In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Diverticulitis.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after being diagnosed with Diverticulitis?

- Why do life insurance companies care if I’ve been diagnosed with Diverticulitis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after being diagnosed with Diverticulitis?

Yes, individuals who have been diagnosed with Diverticulitis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred rate when applying for a no-medical exam life insurance policy!

The only problem is that…

Simply knowing that someone has been diagnosed with Diverticulitis isn’t going to tell a life insurance underwriter all that much about your situation because Diverticulitis is one of “those” kinds of pre-existing medical conditions that can vary significantly from one patient to the next.

Why do life insurance companies care if I’ve been diagnosed with Diverticulitis?

Probably the best way to understand why most of the best life insurance companies (in our humble opinion) are going to “care” about the fact that an individual has been diagnosed with Diverticulitis is by first taking a look at exactly what it means to suffer from this disease as well as take a look at some of the most common symptoms one is likely to experience.

Diverticulitis Defined.

Diverticulitis is a condition that occurs when small pouches located in one’s intestines called diverticula become infected or inflamed. Having these “pouches,” which can become infected, also means that you also suffer from a condition known as Diverticulosis as well.

Common symptoms may include:

- Pain in one’s lower left abdomen,

- Nausea and/or vomiting,

- Fever,

- Constipation or, in some cases, diarrhea,

- Ect…

Fortunately, Diverticulitis is a “treatable” disease. Treatable by modifying one’s diet, using antibiotics to address any symptoms of infection, and in extreme cases, some folks may even elect to undergo surgery to help eliminate any particularly troublesome “Diverticuli”. Some folks with “mild” cases of Diverticulitis may even be able to treat their condition by simply taking it easy, using an over-the-counter stool softener, switching to a liquid diet, and using antibiotics to combat existing infection.

We should also…

Not that “how” you ultimately end up treating your Diverticulitis and how frequently you suffer from a flareup is going to play an important role in determining what “kind” of life insurance rate you will be able to qualify for. This is why, before being approved for a traditional term or whole life insurance policy, most (if not all) life insurance companies are going to want to ask you a series of medical questions about your Diverticulitis.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Diverticulitis?

- Who diagnosed your Diverticulitis? A general practitioner or a specialist?

- What symptoms (if any) led to your Diverticulitis diagnosis?

- How was your Diverticulitis Diagnosed?

- Physical exam?

- CT scan?

- Blood tests?

- Urine test?

- Liver function test?

- Stool test?

- How frequently do you suffer from a “flareup?”

- When was the last time you suffered from a “flareup?”

- In the past 12 months, how many “flareups” have you suffered from (if any)?

- How are you treating your Diverticulitis?

- Diet?

- Medications?

- Surgery?

- Has your primary care physician suggested that you may need or could benefit from a future surgical procedure to treat your Diverticulitis?

- Have you been diagnosed with any other pre-existing medical conditions?

- In the past 2 years, have you been hospitalized for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now, at this point, we usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage that they are looking for.

But…

Not so great if you’re looking for answers to any specific medical questions. In cases like these, we would recommend that you contact a true medical professional who has the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What rate (or price) can I qualify for?

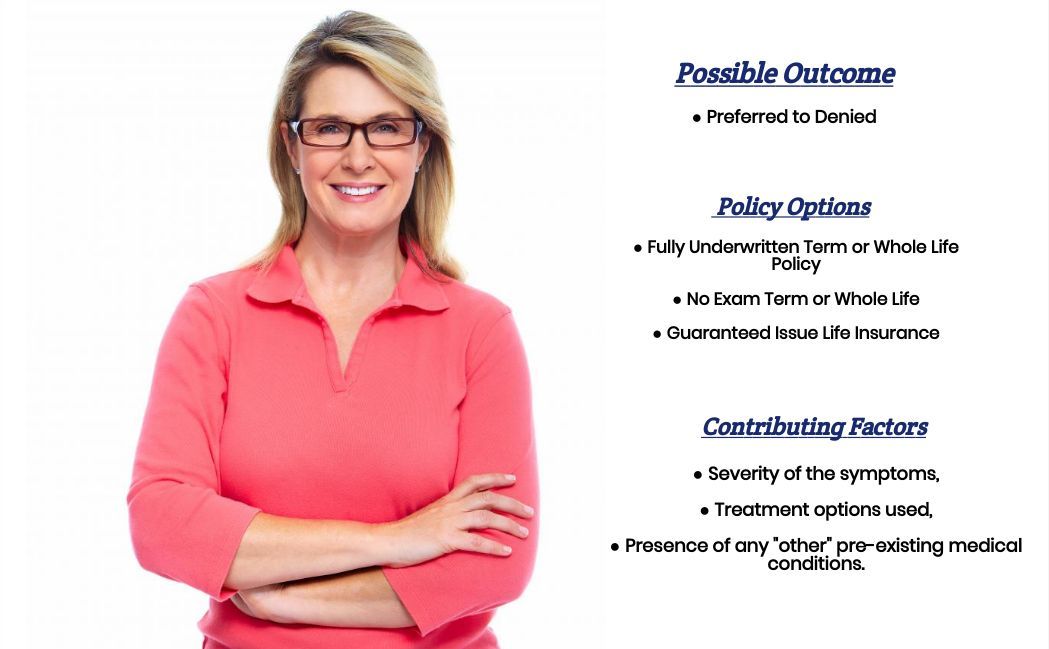

As you can see, many factors can influence the determination of what “kind” of rate an individual might qualify for when applying for a traditional term or whole life insurance policy.

And…

What makes matters even worse is that many of these “factors” that will be considered in determining what “kind” of rate an individual might be able to qualify for tend to be rather “subjective.” This is why an individual who has been diagnosed with Diverticulitis may be considered a “high-risk” applicant by one life insurance company while simultaneously considered a “normal” or “standard” risk by another!

This is why it’s pretty much impossible to know what kind of “rate” an individual might be able to qualify for without first taking a moment to speak with you and getting a better understanding of exactly what your Diverticulitis is like. That said, however, there are a few “assumptions” that we can make about folks applying for a traditional term or whole life insurance policy that will “generally” hold true and hopefully give you a better idea about what kind of rate you might be able to qualify for.

For example…

If you are one of those folks who just “occasionally” suffer from a “mild” case of Diverticulitis, which is usually treated with:

- Rest,

- Over-the-counter stool softeners,

- Diet modification,

And antibiotics there is a chance that you may be able to qualify for a Preferred rate provided that you are in great health otherwise and that you don’t seem to be suffering too “severely” for your Diverticulitis flareup when they do occur.

Conversely…

If you are someone who frequently suffers from Diverticulitis flareups. And you are someone who may have needed to undergo surgery or may need to undergo surgery in the future; chances are you will still be able to qualify for a traditional term or whole life insurance policy, only now will you be considered a “high-risk” applicant. This means that you’re going to want to be more “selective” with which life insurance companies you decide to apply with.

The good news is that regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

Fortunately this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Diverticulitis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.