In this article, we wanted to answer some of the most common questions from people applying for life insurance with Sjogren’s Syndrome.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Sjogren’s Syndrome?

- Why do life insurance companies care if I’ve been diagnosed with Sjogren’s Syndrome?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Sjogren’s Syndrome?

Yes, individuals who have been diagnosed with Sjogren’s Syndrome can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, most patients with Sjogren’s Syndrome can live a long and healthy life!

The only problem is that…

On rare occasions, individuals who have been diagnosed with Sjogren’s Syndrome will go on to develop a variety of different complications, which will undoubtedly affect the outcome of one’s life insurance application. This is why before being approved for a traditional life insurance policy, most (if not all) of the top 10 best life insurance companies (in our humble opinion) will want to learn a little bit more about your Sjogren’s Syndrome so that they can get a better idea of what kind of “risk” you may pose to them as the insurer.

Why do life insurance companies care if I’ve been diagnosed with Sjogren’s Syndrome?

The main reason why a life insurance company is going to “care” if you have been diagnosed with Sjogren’s Syndrome is that in certain rare situations, some individuals may develop an increased risk of developing Lymphoma. For this reason, you may also want to avoid applying for a no-medical-exam term life insurance policy, as these policies tend to be more challenging to qualify for after someone has been diagnosed with a pre-existing medical condition like Sjogren’s Syndrome.

Complications like this are also why we wanted to take a moment to discuss Sjogren’s Syndrome and highlight some of its most common symptoms/complications so that we can better understand what a life insurance underwriter will be looking for when deciding on your life insurance application.

Sjogren’s Syndrome Defined:

Sjogren’s Syndrome is an autoimmune disease that specifically attacks the glands that make tears and saliva. As a result, one of the first symptoms an individual might start experiencing is dry mouth and/or dry eyes.

Other common symptoms/complications may include:

- Joint pain,

- Swollen salivary glands,

- Dental cavities,

- Skin rashes or dry skin,

- Vision problems,

- Persistent dry cough,

- Vaginal dryness,

The most serious of all possible complications, however, will be the increased risk of developing Lymphoma, which is why regular medical care and follow-up are essential for anyone who has been diagnosed with Sjogren’s Syndrome.

Treatment options…

This may include the use of Hydroxychloroquine (Plaquenil), a medication most commonly used to treat malaria, and Methotrexate (Trexall), which is commonly used to suppress one’s immune system.

“This brings us to an important point we think we ought to mention.”

First…

If you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’ll still need to see the doctor, and if you’re wrong, the time you spend being your own doctor could really harm yourself!

Second…

Nobody here at IBUSA is medically trained; we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance they’re looking for. So please don’t mistake any of the medical information we discuss as medical advice because it’s not!

We’re just trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Optic Neuritis… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Typical questions you will likely be asked may include:

- When were you first diagnosed with Sjogren’s Syndrome?

- Who diagnosed your Sjogren’s Syndrome? A general practitioner or specialist?

- What symptoms (if any) led to your diagnosis?

- How are you treating your Sjogren’s Syndrome?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- How often do you see your primary care physician?

- In the past two years, have you been hospitalized for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

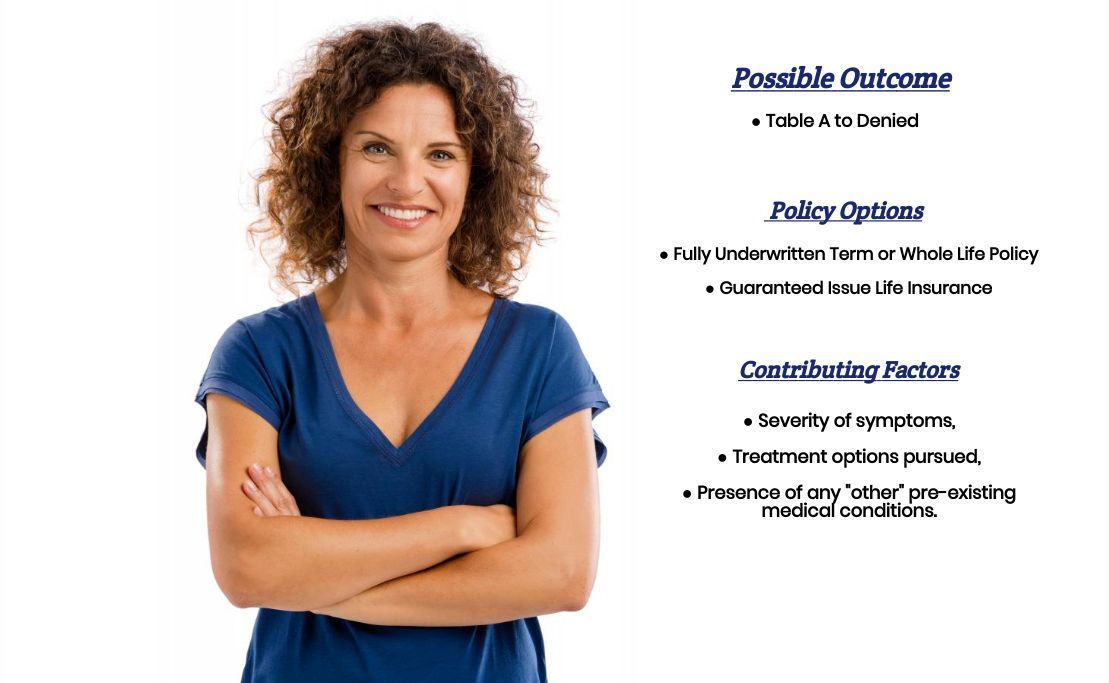

As you can see, many variables can come into play when determining what kind of “rate” an individual diagnosed with Sjogren’s Syndrome might qualify for. This is why knowing what kind of “rate” you might qualify for is almost impossible without first speaking with you directly. That said, however, most individuals who have been diagnosed with Sjogren’s Syndrome will usually fall into one of two categories that we can make some “assumptions” about that will generally hold true.

Category #1.

It will consist of folks who have been diagnosed with Sjogren’s Syndrome but don’t seem to be suffering from any other pre-existing medical conditions and haven’t exhibited any signs of suffering from Lymphoma. In cases like these, what you’re generally going to find is that most individuals will be considered “eligible” for a traditional life insurance policy, however, they’ll most likely only be able to qualify for a Table Rate (somewhere between table A-H).

Table rates…

These are life insurance rates typically reserved for “higher risk” applicants. They range from Table A, considered the “best” or least expensive table rate, to Table J, regarded as the “worst” or most expensive table rate.

Category #2.

The second group of folks that we might encounter will be those who have been diagnosed with Sjogren’s Syndrome and have either been diagnosed with some “other” pre-existing medical conditions or have actually developed Lymphoma as a direct result of having Sjogren’s Syndrome.

In cases like these…

You’ll typically find that most life insurance companies aren’t willing to insure someone for a traditional life insurance policy. This means that most folks in this situation must pursue a Guaranteed Issue Life Insurance Policy if they still wish to qualify for “some” coverage.

The good news is that regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

Fortunately, this is precisely what you’ll find here at IBUSA!