In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Provigil or its generic form Modafinil to treat symptoms of excessive sleepiness caused by sleep apnea and narcolepsy.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Provigil?

- Why do life insurance companies care if I’ve been prescribed Provigil?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help insure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Provigil?

As a general rule of thumb, having been prescribed Provigil to treat either or the two medical conditions that it is most commonly used to treat should not prevent one from being able to qualify for a traditional term or whole life insurance policy. That being said however, it’s presence will usually be noted by most (if not all) life insurance underwriters and will typically cause them to want to learn more about your condition prior to making any kind of decision about your life insurance application.

Why do life insurance companies care if I’ve been prescribed Provigil?

Life insurance companies aren’t all that concerned with the fact that you’ve been prescribed Provigil, what concerns them is “why” you’ve been prescribed Provigil. You see, on the face of things, Provigil is not a medication that one might be inclined to abuse, and while some of its potential side effects might be uncomfortable to deal with, in the end, they aren’t what most life insurance underwriters would consider “life-threatening”.

The problem is…

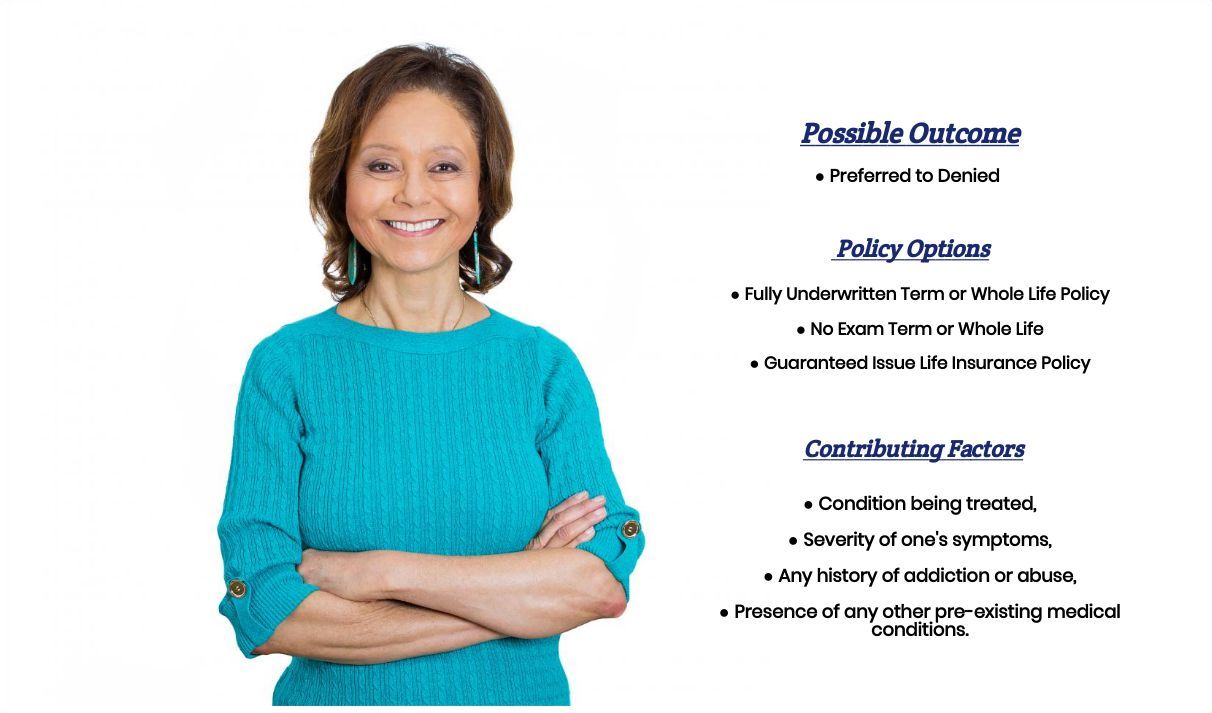

That Provigil is a medication that is used to treat two separate conditions each of which can and often will affect the outcome of one’s life insurance application and when combined with other potential health issues could ultimately lead one to be denied a life insurance policy. This is why, prior to being approved for coverage, most (if not all) life insurance companies will want to learn more about your underlying pre-existing medical condition prior to making a decision about your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

The kind of information that an insurance company will be interested in with regards to your Provigil prescription will primarily center around “why” you have been prescribed Provigil. For this reason, let’s just take a look at some of the questions you might be asked based on whether you’ve been diagnosed with excessive sleepiness due to sleep apnea and then narcolepsy.

Common questions for those suffering from sleep apnea:

- When were you first diagnosed with sleep apnea?

- Have you had a sleep study performed?

- Have you had an Apnea hypopnea Index (AHI) test performed? And if so, what was your score?

- Are you currently using a CPAP machine?

- Aside from Provigil, are you taking any other prescription medications to help you treat your sleep apnea?

- What is your current height and weight?

- In the past 12 months have you used any tobacco or nicotine products?

- Do you have any issues with your driving record?

- Are you currently working now?

- In the past 12 months have you applied or received any form of disability benefits?

Common questions for those suffering from narcolepsy:

- When where you first diagnosed with narcolepsy?

- Who diagnosed your narcolepsy? A general practitioner or a specialist?

- Is Provigil the only medication that your taking to treat your narcolepsy?

- Has your proscription for Provigil changed in any way within the past 12 months?

- How well is Provigil helping you to control your narcolepsy?

- Are you still able to legally drive?

- Are you currently working now?

- In the past 12 months have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

The good news about both pre-existing medical conditions that Provigil is commonly used to treat is that neither of them are cause for a life insurance underwriter to “automatically” deny an applicant. Which means that in “theory” if you have been prescribed Provigil, you should still be considered eligible for a traditional term or whole life insurance policy. In fact, those suffering from sleep apnea may even be able to qualify for a preferred rate when able to show that their sleep apnea is well managed!

Additionally…

For individuals suffering from sleep apnea, there is also the Apnea hypopnea Index (AHI) test that can be performed to provide an insurance underwriter a better idea of how well your sleep apnea is being managed which is great because this allows insurance underwriters to use “concrete” evidence with regards to how “severe” your condition may or may not be rather than simply rely on subjective facts.

Which just happens to be…

The case when trying to determine what “rate” an individual should earn after being diagnosed with narcolepsy. You see the problem with having been diagnosed with narcolepsy from an insurance underwriter’s point of view is that there isn’t really a test one can take to demonstrate how “severe” or “mild” one’s situation may be. As a result, most insurance underwriters will simply take a look at someone’s overall profile and try to “estimate” how severe one’s situation is. Things that they will be specifically interested in will be in details showing how much affect this disease is having on your daily life?

- Are you able to drive?

- Are you currently working?

- Are you currently receiving disability benefits?

Form there, most insurance writers will then either give the applicant a “table rating” somewhere between Table A-C.

Now…

At this point we should take a moment and describe exactly what a “table rating” is. You see, overall, there are 16 different “ratings” one can qualify for when applying for life insurance. You can qualify for a Preferred or Preferred Plus, a Standard or Standard Plus and then from there you get into the “table ratings” which range from A (the best “sub-standard table rating) to J (the worst or most expensive sub-standard table rating). The trick for any individual who has been diagnosed with narcolepsy will be to determine which life insurance company will consider them eligible for a table A rating and which of those companies has the “best” pricing at that category.

What can I do to help insure that I get the “best life insurance” for me?

Unfortunately, with both of these pre-existing medical conditions, aside from making sure that you’re working with a life insurance professional who fully understands what the different insurance companies will be looking for when making their decision, there’s not a whole lot one can do to help increase their chances at qualifying for the “best” life insurance policy from them.

This is because…

There’s really not much one can do to improve their condition from a life insurance application standpoint other than being sure to apply for coverage with a company that will be most “lenient” when it comes to those applying for coverage after being diagnosed with either sleep apnea or narcolepsy.

The good news is…

That here at IBUSA, we have plenty of experience helping folks like yourself qualify for traditional life insurance coverage and because we work with so many different life insurance companies you won’t need to spend days and days calling different insurance companies because we can do that for you simultaneously!

So, what are you waiting for? Give us a call today and see what we can do for you!