In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with Peyronie’s Disease.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Peyronie’s Disease?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Peyronie’s Disease?

Yes, individuals who have been diagnosed with Peyronie’s Disease can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for some of the best no medical exam life insurance companies at a Preferred rate!

The reason for this…

Is because, Peyronie’s Disease isn’t a pre-existing medical condition that is likely to be discussed during a typical life insurance application.

That said, however…

Most “traditional” life insurance applications will have one question which asks:

“Do you have any surgical procedures or medical treatments planned in the near future?”

And here is where an applicant may need to disclose that they have been diagnosed with Peyronie’s Disease because they may be about to have this condition treated surgically.

This is why…

We wanted to take a moment and just briefly describe what Peyronie’s Disease is as well as highlight some of the most common symptoms of this Disease is so that if it is ever discussed during a typical life insurance application, we’ll have a better idea of what a life insurance underwriter will be looking for with regards to this condition.

Peyronie’s Disease Defined:

Peyronie’s Disease is a term used to describe a medical condition whereby an male’s erection becomes “curved” as a result of repeated physical injury typically during sex or other physical activity. As a result of this “injury,” the penis begins to develop fibrous scar tissue inside the penis, which causes the curvature to occur.

Common symptoms may include:

- Fibrous scar tissue that can be felt under the skin of the penis,

- A significant bend of the penis,

- Erectile difficulties,

- A shortening of the penis,

- Painful erections.

Complications that can occur may include:

- Erectile dysfunction,

- Inability to perform sexually,

- Anxiety,

- Stress.

Fortunately, Peyronie’s Disease does have several treatment options, which can minimize many of the harmful effects of this Disease.

Now at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like this one, find and qualify for the life insurance coverage that they are looking for.

But…

Not so great if you’re looking for answers to any specific medical questions. In cases like these, we would recommend that you contact a true medical professional who has the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Now, as we stated in the beginning, it’s not very often that we’ll learn that a client suffers from this condition mainly because unless you’re planning on having your Peyronie’s Disease surgically treated soon, there really isn’t much of a need for us to know about it.

This is why…

Instead of focusing on what questions you’re probably not going to be asked about your Peyronie’s Disease, we figured we’d just take a moment and list some of the questions you’re probably going to be asked when applying for a traditional term or whole life insurance policy.

Questions such as:

- How old are you?

- What are your current height and weight?

- Have you been diagnosed with any pre-existing medical conditions such as cancer, heart disease, diabetes or depression?

- Have you ever suffered from a stroke or heart attack?

- Are you currently taking any prescription medications?

- Do you have any surgical procedures planned, or has your primary care physician suggested you may need to have a surgical procedure performed in the near future?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with cancer, heart disease or diabetes?

- Have any of your immediate family members ever suffer from a heart attack or stroke?

- In the past 12 months, have you used any tobacco or nicotine products?

- In the past two years, have you been hospitalized for any reason?

- Do you have any issues with your drivers’ license? Issues such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have any set plans to travel outside of the United States within the next year?

- Do you actively participate or plan on participating in any dangerous hobbies?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see, there are a wide variety of factors that can come into play when trying to determine what kind of “rate” that an individual can qualify for. For this reason, it’s almost impossible to know for sure what kind of “rate” an individual might qualify for without first speaking with them.

That said, however…

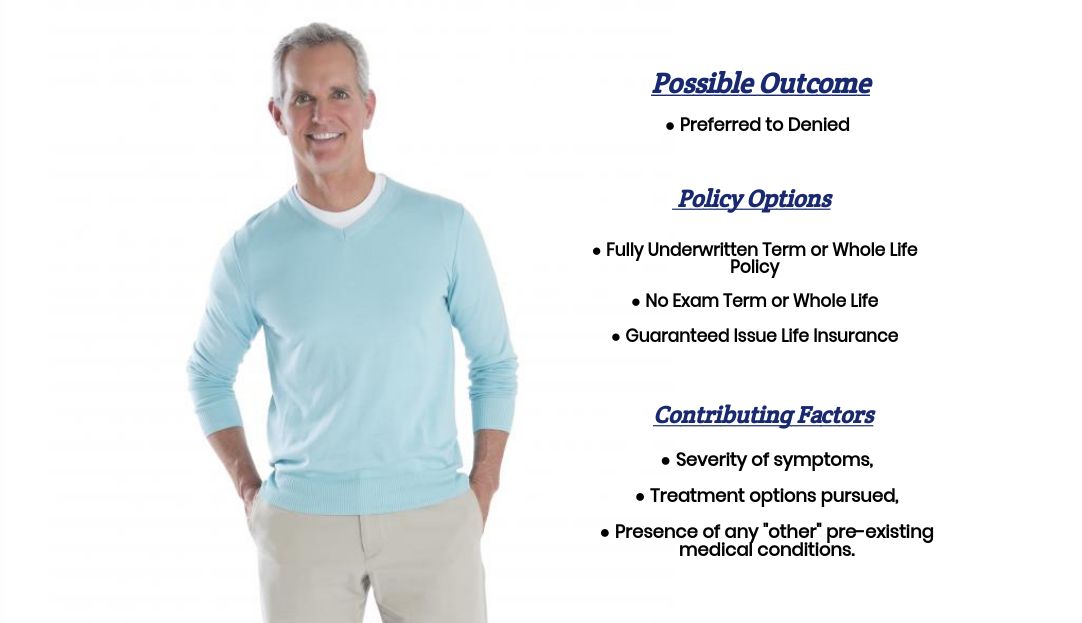

It’s fair to say that if you have been diagnosed with Peyronie’s Disease, chances are this diagnosis isn’t going to play a role in the outcome of your life insurance application. This means that whatever “rate” that you may have been able to qualify for PRIOR to being diagnosed with Peyronie’s Disease should be the same “rate” that you would be able to qualify for AFTER being diagnosed with Peyronie’s Disease.

“Which is great!”

And segues very nicely into the next topic, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”.

So, what are you waiting for? Give us a call today and see what we can do for you!