In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after a Hysterectomy.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have had a Hysterectomy?

- Why do life insurance companies care if I have had a Hysterectomy?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have had a Hysterectomy?

In general, having a hysterectomy should not necessarily disqualify a person from obtaining life insurance. Life insurance companies may consider a person’s medical history, including any surgeries or medical procedures that they have had when determining the terms of a policy.

However, other factors…

Such as age, gender, overall health, and lifestyle may also be considered. For this reason, it is important to disclose all relevant medical information to the insurance company. This includes any surgeries or medical procedures you have had, such as a hysterectomy. The insurance company may also ask for additional information about your medical history, such as the reason for the surgery and any other medical conditions you have.

Why do life insurance companies care if I have had a Hysterectomy?

Life insurance companies may consider a person’s medical history, including any surgeries or medical procedures, when determining the terms of a policy. Certain medical conditions or treatments may potentially increase the risk of mortality, one of the main factors that life insurance companies consider when underwriting a policy. In the case of a hysterectomy, the insurance company may be interested in the reason for the surgery and any related medical conditions.

For example, suppose a Hysterectomy was performed to treat a cancerous tumor. In that case, the insurance company may consider the person’s overall health and the likelihood of recurrence when determining the terms of the policy.

Again, It is important to note that having a hysterectomy is not necessarily a disqualifying factor for life insurance. Life insurance companies consider various factors when determining the terms of a policy, and the impact of a hysterectomy on a person’s eligibility for coverage may vary depending on the specific circumstances.

Hysterectomy Defined:

A Hysterectomy is an operation whereby a woman’s uterus is completely removed. Common reasons why this a woman may need to have a Hysterectomy may include:

- The presence of Uterine Fibroids, which may be causing pain, excessive bleeding, and/or other issues,

- Uterine prolapse,

- Endometriosis,

- Pelvic inflammatory disease (PID),

- Adenomyosis,

- Endometrial cancer,

Fortunately…

With many of these conditions, having a Hysterectomy will provide a “cure” to their previous condition. In this case, the pre-existing medical condition that caused them to need a Hysterectomy will no longer be used as a “factor” in determining what kind of “rate” they can qualify for.

Now, at this point, we usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s it’s not so great if you’re looking for answers to any specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, it is important to disclose all relevant medical information to the insurance company, including any surgeries or medical procedures you have had. If you have had a hysterectomy, the insurance company may ask for additional information about the procedure, such as:

- The reason for the surgery: The insurance company may want to know the reason for the Hysterectomy, such as to treat a medical condition like uterine fibroids or cancer.

- The type of Hysterectomy: There are several different types of hysterectomies, including partial, total, and radical, and the insurance company may want to know which type you have.

- Other medical conditions: The insurance company may want to know if you have any other medical conditions related to your Hysterectomy or that may have contributed to the need for the surgery.

- Follow-up care: The insurance company may want to know if you have received any follow-up care or treatment after your Hysterectomy, such as hormone replacement therapy.

It is important to be honest and forthcoming when answering these questions, as the insurance company will use this information to assess your overall health and determine the terms of your policy.

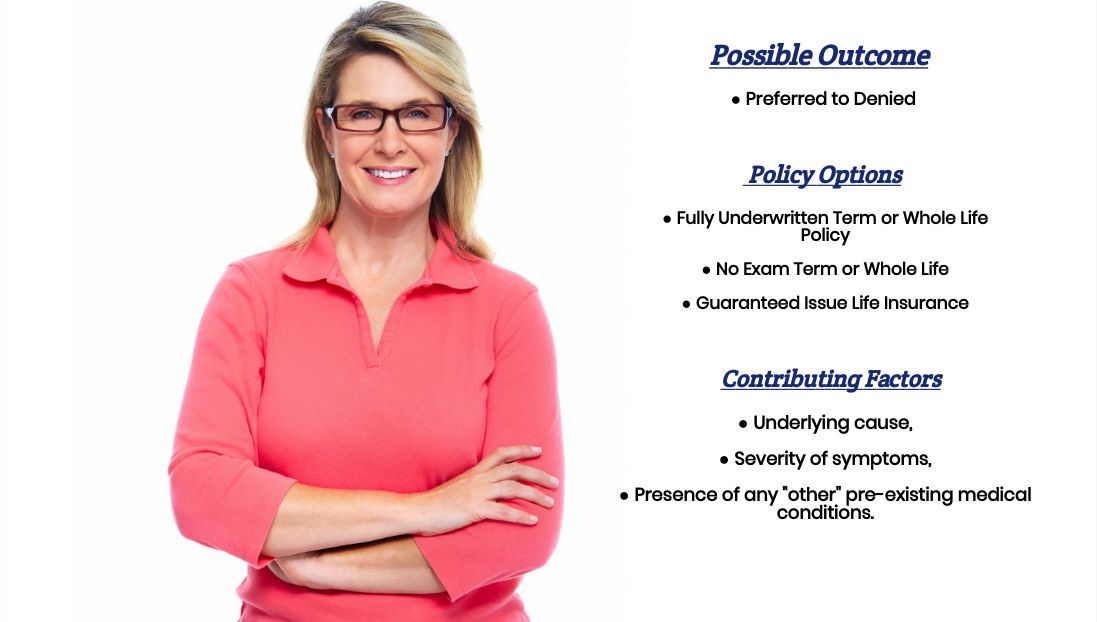

What rate class can I qualify for?

Generally, most insurance companies will consider any applicant who has had a previous Hysterectomy performed in one of two ways. Either the individual had their Hysterectomy because of some medical condition other than cancer, or they had it performed because of cancer.

Now, in the cases…

Where an individual had their Hysterectomy to help treat some “condition” other than cancer, what you’re typically going to find is that once you have made a full recovery and your condition is now considered “cured,” most life insurance companies aren’t going to use your previous Hysterectomy as a factor in the decision-making process.

Or, in other words…

Whatever “rate” you would have been able to qualify for before your need for hysterectomies should be the same “rate” you will be able to qualify for AFTER having had a hysterectomy performed!

Cancer cases, on the other hand, won’t be treated the same. In cancer cases, what you’re usually going to find is that your “cancer” diagnosis will be what ultimately determines what kind of “rate” you will be able to qualify for, and typically, the fact that you have had a Hysterectomy performed usually won’t be considered all that much.

For more information…

About how your previous cancer diagnosis might affect the outcome of your life insurance application, we would advise you to check out our Pre-Existing Medical Conditions page to see if we might have an article dedicated to the “type” of cancer you were diagnosed with or give us a call!

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone who has previously had a Hysterectomy?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.