure.

- The number of seizures you have suffered from in the last year.

- The “kind” of seizures that you suffer from.

As well as how significantly your seizures are affecting the overall quality of your life, which may be evaluated by whether or not you’re still legally allowed to drive and whether or not you have been approved disability coverage due to the severity of your condition.

The good news is…

Regardless of “why” you’ve been prescribed Gabapentin or how serious your “why” is, we here at IBUSA are ready to give it our best try to help you find the “best” life insurance policy that you can qualify for. This is why we now want to shift gears a bit and focus on…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance profession who will work as an advocate for you. Such an agent should be able to help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, you’ll want to ensure you’re completely honest with your life insurance agent before applying for coverage. By doing so, you will be helping them narrow down what options might be the “best.”

So, what are you waiting for? Give us a call today and see what we can do for you!

I had tongue cancer 6 years ago. I am cancer free now. I take gabapentin to help control pain caused by radiation. Two companies have denied me. I don’t know if this is the reason for sure.

Kathi,

If you give us a call, we’d be happy to take a look and see if we might have a carrier that would insure you.

Thanks,

InsuranceBrokersUSA