In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Sclerosing Cholangitis.

Questions that will be directly addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Sclerosing Cholangitis?

- Why do life insurance companies care if I have been diagnosed with Sclerosing Cholangitis?

- What kind of information will the insurance companies ask me or be interested in?

- What options might be available to me?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance if I have been diagnosed with Sclerosing Cholangitis?

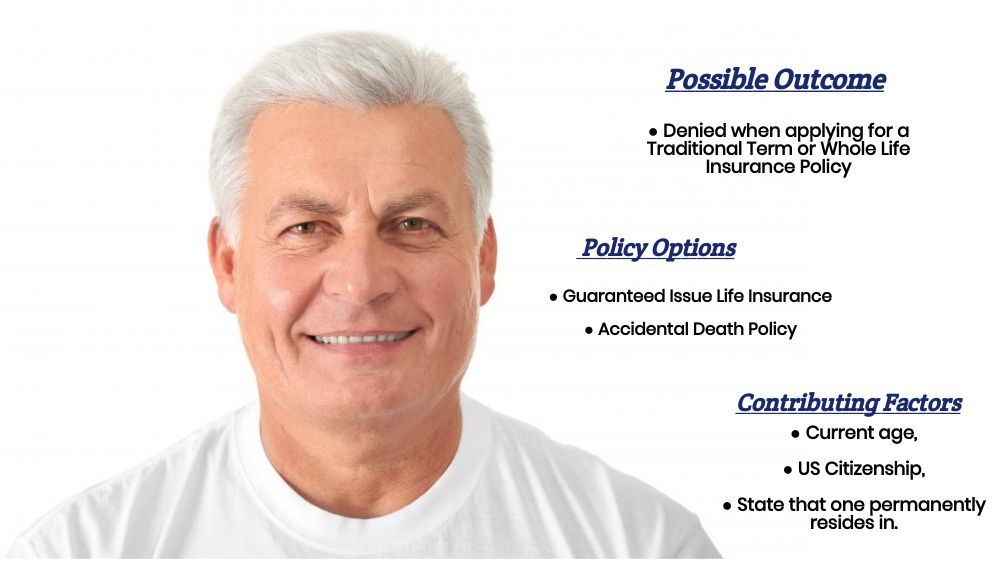

Unfortunately, when it comes to those who have been diagnosed with Sclerosing Cholangitis, what you’re generally going to find is that most (if not all) top life insurance companies are going to “automatically” decline anyone applying for a traditional term or whole life insurance policy. This means that if you have been diagnosed with Sclerosing Cholangitis and you still want to purchase a life insurance policy, chances are you’re going to need to consider purchasing an “alternative” product that won’t require one to meet certain “health” requirements in order to be able to qualify for coverage.

Why do life insurance companies care if I have been diagnosed with Sclerosing Cholangitis?

The main reason why a life insurance company is going to “care” if you have been diagnosed with Sclerosing Cholangitis is a serious disease that can cause some pretty significant complications, particularly if left untreated or improperly treated. This is why we want to take a moment and just briefly describe what Sclerosing Cholangitis is, as well as highlight some of the most common symptoms/complications so that we can gain a better idea of just exactly why most (if not all) life insurance companies are going to immediately deny anyone applying for a “traditional” life insurance policy.

Sclerosing Cholangitis Defined:

Sclerosing Cholangitis is a chronic and progressive disease of the liver and gallbladder that is characterized by the inflammation (and ultimate scaring) of the bile ducts that allow bile to drain from the gallbladder to the pancreas and small intestine.

Technically…

There are two “types” of Sclerosing Cholangitis: a Primary type, which medical researchers are still uncertain about how or why it occurs, and a Secondary type, which can be caused by a variety of different reasons, including:

- Intraductal stone disease,

- Surgical or physical trauma to one’s abdomen,

- Chemotherapy,

- Exposure to bacterial cholangitis,

- And/or recurrent pancreatitis.

Regardless of…

What “type” of Sclerosing Cholangitis may one be diagnosed with? The symptoms of this disease will pretty much be the same, which is why most (if not all) life insurance companies aren’t going to make a distinction between the two.

Symptoms may include:

- Pain in the upper right abdomen,

- Fever,

- Jaundice,

- Unexplained weight loss,

Serious complications may include:

- Enlarged liver or spleen,

- Liver disease and/or failure,

- Increased risk of infections,

- Portal hypertension,

- Weak bones,

- Bile duct cancer,

- Colon cancer,

- Etc…

Unfortunately…

There is no cure for Sclerosing Cholangitis. However, with proper care management, it is possible to improve some of the symptoms commonly associated with Sclerosing Cholangitis and slow the progression of this disease.

“Which brings us to an important point that we think we ought to mention.”

First…

If you think you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being your own doctor could really harm you!

Second…

Nobody here at IBUSA is medically trained, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance that they’re looking for. So please don’t mistake any of the medical information that we talk about as medical advice because it’s not!

We’re just trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Sclerosing Cholangitis… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

What you’ll generally find is that once a life insurance company determines that you’ve been diagnosed with Sclerosing Cholangitis, there isn’t a whole lot more they need to know before denying your life insurance application. After all, if you have been diagnosed with this condition, it’s really not going to matter all that much “why” you developed this condition.

This is mainly because most life insurance agencies will usually be “geared” towards helping those who can qualify for a traditional term life insurance policy and won’t spend too much time focusing on smaller “alternative” products.

The good news is…

Here at IBUSA, we spend an incredible amount of time creating relationships with dozens of different life insurance companies so that we can minimize the number of times we have to apologize to a client that we don’t have any options that they will be able to qualify for. This is why other agencies may inform you that you can’t qualify for a life insurance policy because of your Pulmonary Hypertension diagnosis.

Here at IBUSA, however, we prefer to ask you three simple questions that could determine whether or not you might just be able to qualify for a Guaranteed Issue Life insurance policy.

Those three questions are:

#1. Are you a US Citizen?

#2. Are you between the ages of 40 and 85?

#3. What state do you live in?

What options might be available to me?

Now, at this point, it’s important not to get too excited because while it is true that some folks may be able to qualify for a Guaranteed Issue Life Insurance policy or maybe even an Accidental Death Policy, it’s important to understand that just because you “can” qualify may not mean that you’ll “want” to qualify.

The reason for this…

This is because while these “types” of products may meet the needs of some, they are going to have some pretty serious disadvantages that may be a “deal-breaker” for some. This is why, after reading what we’re about to discuss, we would invite you to then give us a call or visit one of our other articles that will go into greater detail about these “alternative products” so that you’ll know what you are “getting” should you decide to ultimately purchase one of these “types” of products.

Accidental Death and Guaranteed Issue Life Insurance Policies Defined

Accidental Death Policies

Here at IBUSA, we tend to think that when explained properly, Accidental Death Policies tend to be a bit easier to understand than Guaranteed Issue Life Insurance Policies, which is why we want to begin by discussing what an Accidental Death Policy is.

The problem is…

Often, these “types” of products aren’t fully explained or, more commonly, aren’t explained in a way that specifically points out what these policies won’t provide coverage for. This is why we here at IBUSA want to begin our discussion of an Accidental Death Policy by specifically stating that these “types” of policies are NOT TRUE LIFE INSURANCE POLICIES.

This is why you don’t actually need to be a licensed life insurance agent to sell them and why they aren’t going to provide you with any coverage if you die of a “natural” cause of death.

Now, at this point…

You may be asking yourself…

“What do you mean by NATURAL CAUSE of death?”

When we use the term “natural cause of death,” we’re referring to an “illness-based” death like you would experience as a result of:

- Heart disease,

- Cancer,

- Stroke,

Or from some complications that one might experience as a result of suffering from Sclerosing Cholangitis.

These types of products…

Are only going to provide a death benefit to your family if you die from an accidental cause or any cause of death that isn’t “illness based”. Examples that would typically qualify as an Accidental Cause of death would typically include:

- A motor vehicle accident,

- A slip-and-fall accident

- A natural disaster,

- Victim of crime,

- Etc…

Which is nice…

But typically, this isn’t what someone is looking for after they have been diagnosed with Portal Hypertension. On the plus side, these “types” of products are generally pretty affordable. They will allow someone to purchase a large amount of ACCIDENT insurance for a relatively small amount of money. This brings us to our next possible option, which is a…

Guaranteed Issue Life Insurance

A Guaranteed Issue Life Insurance policy, on the other hand, is A TRUE LIFE INSURANCE PRODUCT. This means that you do need to be a licensed life insurance agent to sell them, and “ultimately”, they will provide individuals with true-life insurance coverage. Now we say “ultimately” because when you purchase a Guaranteed Issue Life Insurance Policy, you’re purchasing a life insurance policy that has a “catch” to it.

And…

In our experience here at IBUSA, we’ve found that the best way to discuss these types of life insurance policies is by analyzing the three major disadvantages that these “types” of life insurance policies have aside from the fact that you generally have to be over the age of 50 and live in a state where these “types” of life insurance policies are available.

So, let’s dive right in…

Problem #1.

Guaranteed-issue life insurance policies are only going to provide a limited amount of life insurance coverage and will usually “cap out” right around 25,000 dollars in coverage. This means that if you’re looking to purchase more than 25,000 dollars in coverage, a guaranteed issue life insurance policy might not be right for you!

(Yes, individuals can purchase several different guaranteed issue life insurance policies from several different companies, but as we will now discuss, this can get really expensive).

Problem #2.

Dollar-for-dollar, guaranteed-issue life insurance policies aren’t always the most affordable when compared to other “types” of life insurance policies out there. Now we don’t want to imply that these “types” of life insurance policies are going to cost a fortune, it’s just that if you can qualify for another “kind” of life insurance policy, that coverage will usually cost less dollar for dollar than a guaranteed issue life insurance policy will.

Problem #3.

Guaranteed issue life insurance policies contain a clause most commonly referred to as a Graded Death Benefit.

Graded Death Benefit Defined:

Graded Death Benefits are “clauses” written into most (if not all) guaranteed issue life insurance policies, which state that a guaranteed issue life insurance policy won’t begin to cover an individual from “natural causes” of death until a certain waiting period has elapsed. This “waiting period” will usually last 2 to 3 years and is designed to make sure that someone who knows that they are very close to death is able to purchase these “types” of life insurance policies.

And while…

This may seem extremely unfair; it’s important to remember that a guaranteed issue life insurance policy isn’t going to require you to take a medical exam or answer any health-related questions. So, at the end of the day, a graded death benefit really is the only thing that allows the insurance company to be able to offer one of these “types” of life insurance policies.

The good news is…

While you may have to wait for 2 to 3 years for a guaranteed-issued life Insurance policy to provide you true life insurance protection, these “types” of life insurance policies will provide immediate coverage for any “accidental causes” of death. They may also provide some “return of premium” to the beneficiaries of those insured who do end up dying from natural causes before their Graded Death Benefit expires. It’s like buying a small Accidental Death Policy that will ultimately “turn into” a true-life insurance policy after a period of time.

So, have we confused you yet?

If so, don’t fret. The purpose of this article wasn’t to try to make you an insurance expert; it was just to give you an idea of what questions you’ll want to pursue prior to making any decisions. This brings us to the last topic that we wanted to discuss here in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You should be completely honest with your life insurance agent before applying for coverage. By doing so, you will help him or her narrow down what options might be the “best. ”

So, what are you waiting for? Give us a call today and see what we can do for you!