Life Insurance with Alport Syndrome or Hereditary Nephritis.

In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Alport Syndrome or Hereditary Nephritis.

Questions that will be addressed within this article will include:

- Can I qualify for life insurance if I have been diagnosed with Alport Syndrome or Hereditary Nephritis?

- Why do life insurance companies care if I have been diagnosed with Alport Syndrome or Hereditary Nephritis?

- What “kind” of life insurance policies can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Alport Syndrome or Hereditary Nephritis?

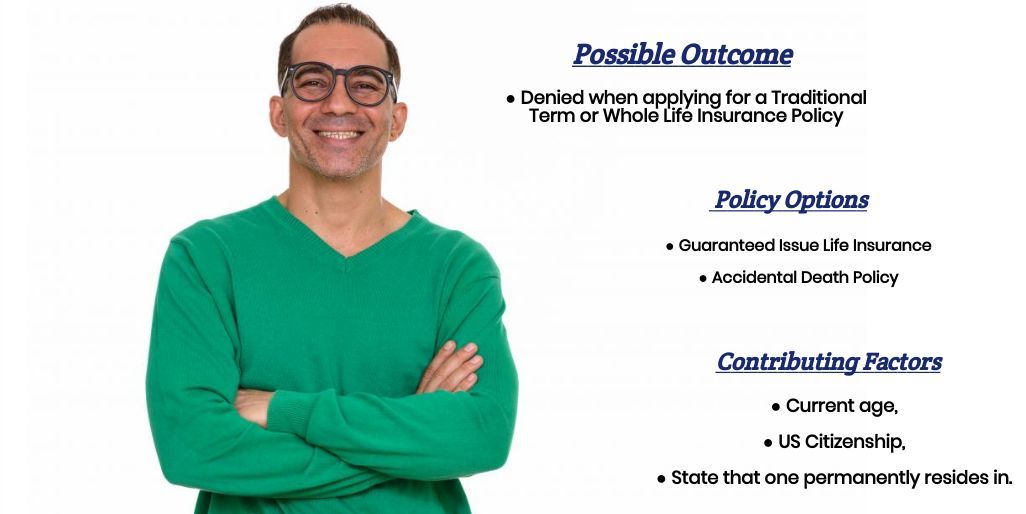

Unfortunately, Alport Syndrome is one of those “kinds” of pre-existing medical conditions that makes it pretty much impossible for you to qualify for a traditional term or whole life insurance policy. This means that if you still wish to purchase a life insurance policy, you will need to consider an “alternative” option such as a guaranteed issue life insurance policy (aka Final Expense Insurance) or an accidental death policy.

Why do life insurance companies care if I have been diagnosed with Alport Syndrome or Hereditary Nephritis?

The main reason why most top rated life insurance companies are going to “care” if you have been diagnosed with Alport Syndrome is because Alport Syndrome is a genetic disease that damages the small blood vessels located within a patient’s kidneys which will typically lead to kidney disease and/or kidney failure.

In males, symptoms of Alport Syndrome typically manifest during early childhood, with full end-stage renal disease developing by age 40. However, recent studies have shown some progress in developing new treatment options that could potentially slow down the progression of the disease, offering hope for a brighter outlook.

Now since Alport Syndrome is a recessive gene linked to the X chromosome, which does limit its harmful effects to males. As a result, women who suffer from this condition generally experience kidney failure far less frequently and at a slower rate. Because of this both genders are still at risk of developing kidney failure, which is why most life insurance companies will deny an application for traditional term or whole life insurance once an Alport Syndrome diagnosis is confirmed, regardless of gender.

For this reason, individuals diagnosed with Alport Syndrome will need to seek alternative life insurance products if they wish to provide coverage for themselves.

What “kind” of life insurance policies can I qualify for?

In situations like these, there is limited scope for discussion because individuals with a diagnosis of Alport Syndrome typically do not qualify for traditional life insurance policies. Instead of focusing on what kind of rate they might qualify for, our conversation should center around what kind of life insurance policy they might be eligible for.

To be specific…

What are the life insurance policies available to individuals with a pre-existing medical condition that is generally considered serious? Fortunately, there are two different products that one might qualify for after being diagnosed with Alport Syndrome. However, the downside is that neither of them is likely to be the perfect fit.

Therefore…

We would like to take a moment in this article to briefly look at each of the options available and invite you to either check out some of our other articles, which provide more detailed explanations about these products, or contact us to discuss each option individually.

Accidental Death Policies.

It’s important to understand that policies like accidental death insurance are not considered true life insurance policies because they only provide coverage in the event of accidental death, such as a motor vehicle accident, slip and fall, or natural disaster. They will not offer financial protection if you pass away from a heart attack, stroke, or cancer.

For individuals with Alport Syndrome, it’s essential to note that if kidney failure is the cause of death, an accidental death policy will not pay out a death benefit to their family. As such, choosing an accidental death policy may not be the best solution for those diagnosed with Alport Syndrome.

That being said, accidental death policies can serve as a great supplement to a true life insurance policy that offers coverage for natural causes of death. However, it’s important to keep in mind that these policies will never provide coverage in the event of a natural cause of death. It’s crucial to fully understand the terms and limitations of these policies before purchasing them.

Guaranteed Issue Life Insurance Policies.

Guaranteed issue life insurance policies, on the other hand, are TRUE life insurance policies that will provide coverage if you die from a natural cause of death after you live beyond a certain waiting period (which will be determined by the insurance company you choose). This “waiting period” is commonly referred to as a GRADED DEATH BENEFIT.

During this “waiting period”…

Your guaranteed issue life insurance policy will only provide coverage for accidental causes of death. Still, it will (in most cases) return all monies paid to the insurance companies to your beneficiary if you die from a natural cause of death before the GRADED DEATH BENEFIT expiring.

The reason why…

Guaranteed issue life insurance policies contain a graded death benefit is because you will not be asked any medical questions during the application process. In fact, as long as you live in a state where these “types” of life insurance policies are offered, and you are a US citizen over the age of 50 (sometimes 45), you should be eligible.

Which means that…

It’s possible that someone who is very seriously ill will purchase one of these life insurance policies just days before they die from some kind of natural disease. In cases like these, the insurance companies would have no way of protecting themselves from such a financial loss which is why they use a Graded Death Benefit as way of ensuring that folks don’t try to purchase one of these types of life insurance policies at the last moment.

We should note however…

That while these life insurance policies can be very helpful to those who can’t qualify for any other “type” of life insurance coverage, they do tend to be a bit “pricey” dollar for dollar when compared to other types of life insurance policies and will generally only allow an individual to purchase up to 25,000 dollars in coverage which may not make it worth it for some individuals.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

Based on our experience here at IBUSA, we have found that individuals who take their time to review their options, ask a lot of questions and seek out life insurance agents with experience working with various pre-existing medical conditions, usually find the best life insurance policy for them. Furthermore, it’s important to work with agents who have access to multiple life insurance companies, so that they can provide a customized solution, rather than a “one size fits all” approach.

The good news is that here at IBUSA, we pride ourselves on having a team of experienced agents who can help you find the right policy, especially if you have been diagnosed with a pre-existing medical condition like Alport Syndrome. So, if you’re ready to find out how we can assist you, please give us a call!