A benign prostatic hyperplasia (BPH) diagnosis often brings two big worries: managing symptoms and protecting your family’s financial security. Many men fear that any prostate condition will make life insurance harder to get—but that’s rarely the case.

Most insurers treat BPH as a routine, age-related condition. Once it’s confirmed benign, traditional coverage is typically available at standard rates, without added restrictions. Even during the diagnostic stage, no-exam policies can provide quick protection until full underwriting is complete.

This guide outlines the best coverage strategies, helping you confidently secure meaningful life insurance while managing BPH.

Important Medical Disclaimer

This article provides insurance guidance only and is not medical advice. Always consult with your healthcare provider about your specific condition and treatment options. If you’re experiencing a medical emergency, contact emergency services immediately.

About Our Team

The Insurance Brokers USA Team consists of licensed insurance professionals with extensive experience helping clients with benign prostatic hyperplasia find appropriate coverage. Our agents have worked with thousands of men facing BPH challenges, specializing in standard rate approvals when traditional underwriting recognizes BPH as a manageable condition.

How Does BPH Affect Life Insurance Eligibility?

Key insight: Benign prostatic hyperplasia typically has minimal impact on life insurance eligibility, with most men qualifying for standard rates once underwriters confirm the condition is not cancer-related.

Insurance companies view BPH as a common age-related condition affecting millions of men over 50. The primary underwriting concern focuses on ruling out prostate cancer rather than the enlarged prostate itself, making the approval process straightforward for most applicants.

“BPH is one of the most insurance-friendly conditions we encounter. Once we establish it’s benign, most carriers treat it as they would any routine age-related condition – with minimal impact on rates or approval chances.”

– InsuranceBrokers USA – Management Team

What BPH means for your application:

- Routine condition consideration since BPH affects over 50% of men over age 60 and is considered a normal part of aging rather than a serious medical condition requiring special underwriting consideration.

- Cancer exclusion verification through PSA test results, medical records review, and physician assessments to confirm your enlarged prostate is definitively benign rather than malignant.

- Symptom management assessment evaluating how well your BPH symptoms are controlled through medication, lifestyle modifications, or surgical interventions, with well-managed cases receiving favorable consideration.

- Standard rate eligibility for most men whose BPH diagnosis is confirmed benign, well-controlled, and not associated with complications or additional urological concerns.

Common BPH symptoms that don’t affect insurability include:

- Frequent urination, especially at night (nocturia)

- Weak or interrupted urine stream

- Difficulty starting urination

- Inability to completely empty the bladder

- Occasional urinary incontinence

Bottom Line

BPH affects life insurance eligibility minimally, with most men qualifying for standard rates once underwriters confirm the condition is benign and well-managed rather than cancerous.

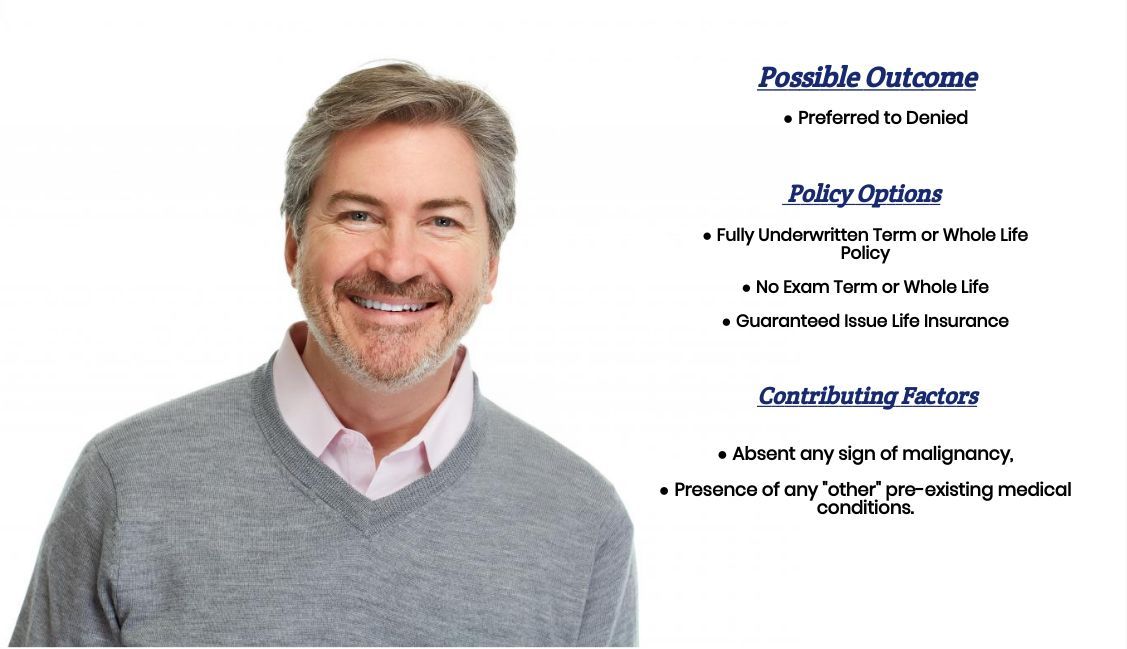

What Coverage Options Are Available?

Key insight: Men with BPH have access to the full spectrum of life insurance products, from no-exam policies to traditional underwritten coverage, often at standard rates comparable to men without BPH.

The comprehensive range of coverage options available to BPH patients reflects insurance industry recognition that enlarged prostate represents a manageable condition rather than a significant mortality risk.

Coverage Options for Men with BPH

| Coverage Type | Typical Eligibility | Expected Rate Class |

|---|---|---|

| No Medical Exam | Immediate, any BPH status | Standard to Preferred |

| Simplified Issue | Immediate with basic health questions | Standard to Preferred |

| Traditional Term Life | Full medical underwriting | Standard to Preferred Plus |

| Whole Life Insurance | Full medical underwriting | Standard to Preferred Plus |

No Medical Exam Life Insurance

No medical exam policies provide the quickest path to coverage for men with BPH, typically requiring only basic health questions without blood tests, physical exams, or extensive medical record reviews. Most carriers offer coverage amounts up to $500,000 through no-exam applications.

These policies often approve BPH cases at preferred rates, particularly when applicants can demonstrate good overall health and effective symptom management through medication or lifestyle modifications.

“We regularly see men with well-managed BPH receive preferred rates on no-exam policies. The key is demonstrating that your condition is stable and your overall health remains excellent.”

– InsuranceBrokers USA – Senior Life Insurance Specialist

Traditional Underwritten Coverage

Traditional underwritten policies offer the highest coverage amounts and most competitive rates for men with BPH willing to complete medical exams and provide comprehensive health information. Most BPH cases qualify for standard or better rate classifications.

The underwriting process typically focuses on PSA levels, urological assessments, and overall prostate health rather than viewing BPH as a significant risk factor requiring rate increases or coverage limitations.

Specialized BPH-Friendly Carriers

Several insurance carriers have developed specific expertise in evaluating prostate conditions and offer particularly favorable consideration for BPH cases. These companies understand the condition’s benign nature and often provide better rates than general market carriers.

Working with agents who understand carrier-specific BPH guidelines helps identify the most favorable options for your particular situation and symptom management status.

Key Takeaways

- All major life insurance product types remain available with BPH

- Standard to preferred rates are commonly achieved

- No-exam options provide quick approval paths

- Traditional underwriting often yields optimal results

- Specialized carriers may offer enhanced consideration

What Should You Expect During the Application Process?

Key insight: The application process for men with BPH typically proceeds smoothly, focusing on routine health questions and basic medical information rather than extensive specialized underwriting requirements.

Understanding the straightforward application process helps set appropriate expectations and ensures you’re prepared with the basic information needed for efficient processing and approval.

Standard application components include:

- Basic health questionnaire covering your BPH diagnosis, current symptoms, medications, and treatment effectiveness, typically requiring only 5-10 minutes to complete.

- Medical exam scheduling for traditional policies, including standard measurements, blood work, and urine tests that evaluate overall health rather than focusing specifically on prostate conditions.

- Medical records authorization allowing the insurance company to verify your BPH diagnosis, treatment history, and current health status through your healthcare providers.

- Lifestyle and family history questions addressing general health factors, tobacco use, exercise habits, and family medical history that influence overall insurability.

“Most BPH applications move through underwriting quickly because the condition is so well understood. We typically see approvals within 2-4 weeks for straightforward cases.”

– InsuranceBrokers USA – Licensed Life Agent

Timeline expectations:

- No-exam applications: 1-2 weeks for approval in most cases

- Traditional underwritten policies: 3-6 weeks depending on medical record availability

- Simplified issue policies: 2-3 weeks with basic health verification

What makes the process efficient:

BPH’s classification as a routine condition means underwriters follow established guidelines rather than requiring specialized medical consultation or extensive case review. Most applications proceed through normal channels without delays or additional requirements.

The key to smooth processing lies in providing complete, accurate information about your diagnosis, current treatment, and symptom management rather than attempting to minimize or avoid discussing your condition.

Bottom Line

The application process for BPH proceeds routinely through standard underwriting channels, typically resulting in efficient processing and favorable outcomes for well-managed cases.

What Questions Will Insurance Companies Ask?

Key insight: Insurance companies ask straightforward questions about your BPH diagnosis, treatment, and current management rather than extensive specialized inquiries, focusing on ruling out cancer and confirming symptom control.

Understanding typical underwriting questions helps you prepare accurate responses and gather any necessary documentation before beginning the application process.

Diagnosis and timing questions:

- When were you first diagnosed with benign prostatic hyperplasia?

- Who made the diagnosis – your primary care physician or a urologist?

- What symptoms led to your diagnosis?

- Have you had any surgical procedures related to your prostate?

Current management questions:

- What medications are you currently taking for BPH?

- How well controlled are your symptoms?

- Have your medications changed in the past 12 months?

- Are you under regular urological care?

“The questions are routine and straightforward. Underwriters want to confirm your condition is well-managed and not progressing toward complications that might require surgery.”

– InsuranceBrokers USA – Underwriting Consultant

Cancer screening questions:

- Have you had PSA (prostate-specific antigen) testing? What were your results?

- Have you ever had a prostate biopsy?

- Has any doctor expressed concern about prostate cancer?

- Do you have a family history of prostate cancer?

General health questions:

- What is your current height and weight?

- Do you use tobacco or nicotine products?

- Are you currently working?

- Have you applied for disability benefits?

- Do you have other medical conditions?

How to answer effectively:

Provide complete, accurate information about your condition without downplaying or exaggerating symptoms. Underwriters appreciate straightforward responses that demonstrate you understand and actively manage your condition.

If you’re unsure about specific dates, medication names, or test results, gather this information from your healthcare providers before completing the application rather than guessing.

Key Takeaways

- Questions focus on routine medical information rather than complex assessments

- Cancer screening results are particularly important to underwriters

- Current symptom management demonstrates responsible health care

- Complete accuracy is more important than perfect recall of dates

- Preparation with medical records improves application efficiency

What Rates Can You Qualify For?

Key insight: Men with well-managed BPH typically qualify for standard to preferred rates, with many achieving the same pricing they would have received before their diagnosis.

Rate classifications for BPH focus on overall health status and condition management rather than the enlarged prostate itself, resulting in favorable pricing for most applicants.

Expected Rate Classifications for BPH (Age 60 Male, $250,000 Coverage)

| BPH Management Status | Typical Rate Class | Estimated Annual Premium |

|---|---|---|

| Well-controlled, no complications | Standard to Preferred | $1,200-$1,800 |

| Recently diagnosed, stable | Standard | $1,500-$2,200 |

| Mild symptoms, good health | Preferred to Preferred Plus | $1,000-$1,500 |

| Surgical treatment, recovered | Standard to Preferred | $1,200-$1,900 |

*Rates vary by carrier, health status, and other underwriting factors.

Factors that support preferred rates:

- Excellent overall health beyond the BPH diagnosis, including normal blood pressure, healthy weight, and absence of other medical conditions that might affect insurability.

- Well-controlled symptoms through medication compliance, lifestyle modifications, or successful surgical intervention that demonstrates effective condition management.

- Regular medical follow-up with your healthcare providers showing responsible health maintenance and proactive monitoring of your condition.

- Normal PSA levels and absence of any concerning prostate-related findings that might suggest cancer risk or disease progression.

“We consistently see men with BPH achieve preferred rates when their overall health profile is strong. The key is demonstrating that BPH is just one small part of an otherwise healthy lifestyle.”

– InsuranceBrokers USA – Senior Underwriter

Rate optimization strategies:

- Timing applications strategically after achieving stable symptom control or completing successful treatment to demonstrate optimal health status.

- Emphasizing positive health factors such as regular exercise, non-smoking status, healthy diet, and preventive healthcare compliance that support overall insurability.

- Carrier comparison shopping as different companies may offer varying rate classifications for identical BPH presentations, making professional guidance valuable.

- Policy type optimization balancing coverage needs with rate considerations, as some carriers offer better BPH rates on specific product lines.

Long-term rate stability:

Once approved, your rates remain locked regardless of BPH symptom changes, disease progression, or treatment modifications. This protection makes securing coverage while healthy particularly valuable for long-term financial planning.

Most term policies offer level premiums for 10-30 years, while permanent policies provide lifetime rate guarantees that protect against future health changes affecting your insurability.

Bottom Line

Well-managed BPH typically qualifies for standard to preferred rates, with many men achieving the same pricing they would have received before their diagnosis, making coverage both accessible and affordable.

How Can You Ensure the Best Outcome?

Key insight: Success with BPH life insurance applications relies on demonstrating effective condition management, maintaining excellent overall health, and working with professionals who understand BPH-friendly carriers.

Strategic preparation and presentation significantly improve both approval chances and rate classifications for men with benign prostatic hyperplasia.

Medical management optimization:

- Consistent medication compliance with prescribed BPH treatments such as alpha-blockers or 5-alpha-reductase inhibitors that demonstrate responsible symptom management.

- Regular urological monitoring through scheduled follow-up appointments that show proactive healthcare engagement and condition stability assessment.

- PSA testing maintenance with current results showing stable or improving levels that support the benign nature of your enlarged prostate.

- Symptom documentation with your healthcare provider to establish baseline function and treatment effectiveness for underwriter review.

“The applications that receive the best rates are from men who clearly demonstrate they’re actively managing their BPH and maintaining excellent overall health. It’s about showing you’re thriving, not just surviving with the condition.”

– InsuranceBrokers USA – Licensed Agent

Lifestyle factor optimization:

- Overall fitness maintenance through regular exercise, healthy weight management, and cardiovascular health that supports positive underwriting assessment.

- Tobacco cessation if applicable, as non-smoking status significantly improves rate classifications across all policy types and coverage amounts.

- Alcohol moderation demonstrating responsible lifestyle choices that support long-term health and reduce overall mortality risk factors.

- Preventive healthcare compliance with recommended screenings, vaccinations, and routine medical care that shows commitment to health maintenance.

Application preparation strategies:

- Medical record compilation ensuring your healthcare providers have complete, up-to-date documentation of your BPH diagnosis, treatment response, and current status.

- Physician communication with your urologist or primary care provider to ensure they can provide positive assessments of your condition management and prognosis.

- Timing considerations applying when your health status is optimal and BPH symptoms are well-controlled rather than during symptom flare-ups or medication adjustments.

- Complete honesty about your condition while emphasizing positive management aspects rather than downplaying the diagnosis or exaggerating complications.

Professional guidance benefits:

Working with agents experienced in BPH cases provides access to carriers with favorable underwriting guidelines and helps present your application in the most advantageous manner possible.

Professional guidance helps identify which carriers treat BPH most favorably and can often predict likely outcomes before formal application submission.

Key Takeaways

- Consistent medical management demonstrates responsibility and stability

- Overall health status influences rates more than BPH itself

- Proper timing and preparation improve application outcomes

- Professional guidance helps identify optimal carrier options

- Honesty combined with positive presentation yields best results

How Can Professional Guidance Help?

Key insight: Insurance professionals experienced with BPH cases provide access to carriers with favorable underwriting guidelines, application optimization strategies, and advocacy throughout the approval process.

Professional guidance becomes particularly valuable for BPH cases where carrier selection and application presentation can significantly impact both approval chances and final rate classifications.

Specialized knowledge includes:

- Carrier-specific BPH guidelines understanding which insurance companies offer the most favorable consideration for enlarged prostate cases and their specific underwriting criteria.

- Rate classification expertise knowing how different carriers evaluate BPH symptoms, medications, and management approaches to predict likely outcomes before application submission.

- Application optimization presenting your medical information in formats that emphasize positive factors while addressing underwriter concerns proactively.

- Product knowledge across no-exam, simplified issue, and traditional policies to identify the most appropriate coverage type for your specific situation and goals.

“BPH is so routine that the real value comes from knowing which carriers treat it most favorably and how to present the application for optimal results. The right carrier selection can mean the difference between standard and preferred rates.”

– InsuranceBrokers USA – Management Team

Professional services typically include:

- Comprehensive case analysis evaluating your BPH history, current management, overall health status, and coverage objectives to develop optimal application strategies.

- Carrier comparison and selection identifying insurance companies most likely to offer favorable rates and terms based on your specific BPH presentation and health profile.

- Application preparation and submission ensuring forms are completed accurately and medical information is presented effectively to maximize approval chances.

- Underwriting advocacy communicating with insurance companies during the review process to clarify information and address any concerns that arise.

Ongoing support benefits:

- Policy monitoring for rate improvement opportunities as your health status stabilizes or BPH management becomes more effective over time.

- Coverage upgrades when better options become available or your health profile improves sufficiently to qualify for enhanced rates.

- Claims support providing guidance to beneficiaries when claims need to be filed, ensuring smooth processing during difficult times.

Choosing appropriate professionals:

Look for agents with specific experience in medical condition cases rather than general life insurance sales, as BPH applications benefit from specialized underwriting knowledge.

Verify access to multiple insurance carriers including companies known for favorable BPH consideration, ensuring comprehensive option evaluation rather than limited product selection.

Understand service commitments and ongoing support availability, particularly important for coverage monitoring and potential future upgrades as health status improves.

Our team specializes in helping men with BPH navigate the life insurance process efficiently, with access to carriers offering the most favorable consideration for prostate conditions and comprehensive support throughout the application and approval process.

Key Takeaways

- Specialized knowledge improves carrier selection and rate outcomes

- Professional guidance optimizes application presentation and timing

- Multiple carrier access provides better options than single-company agents

- Ongoing support helps maximize long-term coverage benefits

- Experience with medical conditions yields better results than general agents

Frequently Asked Questions

Will my BPH medications affect my life insurance application?

Direct answer: Standard BPH medications typically have no negative impact on life insurance applications and often demonstrate responsible health management that underwriters view favorably.

Common BPH medications like alpha-blockers (tamsulosin, doxazosin), 5-alpha-reductase inhibitors (finasteride, dutasteride), and combination therapies are well-understood by underwriters and rarely affect rate classifications. Taking prescribed medications consistently actually demonstrates good medical compliance and proactive health management. Some newer treatments or frequent medication changes might prompt additional questions, but established treatments with stable dosing typically support rather than hinder applications.

Can I get life insurance immediately after a BPH diagnosis?

Direct answer: Yes, you can typically apply for life insurance immediately after a BPH diagnosis, with many no-exam and simplified issue policies available without waiting periods.

Unlike cancer or other serious conditions requiring waiting periods, BPH is considered a routine condition that doesn’t necessitate delays in applying for coverage. No medical exam policies often approve immediately, while traditional underwritten policies may require basic medical records review but rarely impose waiting periods. The key is ensuring your diagnosis is confirmed as benign prostatic hyperplasia rather than a more serious prostate condition, which your medical records will clearly demonstrate.

What if I need surgery for my enlarged prostate?

Direct answer: Surgical treatments for BPH typically don’t disqualify you from life insurance coverage, though timing and type of procedure may influence application strategy and carrier selection.

Common BPH surgeries like TURP (Transurethral Resection of the Prostate), laser therapy, or minimally invasive procedures are generally well-accepted by insurance companies as routine treatments for symptom management. If surgery is planned, you might consider applying for coverage beforehand to avoid any temporary underwriting delays. Post-surgery applications typically proceed normally once you’ve recovered and demonstrated stable health status. More extensive surgeries might require brief waiting periods, but these are usually measured in months rather than years.

How important are my PSA test results for life insurance?

Direct answer: PSA levels are important for ruling out prostate cancer concerns, but moderately elevated PSA due to BPH alone rarely affects life insurance eligibility or rates.

Underwriters understand that benign prostatic hyperplasia naturally causes PSA elevation, so levels up to 10-15 ng/mL are often considered normal for men with documented BPH. What matters more is the trend over time and correlation with your BPH diagnosis rather than absolute numbers. Extremely high PSA levels or rapidly rising trends might prompt additional medical review, but stable elevations consistent with BPH typically don’t impact approval or pricing. Having recent PSA results available helps underwriters quickly assess your situation.

Can I increase my coverage amount later if my BPH improves?

Direct answer: Yes, you can typically apply for additional coverage if your BPH symptoms improve, your overall health enhances, or you want to supplement existing policies with new applications.

Most life insurance policies allow you to apply for additional coverage at any time, subject to new underwriting based on your current health status. If your BPH becomes better controlled, symptoms improve significantly, or your overall health profile enhances, you might qualify for better rates on new coverage. Some policies also include guaranteed purchase options or conversion privileges that allow coverage increases without full medical underwriting. Working with your agent to monitor improvement opportunities can help optimize your long-term coverage portfolio.

What if I have other health conditions in addition to BPH?

Direct answer: Additional health conditions are evaluated separately from BPH, with underwriters considering your overall health profile rather than focusing solely on the enlarged prostate.

BPH rarely adds significant risk to other health conditions, so underwriters typically evaluate each condition independently. Common combinations like BPH with diabetes, high blood pressure, or heart conditions are assessed based on the management and severity of each condition rather than cumulative negative effects. In many cases, well-managed BPH actually demonstrates good healthcare engagement that supports positive underwriting assessment of other conditions. The key is comprehensive management of all health issues rather than allowing any single condition to remain uncontrolled.

Get Expert Help with Your BPH Life Insurance Application

Don’t leave your life insurance coverage to chance. Our specialized team understands exactly how BPH affects applications and knows which carriers offer the most favorable consideration for enlarged prostate cases.

What We Provide:

- Comprehensive analysis of your BPH case and optimal carrier selection

- Application optimization to maximize approval chances and rate classifications

- Access to carriers with the most BPH-friendly underwriting guidelines

- Professional advocacy throughout the underwriting process

- Ongoing coverage monitoring for rate improvement opportunities

- No-cost consultation and coverage strategy development

Call 888-211-6171 for your free consultation

Licensed in all 50 states • Specialized in BPH cases • No obligation consultation

Related Coverage Resources

Men with BPH often benefit from exploring comprehensive coverage strategies and understanding all available insurance options:

- Life Insurance Approvals with Pre-Existing Medical Conditions – Comprehensive strategies for medical condition applications

- Top 10 Best No-Exam Life Insurance Companies (2025 Update) – Quick approval processes for health-conscious applicants

- Top 10 Best Life Insurance Companies in the U.S. (2025): Expert Broker Rankings – Overall carrier analysis and recommendations