In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Depakote or its generic form Divalproex to treat various types of seizure disorders, manic episodes related to bipolar disorder and even to prevent migraine headaches is some individuals.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Depakote?

- Why do life insurance companies care if I’ve been prescribed Depakote?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

- Why do life insurance companies care if I’ve been prescribed Depakote?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Depakote?

The vast majority of individuals who have been prescribed Depakote can and often will be able to qualify for a traditional term or whole life insurance policy. That said, however, because Depakote is a medication that can treat a wide variety of pre-existing medical conditions that can and often be quite serious, most (if not all) life insurance companies are going to want to know a little bit more about “why” you’ve been prescribed Depakote before making any decisions about your life insurance application.

Why do life insurance companies care if I’ve been prescribed Depakote?

Unlike some prescription medications, which can be “habit” forming or have a lot of “serious” side effects, Depakote, in comparison, is a relatively “worry-free” medication in the eyes of a life insurance underwriter. Sure, it’s not fun to suffer from some of the side effects of taking Depakote:

- Nausea,

- Vomiting,

- Constipation,

- Diarrhea,

- Mood swings,

- Etc…

It’s not like any of these are considered “life-threatening” which is why life insurance companies are all that worried about the fact that you’ve been prescribed Depakote, instead, they’re more worried about “why” you’ve been prescribed Depakote and is that underlying reason something that they should be concerned about.

This is why…

Most (if not all) life insurance companies will want to ask you a series of questions about “why” you’ve been prescribed Depakote before proceeding with your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Initially, the first thing that a life insurance company is going to want to know about with regards to your Depakote prescription is “why” have you been prescribed it? Is it because you suffer from:

- Seizures?

- Migraines?

- Or manic episodes associated with bipolar disorder?

From there, they’ll want to know how serious this underlying condition is so that they can get a better idea of what kind of risk you pose to the insurance carrier. This is why you’ll likely be asked different kinds of questions depending on what pre-existing medical condition you are using your Depakote prescription to treat.

Common questions for those suffering from seizures:

- Have you been diagnosed with a specific medical condition?

- Who diagnosed your condition? A general practitioner or a specialist?

- Is Depakote the only prescription medication that you’re using to treat your seizures?

- In the past 12 months, has your Depakote prescription changed at all?

- What kind of seizures do you suffer from?

- How old were you when you first suffered from a seizure?

- How often do you suffer from seizures?

- Have you suffered from a seizure in the past 12 months?

- Have you ever been hospitalized due to a seizure?

- Do you currently hold a valid driver’s license? Or, in other words, are you currently allowed to drive due to your pre-existing medical condition?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Common questions for those suffering from Migraines:

- How old were you when you first experienced a migraine headache?

- How often do you suffer from migraines?

- Is Depakote the only prescription medication that you’re using to treat your seizures?

- In the past 12 months, has your Depakote prescription changed at all?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Common questions for those suffering from manic episodes associated with bipolar disorder:

- Have you been diagnosed with bipolar disorder?

- Who prescribed your Depakote? A general practitioner or a specialist?

- Are you taking any other prescription medications to treat your condition other than Depakote?

- In the past 12 months, has your Depakote prescription changed at all?

- Have you ever been hospitalized as a result of a “manic episode”?

- Do you suffer from any history of drug or alcohol abuse?

- Have you ever been convicted of any felonies or misdemeanors?

- Do you have any issues with your driver’s license, such as multiple moving violations, DUIs, or a suspended license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

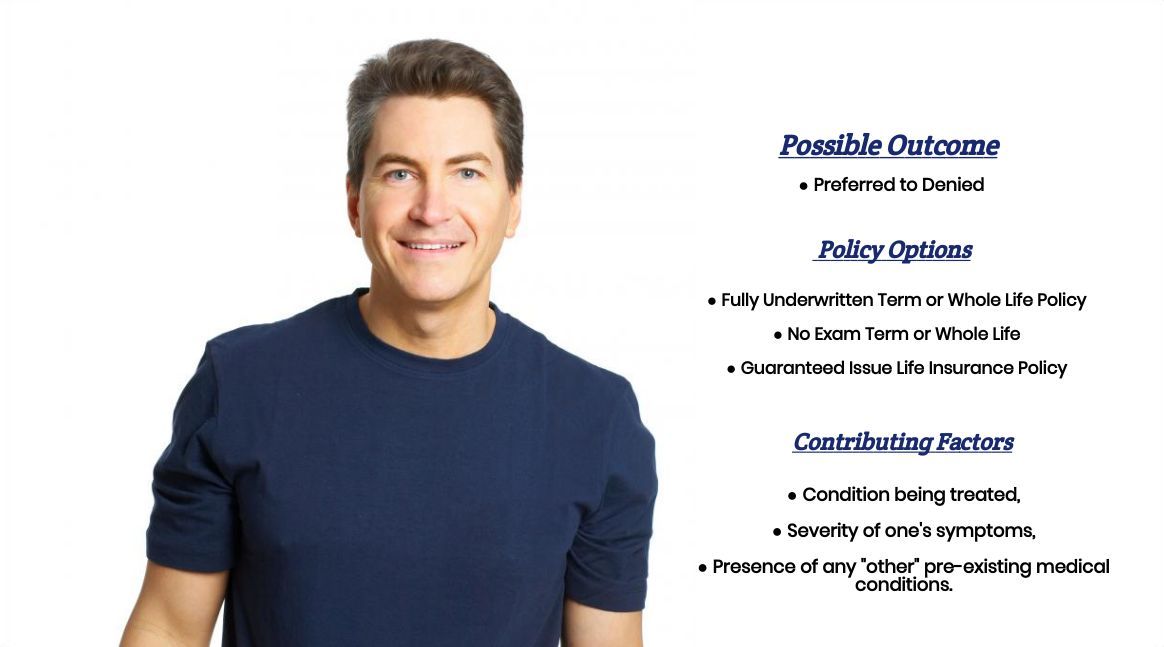

When it comes time to help an individual who has been diagnosed with a condition that Depakote can help treat, what we’ve historically found is that in “theory,” regardless of whether you’re using your Depakote to treat seizures, migraines, or manic episodes, most life insurance companies will still consider one “potentially” eligible for coverage.

In fact, many life insurance companies will even be willing to offer some applicants a Preferred rate. The problem is that because these medical conditions will have a broad spectrum of symptoms and severities, it’s nearly impossible to know for sure what “rate” one could potentially qualify for without knowing the specifics of an individual’s situation.

What we can tell you for sure is…

If you’re currently working and don’t seem to be experiencing too many difficulties/consequences associated with your pre-existing medical condition, you ought to be able to qualify for coverage at least at a Standard or better rate, assuming that you would otherwise be eligible aside from your need for Depakote. That said, however, if your condition is preventing you from being able to live a “normal” life or it is preventing you from being able to work full time, chances are most (if not all) life insurance companies will tend to deny one from being able to qualify for a traditional term or whole life insurance policy. In cases like these, it may be necessary to pursue an alternative insurance product, such as a guaranteed issue life insurance policy or accidental death policy.

This brings us to the last topic that we wanted to take a moment and discuss here in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experiences here at IBUSA, what we have found that seems to offer our clients the best opportunity for success is having plenty of options. That and having plenty of experience helping folks with pre-existing medical conditions find coverage that they can afford.

As a general rule, our advice would be to be completely honest with the life insurance agent whom you choose to apply for coverage with so that he or she can fully understand your situation and what you’re trying to achieve by purchasing a life insurance policy in the first place, and be sure that this same agent has plenty of companies to pick and choose from when it comes time to apply.

After all…

The last thing that you want to have happen is for a great life insurance agent to try and place you with a life insurance company that just isn’t the “best” for you. So, if you’re interested in speaking with a true life insurance professional who has access to dozens of the top life insurance companies, give us a call, and let us show you what we can do for you!