In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Colon Polyps.

Questions that will be directly answered will include:

- Can I qualify for life insurance if I have been diagnosed with Colon Polyps?

- Why do life insurance companies care if I have been diagnosed with Colon Polyps?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- How can I help ensure I get the “best life insurance”?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Colon Polyps?

Yes, individuals who have been diagnosed with Colon Polyps can and often will be able to qualify for a traditional term or whole life insurance policy. They may even be eligible for a term life insurance policy without a medical exam at a Preferred rate, provided they have been “dealt” with and proven benign.

Why do life insurance companies care if I have been diagnosed with Colon Polyps?

The main reason why most of the best life insurance companies are going to be interested in the fact that an individual has been diagnosed with a Colon Polyp or Colon Polyps is that if left untreated, some of these polyps may have the ability to develop into colon cancer, which can prove fatal if discovered in its later stages.

This is why…

Once a life insurance company learns that an individual has been diagnosed with a Colon Polyp, this will usually trigger a series of additional questions that most (if not all) will want to know the answers to before making any “definitive” decisions about an individual’s life insurance application. This is also why you and the life insurance agent you apply for coverage with must be familiar with this pre-existing medical condition and know what kind of questions a typical life insurance company will likely ask.

Colon Polyp Defined:

Colon polyps are small clusters of cells that form on the lining of one’s colon. The good news is that most colon polyps are benign or non-cancerous and are generally considered harmless to those affected. The problem is that some colon polyps can develop into cancerous or neoplastic tumors, which can be pretty challenging to treat, particularly in their later stages.

Unfortunately…

Unless each polyp is excised and examined on its own, it’s pretty much impossible to know “which” polyp might become dangerous later on vs. which ones will remain harmless for the rest of one’s life. This is why most life insurance companies will be unwilling to insure anyone with a traditional term or whole life insurance policy if they have been diagnosed with a colon polyp and have not had it removed immediately.

To make matters worse…

Many individuals who suffer from Colon Polyps won’t experience any symptoms of their disease until later, upon which their condition may have entered into more dangerous phases. This is why most doctors will routinely advise anyone aged 50 to 75 years of age to get screened for colorectal cancer and for those who may have a family history of colon cancer to start their screening even earlier!

Especially if you’re experiencing any symptoms that could be related to having an existing colon polyp, including:

- Rectal bleeding,

- Unexplained abdominal pain,

- Stool color changes,

- Iron deficiency,

- And/or unexplained bowel habit changes.

“This brings us to an important point we should mention.”

First…

If you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’ll still need to see the doctor, and if you’re wrong, the time you spend being a doctor could cause significant harm to yourself!

Second…

Nobody here at IBUSA is medically trained; we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be good at helping individuals find and qualify for the life insurance they’re looking for. So please don’t mistake any of the medical information we discuss as medical advice because it’s not!

We’re just trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Colon Polyps… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- How old were you when you were first “screened” for colon cancer?

- Were your polyps discovered as part of a routine screening?

- How many colon polyps were found?

- Were any of your polyps determined neoplastic?

- Have you been diagnosed with colon cancer?

- What symptoms (if any) led to your diagnosis?

- Have all of your polyps been removed?

- When was the last time you had a colonoscopy?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with colon cancer?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What “rate” can I qualify for?

As you can see, there are a lot of factors that can come into play when it comes time to determine what kind of “rate” an individual might be able to qualify for after they have been diagnosed with a colon polyp.

And the crazy thing is…

Until now, we’ve only discussed factors directly related to being diagnosed with a colon polyp. In addition to the questions we’ve listed above, most life insurance companies will also be interested in other factors.

Factors such as:

- Your current height and weight.

- Your driving record/

- Family medical history.

- Have you ever been convicted of a felony or misdemeanor?

- Do you participate in any dangerous hobbies?

- Etc…

This is why knowing what kind of “rate” you might qualify for is pretty impossible without speaking with you directly.

That said, however…

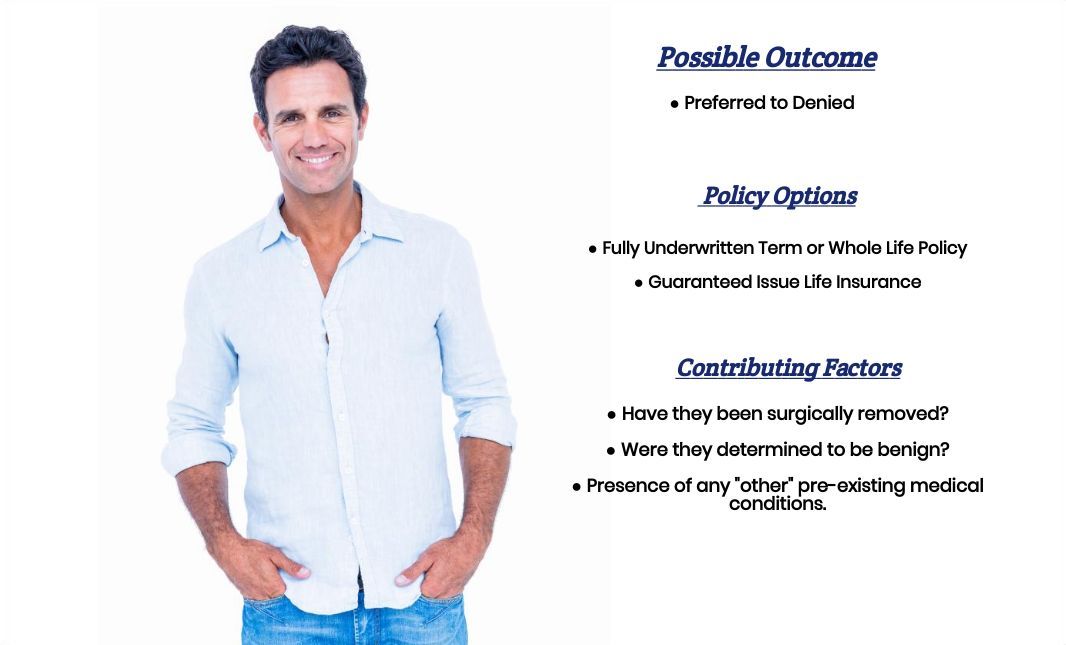

There are a few “assumptions” that one can make that will generally hold true and may provide you with a “basic” idea of what kind of “rate” you might be able to qualify for. For example, suppose you have been diagnosed with one or two colon polyps and have had them removed and examined, and it has been determined that they were not cancerous. In that case, chances are, if you don’t have a family history of colon cancer, these colon polyps will probably not affect the outcome of your life insurance application.

Or, to put it another way…

Whatever rate you would have been able to qualify for before being diagnosed with a colon polyp should be the same rate that you would be able to qualify for AFTER having been diagnosed with a colon polyp.

Conversely…

Suppose you have been diagnosed with a colon poly and either haven’t had it removed yet or have found that it may be cancerous. In that case, chances are you’re not going to be immediately approved for a traditional life insurance policy and may have to wait until you have had your polyp removed or you have been definitively determined cancer-free for a set period until which point you would then become eligible for coverage.

The good news is that regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance”?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

Fortunately, this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone previously diagnosed with a colon polyp?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!