In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Bladder Cancer.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Bladder Cancer?

- Why do life insurance companies care if I’ve been diagnosed with Bladder Cancer?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Bladder Cancer?

Yes, some individuals who have been diagnosed with Bladder Cancer will be able to qualify for a traditional life insurance policy. In fact, some may even be able to qualify for a Preferred rate, which is pretty extraordinary considering the seriousness of this disease.

That said however…

Most of the best life insurance companies are going to want to learn a lot more about your Bladder Cancer diagnosis well before they’ll be willing to approve your life insurance applicant at any rate.

This is why it’s important to work with an insurance agent who is familiar with helping folks qualify for coverage with pre-existing medical conditions like Bladder Cancer so that they can “prepare” your life insurance application properly from the start so that much of the “wait time” to get you approved can be eliminated.

Why do life insurance companies care if I’ve been diagnosed with Bladder Cancer?

Life insurance companies use a variety of factors to determine the premiums they charge for their policies and to decide whether to offer coverage to a particular individual. One of these factors is the applicant’s overall health, and having a serious illness like bladder cancer can be seen as an increased risk for the insurer.

If an applicant has been diagnosed with bladder cancer, the insurer will want to know more about the specifics of the diagnosis, including the stage of the cancer, the treatment that has been received, and the prognosis. This information can help the insurer to assess the applicant’s risk of death and to set the premiums for the policy accordingly.

Bladder cancer defined

Bladder cancer is a type of cancer that occurs in the bladder, which is a organ in the lower abdomen that stores urine. It is a relatively common type of cancer, and it is more likely to occur in people over the age of 50. There are several different types of bladder cancer, and the specific type can affect the prognosis and treatment options.

Symptoms of bladder cancer can include blood in the urine, pain or burning during urination, and frequent urges to urinate. If bladder cancer is suspected, a healthcare provider will typically order tests such as a urine sample, imaging tests, and a biopsy to confirm the diagnosis.

Treatment options for bladder cancer can include surgery to remove the cancerous tissue, chemotherapy, and radiation therapy. The outlook for people with bladder cancer can vary depending on the stage of the cancer and other factors, but early detection and treatment can increase the chances of a successful outcome.

Bladder cancer stages:

Bladder cancer is typically staged using the TNM system, which stands for tumor, nodes, and metastasis. The T category refers to the size and extent of the primary tumor in the bladder. The N category refers to whether the cancer has spread to the lymph nodes. The M category refers to whether the cancer has spread (metastasized) to other parts of the body.

The stages of bladder cancer are typically described as stages 0 through IV, with stage 0 being the earliest and least aggressive stage and stage IV being the most advanced and aggressive.

Here is a brief overview of the stages of bladder cancer:

- Stage 0: The cancer is limited to the inner lining of the bladder and has not invaded deeper tissue. The most important take away here is that regardless of one’s tumor “size” because cancer remains “non-invasive”, it will be considered less dangerous/harmful than any other stage of Bladder Cancer. Individuals diagnosed with Stage 0 Bladder Cancer typically experience a 96% five year survival rate.

- Stage I: The cancer has invaded the muscular layer of the bladder wall but has not spread beyond the bladder. These “types” of cases are generally considered “localized” cases and usually experience a 5 year survival rate of right around 70%.

- Stage II: The cancer has invaded the fatty tissue around the bladder or has spread to nearby organs such as the prostate or uterus. Stage 2 Bladder Cancer marks the first time that the cancerous cells can enter into the muscular wall of the bladder, which certainly represents a further expansion of the disease, however, if caught and treated quickly, the 5 year survival rate usually isn’t affected too significantly from those battling Stage 1.

- Stage III: The cancer has invaded the pelvic wall or has spread to nearby lymph nodes. At this point, the bladder cancer will typically be referred to as “regional” Bladder Cancer. The 5-year survival rate for this type of Bladder Cancer is usually around 36%.

- Stage IV: With Stage 4, what you’re generally going to find is that one’s Bladder Cancer as spread throughout one’s bladder and has been able to spread or metastasis to other parts of the body. In cases like these, treatment will usually need to be much more intensive because patients and doctors will be fighting one’s cancer on multiple fronts. Unfortunately, stage 4 cancer patients will typically see a much lower five year survival rate which usually hovers right around 7-10% but could be greater than this depending upon the organs affected.

It’s important to note that the staging of bladder cancer can be complex and may involve additional factors beyond the TNM system.

This is why, most individuals who have been diagnosed with bladder cancer in the past will not be able to qualify for a no medical exam life insurance policy, simply because these types of life insurance policies won’t offer enough information to an insurance underwriter to be confident enough to approve one’s application.

This is also why…

When someone calls us asking if they will be able to qualify for a traditional term or whole life insurance policy after being diagnosed with Bladder Cancer, the truth is, we’re not going to have any idea whether or not they will until we ask many of the same questions most life insurance companies are going to need to as well.

What kind of information will the insurance companies ask me or be interested in?

If you have been diagnosed with bladder cancer and are applying for life insurance, the insurance company will likely ask you a number of questions about your diagnosis and treatment.

They may ask for the specifics of your diagnosis, including the stage of the cancer, the grade of the cancer (which indicates how aggressive it is), and the size and location of the tumor. They may also ask about your treatment history, including any surgeries, chemotherapy, or radiation therapy that you have received.

In addition, the insurance company may ask about your overall health, including any other medical conditions you have and any medications you are taking.

And they may also ask about your lifestyle habits, such as whether you smoke or drink alcohol. The insurance company will then use this information, along with other factors, to determine the risk of insuring you and to set the premiums for your policy.

It’s important to be as honest and accurate as possible when answering these questions, as providing incorrect or incomplete information could affect your coverage.

What rate (or price) can I qualify for?

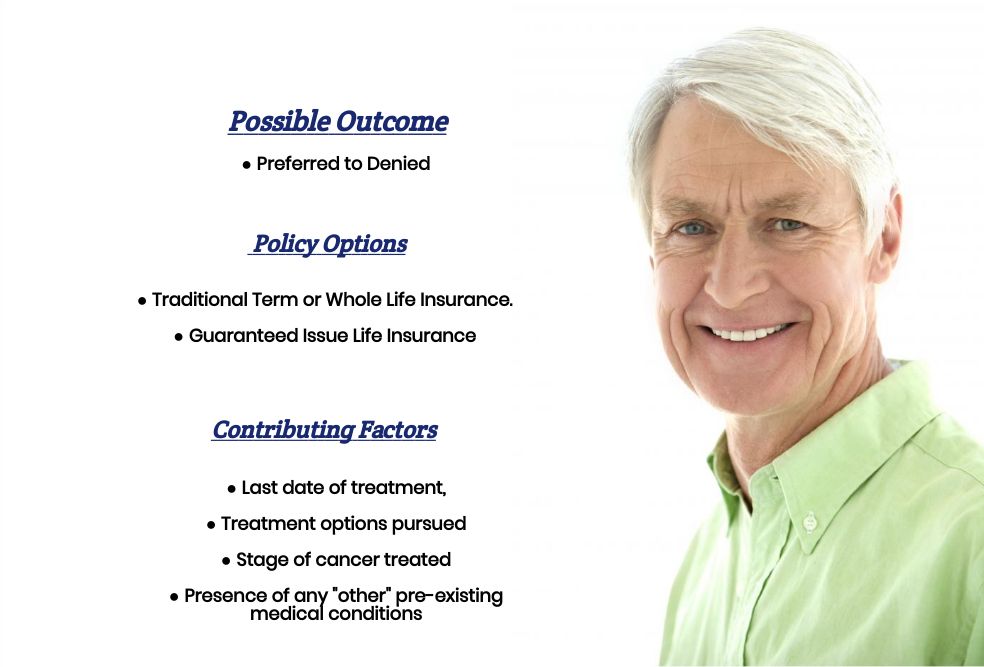

Usually, what you’re going to find is that people who have been diagnosed with lower “stages” of Bladder Cancer and have been in remission longer will generally have a better chance at being able to qualify for a traditional life insurance policy.

This is why…

Only individuals who have been diagnosed with stage 0 Bladder Cancer and have been in remission form several years (minimum 2 to 5 years) will potentially be able to qualify for a Preferred rate.

Other than that…

Everyone else who has been diagnosed with Bladder Cancer are either going to find themselves in a situation where they are either going to have to settle for a Standard or Sub-Standard rate or in cases where there are still fighting their cancer or were diagnosed with Stage 3 or 4 Bladder Cancer qualifying for traditional coverage may prove impossible.

In cases like these…

Some folks may need to consider an alternative product, such as an Accidental Death Policy or a Burial Life Insurance policy instead.

Fortunately, we here at IBUSA offer a wide variety of different insurance products offered by dozens of different life insurance companies. This brings us to our next topic, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experiences here at IBUSA, we’ve found that usually, the “best” approach in helping someone find the “best” life insurance policy for them is to first:

1. Fully understand what an individual is trying to achieve by purchasing their life insurance policy.

Are they looking to:

- Cover the cost of a mortgage?

- Replace lost wages?

- Protect a child or spouse?

- Or just cover one’s final expenses?

2. Then provide one with plenty of options to choose from so that you’re not limited to just one or two different options.

This is why…

We here at IBUSA choose to work with so many different life insurance companies so that when it comes time to help you decide “which” life insurance company is going to be the best for you, we don’t have to apply a…

“One Size Fits All”

Approach. Instead, we can make dozens of different life insurance companies compete for your business.

So, what are you waiting for? Give us a call today and experience the IBUSA difference.