In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Myositis.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Myositis?

- Why do life insurance companies care if I have been diagnosed with Myositis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Myositis?

Yes, individuals who have been diagnosed with Myositis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for some of the best no-medical exam life insurance companies at a Preferred rate!

The problem is…

IIn some cases, a life insurance company may consider Myositis more of a “symptom” of some other pre-existing medical condition rather than the “real” concern during the underwriting process. In situations like these, you’ll likely find that your Myositis diagnosis will largely be ignored. At the same time, more time will be spent on understanding what is causing you to suffer from this condition.

Why do life insurance companies care if I have been diagnosed with Myositis?

In general, we here at IBUSA have found that most life insurance companies aren’t going to be all that worried about an individual diagnosed with Myositis provided that it isn’t caused by some “kind” of a serious pre-existing medical condition. This is why we wanted to take a moment to determine what Myositis is and highlight the most common symptoms and causes of this disease to get a better idea of when this condition will and won’t play a significant role in one’s life insurance application.

Myositis Defined:

Myositis is when the muscles you use to move your body become inflamed. Typically, this condition will be broken down further into one of two types: Polymyositis and Dermatomyositis. Polymyositis and Dermatomyositis will cause a patient to suffer from muscle weakness; only Dermatomyositis will include additional skin rashes.

Common symptoms of Myositis may include:

- Difficulty rising or climbing upstairs,

- Fatigue,

- Difficult swallowing and sometimes breathing,

- Unexplained sore muscles,

- Elevated CPK and Aldolase enzyme levels

Now…

Before anyone gets upset or begins to complain about the simplicity of the definitions we’re using here, it’s essential to understand that we here at IBUSA aren’t medical experts or doctors. We are a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

Which means that…

Because we won’t be the ones “diagnosing” your condition and certainly won’t be involved in treating it, all we need to do is understand that there are differences between these different pre-existing medical conditions and how those differences affect how a life insurance underwriter will consider you a potential “risk. ” The good news is that despite how simple our definitions of these diseases may be, we have this down pat!

Which is why…

When we are approached by an individual diagnosed with any of these “kinds” of conditions, we’ll know right away what questions a life insurance underwriter will want to know the answers to before making any decision about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Myositis?

- Who diagnosed your Myositis? A general practitioner? A specialist? Yourself?

- What symptoms led to your diagnosis?

- Did your Myositis also have a skin rash component (Dermatomyositis)?

- Do you know what caused your Myositis?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any disability benefits?

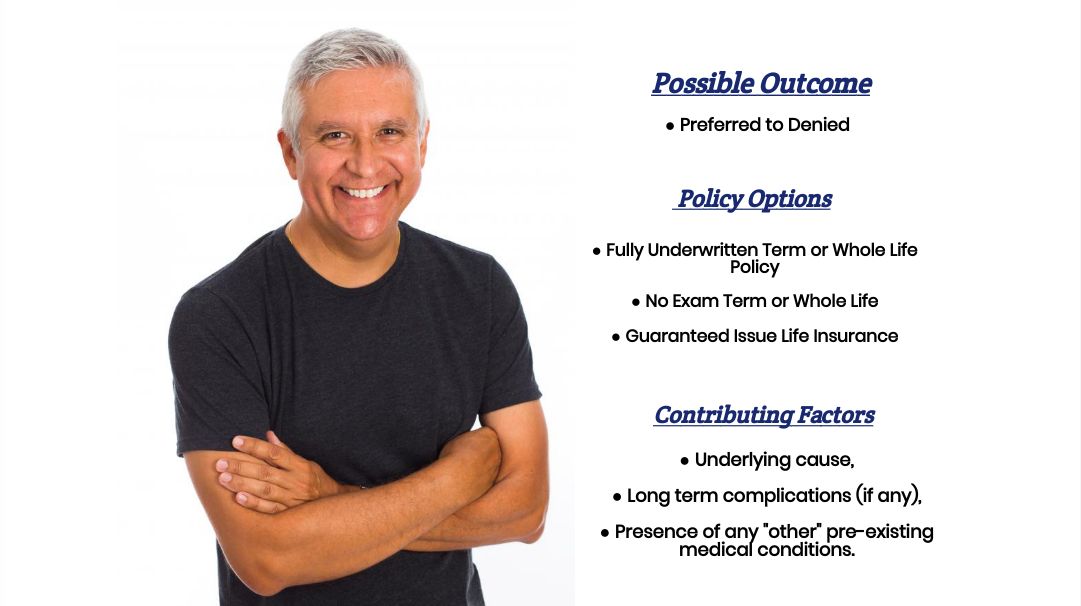

What rate (or price) can I qualify for?

Generally, what we here at IBUSA have found is that most individuals diagnosed with Myositis are going to fall into one of three categories when it comes to determining what kind of “rate” they might be able to qualify for.

Category #1.

The first category will be those who are currently treating their Myositis. In cases like these, their application will likely be “postponed” until they are “cured,” at which point they would be classified into one of the following categories.

Category #2.

Individuals in this category will have recovered from their previous Myositis infection; however, some other pre-existing medical condition or “lifestyle” choice (illicit drug use, excessive alcohol use) will likely become the primary factor in determining what “rate” they will be able to qualify for.

In cases like these…

The Myositis diagnosis is more of a “symptom” of some other condition rather than the main concern for a life insurance underwriter (see Pre-existing Medical Conditions for more information about what is causing you to suffer from Myositis).

Category #3.

The last category of folks who have been diagnosed with Myositis will consist of those who have recovered from their Myositis and don’t seem to be suffering from any pre-existing condition (or lifestyle choice) that would cause them to be at an increased risk of developing Myositis again. In cases like these, you’re generally going to find that whatever rate an individual might have been able to qualify for before being diagnosed with Myositis should be the same “rate” that they would allow for AFTER having been diagnosed with Myositis.

“Which is great!”

This segues nicely into the last topic that we wanted to take a moment to discuss with you today, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you. Such an agent that can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Now, can we help out everyone previously diagnosed with Myositis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, call us!

I’ve recently been diagnosed with dermatomyositis, but it’s very mild. I have little muscle weakness and little skin involvement at this point. I’m getting treated for it and there is no underlying cause for the dermatomyositis that I have. I have no other chronic illnesses or serious diagnosis. I need to get term life insurance and want to get the best rate I can. I’m 42 years old and I’m half dead, so can’t speak well over the phone. I need communication to be via email or text message. Thank you.

Candy,

We’ll have an agent reach out to you via email so that we can determine what opportunities may be available to you.

Thanks,

InsuranceBrokersUSA