It’s safe to assume that whenever you discuss your heart condition with a life insurance underwriter, you can expect a few follow-up questions. However, this shouldn’t necessarily be a cause for concern, especially when it comes to heart murmurs. Life insurance companies are aware that there are different types of heart murmurs, and not all of them are severe.

In fact, some murmurs are so benign that doctors and cardiologists may opt not to treat them, preferring instead to leave them alone. With that in mind, we’d like to address some of the most common questions we receive from people with heart murmurs who are applying for life insurance. Our goal is to help you better understand the application process.

We’ll be answering the following questions:

- Can I qualify for life insurance if I have been diagnosed with an Aortic Murmur or Aortic Valve Insufficiency?

- Why do life insurance companies care if I have been diagnosed with an Aortic Murmur or Aortic Valve Insufficiency?

- What kind of information will insurance companies ask for?

- What “rate” can I qualify for?

- What can I do to ensure that I get the best life insurance policy for me?

So, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Aortic Murmur or Aortic Valve Insufficiency?

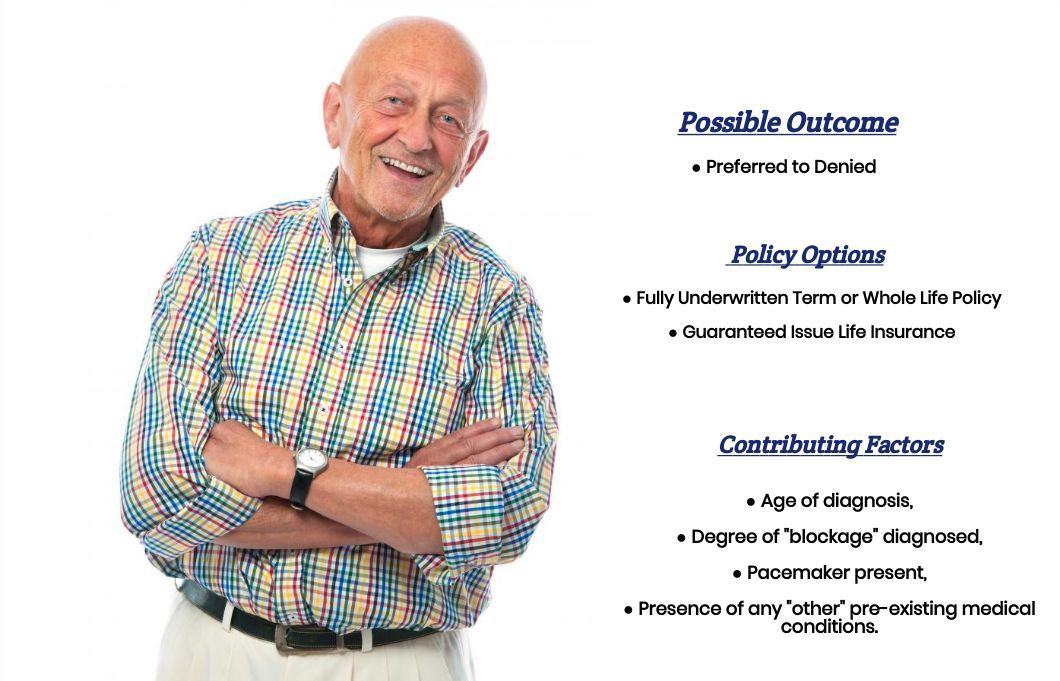

Yes, it is possible to qualify for life insurance if you have been diagnosed with Aortic Murmur or Aortic Valve Insufficiency. However, the type and amount of coverage you may qualify for can be impacted by the severity of your condition, your age, and other factors. It is important to note that individuals with Aortic Murmur or Aortic Valve Insufficiency may be classified as high-risk, which can lead to higher premiums

In addition to being classified as high-risk, individuals with Aortic Murmur or Aortic Valve Insufficiency may also need to undergo a medical exam and provide detailed medical history to the insurance company. The medical exam can include tests such as an electrocardiogram (EKG) or echocardiogram to assess the severity of the condition. The insurance company may also ask for information about any treatments or medications being taken, as well as lifestyle factors such as smoking or exercise habits.

The severity of the condition will also determine the type of coverage you may qualify for. In some cases, individuals with Aortic Murmur or Aortic Valve Insufficiency may only be able to qualify for a graded or modified life insurance policy, which typically has lower death benefits and higher premiums.

We should also mention that individuals who have been diagnosed with an Aortic Murmur will probably want to avoid applying for a No Medical Exam Term Life Insurance Policy which would most likely deny their application.

And instead…

Choose to apply for a fully underwritten life insurance policy, which would require that they do take a medical exam, which would likely provide them with the best opportunity for success.

Why do life insurance companies care if I have been diagnosed with an Aortic Murmur or Aortic Valve Insufficiency?

Life insurance companies care if you have been diagnosed with an Aortic Murmur or Aortic Valve Insufficiency because these conditions can potentially increase the risk of premature death. As a result, the insurance company may need to charge higher premiums or limit the amount of coverage they can offer to individuals with these conditions.

Aortic Murmur is a condition where there is an abnormal sound in the heart caused by turbulent blood flow, and it can be an indicator of an underlying heart problem. Aortic Valve Insufficiency occurs when the aortic valve in the heart does not close properly, which can lead to blood flowing back into the heart.

Both of these conditions can lead to serious health complications, such as heart failure or stroke, which can increase the likelihood of premature death. Insurance companies use actuarial data and risk assessment models to determine the level of risk associated with each applicant and adjust their premiums and coverage accordingly.

Therefore, the insurance company needs to be aware of any pre-existing medical conditions that could affect your overall health and longevity, including Aortic Murmur or Aortic Valve Insufficiency.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, it is important to disclose any medical conditions you have, including a heart murmur. Insurance companies will typically ask about your medical history as part of the application process, and they may also require you to undergo a medical exam as part of the underwriting process.

The insurance company will be interested in the type of heart murmur you have, as well as any related symptoms or complications that you have experienced. They will also want to know about any treatments or medications you are taking, and whether you have any restrictions on your activities or lifestyle as a result of the heart murmur.

Specific questions you’ll likely be asked may include:

- When were you first diagnosed with an Aortic Murmur?

- Who diagnosed your Aortic Murmur? A general practitioner or a cardiologist?

- What symptoms (if any) led to your diagnosis?

- What symptoms (if any) are you currently suffering from?

- What prescription medications (if any) are you currently taking now?

- Have any of these medications changed in the past 12 months?

- Have you had any kind of surgical procedures preformed, or has your doctor suggested you need any surgical procedures to correct your Aortic Murmur?

- Have you been diagnosed with any other cardiovascular diseases?

- Have you ever suffered from a heart attack or stroke?

- In the past two years, have you been hospitalized for any reason?

- In the past 12 months, have you used any tobacco or nicotine products?

- What is your current height and weight?

- Are you currently working right now?

- In the past 12 months, have you applied for or received any form of disability insurance?

Now before we go…

Any further, this is where we usually like to remind folks that we here at IBUSA we are not medical professionals, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are good at helping folks with pre-existing medical conditions find and qualify for the life insurance that they’re looking for.

So…

Should you have any specific medical questions, please know we’re not the guys you would want to ask, we’re just the guys who know a lot about different life insurance companies and which one’s are better than others in certain circumstances.

This brings us to the next topic that we want to focus on, which is…

What “rate” can I qualify for?

Now as you can see, there are a lot of factors that can come into play when trying to determine what kind of “rate” an individual might be able to qualify for after having been diagnosed with an Aortic Murmur, which is why it’s pretty much impossible to know for sure what kind of “rate” you might be able to qualify for without actually speaking with you first!

That said however…

There are a few assumptions that one can generally make that will usually hold true which is that most of the time when an individual can qualify for a traditional term or whole life insurance policy after having been diagnosed with an Aortic Murmur or Aortic Insufficiency is that they will not be able to qualify for anything better than a Standard rate.

And in fact…

We would hesitate even to quote someone a Standard rate simply because the vast majority of individuals won’t be able to qualify for a Standard rate, and the last thing that we want to do is provide someone with “false hope.”

Instead…

We would rather prepare an applicant for what is more likely to happen and spend more time focusing on “which” life insurance companies provide the options and pricing at the “rate” they will most likely qualify for!

This brings us to the last topic that we wanted to take a moment and discuss with you here today, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent before applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”.

Now, will we be able to help out everyone who has been previously diagnosed with an Aortic Murmur?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!