In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Premarin or its generic form conjugated estrogens to help treat symptoms associated with menopause or low estrogen levels. Premarin has also been found to be helpful in treating those suffering from advanced breast and prostate cancer.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Premarin?

- Why do life insurance companies care if I’ve been prescribed Premarin?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Premarin?

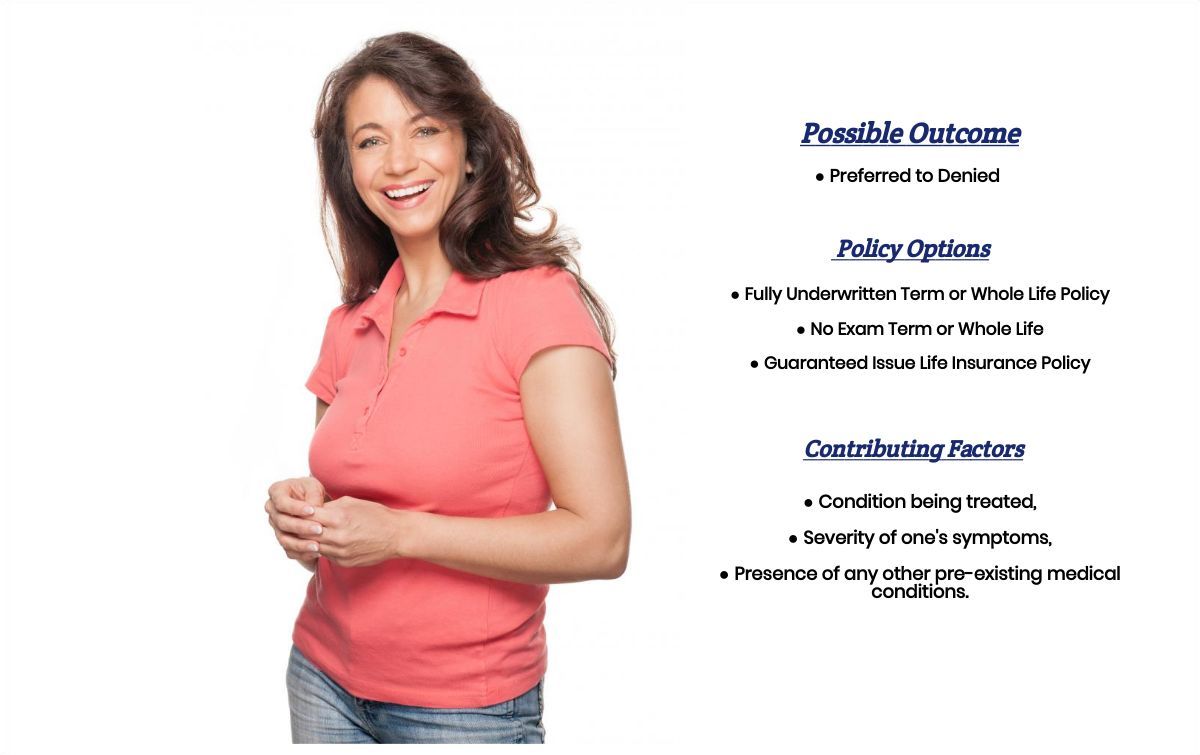

Yes, individuals who have been prescribed Premarin can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, many may even be able to qualify for a Preferred Plus rate!

Why do life insurance companies care if I’ve been prescribed Premarin?

The only real reason why a life insurance company may decide to “care” about whether or not you have been prescribed Premarin is when it “appears” that your Premarin prescription might not be simply to treat “normal” menopause.

In cases like these…

What might cause a life insurance underwriter to want to know more about your Premarin prescription would be if you’ve been prescribed it as a “male” or if it appears that you may be too young to actually be going through menopause. In cases like these, it’s not uncommon for a life insurance underwriter to want to ask a series of medical questions about your Premarin prescription so that they can get a better idea of “why” you have been prescribed Premarin and whether or not this underlying pre-existing medical condition is one that they should be worried about.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first prescribed Premarin?

- Who prescribed your Premarin? A general practitioner or a specialist?

- How old were you when you were first prescribed Premarin?

- What symptoms led to you being prescribed Premarin?

- Has your Premarin helped you deal with these symptoms?

- Have you ever been diagnosed with cancer?

- Are you taking any other prescription medications?

- Are you working right now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

What we have found here at IBUSA is that if you have been prescribed Premarin, chances are it’s not going to affect the outcome of your life insurance application. This is because you’ve either been prescribed it because you are currently undergoing normal symptoms associated with age-related menopause, in which case your Premarin won’t be an issue.

Or…

You’ve been prescribed Premarin as a way of coping with symptoms associated with being diagnosed with advanced breast cancer or prostate cancer, in which case, the fact that you have been prescribed Premarin isn’t really going to mean all that much in the grand scheme of things!

This means that if you’ve been prescribed Premarin to help yourself cope with normal symptoms associated with menopause, chances are that whatever “rate” you might have been able to qualify for PRIOR to being prescribed Premarin ought to be the same “rate” that you would be able to qualify for AFTER being prescribed Premarin.

And for those…

Who have been diagnosed with either breast or prostate cancer, what we’re going to want to do is take a look at how advanced your case was prior to going into remission and also take a look at what treatment options were used as well as when the “last date of treatment” was determined so that we can get a better idea of what “kind” of insurance you might be able to qualify for and at what rate.

The good news is that regardless of “why” you have been prescribed Premarin, here at IBUSA we have plenty of experience helping folks with all sorts of pre-existing medical conditions find the coverage their looking for so it’s really just a matter of you giving us a call! Which brings us to the last topic that we wanted to take a moment and discuss with you here in this article which is…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients are able to find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see, by only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBUSA truly do offer a one stop shop for folks looking to protect their family.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So what are you waiting for? Give us a call today, and let us earn the right to protect your family today!