In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance who have been diagnosed with Esophageal Varices.

Questions that will be directly addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Esophageal Varices?

- Why do life insurance companies care if I have been diagnosed with Esophageal Varices?

- What kind of information will the insurance companies ask me or be interested in?

- What options might be available to me?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance if I have been diagnosed Esophageal Varices?

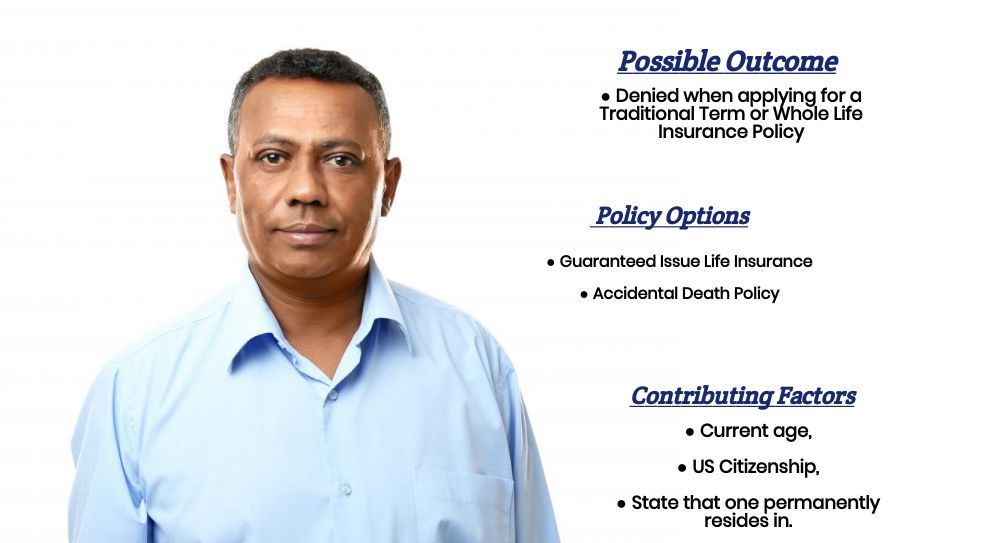

Unfortunately, receiving a diagnosis of Esophageal Varices will pretty much automatically prevent someone from being able to qualify for a traditional term or whole life insurance policy.

Which means that…

If an individual still wishes to purchase and insurance policy, they will need to seek out some kind of “alternative” product such as a guaranteed issue life insurance policy or an accidental death policy (which are not true life insurance policies) which won’t require an individual to have to be able to “medically” qualify for coverage.

Why do life insurance companies care if I’ve been diagnosed with Esophageal Varices?

The main reason why a life insurance company is going to “care” if an individual has been diagnosed with Esophageal Varices is because they typically a sign or symptom you’ll see in someone that is suffering from serious liver disease.

For this reason…

Once an individual has been diagnosed with Esophageal Varices, most life insurance companies will automatically “assume” that an applicant is also suffering from liver disease as well. This is why we wanted to take a moment and describe exactly what Esophageal Varices are as well as highlight some of the most common symptoms and complications associated with this disease.

This way, we’ll have a better idea of “why” a life insurance company would be hesitant about insuring someone with this disease as well as discuss options one may be able to pursue despite this diagnosis.

Esophageal Varices Definition:

Esophageal Varices are abnormal, enlarged veins that develop along the esophagus when normal blood flow through the liver becomes blocked either blow a clot or because of actual scar tissue that has developed within the liver itself. Esophageal Varices are generally considered a symptom of having a serious liver disease.

Symptoms may include:

- Vomiting blood,

- Black or blood stools,

- Dizziness,

- Loss of consciousness.

In severe cases, a ruptured Esophageal Varices can even lead to death.

What kind of information will the insurance companies ask me or be interested in?

Now because an Esophageal Varices is a pre-existing medical condition which will likely cause one to be “automatically” denied coverage once it has been determined that you have been diagnosed with this condition, most life insurance companies aren’t going to need to learn all that much more about your situation given that you won’t be able to qualify for a traditional term or whole life insurance policy.

But…

Here at IBUSA, we pride ourselves on trying to help even the most difficult cases find a life insurance policy that can hopefully help them meet their life insurance needs.

Which is why even when it’s clear that an individual might not be able to qualify for a “traditional” life insurance policy, we do like to point out that an individual might be able to qualify for an “alternative” product such as a guaranteed issue life insurance policy or an accidental death policy which won’t require an individual to have to be able to “medically” qualify for them!

“Which is great!”

But…

There is a reason why these “type” of products are usually an individual’s second choice which is why we want to take a moment and briefly discuss some of the pros and cons of each of these “types” of products so that you have a complete understanding of how each of these products work PRIOR to spending any money on either of them.

Alternative options that may be available:

Guaranteed issue life insurance:

Guaranteed issue life insurance policies are life insurance policies that won’t require an individual to have to answer any medical questions or take a medical exam to be able to qualify for them. In fact, there are only three requirements that one must meet to be able to qualify for one of these “types” of life insurance policies.

- First, they must be a US citizen,

- Second, they must life in a state where these “types” of life insurance policies are offered,

- And lastly, they must meet the minimum age requirements.

“And that’s it!”

But, before you get too excited, we want to point out what we feel are three serious disadvantages to these “types” of life insurance policies that everyone who is considering purchasing one must be aware of.

#1 Disadvantage to Guaranteed Issue Life Insurance Policies.

Cost. Now when we say that cost is a major disadvantage to these “types” of life insurance policies, we don’t want to give you the impression that they are super expensive because, in many cases, they are.

It’s just that…

Dollar for dollar, guaranteed issue life insurance policies will cost more than traditional term or whole life insurance policies. This is simply another way of saying that per “unit of coverage”, these “types” of policies charge more than a traditional term or whole life insurance policy would.

#2. Disadvantage to Guaranteed Issue Life Insurance Policies.

Coverage Amount. Guaranteed issue life insurance policies generally won’t provide more than 25,000 dollar in coverage. So, if you’re looking to purchase life insurance to:

- Cover the cost of a mortgage,

- Replace lost wages,

- Or protect a spouse or child,

Chances are 25,000 dollars in coverage isn’t going to get the job done! Now it is conceivable that you might be able to buy several different guaranteed issue life insurance policies from several different insurance companies, which is perfectly acceptable to do, however, this is where the previous problem of “cost” can certainly set in.

#3. Disadvantage to Guaranteed Issue Life Insurance Policies.

The Graded Death Benefit Clause. Guaranteed issue life insurance policies will include a “clause” in them called a graded death benefit.

And…

What this clause is designed to do is protect the insurance company from insuring someone that is really, really sick!

And what it states is…

That you, the insured will need to stay alive from some “set period of time” prior to the insurance policy paying a death benefit if you die from a “natural cause” of death.

You see…

Because the insurance company hasn’t asked you any medical questions or requires you to take a medical exam, there really is no thing about you or your health. So, it’s conceivable that someone might want to purchase one of these life insurance policies while on their “death bed”.

This is why…

Insurance companies use a Graded Death Benefit clause to protect themselves from this happening. Now because there are many different insurance companies out there, and because they’ll all have their own “unique” graded death benefit clauses, we don’t want to go into specifics here in this article.

However…

We will tell you that when helping folks decide, “which” guaranteed issue life insurance policy is going to be the “best,” there are three things we like to look at, which should help one decide on which company is the “best” for them.

These three factors are:

- The reputation of the company,

- Graded death benefit wait time,

- And the price.

Accidental Death Policies.

A second option that one might want to consider is an Accidental Death Policy. Now with these “types” of policies, it’s important to understand that when you purchase an Accidental Death Policy, you’re NOT purchasing a life insurance policy. You’re purchasing an Accident Policy. This means that this policy is only offering coverage if you suffer from an accident.

So…

If you happen to die from a “natural” cause of death such as cancer, diabetes, heart disease, or any number of complications that could arise from having been diagnosed with Esophageal Varices, these “types” of policies will not provide a death benefit to your beneficiaries.

But if…

You do end up dying from an accident like a:

- Motor vehicle accident,

- Natural disaster,

- Victim of crime,

- Etc…

Your policy would payout in full. And while this may not be exactly what you are looking for, here at IBUSA, we’ll often recommend one of these “types” of policies when used in conjunction with another TRUE life insurance product simply because they are a great way to affordably supplement one’s insurance if they due die as a result of some kind of accident.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!