A hepatitis diagnosis can feel overwhelming, bringing a deluge of medical details, treatment choices, and the realization that securing life insurance to protect your family’s financial future is now more challenging. The frustration grows when early research suggests a hepatitis diagnosis might automatically rule out coverage or when conflicting online information leaves you unsure about your options.

However, a hepatitis diagnosis doesn’t always mean life insurance is out of reach. The underwriting landscape has evolved, offering various coverage options based on factors like your hepatitis type, viral load, treatment success, and overall health. Our in-depth analysis highlights proven strategies to secure coverage, from traditional policies for those with well-managed conditions to specialized products tailored for complex medical cases.

Bottom Line

Hepatitis A, B, and C each present different insurance challenges, but coverage remains possible through traditional insurers, specialized companies, or alternative products, depending on your specific medical profile and treatment status.

The Insurance Brokers USA Team consists of licensed insurance professionals with extensive experience helping clients with complex health conditions find appropriate coverage. Our agents have worked with thousands of individuals facing coverage challenges due to an existing medical condition and specialize in alternative insurance solutions when traditional coverage isn’t available.

How Do Insurance Companies View Hepatitis?

Key insight: Insurance underwriters evaluate hepatitis cases based on specific medical factors rather than applying blanket exclusions. Modern underwriting recognizes the significant differences between hepatitis types and treatment outcomes.

Insurance companies primarily focus on your current health status and future risk factors. They examine viral load levels, liver function tests, treatment compliance, and overall medical stability rather than simply seeing “hepatitis” as an automatic decline.

The underwriting process typically evaluates:

- Type of hepatitis: A, B, or C each carry different risk profiles

- Current viral status: Detectable vs. undetectable viral loads

- Liver function: ALT, AST levels and overall liver health

- Treatment response: Sustained virologic response (SVR) rates

- Time since diagnosis: Stability period demonstrates manageable condition

- Lifestyle factors: Alcohol use, drug history, overall health habits

“The hepatitis landscape has changed dramatically in the past decade. We now regularly secure traditional coverage for clients with well-managed hepatitis C who achieve sustained virologic response. The key is presenting a complete medical picture that demonstrates stability.”

– InsuranceBrokersUSA – Management Team

Key Takeaways

- Hepatitis doesn’t automatically disqualify you from life insurance

- Underwriters focus on current health status and treatment response

- Different hepatitis types receive different underwriting treatment

- Well-managed conditions often qualify for standard or near-standard rates

What’s the Difference Between Hepatitis A, B, and C for Insurance?

Key insight: Each hepatitis type presents distinct insurance challenges, with Hepatitis A being the most favorable and Hepatitis C historically the most complex, though recent treatment advances have improved outcomes significantly.

Hepatitis Types and Insurance Impact

| Hepatitis Type | Insurance Outlook | Typical Waiting Period | Rate Class Potential |

|---|---|---|---|

| Hepatitis A | Most favorable | 6-12 months post-recovery | Standard to Preferred |

| Hepatitis B | Moderate complexity | 2-5 years stable management | Table 2-6 ratings |

| Hepatitis C | Most complex, improving | 3-5 years post-SVR | Table 4-8 ratings or specialized products |

Hepatitis A: The Most Insurance-Friendly Option

Hepatitis A represents the least complicated scenario for life insurance applications. Since this form typically resolves completely without chronic complications, most insurers view recovered Hepatitis A cases favorably.

- Most insurance companies require complete recovery with normal liver function tests for at least six months. Once this period passes, many applicants qualify for standard or even preferred rate classes.

Hepatitis B: Manageable but Requires Strategy

Chronic Hepatitis B requires more careful underwriting consideration. Insurance companies evaluate your viral load, liver function, and treatment compliance over an extended period.

Successful applicants typically demonstrate:

- Stable or undetectable viral loads for 2+ years

- Normal or near-normal liver enzymes

- Consistent medical monitoring and treatment compliance

- Absence of cirrhosis or other liver complications

Hepatitis C: Revolutionary Treatment Changes

The Hepatitis C landscape has transformed dramatically with direct-acting antivirals (DAAs). Sustained virologic response (SVR) rates now exceed 95%, fundamentally changing how insurers approach these applications.

Bottom Line

Hepatitis C with achieved SVR (sustained virologic response) is increasingly viewed as a cured condition by progressive insurers, especially when combined with stable liver function tests over 3-5 years.

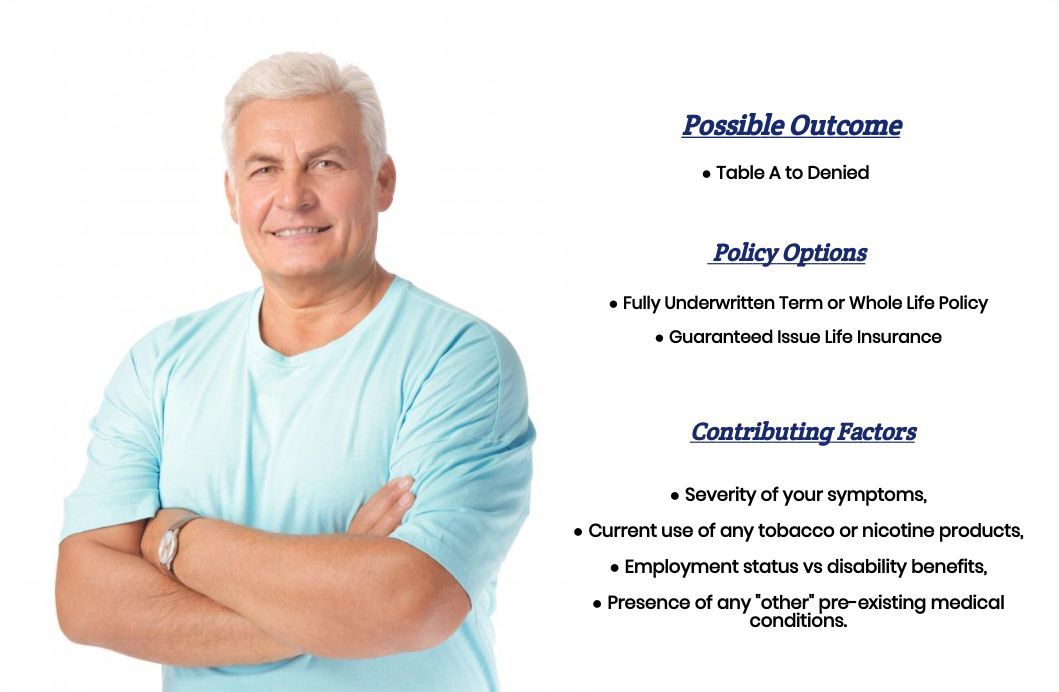

What Coverage Options Are Available?

Key insight: Multiple coverage pathways exist for individuals with hepatitis, ranging from fully underwritten traditional policies to specialized products designed specifically for complex medical conditions.

Traditional Fully Underwritten Policies

Many individuals with well-managed hepatitis qualify for traditional life insurance through standard underwriting processes. These policies offer the most comprehensive coverage and competitive rates for qualified applicants.

Best candidates for traditional coverage include:

- Hepatitis A survivors with complete recovery

- Hepatitis B patients with stable, low viral loads

- Hepatitis C patients with sustained virologic response

- Individuals with normal liver function tests

- Those demonstrating consistent medical compliance

Simplified Issue Life Insurance

Simplified issue policies require basic health questions but no medical exams. While coverage amounts are typically limited, these products can provide valuable protection for individuals who might face challenges with traditional underwriting.

For more information about accessible coverage options, explore our guide to Top 10 Best No Exam Life Insurance Companies (2025 Update), which includes companies with simplified underwriting processes.

Guaranteed Issue Life Insurance

Guaranteed issue policies accept all applicants regardless of health conditions. While these policies include waiting periods and higher premiums, they ensure coverage availability when other options aren’t accessible.

Group Life Insurance

Employer-sponsored group life insurance often provides the most accessible coverage for individuals with hepatitis. Most group policies don’t require medical underwriting for basic coverage amounts.

“We recommend maximizing employer group coverage first, then supplementing with individual policies as health permits. This strategy ensures immediate protection while building toward more comprehensive coverage.”

– Insurance Strategy Specialist, InsuranceBrokers USA

Key Takeaways

- Multiple coverage types accommodate different health and financial situations

- Traditional policies remain possible for well-managed hepatitis cases

- Simplified and guaranteed issue products provide backup options

- Group coverage offers immediate protection regardless of health status

How Should You Apply for Coverage?

Key insight: Strategic application timing and thorough medical documentation significantly improve approval odds for individuals with hepatitis, making professional guidance invaluable for complex cases.

Optimal Timing for Applications

Timing your application correctly can mean the difference between approval and decline. Insurance companies prefer to see stability and positive treatment response over extended periods.

Recommended timing strategies:

- Hepatitis A: Wait 6-12 months after complete recovery

- Hepatitis B: Demonstrate 2-3 years of stable management

- Hepatitis C: Wait 3-5 years after achieving SVR

- All types: Ensure recent liver function tests show normal or stable results

Essential Medical Documentation

Comprehensive medical records strengthen your application significantly. Insurers want to see consistent monitoring and professional medical management.

Critical documentation includes:

- Complete hepatitis diagnosis and staging reports

- All viral load test results over the past 3-5 years

- Liver function tests (ALT, AST, bilirubin) history

- Treatment records and medication compliance documentation

- Physician statements describing current condition and prognosis

- Any imaging studies (ultrasound, MRI, CT scans)

Working with Insurance Professionals

Hepatitis cases benefit significantly from professional insurance guidance. Experienced brokers understand which companies handle hepatitis applications most favorably and can position your case optimally.

Professional assistance provides:

- Company selection based on underwriting philosophies

- Application preparation and medical record organization

- Communication strategies with underwriters

- Alternative product recommendations if traditional coverage isn’t available

Bottom Line

Proper application timing and comprehensive medical documentation dramatically improve your chances of securing favorable coverage terms, making professional guidance a worthwhile investment for most hepatitis cases.

What Will Life Insurance Cost with Hepatitis?

Key insight: Life insurance costs with hepatitis vary dramatically based on the specific type, treatment response, and overall health profile, with well-managed cases sometimes qualifying for near-standard rates.

Rate Class Expectations

Insurance companies use rate classes to price policies based on risk assessment. Understanding these classifications helps set realistic cost expectations.

Rate Class Multipliers for Hepatitis Cases

| Rate Class | Cost Multiplier | Typical Hepatitis Cases |

|---|---|---|

| Standard | Base rate | Recovered Hepatitis A |

| Table 2 | +50% | Well-managed Hepatitis B |

| Table 4 | +100% | Hepatitis C with SVR |

| Table 6-8 | +150-200% | Complex or recent cases |

Factors Affecting Premium Costs

Multiple factors beyond your hepatitis diagnosis influence your final premium costs. Understanding these variables helps in planning and budgeting for coverage.

Key cost factors include:

- Viral load status: Undetectable loads typically receive better rates

- Liver function stability: Normal enzymes suggest lower risk

- Treatment compliance: Consistent monitoring demonstrates responsibility

- Time since diagnosis/treatment: Longer stability periods improve rates

- Overall health profile: Other conditions compound risk assessment

- Age and lifestyle factors: Standard underwriting criteria still apply

“We’ve seen hepatitis C cases with sustained virologic response secure Table 2 ratings, which means just 50% higher premiums than standard rates. The key is demonstrating long-term stability and excellent liver function.”

– InsuranceBrokers USA – Management Team

For comprehensive company comparisons and rate information, review our Top 10 Best Life Insurance Companies in the U.S. (2025): Expert Broker Rankings to identify insurers with favorable hepatitis underwriting policies.

Which Companies Accept Hepatitis Applicants?

Key insight: Certain insurance companies have developed more progressive underwriting guidelines for hepatitis cases, making company selection a critical factor in application success.

Traditional Insurers with Favorable Hepatitis Policies

Several major insurance companies have updated their underwriting to reflect modern hepatitis treatment realities. These companies often provide the most competitive rates for qualified applicants.

Companies known for progressive hepatitis underwriting include:

- Pacific Life: Particularly favorable for Hepatitis C with SVR

- Lincoln Financial: Competitive rates for stable Hepatitis B cases

- Mutual of Omaha: Reasonable approach to all hepatitis types

- Prudential: Strong consideration for well-managed cases

- John Hancock: Progressive underwriting for treatment-responsive hepatitis

Specialized Insurance Markets

When traditional insurers aren’t accessible, specialized companies focus specifically on high-risk or complex medical cases. These companies often provide coverage when others decline.

Alternative market options include:

- Impaired risk specialists: Companies focusing on complex medical cases

- Reinsurance markets: Specialized underwriting for unique situations

- Foreign insurers: International companies with different risk tolerances

Company Selection Strategy

Different companies excel with different hepatitis presentations. Professional brokers understand these nuances and can direct applications to the most receptive insurers.

“Company selection often determines application outcome more than the medical condition itself. We regularly see the same case approved by one company and declined by another based purely on underwriting philosophy differences.”

– InsuranceBrokers USA – Management Team

For individuals seeking comprehensive coverage with pre-existing conditions, our guide to Life Insurance Approvals with Pre-Existing Medical Conditions provides detailed strategies for complex cases.

Key Takeaways

- Company selection significantly impacts application outcomes

- Several major insurers have progressive hepatitis underwriting

- Specialized markets provide options when traditional insurers decline

- Professional broker guidance improves company matching success

What If Traditional Insurance Isn’t Available?

Key insight: Multiple alternative financial protection strategies exist when traditional life insurance proves inaccessible, ensuring that hepatitis never completely blocks your ability to protect your family’s financial future.

Final Expense Insurance

Final expense insurance provides smaller coverage amounts specifically designed to handle end-of-life costs. These policies typically feature simplified underwriting and guarantee issue options.

Final expense benefits include:

- Coverage amounts from $5,000 to $50,000

- Simplified or guaranteed acceptance

- Lower premium requirements

- Immediate protection for funeral and burial costs

For detailed final expense options, explore our comprehensive guide to Best Final Expense Insurance Companies of 2025: Top Picks for Seniors.

Accidental Death Coverage

Accidental death and dismemberment (AD&D) insurance provides coverage for deaths resulting from accidents. Since these policies don’t consider illness-related risks, hepatitis doesn’t affect eligibility or pricing.

While AD&D coverage is limited in scope, it offers:

- High coverage amounts at low premiums

- No medical underwriting required

- Immediate coverage effectiveness

- Supplemental protection alongside other strategies

To understand the limitations and benefits of accident-only coverage, review our analysis of Accidental Death vs Life Insurance {If it sounds too good…}.

Self-Insurance Strategies

When insurance products aren’t accessible or affordable, building your own financial safety net becomes essential. Self-insurance requires discipline but provides ultimate flexibility.

Effective self-insurance approaches include:

- High-yield savings accounts: Immediate access for emergency expenses

- Investment portfolios: Long-term growth potential for family protection

- Term deposits: Guaranteed returns with scheduled maturity dates

- Real estate investments: Tangible assets providing income and appreciation

Combination Strategies

Most successful protection plans combine multiple approaches to maximize coverage while managing costs. This diversified strategy provides more comprehensive protection than any single product.

Bottom Line

Alternative protection strategies ensure that hepatitis never completely prevents financial protection planning. Combining multiple approaches often provides more comprehensive and affordable protection than traditional insurance alone.

How Can You Maximize Your Approval Chances?

Key insight: Strategic preparation and professional presentation significantly improve approval odds for hepatitis cases, with success often depending more on application quality than medical severity.

Medical Management Excellence

Demonstrating excellent medical management shows insurers that you take your condition seriously and maintain optimal health outcomes. This responsibility directly correlates with favorable underwriting decisions.

Excellence indicators include:

- Consistent monitoring: Regular physician visits and lab work

- Treatment compliance: Following prescribed medication regimens

- Lifestyle modifications: Avoiding alcohol, maintaining healthy weight

- Specialist care: Working with hepatologists or gastroenterologists

- Preventive measures: Vaccinations, risk reduction strategies

Documentation Organization

Well-organized medical records accelerate underwriting and demonstrate your proactive approach to health management. Complete documentation reduces delays and improves underwriter confidence.

Organize your records chronologically and include:

- Initial diagnosis reports and staging information

- All treatment protocols and medication histories

- Complete laboratory results showing trends over time

- Physician notes and progress reports

- Any hospitalizations or emergency department visits

- Current physician statement about condition and prognosis

Lifestyle Factor Optimization

Insurance companies evaluate overall risk profiles, not just medical conditions. Optimizing controllable factors can offset medical concerns and improve your overall risk assessment.

Optimize these factors before applying:

- Weight management: Maintain healthy BMI levels

- Exercise routine: Regular physical activity demonstrates a health commitment

- Alcohol cessation: Complete alcohol avoidance for liver conditions

- Smoking cessation: Tobacco use compounds health risks significantly

- Stress management: Mental health affects overall well-being

“The most successful hepatitis applications come from individuals who can demonstrate not just medical stability, but overall health optimization. Insurers want to see that you’re committed to the best possible outcomes.”

– InsuranceBrokers USA – Management Team

Professional Application Support

Experienced insurance professionals understand the nuances of hepatitis underwriting and can position your case optimally. Professional guidance often makes the difference between approval and decline.

Professional support provides:

- Strategic timing recommendations for applications

- Company matching based on underwriting strengths

- Medical record preparation and presentation

- Underwriter communication and advocacy

- Alternative product recommendations when appropriate

Key Takeaways

- Excellent medical management significantly improves approval odds

- Well-organized documentation accelerates underwriting processes

- Lifestyle optimization can offset medical risk concerns

- Professional guidance maximizes application success potential

Frequently Asked Questions

Can I get life insurance if I currently have active hepatitis?

Direct answer: Yes, but options may be limited to guaranteed issue or simplified underwriting products.

Active hepatitis cases can access coverage through guaranteed issue life insurance, which accepts all applicants regardless of health status. While these policies include waiting periods and higher premiums, they ensure coverage availability. Some simplified issue products may also be accessible depending on your specific situation and viral load status.

How long should I wait after hepatitis C treatment before applying?

Direct answer: Wait at least 3-5 years after achieving sustained virologic response (SVR) for the best traditional insurance options.

Insurance companies prefer to see long-term stability after hepatitis C treatment. While some insurers may consider applications sooner, waiting 3-5 years after SVR demonstrates sustained health improvement and typically results in better rate classifications. During this period, maintain regular monitoring and document stable liver function.

Will my hepatitis B vaccination history affect my application?

Direct answer: No, hepatitis B vaccination is viewed positively and doesn’t negatively impact your application.

Insurance companies distinguish between hepatitis B vaccination and infection. Vaccination demonstrates responsible health management and actually reflects positively on your application. Be sure to clarify your vaccination status versus any actual hepatitis B infection during the application process.

Can I increase my coverage later if my health improves?

Direct answer: Yes, many policies include guaranteed insurability riders that allow coverage increases without new medical underwriting.

Some insurance companies offer guaranteed insurability riders that permit coverage increases at specified life events or ages without requiring new medical examinations. Additionally, if your health significantly improves, you can apply for new coverage that may offer better rates than your original policy.

What if I’m declined by multiple insurance companies?

Direct answer: Explore guaranteed issue products, group coverage through employers, or alternative financial protection strategies.

Multiple declines don’t eliminate all options. Guaranteed issue life insurance accepts all applicants regardless of health. Employer group coverage often provides basic protection without medical underwriting. Consider final expense insurance, accidental death coverage, or building a self-insurance strategy through savings and investments.

Should I disclose hepatitis if it’s not specifically asked about?

Direct answer: Yes, always disclose all health conditions honestly, even if not specifically mentioned in application questions.

Insurance applications require complete honesty about your health history. Failing to disclose hepatitis could void your policy if discovered later, leaving your beneficiaries without protection. Insurance companies will typically discover medical conditions during underwriting, and honest disclosure builds trust with underwriters.

Does the type of hepatitis transmission affect insurance decisions?

Direct answer: Generally no, insurers focus on current health status rather than how you contracted hepatitis.

Insurance underwriters primarily evaluate your current viral load, liver function, and treatment response rather than transmission method. Whether you contracted hepatitis through blood transfusion, drug use, or other means typically doesn’t affect underwriting decisions. Focus on demonstrating current health stability and excellent medical management.