In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Lucentis or its generic form, Ranibizumab, to help treat wet age-related macular degeneration.

Lucentis can also be used to treat edema that is specifically caused by either:

As well as diabetic retinopathy.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Lucentis?

- Why do life insurance companies care if I’ve been prescribed Lucentis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Lucentis?

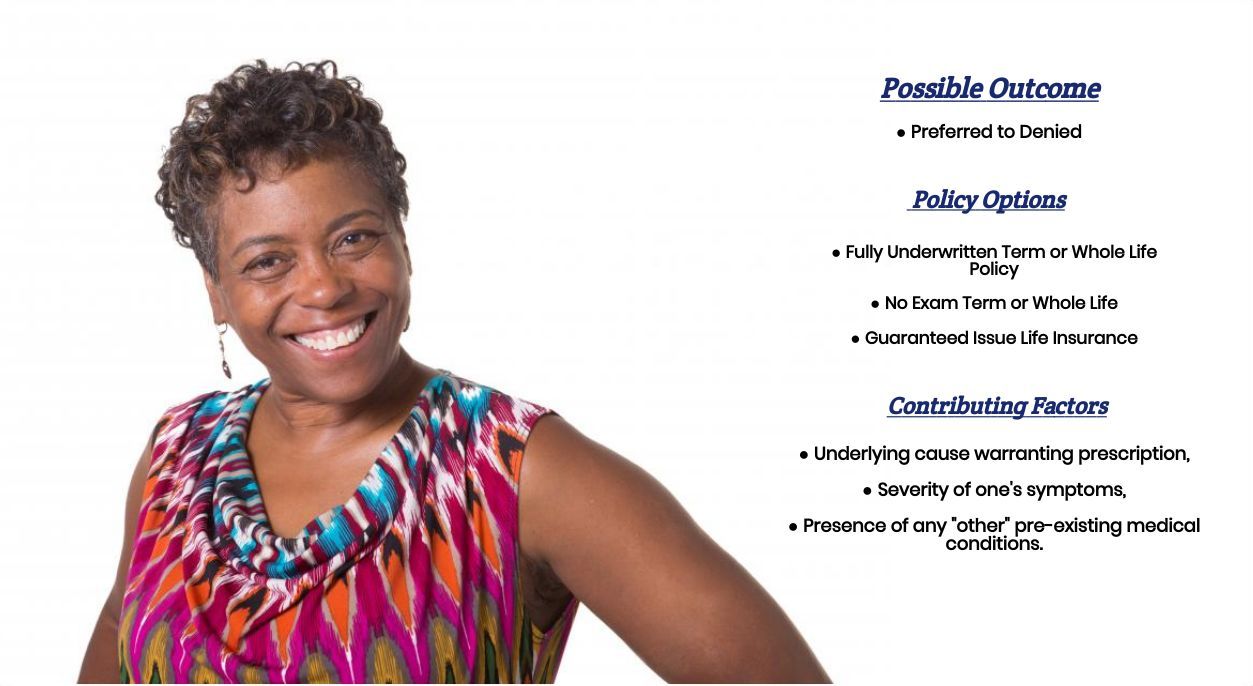

Yes, individuals who have been prescribed Lucentis can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is that because Lucentis can also be used to treat additional pre-existing medical conditions other than wet age-related macular degeneration, it (Lucentis) is also a medication that can trigger an “automatic” denial in some cases.

Why do life insurance companies care if I’ve been prescribed Lucentis?

Life insurance companies “care” if an individual has been prescribed Lucentis because it is a prescription medication that is either dealing with a disease that can “potentially’ have a significant impact on the qualify of one’s life (wet-age related macular degeneration) or is treating rather severe symptoms associated with diabetes which is a pre-existing medical condition which life insurance companies are always a “bit” hesitant about.

This is why…

Once a life insurance underwriter sees that you have been prescribed Lucentis, they’re definitely going to want to learn more about “why” you have been prescribed Lucentis and how “severe” your condition is prior to making any decision about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first prescribed Lucentis?

- Who prescribed your Lucentis? A general practitioner or a specialist?

- Why have you been prescribed Lucentis?

- Have you ever been diagnosed with diabetes?

- If so:

- What type of diabetes have you been diagnosed with?

- How old were you when you were first diagnosed?

- What symptoms (if any) led to your diagnosis?

- What symptoms (if any) are you experiencing now?

- What would you estimate your daily blood sugar levels to be?

- When was the last time you had your A1C checked? What was that value?

- How often do you see your primary care physician?

- Have you been diagnosed with heart disease?

- If so:

- What “official” diagnosis have you been given?

- When were you originally diagnosed?

- Have you ever suffered from a heart attack or stroke or experienced chest pain or angina?

- What symptoms (if any) led you to be prescribed Lucentis?

- What symptoms (if any) are you experiencing now?

- Are you taking any other prescription medications?

- What is your current height and weight?

- Have any of your prescription medications changed in any way within the past 12 months?

- In the past 12 months, have you used any tobacco or nicotine products?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

- If so:

- If so:

What rate (or price) can I qualify for?

As you can see, there are a lot of factors that can come into play when trying to determine what kind of “rate” an individual might be able to qualify for. This is why it’s pretty much to give someone an accurate idea about whether or not they’ll even be able to qualify for insurance without actually speaking with them directly.

That said, however…

There are a few “assumptions” that we can make based on the fact that an individual has been prescribed Lucentis. First off, if you have only been prescribed Lucentis because the only pre-existing medical condition you are suffering from is wet-age-related macular degeneration, the is a chance depending on how advanced your condition is that you may be able to qualify for a Standard Plus rate (or even Preferred) assuming that your condition is well under control and doesn’t seem to be advancing to the point where you may one day be unable to “live life” like you do currently.

In cases like these…

The insurance companies will want to see that after your original diagnosis, your vision seems to have “stabilized” and that you have been able to continue doing “most” of the same things that you did prior to your diagnosis.

Now as for cases where an individual is taking Lucentis to treat symptoms directly related to a previous diabetes diagnosis or cardiovascular disease diagnosis, what you’re typically going to find is that, in most cases, your underlying pre-existing medical condition is going to be the primary driving force behind what kind of “rate” that you’ll be able to qualify for. In many cases, this may mean that you may only be able to qualify for a “sub-standard” or “higher risk” category at best!

The good news is that…

Here at IBUSA, we have plenty of experience helping folks with all sorts of pre-existing medical conditions find the “best” life insurance policy that they can qualify for which is why we wanted to end this article with a brief discussion on…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance profession who will work as an advocate for you. Such an agent who can help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now does it?

Lastly, you’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”

So, what are you waiting for? Give us a call today and see what we can do for you!