It’s a common misconception that just because someone is overweight, they won’t be able to get life insurance coverage. Unfortunately, the thought of being turned down for coverage because of your weight can be so discouraging that it will often prevent some from even applying for coverage.

Despite these feelings and misconceptions though, it’s important to remember that you are not alone. Many individuals struggle with obesity and have found success in obtaining life insurance coverage. In fact, many smaller life insurance policies won’t even ask an applicant about their weight at all.

This is why,, in this article, we aim to demystify the process of obtaining life insurance for obese people and provide practical tips to help you navigate the process with confidence. Our goal is to help you understand that with the right preparation and support, it’s quite possible that you can secure the coverage you need to protect your loved ones.

Obesity, as it is defined by the insurance industry

In the life insurance industry, obesity is defined as having a body mass index (BMI) that exceeds a certain level. BMI is a calculation based on an individual’s height and weight and is used to determine if someone is underweight, normal weight, overweight, or obese.

Typically, life insurance companies consider a BMI of 25 to 29.9 to be “overweight”, and a BMI of 30 or higher to be “obese”. The specific BMI cutoff can vary between insurance companies, but in general, the higher an individual’s BMI, the greater the risk they may be considered to pose to the insurance company.

It’s important to note that while BMI is used as a standard by many life insurance companies, it’s not the only factor considered when evaluating an individual’s overall health and life insurance eligibility. Other factors, such as health history, family medical history, and lifestyle habits, are also taken into consideration when underwriting a life insurance policy.

Additional risk factors causing one’s obesity

Life insurance companies are always looking to minimize risk. For this reason, an applicant’s weight is often viewed as a possible symptom of another risk factor they need to be aware of. Insurance companies will often want to have a better understanding of what is causing an applicant to gain weight. Are there any other risk factors that they should be aware of?

After all, obesity is a complex condition that can be caused by a combination of factors, including:

- Genetics: Obesity can run in families and may be influenced by genes that affect metabolism and appetite.

- Lifestyle factors: Poor diet, sedentary lifestyle, and lack of physical activity can contribute to weight gain and obesity.

- Environmental factors: The availability of unhealthy food options and limited opportunities for physical activity in certain communities can contribute to obesity.

- Psychological factors: Emotional eating, stress, and mental health conditions such as depression can lead to overeating and weight gain.

- Medical conditions: Certain medical conditions, such as hypothyroidism, can cause weight gain and make it difficult to lose weight.

- Medications: Some medications, such as steroids and antidepressants, can cause weight gain as a side effect.

It’s crucial to acknowledge that obesity is a multifaceted condition, and no single factor is solely responsible for it. While one may assume that their weight is the sole hindrance in obtaining life insurance coverage, it’s important to note that the underlying reasons for their weight gain could be of greater concern to the insurance company.

Health risks associated with obesity

Obesity is associated with several health risks, including:

- Cardiovascular disease: Obesity can increase the risk of heart disease, stroke, and high blood pressure.

- Diabetes: Obesity is a major risk factor for type 2 diabetes, a chronic condition that affects the way the body processes sugar.

- Joint problems: Obesity can put extra stress on joints, leading to osteoarthritis and other joint problems.

- Sleep apnea: Obesity can increase the risk of sleep apnea, a condition where breathing is briefly and repeatedly interrupted during sleep.

- Cancer: Obesity has been linked to several types of cancer, including breast, colon, endometrial, and kidney cancer.

- Liver disease: Obesity can increase the risk of non-alcoholic fatty liver disease, a condition where fat builds up in the liver and can lead to liver damage.

- Metabolic syndrome: Obesity is a component of metabolic syndrome, a group of risk factors that increase the risk of heart disease, stroke, and type 2 diabetes.

Any one of these conditions alone could cause someone to be denied coverage, which is why it’s important to disclose any additional pre-existing medical conditions that you may have so that your insurance agent can use this information to guide you to the right company and the right policy.

Factors Affecting Life Insurance Eligibility

Life insurance companies don’t solely focus on your BMI. Instead, they adopt a comprehensive approach to evaluating the level of risk you present to them by considering both your health and lifestyle factors.

With this holistic approach to evaluating risk, insurance companies consider several factors in determining life insurance eligibility, including:

- Age: Younger individuals are generally considered to be a lower risk and may be offered more favorable rates.

- Health history: Insurance companies review an individual’s health history, including any pre-existing medical conditions, to assess their overall health and risk of death.

- Family medical history: Insurance companies also consider an individual’s family medical history, including any history of genetic or hereditary conditions.

- Lifestyle factors: Habits such as smoking, alcohol consumption, and drug use can impact life insurance eligibility and rates.

- Occupation and hobbies: Some occupations and hobbies, such as extreme sports, are considered to be riskier and may impact life insurance eligibility.

- Weight and body mass index (BMI): As discussed earlier, insurance companies may use BMI as a factor in evaluating life insurance eligibility, with higher BMIs potentially resulting in higher rates or reduced coverage.

- Medical examinations and lab tests: Insurance companies may require a medical exam and laboratory tests to evaluate an individual’s overall health and confirm their life insurance eligibility.

It’s important to keep in mind that life insurance eligibility can vary between insurance companies, and the specific factors that are considered may vary based on the individual’s unique circumstances.

Challenges of obtaining life insurance when obese

There are several challenges that obese individuals may face when trying to obtain life insurance coverage:

- Higher Risk: Obesity is considered a risk factor for many health problems, such as heart disease, diabetes, and high blood pressure. As a result, insurance companies may consider obese individuals to be a higher risk and charge higher premiums or decline coverage altogether.

- Medical Tests: Some life insurance companies require medical tests, including blood tests and a physical exam, which can be more challenging for obese individuals.

- Limited Policy Options: Obesity may limit the type of life insurance policy available to an individual. For example, some policies may not be offered to those with a body mass index (BMI) over a certain level.

- Higher Premiums: Due to the higher risk associated with obesity, life insurance premiums can be more expensive for obese individuals.

Lastly, it’s not uncommon for life insurance agents to make assumptions about an applicant’s eligibility, causing some overweight individuals to miss out on their true options. This happens when the agent they are working with assumes they won’t qualify for coverage. To ensure that you are aware of all your options, it’s advisable to seek additional opinions if you’ve been told that you’re ineligible for a traditional life insurance policy.

Preparing for Life Insurance Application

If you are obese and planning to apply for life insurance, there are several steps you can take to prepare:

- Get a medical evaluation: Schedule a check-up with your doctor to discuss your overall health and address any health concerns.

- Manage any underlying health conditions: If you have any health conditions that contribute to your obesity, work with your doctor to manage them.

- Lead a healthy lifestyle: Engage in regular exercise and maintain a balanced diet to improve your overall health.

- Quit smoking: If you smoke, quitting is one of the best things you can do for your health and life insurance eligibility.

- Gather information: Before you apply, gather all relevant information about your health history, including any medical records, family medical history, and medication list.

- Shop around: Get quotes from several life insurance companies to compare rates and coverage options.

- Consider a life insurance broker: A life insurance broker can help you navigate the process and find the best coverage options based on your individual needs and circumstances.

By taking these steps, you can help increase your chances of getting the best life insurance coverage available to you.

Types of life insurance policies

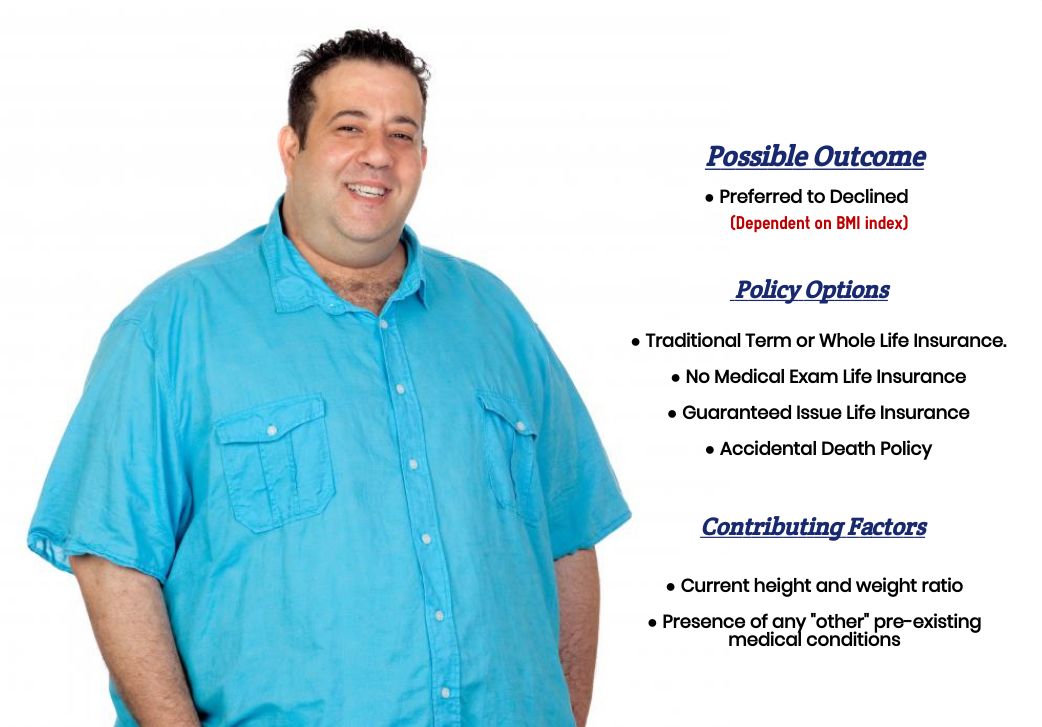

If you are obese, the following types of life insurance policies may be available to you:

- Term life insurance: This type of life insurance provides coverage for a specified term, typically 10, 20, or 30 years.

- Whole life insurance: This type of life insurance provides coverage for the entire lifetime of the policyholder and may accumulate cash value over time.

- Guaranteed issue life insurance: This type of policy does not require a medical exam or health questions and may be available to individuals with pre-existing health conditions, including obesity.

For those unable to qualify for a traditional life insurance policy, such as a term or whole life insurance policy, a guaranteed issue life insurance policy may be an acceptable alternative.

Guaranteed issue life insurance policy.

A guaranteed issue life insurance policy is a type of life insurance that does not require a medical exam or health questions. This means that the policy is available to individuals with pre-existing health conditions, including obesity, without having to answer any health questions or undergo a medical exam.

A guaranteed issue life insurance policy typically comes with a graded death benefit. This means that the policy provides a limited death benefit during the first two or three years of the policy’s term. If the policyholder dies due to natural causes within the first two or three years, the death benefit will not be paid to your beneficiary. If the policyholder dies after the first two or three years, the full death benefit is paid out.

The graded death benefit is in place to deter individuals from purchasing a guaranteed issue life insurance policy only to die immediately and receive the full death benefit. The policyholder must live long enough for the policy to become fully effective before they can receive the full death benefit.

So, as you can see, many factors impact an individual’s eligibility for a traditional life insurance policy, with weight being a significant consideration but not necessarily the only deciding factor. Therefore, we encourage anyone seeking to secure the financial future of their loved ones to take the opportunity to explore their life insurance options. The effort involved is minimal, and the potential benefits of finding a suitable policy are significant.