In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Trilyte, which is a laxative solution that is generally used to help prepare one’s bowel before a colonoscopy, a barium x-ray or some other kind of “intestinal” procedure.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Trilyte?

- Why do life insurance companies care if I’ve been prescribed Trilyte?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Trilyte?

Yes, individuals who have been prescribed Trilyte can and often will qualify for a traditional term or whole life insurance policy. In fact, they may even qualify for a preferred rate!

Why do life insurance companies care if I’ve been prescribed Trilyte?

The only reason why a life insurance policy would necessarily be worried or alarmed about the fact that someone has been prescribed Trilyte is when, during the life insurance application, an applicant hasn’t eluded to any medical procedure that might have warranted this medication. After all, Trilyte isn’t a medication that one would be likely to abuse or consider dangerous to use. It’s just a medication that might pique a life insurance underwriter’s interest if you haven’t divulged any kind of “gastrointestinal” issues or are younger than when a typically routine colonoscopy would be expected.

Which is why…

In cases like these, it might not be unusual for a life insurance underwriter to ask you a few questions before your approval so that they can fully understand “why” you have been prescribed Trilyte in the past, particularly if you were prescribed Trilyte recently.

What kind of information will the insurance companies ask me or be interested in?

Common questions you might be asked about your Trilyte prescription may include:

- Have you recently had a colonoscopy or barium x-ray performed?

- If so, why was it performed? Was it a routine examination, or was it ordered due to some “symptom” that you were suffering from?

- Who prescribed your Trilyte prescription? A general practitioner or a specialist?

- Have you been diagnosed with any gastrointestinal medical condition?

- Are you taking any other prescription medications?

- Do you have any follow-up procedures or surgical procedures planned, or has a doctor recommended or suggested that you may need any within the next six months?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

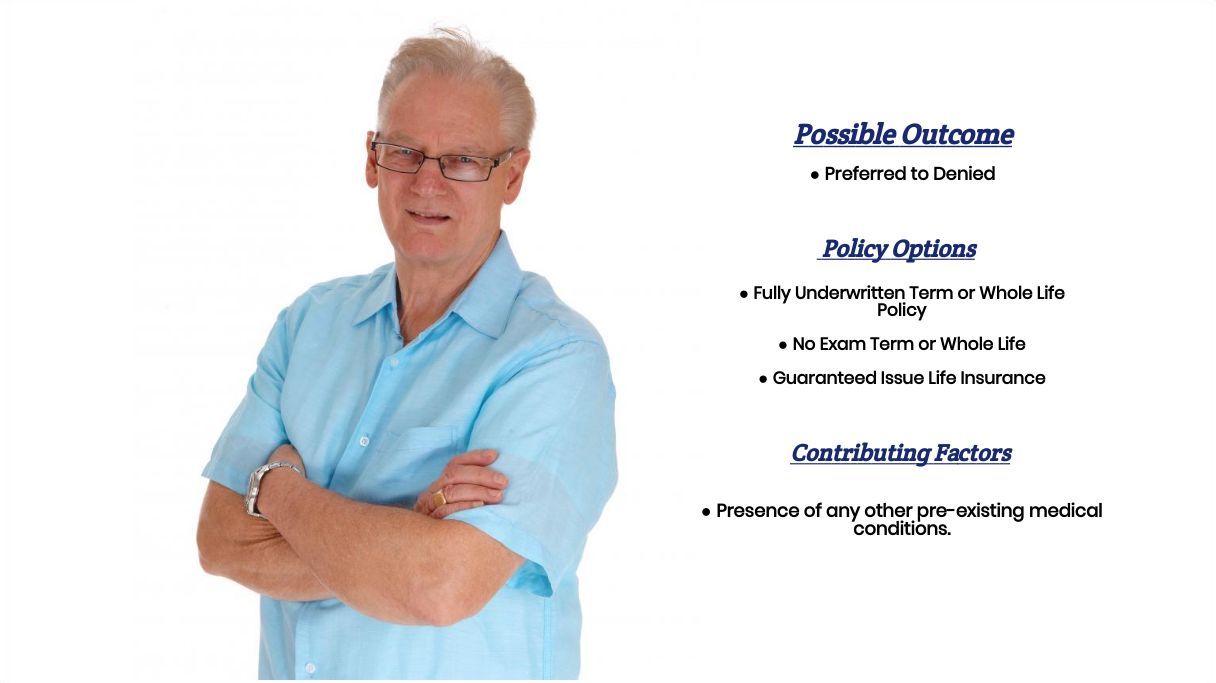

As a general rule of thumb, what we here at IBUSA have found is that provided that you haven’t been diagnosed with any pre-existing medical conditions which still exist today and you’re not expecting to need any future treatments or surgical procedures in the near future having been prescribe Trilyte in the past should not have any effect on the outcome of your life insurance application.

Or, to put it another way…

The “rate” that you would have been able to qualify for BEFORE you were prescribed Trilyte should be the same “rate” that you would be able to qualify for AFTER you’ve been prescribed Trilyte. This brings us to the last topic that we wanted to discuss here in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use many “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to ensure that our clients find the “best” life insurance policy that they can qualify for is to be sure to know our stuff and offer a ton of options.

You see…

By employing only true life insurance professionals who have extensive experience helping people with all sorts of pre-existing medical conditions and then providing them with a wide range of options to offer their clients, we here at IBUSA truly do offer a one-stop shop for people looking to protect their families.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent they choose to work with is truly an expert and that he or she has dozens of options for you to consider. Even if they are the greatest life insurance agent in the world, if they don’t have access to the “best” life insurance policy for you, what good is that going to do you?

So what are you waiting for? Call us today and let us earn the right to protect your family!