In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Berger’s Disease or IgA Nephropathy.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with Berger’s Disease or IgA Nephropathy?

- Why do life insurance companies care if I’ve been diagnosed with Berger’s Disease or IgA Nephropathy?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Berger’s Disease or IgA Nephropathy?

Yes, individuals who have been diagnosed with Berger’s Disease or IgA Nephropathy can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is that because there is no known cure for this disorder, individuals who have been diagnosed with it will typically be considered a “higher risk” applicant.

Why do life insurance companies care if I’ve been diagnosed with Berger’s Disease or IgA Nephropathy?

The best way to understand why a life insurance company is likely to “care” if you have been diagnosed with Berger’s Disease is first to examine precisely what Berger’s Disease is and what can happen to those who suffer from it.

Berger’s Disease Defined.

Berger’s Disease is a pre-existing medical condition that affects the kidneys when a known antibody called immunoglobulin A (IgA) builds up within the kidney tissues. As a result of this IgA accumulation, inflammation and swelling will occur within the kidney, thus diminishing the kidneys’ ability to filter waste from one’s blood and, over time, can lead to total kidney failure!

Symptoms that one might experience may include:

- Cola or tea-colored urine.

- Frothy for “foamy” urine.

- Proteinuria.

- Hematuria,

- Hypertension or high blood pressure,

- Fatigue’

- Swelling of the hands and feet.

- Increased susceptibility to allergies.

- Mood swings.

And an increased susceptibility to urinary tract infections (UTIs).

The good news is…

With medications, one will typically be able to slow down the progress of this Disease. The bad news is that even despite this ability to slow down the progression of this Disease, nearly 50% of all affected patients will eventually end up suffering from end-stage renal Disease (ESRD) or kidney failure.

This is why…

Before making any decision about who they will and won’t insure, most (if not all) life insurance companies are going to want to ask you a series of medical questions about your Berger’s Disease so that they can get a better idea about how “serious” your condition is and whether or not you might one day become someone who may end up suffering from complete kidney failure.

What kind of information will the insurance companies ask me or be interested in?

- When were you first diagnosed with Berger’s Disease or IgA nephropathy?

- Who first diagnosed your Berger’s Disease? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- How long have you been treating your IgA nephropathy?

- What symptoms are you currently experiencing due to Berger’s Disease?

- Have you noticed that your symptoms are getting better or worse (or no change)?

- Have you been diagnosed with any other medical conditions or have any other medical conditions that are affecting your kidneys?

- Have you ever been diagnosed with diabetes?

- What medications are you currently taking now?

- Over the past 12 months, have any of your medications changed?

- How is your condition progressing? What type of outlook has your doctor given you?

- Have you ever been hospitalized for any reason in the last two years?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now, at this point…

We like to remind folks that it’s essential to understand that we here at I&E are not medical professionals or doctors. All we are is a bunch of life insurance agents who are really good at helping folks with all sorts of pre-existing medical conditions find and qualify for the coverage they’re looking for.

So, while we…

Although we may seem to know a thing or two about a particular medical condition like Berger’s Disease, the truth is that all we know is what most life insurance underwriters like to know about your condition and how they’ll use this information to make decisions about who they will and won’t insure. This information is a HUGE help when looking to purchase a life insurance policy, but it isn’t all that useful in any other situation.

Which is why, if you have any specific medical questions, we encourage you to ask your doctor or seek out an actual medical professional and save all the insurance questions for us!

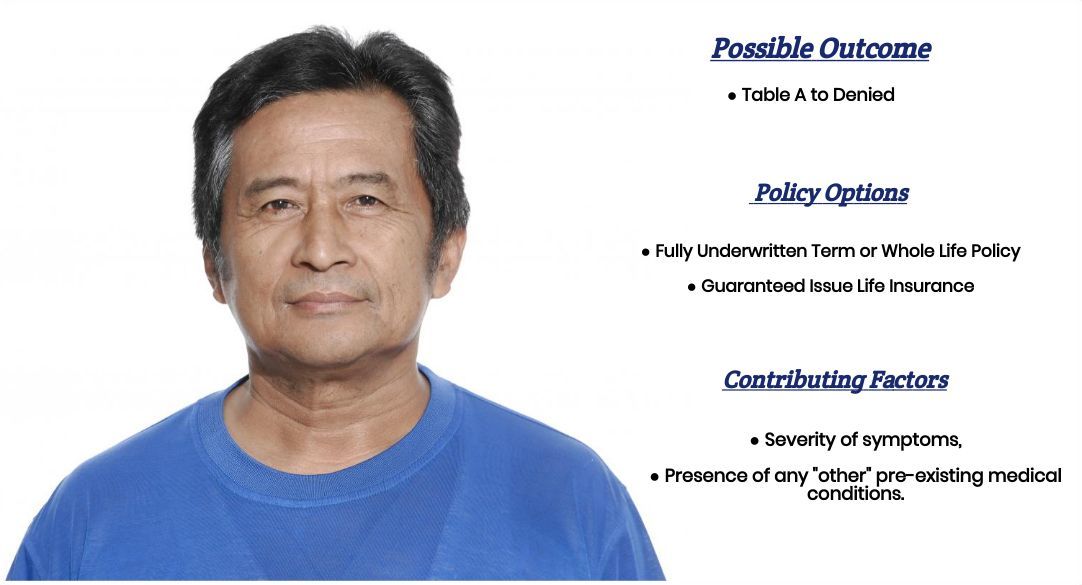

What rate (or price) can I qualify for?

As you can see, many factors can come into play when trying to determine what kind of “rate” an individual diagnosed with Berger’s Disease might qualify for. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first speaking to you directly.

That said, however…

There is one “assumption” that we can make about individuals who have been diagnosed with Berger’s Disease, which is that if they can qualify for a traditional term or whole life insurance policy, it will be at a “sub-standard” rate or a “high-risk” rate class.

This makes applying with the “right” life insurance company all the more important because this way, you can be sure that you’re not only qualifying for the “best” sub-standard rate out there, but you’re also getting that “rate” at the best price. The good news is that “finding” such a policy is pretty much all we do here at I&E, so you won’t have to do this part alone!

This brings us to the last topic we wanted to discuss here in this article, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at I&E, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you. Such an agent that can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

Before applying for coverage, it would be best to be completely honest with your life insurance agent. By doing so, you will help them narrow down what options might be the “best. ”

So, what are you waiting for? Give us a call today and see what we can do for you!