In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with Coccidioidomycosis or Valley Fever, which it is sometimes referred to.

Questions that will be directly answered will include:

- Can I qualify for life insurance if I have been diagnosed with Coccidioidomycosis?

- Why do life insurance companies care if I have been diagnosed with Coccidioidomycosis?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Coccidioidomycosis?

Yes, individuals who have been diagnosed with Coccidioidomycosis or Valley Fever can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred rate when applying for a no exam term life insurance policy!

Why do life insurance companies care if I have been diagnosed with Coccidioidomycosis?

In order to understand why a life insurance company is likely to “care” if an individual has been diagnosed with Coccidioidomycosis or Valley Fever, it helps to take a moment and actually examine what Coccidioidomycosis is and discuss just some of the sort term and long term symptoms that this disease may cause which can become a concern for a life insurance company.

Coccidioidomycosis or Valley Fever Defined:

Coccidioidomycosis is defined as an infection that usually occurs within the lungs, which is caused by the fungus known as Coccidioides immitis. It is usually “transmitted” when soil or dirt that contains the fungus is disrupted and subsequently “breathed in” by the affected patient.

Symptoms of this disease may include:

- Fatigue,

- Fever,

- A chronic cough,

- Difficulty breathing,

- Muscle and/or joint pain,

- Unexplained rashes upon the upper body or legs,

- Etc…

Fortunately…

Coccidioidomycosis is “treatable” for those experiencing “severe” symptoms from their infection; however, in cases where treatment is necessary, it will usually take 3 to 6 months of antifungal medications such as Fluconazole to make a full recovery. In cases like these, what will concern a life insurance company the most will be the potential for “nodules” or “cavities” to appear that can take up to two years to become fully resolved.

This is why…

Most of the best life insurance companies will take an interest in someone who has been diagnosed with Coccidioidomycosis, which is why they’re likely to ask a series of medical questions prior to making any decision about an individual’s life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Coccidioidomycosis or Valley Fever?

- Who diagnosed your Coccidioidomycosis or Valley Fever? A general practitioner or a specialist?

- Do you know how you acquired Coccidioidomycosis?

- What symptoms led to your diagnosis?

- What treatment options have you received?

- Are you still treating your Coccidioidomycosis?

- Has your Coccidioidomycosis spread to other areas of your body, or is it contained in just one area?

- Have you been diagnosed with any lung “nodules” or “cavities”?

- Have you received any surgical procedures to treat your condition?

- Has your doctor indicated that you might need any future surgical procedures to treat your condition?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you been prescribed any prescription medications?

- In the past two years, have you been admitted to a hospital for any reason?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

“Which brings us to an important point that we think we ought to mention.”

First…

If you think you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being your own doctor could really cause great harm to yourself!

Second…

Nobody here at IBUSA is medically trained, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance that they’re looking for. So please don’t mistake any of the medical information that we talk about as medical advice because it’s not!

We’re just…

Trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Coccidioidomycosis… that’s it! This brings us to our next topic, which is…

What “rate” can I qualify for?

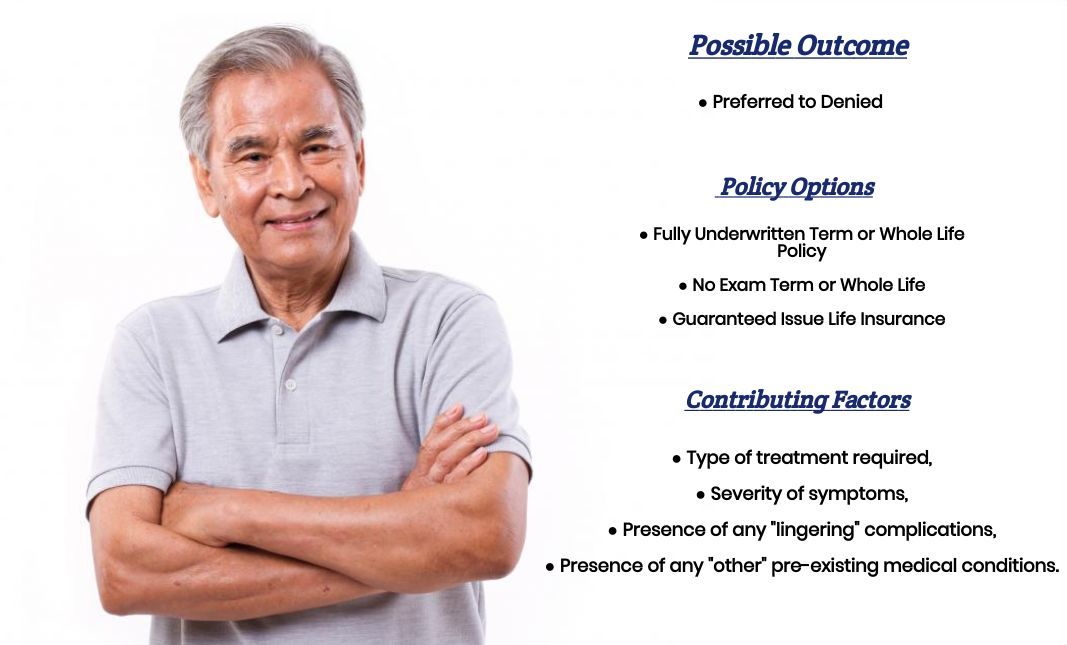

Typically, what you’re going to find when it comes time to determine what kind of “rate” an individual will be able to qualify for after they have been diagnosed with Coccidioidomycosis is that most (if not all) life insurance companies are going to require that an individual has fully recovered from their infection before they will be considered eligible for coverage.

From there…

The next thing that most life insurance companies are going to be looking for is to make sure that you’re Coccidioidomycosis wasn’t one that because “systemic” or disseminated to other parts of your body. In cases like these, what you’ll likely find is that most life insurance companies are going to consider you ineligible for a traditional term or whole life insurance policy, which means that you’ll most likely need to seek out an “alternative” product such as a guaranteed issue life insurance policy or an accidental death policy if you still wish to purchase some “kind” of protection for your family.

Which leaves the…

Majority of individuals who have been exposed to the Coccidioides immitis fungus but did not experience a “severe” case of Coccidioidomycosis. For these individuals, most life insurance companies will be looking at “what” symptoms you suffered from and “how” severe those symptoms became.

This puts us here at IBUSA in a bit of a bind because, without first speaking with you, we really don’t have any idea what “rate” you might qualify for.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!