When it comes to final expense insurance, the best final expense insurance companies in the U.S. are those that offer excellent financial ratings, high-quality policies, and affordable prices.

In this article, we review Lincoln Heritage, one of the top burial insurance plans in the market. While we provide a comprehensive breakdown of the company and its flagship product, Funeral Advantage, we recommend considering other options before deciding. It’s always wise to shop around and compare different providers to find the best policy that fits your needs and budget.

Compare over 50 top life insurance companies instantly.

|

Review of Lincoln Heritage

Table of contents:

- About Lincoln Heritage

- Lincoln Heritage Final Expense Products

- Applying for Lincoln Heritage Final Expense Insurance

- Funeral Advantage Waiting Period

- Immediate Coverage Through Lincoln Heritage

- Lincoln Heritage Funeral Advantage Rates

- Funeral Advantage Benefits

- Life Insurance Riders

About Lincoln Heritage

Lincoln Heritage Life Insurance Company, a registered trademark of the Phoenix-based Londen Insurance Group, Inc., specializes in burial insurance for seniors. With almost 60 years in the industry, Lincoln Heritage is the leading carrier for agent-produced final expense policies.

While the company’s insurance options are narrow and underwriting is strict for final expense coverage, Lincoln Heritage is known for providing excellent customer service. The company has a solid financial standing with an A+ rating from the Better Business Bureau and an A- rating from A.M. Best, although some other insurers are even stronger.

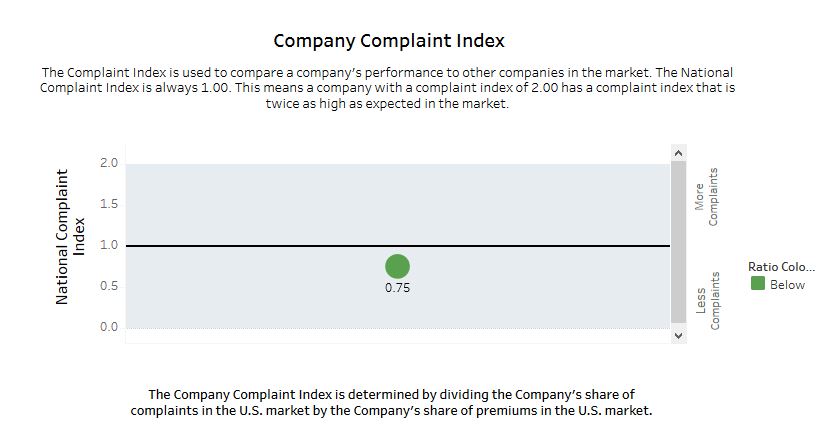

Moreover, Lincoln Heritage maintains a low NAIC complaint index rating of .75 for 2019, which indicates that the company receives fewer complaints per its share of the U.S. market than its competitors. However, it’s important to remember that each individual’s needs and circumstances are unique. So, it’s always a good idea to compare several options and carefully consider each before making a final decision.

Lincoln Heritage’s Final Expense Insurance Products

Lincoln Heritage’s leading policy is “Lincoln Heritage Funeral Advantage,” the company also offers a Modified Plan for applicants who are ineligible for Funeral Advantage due to preexisting health issues.

Both are small whole-life insurance policies with fixed premiums and death benefits and are guaranteed to remain in place for the insured’s entire life.

As whole life insurance, policies accrue cash value the longer they remain in place. The cash value can be borrowed during the insured’s life, with any loan amounts remaining unpaid upon the insured’s death deducted from the policy proceeds.

Lincoln Heritage issues new policies to applicants between 40 and 85. Up to age 80, new applicants can obtain a maximum of $20,000 in coverage. Coverage for applicants over 80 is limited to $15,000.

Lincoln Heritage issues Funeral Advantage policies in every state but New York. Modified Plan policies are available in every state but New York, Alaska, and Montana.

Applying for Lincoln Heritage Final Expense Life Insurance

Lincoln Heritage funeral insurance policies are known as “simplified issue,” which means the application process does not include a physical or medical check-up but requires completing a questionnaire with health and medical history information.

The company will also run a prescription history report when reviewing applications. For policies with higher coverage limits, an applicant may need a telephone interview with a Lincoln Heritage representative.

Unlike most life insurers offering similar products, Lincoln Heritage doesn’t consider an applicant’s body-mass index (“BMI,” the ratio between the applicant’s height and weight).

Modified Plan

Applicants with some medical conditions are ineligible for Funeral Advantage but can still qualify for Modified Plan coverage.

Without limitation, conditions that preclude Funeral Advantage include a prescription for a blood thinner or other “high-risk” medication; a recent history of heart or circulatory problems or stroke; most cancers, kidney or liver disease including cirrhosis; significant chronic respiratory issues like emphysema, COPD, or chronic bronchitis; cystic fibrosis, tuberculosis, multiple sclerosis, severe diabetes, Alzheimer’s, and ALS.

Difference

The principal differences between the Funeral Advantage and the Modified Plan are that the Modified Plan has comparatively higher premiums and a mandatory waiting period.

Because Lincoln Heritage considers applicants who qualify for Funeral Advantage to have less risk of early death, Funeral Advantage has lower premiums. It is available with full coverage commencing as soon as a policy is issued.

Lincoln Heritage does not offer a “guaranteed acceptance life insurance” policy. Applicants with HIV / AIDS, or who have been diagnosed with a terminal illness, or who are currently hospitalized, incarcerated, receiving hospice care, or residing in a long-term care facility will not be able to obtain life insurance through Lincoln Heritage.

The underwriting process for every life insurance company is a little different, and not all insurers screen for the same conditions.

At least some circumstances that would lead to ineligibility, substantially higher premiums, and/or a mandatory waiting period when applying with Lincoln Heritage could be accepted by one or more other life insurers.

Lincoln Heritage’s Waiting Period

When a life insurance policy has a “waiting period,” the full death benefit amount does not take effect until the policy has been in place for a defined period.

If the insured dies during the waiting period, the beneficiary receives a premium refund, usually with interest, but not the policy’s entire proceeds.

Waiting periods allow life insurers to charge lower premiums overall by mitigating the insurer’s risk of a large pay-out on a recently issued policy that hasn’t contributed much premium.

Modified Whole Life Waiting Period

Like most life insurance companies that offer funeral and burial insurance, Lincoln Heritage includes a waiting period in many of the policies it issues. The period lasts for either three years (for new insureds under age 50) or two years (for older applicants).

Funeral Advantage policies are available with no waiting period.

Suppose a policy is triggered during its waiting period. In that case, Lincoln Heritage calculates the payout as a complete refund of premiums paid so far, plus ten percent interest if the policy is in the first year of the waiting period, twenty percent if it’s in the second, or thirty percent in the third year.

Ten percent interest during the waiting period is average for final expense carriers. The twenty and thirty-percent rates for policies that have been in place longer are more generous than what most other companies offer during waiting periods.

Waiting periods are standard in funeral insurance policies; consumers shouldn’t necessarily view them as bad. In exchange for the reduced risk resulting from a waiting period, insurers can charge lower premiums or offer higher coverage levels for the same premium. And waiting periods also allow life insurers to provide coverage to applicants who might otherwise be ineligible.

Of course, there are some situations where it’s better to have coverage that kicks in immediately. In the world of final expense insurance, coverage that starts as soon as the policy is issued is called “immediate coverage” or “immediate issue.”

Immediate Coverage Through Lincoln Heritage

Lincoln Heritage offers immediate coverage (i.e., no waiting period) policies for applicants who qualify for Funeral Advantage policies.

Applicants who can only qualify for Lincoln Heritage’s Modified Plan cannot get immediate coverage.

Even for healthy applicants, choosing a no-waiting-period policy will result in higher premiums than if the same applicant chose an otherwise identical policy with a waiting period.

Policyholders who qualify for immediate issue life insurance coverage can opt for Lincoln Heritage’s “20 Pay Option.” When 20 Pay is chosen, the policyholder’s obligation to pay premiums ceases after the policy has been in place for twenty years.

At that point, the policy is “paid up,” remaining effective for the rest of the insured’s life, but no further premiums are owed.

20 Pay requires higher premium payments in the near term but can be a smart choice for an insured who anticipates living significantly longer than twenty years after the policy is issued.

Lincoln Heritage Funeral Advantage Rates

Lincoln Heritage’s life insurance rates are generally considered to be on the higher side. Like other life insurance companies, premiums are primarily based on an applicant’s age, sex, health status, and desired benefit level. Generally speaking, younger, healthier, and female applicants will pay lower premiums, while older male applicants with existing health problems will pay higher premiums. Additionally, Lincoln Heritage charges higher rates for tobacco users.

It’s important to note that once a policy is issued, the premiums are fixed, so an insured who later develops a medical condition that would have led to higher premiums or been disqualified will not have their premiums increased. While existing medical issues will result in higher premiums, it’s still important to shop around and compare rates from different insurance companies to ensure you’re getting the best coverage at the most competitive price.

Funeral Advantage Benefits Vs the Competition

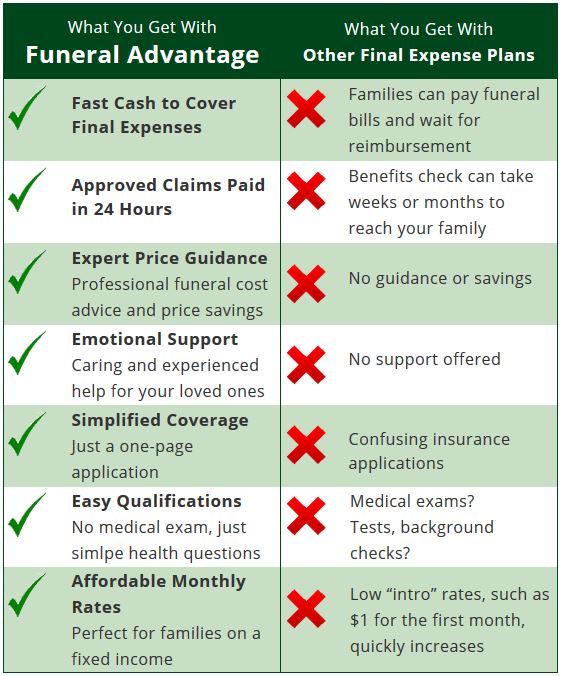

Although the Funeral Advantage costs more than a similar burial insurance policy, many prefer the plan’s benefits.

Notable Features and Options

Lincoln Heritage advertises as a benefit of its policies that claims are paid out within 24 hours of approval. This doesn’t mean that a policy’s death benefit will be paid to the beneficiary within 24 hours of the insured’s death—or within 24 hours of a claim being submitted.

Instead, Lincoln Heritage strives to pay claims within 24 hours after determining the claim is valid and payable.

Importantly, this is not a binding, enforceable contractual commitment but rather a company protocol that cannot always be met.

Funeral Consumer Guardian Society

All Lincoln Heritage life insurance policies include a Funeral Consumer Guardian Society membership.

The membership benefits are purported to help document the insured’s wishes for memorial services, the disposition of remains, and assistance to surviving family members with pricing and arranging funeral homes upon death.

Funeral Consumer Guardian Society is the main differentiator between Lincoln Heritage and the competition.

Life Insurance Riders

Lincoln Heritage final expense insurance is offered with several riders (at an additional premium), which may or may not be of value, depending on the individual insured.

Child Rider

The “Child Rider” provides term life insurance coverage for children (including step-children), grandchildren, and great-grandchildren. The term coverage is priced at $2 in additional premium for each $5,000 coverage (up to $25,000) purchased for the covered child. The coverage ceases when the child reaches age 25, but covered children can convert the coverage into permanent life insurance of equal or lesser value.

AD&D Rider

Finally, Lincoln Heritage offers an AD&D (“Accidental Death and Dismemberment”) Rider with increased benefits in the event of the insured’s accidental death. The AD&D coverage is offered in units of $5,000, with a total of five units available per policyholder. Coverage amounts are doubled if death occurs due to a car accident—or quadrupled if death occurs due to an accident occurring while the insured is a passenger on a common carrier or due to an act of war or terrorism.

Final thoughts…

While Lincoln Heritage Life Insurance Company has a strong reputation for customer service and financial stability, it’s important to compare its offerings with other insurance providers before deciding. While their focus on burial insurance for seniors may be appealing to some, it’s important to evaluate their underwriting standards and premium rates, as these can vary widely depending on an individual’s age, health, and other factors.

By shopping around and comparing different providers, individuals can ensure they are getting the best possible coverage and rates to meet their specific needs. So, while Lincoln Heritage may be an excellent option for some, it’s always wise to do your due diligence and compare policies and rates from several different providers before making a final decision.