In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Cardiomyopathy.

- Can I qualify for life insurance if I have been diagnosed with Cardiomyopathy?

- Why do life insurance companies care if I have been diagnosed with Cardiomyopathy?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Cardiomyopathy?

Yes, individuals who have been diagnosed with Cardiomyopathy can and often will be able to qualify for a traditional term or whole life insurance policy. The problem is, that because Cardiomyopathy is a disease of the heart muscle, most (if not all) of the top-rated life insurance companies are going to want to know a lot more about this pre-existing medical condition before making any decisions about an individual’s life insurance application after they have been diagnosed with Cardiomyopathy.

It’s also why…

Even though it may be theoretically possible to qualify for a no medical exam term life insurance policy, most folks who have been diagnosed with Cardiomyopathy will fair a much better chance at being able to qualify for a fully underwritten (exam required) term life insurance policy than a policy which won’t require one to take an exam.

Why do life insurance companies care if I have been diagnosed with Cardiomyopathy?

Any time an individual has been diagnosed with a pre-existing medical condition having to do with the heart, you can bet that most (if not all) life insurance underwriters are going to want to know more about it before they will be willing to make any kind of decision about an individual’s life insurance application.

This is particularly true…

When we’re talking about a pre-existing cardiac condition, which is defined as a disease of the heart muscle itself, which ultimately makes it more difficult for one’s heart to pump blood to the rest of the body.

And…

Just to complicate the matter even further, it’s important to point out that there are several different “types” of Cardiomyopathy that an individual may suffer from. Yet, one more thing that a life insurance underwriter will be interested in learning more about.

Cardiomyopathy defined:

Cardiomyopathy is a type of heart muscle disease that occurs when the heart muscle becomes damaged or weakened. This can lead to a range of symptoms and complications, including heart failure, arrhythmias, and an increased risk of heart attack or stroke.

There are several types of cardiomyopathy, including:

- Dilated cardiomyopathy:

- This is the most common type of cardiomyopathy, and it occurs when the heart becomes enlarged and weakened, making it difficult for the heart to pump blood effectively.

- Symptoms of dilated cardiomyopathy may include shortness of breath, fatigue, and swelling in the legs, ankles, and feet. The condition can be caused by a variety of factors, including genetics, viral infections, high blood pressure, and excessive alcohol consumption. It can also be a complication of other medical conditions, such as HIV/AIDS or diabetes.

- Treatment for dilated cardiomyopathy typically includes medications to improve heart function and reduce the risk of complications, as well as lifestyle changes, such as quitting smoking, eating a healthy diet, and getting regular exercise. In some cases, surgery may be necessary to repair or replace the damaged heart muscle.

- Hypertrophic cardiomyopathy:

- Hypertrophich cardiomyopathy is a type of heart muscle disease that is characterized by thickened heart muscle, which can make it difficult for the heart to relax and fill with blood. It is usually inherited and can occur in people of any age, but it is most commonly diagnosed in young athletes.

- Symptoms of hypertrophic cardiomyopathy may include shortness of breath, chest pain, and fainting, particularly during physical activity. The condition can also cause arrhythmias, or irregular heart rhythms.

- Treatment for hypertrophic cardiomyopathy may include medications to control heart rhythm and reduce the workload on the heart, as well as lifestyle changes, such as quitting smoking, eating a healthy diet, and getting regular exercise. In some cases, surgery may be necessary to remove part of the thickened heart muscle or to implant a device to help regulate heart rhythm.

- Restrictive cardiomyopathy:

- Restrictive cardiomyopathy is a type of heart muscle disease that occurs when the heart muscle becomes stiff and inflexible, making it difficult for the heart to fill with blood. This can lead to a range of symptoms and complications, including shortness of breath, fatigue, and swelling in the legs, ankles, and feet.

- The exact cause of restrictive cardiomyopathy is often unknown, but it can be associated with other medical conditions, such as amyloidosis (a condition in which abnormal proteins build up in the body’s organs and tissues), sarcoidosis (a condition in which inflammation occurs in the body’s organs), and radiation therapy.

- Treatment for restrictive cardiomyopathy may include medications to improve heart function and reduce the risk of complications, as well as lifestyle changes, such as quitting smoking, eating a healthy diet, and getting regular exercise. In some cases, surgery may be necessary to repair or replace the damaged heart muscle.

- Arrhythmogenic right ventricular cardiomyopathy (ARVC):

- Arrhythmogenic right ventricular cardiomyopathy (ARVC) is a rare type of heart muscle disease that affects the right ventricle of the heart and can cause arrhythmias, or irregular heart rhythms. It is usually inherited and can occur in people of any age, but it is most commonly diagnosed in young athletes.

- Symptoms of ARVC may include palpitations, fainting, and chest pain, particularly during physical activity. The condition can also cause heart failure and sudden cardiac arrest.

- Treatment for ARVC may include medications to control heart rhythm and reduce the risk of complications, as well as lifestyle changes, such as quitting smoking, eating a healthy diet, and getting regular exercise. In some cases, surgery may be necessary to remove part of the damaged heart muscle or to implant a device to help regulate heart rhythm.

What kind of information will the insurance companies ask me or be interested in?

If you have been diagnosed with cardiomyopathy and are applying for life insurance, the insurance company will likely ask you for detailed information about your medical history, including your diagnosis and treatment. They may ask you to provide records from your treating physicians, such as test results and notes from office visits.

The insurance company will also likely ask you about your symptoms and how they impact your daily life. They may ask you about any medications you are taking, as well as the dosage and frequency. They may also ask you about any lifestyle changes you have made or treatments you have undergone in order to manage your condition.

Specific questions may include:

- When were you first diagnosed with Cardiomyopathy?

- Who diagnosed your Cardiomyopathy?

- What kind of Cardiomyopathy have you been diagnosed with?

- Dilated Cardiomyopathy (DCM)?

- Hypertrophic Cardiomyopathy (HCM) or Hypertrophic Obstructive Cardiomyopathy (HOCM)?

- Restrictive Cardiomyopathy (RCM)?

- Left Ventricular Non-compaction (LVNC)?

- Arrhythmogenic Right Ventricular Dysplasia (ARVD)?

- What symptoms (if any) led to your diagnosis?

- What treatment options have you received?

- Medications?

- Surgical procedures?

- Devices?

- Are you currently suffering from symptoms now?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you ever suffered from a heart attack or stroke?

- In the past two years, have you been hospitalized for any reason?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What “rate” can I qualify for?

Now, as one can, there are a lot of factors that can come into play when trying to determine what kind of “rate” an individual may or may not be able to qualify for. This is why it’s almost impossible to know what “kind” or rate you might qualify for without first speaking with you for a few moments.

That said however…

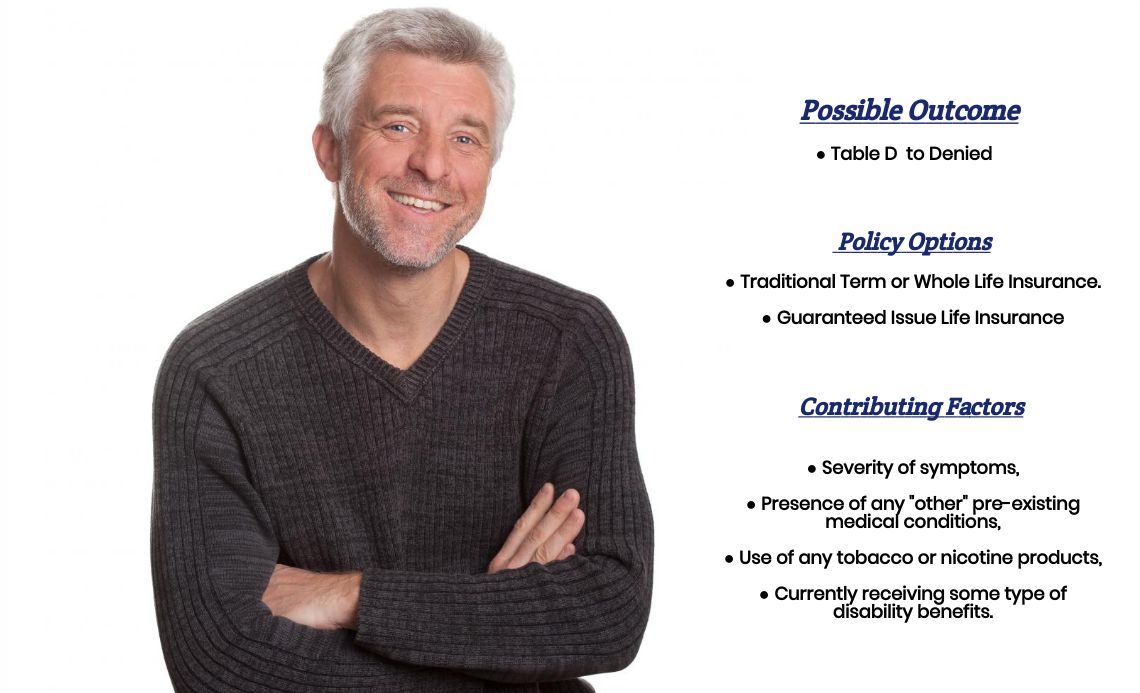

There are few “assumptions” that we can make about individuals who have been diagnosed with Cardiomyopathy, which will generally hold true. Assumptions such as if an individual is able to qualify for a traditional term or whole life insurance policy it’s safe to say that they will only be able to qualify for a “high-risk” category, so it’s very unlikely that they will be able to qualify for a Standard or better rate.

Also…

One’s chances at being able to qualify for a traditional term or whole life insurance policy will be much higher in cases where an individual is first diagnosed with Cardiomyopathy after the age of 40, and aren’t currently receiving any disability benefits. Beyond that, there isn’t much else we can infer simply by knowing that an individual has been diagnosed with Cardiomyopathy!

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for.

Which brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Cardiomyopathy?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!