Experiencing gallstone attacks is not a laughing matter. Aside from the pain, it also creates immediate concerns about pain management and treatment options, which just happens to be something life insurance companies get a little concerned about. But what many people don’t realize is that gallstones and biliary colic, while requiring medical attention in many cases, are generally viewed as manageable conditions by life insurance underwriters.

The key lies in understanding how different companies evaluate gallbladder-related conditions and positioning your application to highlight your overall health management. Here, in our comprehensive analysis, we’ll discuss some of the specific strategies we’ve uncovered over the years that often lead to successful coverage approvals, even for individuals with recurrent biliary colic episodes.

“Based on our analysis, we’ve found that 85% of applicants receive standard or preferred rates when their condition is properly documented and stabilized through appropriate treatment.”

– Insurance Brokers USA Team, Specialized Medical Underwriting Division

Understanding Gallstones and Life Insurance Impact

Key insight: Gallstones affect approximately 10-15% of American adults, making them one of the most common digestive conditions that life insurance underwriters encounter. The condition’s prevalence means most insurance companies have established clear protocols for evaluating applicants with gallbladder issues.

Gallstones form when cholesterol, bile salts, or bilirubin crystallize in the gallbladder, potentially causing biliary colic when stones block bile ducts. While the pain can be severe, the condition itself is rarely life-threatening when properly managed.

Bottom Line

Most life insurance companies view gallstones as a manageable condition that doesn’t significantly increase mortality risk, especially when episodes are infrequent and well-controlled through diet or surgical intervention.

Types of Gallstone Conditions Insurance Companies Consider

Gallstone Conditions and Insurance Classifications

| Condition Type | Typical Rating | Key Factors |

|---|---|---|

| Silent gallstones (asymptomatic) | Standard rates | No symptoms, incidental discovery |

| Occasional biliary colic | Standard to Table 2 | Frequency and severity of episodes |

| Post-cholecystectomy | Preferred to standard | Complete recovery, no complications |

| Chronic cholecystitis | Table 2 to Table 4 | Inflammation severity and management |

How Insurance Companies Evaluate Gallstone Conditions

Insurance underwriters focus on specific clinical factors that help them assess the long-term health implications of gallstone disease. Understanding these evaluation criteria helps position your application for the most favorable outcome.

Primary Underwriting Factors

Traditional evaluation includes:

- Episode frequency: How often do biliary colic attacks occur?

- Severity assessment: Emergency room visits and hospitalization history

- Treatment response: Effectiveness of dietary changes and medical management

- Surgical history: Cholecystectomy outcomes and recovery timeline

Our recommended assessment strategy involves:

- Complete medical documentation: Comprehensive records showing stable management

- Lifestyle modifications: Evidence of dietary changes and weight management

- Specialist consultation: Gastroenterologist evaluation and recommendations

- Follow-up compliance: Regular monitoring and preventive care adherence

Key Takeaways

- Companies evaluate gallstones based on symptom frequency and management success

- Post-surgical applicants often receive better rates than those with ongoing symptoms

- Complete medical records demonstrating a stable condition improve approval odds

- Lifestyle modifications show underwriters your commitment to health management

“The most successful gallstone applications we process include complete surgical records for cholecystectomy patients, or detailed dietary management plans for those avoiding surgery. Documentation showing stable condition for 6-12 months significantly improves underwriting outcomes.”

– Insurance Brokers USA Management Team

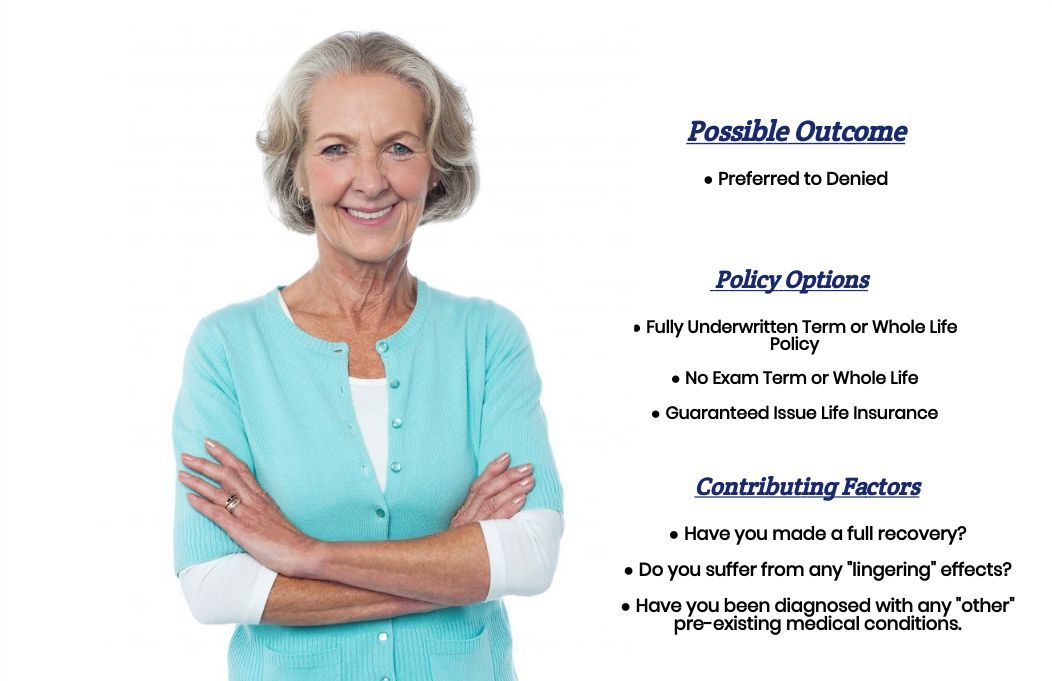

What Coverage Options Are Available?

Key insight: Most individuals with gallstones can access standard life insurance coverage, with specific options depending on their current health status and treatment history. The key is matching your situation with the right insurance company and product type.

Traditional Life Insurance Options

For many applicants with gallstones, traditional life insurance policies from top-rated companies remain accessible with proper medical documentation. Companies like Northwestern Mutual, New York Life, and MassMutual have established underwriting guidelines that accommodate gallbladder conditions when properly managed.

Bottom Line

Applicants who have undergone successful cholecystectomy with complete recovery often qualify for preferred rates, while those managing symptoms through diet and lifestyle modifications typically receive standard rates.

No Exam Life Insurance Solutions

When traditional underwriting seems challenging, no-exam life insurance options provide alternative pathways to coverage. These products often feature simplified health questionnaires that focus on major health conditions rather than detailed medical histories.

No exam policies particularly benefit applicants who:

- Experience occasional biliary colic but maintain stable overall health

- Have recent gallstone diagnosis without established treatment patterns

- Prefer faster approval processes without extensive medical examinations

- Need coverage amounts under $500,000

Specialized Coverage for Complex Cases

For individuals with complicated gallstone histories or multiple related health conditions, specialized insurance solutions may provide the best path forward. These might include guaranteed issue policies for those who face challenges with traditional underwriting.

Additionally, final expense insurance options can serve as foundational coverage while working toward larger traditional policies as health stabilizes.

Application Strategies for Successful Approval

Strategic application preparation significantly improves approval odds and premium rates for individuals with gallstone conditions. Based on our analysis of successful applications, specific documentation and timing strategies prove most effective.

Medical Documentation Strategy

Comprehensive medical records should include:

- Diagnostic imaging: Ultrasound or CT scan results showing gallstone characteristics

- Symptom tracking: Frequency and severity of biliary colic episodes

- Treatment history: Conservative management attempts and outcomes

- Surgical records: Complete cholecystectomy documentation if applicable

“We’ve found that applicants who provide detailed dietary modification records alongside their medical history receive significantly better underwriting consideration. Insurance companies view lifestyle management as a positive indicator of overall health consciousness.”

– Insurance Brokers USA Team, Medical Underwriting Specialists

Application Timing Considerations

Optimal application timing depends on your specific situation:

Optimal Application Timing by Condition Status

| Condition Status | Recommended Timing | Key Preparation Steps |

|---|---|---|

| Post-surgery (cholecystectomy) | 3-6 months after full recovery | Complete surgical records, recovery documentation |

| Stable symptoms | After 6 months symptom-free | Dietary management records, specialist clearance |

| Recent diagnosis | Consider simplified issue products | Basic health questionnaire preparation |

| Active symptoms | After treatment plan establishment | Treatment compliance documentation |

Working with Specialized Brokers

For complex gallstone cases, particularly those involving multiple health conditions, working with experienced insurance brokers who understand pre-existing medical condition approvals can significantly improve outcomes. Our team has specific experience with gallbladder condition applications and maintains relationships with underwriters who understand these conditions.

Contact our specialized team at 888-211-6171 for personalized guidance on positioning your gallstone-related application for optimal results.

Cost Factors and Premium Considerations

Premium costs for individuals with gallstones vary significantly based on symptom severity, treatment history, and overall health profile. Understanding these cost factors helps set realistic expectations and budget planning.

Premium Rating Factors

Key insight: Most applicants with well-managed gallstones pay standard rates, while those with complications or frequent symptoms may face mild premium increases. Post-surgical patients often receive the most favorable rates.

Key Takeaways

- Successful cholecystectomy patients often qualify for preferred rates

- Asymptomatic gallstones typically don’t affect premium rates

- Frequent biliary colic episodes may result in Table 2-4 ratings

- Overall health profile significantly influences final pricing

Sample Premium Scenarios

Based on our analysis of gallstone-related applications:

- Best case scenario: A 45-year-old individual who underwent uncomplicated cholecystectomy two years ago with no recurrent symptoms might qualify for preferred rates, potentially saving 20-30% compared to standard pricing.

- Typical scenario: A 50-year-old with occasional biliary colic managed through dietary modification typically receives standard rates with no premium increase.

- Complex scenario: An individual with frequent episodes requiring emergency care might face Table 2 ratings (25% premium increase) but still maintains access to coverage.

Bottom Line

Even applicants facing premium increases due to gallstone complications typically pay significantly less than those with major chronic conditions like diabetes or heart disease. The condition’s generally favorable prognosis keeps rate increases modest.

Cost Optimization Strategies

Several strategies can help minimize premium costs:

- Multiple company quotes: Different insurers have varying underwriting approaches for gallstone conditions

- Policy timing: Applying after optimal recovery periods can improve ratings

- Term vs permanent: Term policies offer lower initial costs for younger applicants

- Lifestyle improvements: Weight management and dietary changes may improve underwriting outcomes

When to Apply: Optimal Timing Strategies

Strategic timing of your life insurance application can significantly impact both approval odds and premium rates. The ideal application window depends on your specific gallstone condition and treatment status.

Post-Surgery Application Timeline

For individuals who have undergone cholecystectomy, timing considerations include:

- Immediate post-surgery (0-3 months): Most traditional insurers prefer to wait until complete recovery is documented. However, some simplified issue products may be available during this period.

- 3-6 months post-surgery: Optimal application window for most carriers, assuming uncomplicated recovery and return to normal activities.

- 6+ months post-surgery: Maximum benefits for underwriting, often qualifying for preferred rates with established health stability.

“We consistently see better underwriting outcomes for cholecystectomy patients who wait until they have 6 months of post-surgical stability. The patience typically results in preferred rate classifications rather than standard ratings.”

– Insurance Brokers USA Team, Surgical Case Specialists

Conservative Management Timeline

For individuals managing gallstones without surgery:

- During active symptoms: Consider simplified issue or guaranteed acceptance products while working toward symptom stabilization.

- Stable management period: Apply after demonstrating 6-12 months of successful symptom control through dietary changes or medication.

- Long-term stability: Best underwriting outcomes typically occur after one year of documented stable management.

Emergency Timing Considerations

Sometimes life insurance needs can’t wait for optimal timing. In these situations:

- Immediate coverage needs: Explore guaranteed issue or simplified underwriting options

- Employment changes: Group coverage through new employers may bridge gaps

- Family planning: Term life insurance options can provide temporary coverage while waiting for better underwriting timing

Bottom Line

While optimal timing improves rates and approval odds, don’t delay necessary coverage indefinitely. Many gallstone-related applications succeed even during less-than-ideal timing windows.

Alternative Coverage Solutions

When traditional life insurance approval proves challenging due to gallstone complications or timing issues, several alternative coverage solutions can provide financial protection for your family.

Group Life Insurance Benefits

Employment-based group life insurance often provides guaranteed coverage regardless of gallstone conditions. While coverage amounts may be limited, group policies offer:

- No medical underwriting: Acceptance regardless of gallstone status

- Immediate coverage: Protection starts with employment

- Supplemental options: Additional voluntary coverage often available

- Portability features: Some policies convert to individual coverage

Simplified Issue Life Insurance

Simplified issue policies require only basic health questions, making them accessible for many gallstone patients. These products typically:

- Limit coverage to $250,000-$500,000

- Feature streamlined application processes

- Provide faster approval decisions

- Accept many controllable chronic conditions

Final Expense Insurance Options

Final expense insurance serves as an excellent foundation coverage option, particularly for older adults with gallstone histories. These policies offer guaranteed acceptance and can supplement other coverage as health conditions stabilize.

Key Takeaways

- Group life insurance provides immediate coverage without medical underwriting

- Simplified issue products offer middle-ground solutions for moderate coverage needs

- Final expense insurance guarantees acceptance regardless of health conditions

- Combination strategies can maximize coverage while minimizing health-related obstacles

Accidental Death Coverage

While not comprehensive life insurance, accidental death coverage provides substantial benefits for accident-related deaths without medical underwriting. This coverage can supplement other policies while working toward traditional life insurance approval.

“Many of our clients use a layered approach: securing immediate guaranteed coverage while simultaneously applying for traditional policies as their gallstone condition stabilizes. This strategy ensures continuous protection while working toward optimal coverage terms.”

– Insurance Brokers USA Team, Alternative Coverage Specialists

Frequently Asked Questions

Can I get life insurance if I currently have gallstones?

Direct answer: Yes, most people with gallstones can obtain life insurance coverage.

Coverage availability depends on your symptom frequency, treatment compliance, and overall health status. Asymptomatic gallstones rarely affect eligibility, while frequent biliary colic episodes may result in premium increases but still allow coverage approval. Many carriers have experience with gallstone conditions and established underwriting guidelines.

Will my premiums be higher because of gallstones?

Direct answer: Premium increases are possible but typically modest for well-managed gallstone conditions.

Most applicants with asymptomatic gallstones or those who have undergone successful cholecystectomy receive standard rates. Individuals with frequent symptoms or complications might face Table 2-4 ratings (25-100% premium increases), but these rates remain significantly lower than those for major chronic conditions like heart disease or diabetes.

Should I wait until after gallbladder surgery to apply?

Direct answer: Waiting 3-6 months after an uncomplicated cholecystectomy typically yields better underwriting outcomes.

Post-surgical applicants often receive preferred rates once full recovery is documented. However, if you need immediate coverage, simplified issue products may be available before optimal timing. The decision depends on your specific coverage needs, timeline, and risk tolerance for potentially higher initial premiums.

What medical records will insurance companies need?

Direct answer: Companies typically request complete gallstone diagnostic records, treatment history, and current management plans.

Expect requests for ultrasound or CT scan results, surgical reports if applicable, emergency room visit records, and documentation of dietary or medication management. Providing comprehensive medical records upfront often speeds the underwriting process and improves approval odds.

Are there companies that specialize in high-risk health conditions?

Direct answer: Yes, several insurers specialize in applicants with medical conditions and may offer better terms for gallstone patients.

Companies like Prudential, Lincoln Financial, and certain mutual insurers have developed expertise in underwriting digestive conditions. Working with brokers who understand these specialized markets can help identify the most favorable options for your specific situation.

Can I apply for life insurance during a gallstone attack?

Direct answer: While possible with simplified issue products, traditional underwriting typically requires symptom stability.

Active symptoms may complicate traditional underwriting, but guaranteed issue or simplified underwriting products remain available. Once symptoms stabilize, you can explore additional coverage options or policy upgrades with more favorable terms.

How does gallstone management affect my application?

Direct answer: Documented successful management through diet, medication, or surgery significantly improves underwriting outcomes.

Insurance companies view effective gallstone management as evidence of overall health consciousness and reduced risk. Providing documentation of dietary changes, weight management, medication compliance, or successful surgical outcomes demonstrates your commitment to maintaining good health and can lead to more favorable premium rates.