In this article, we wanted to take a moment and try to answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Lithium Carbonate or one of the common brand names it is sold under, including:

- Eskalith,

- Lithobid,

- Lithonate,

Or Lithotabs to help treat/manage one’s manic-depressive disorder (bipolar disorder).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Lithobid?

- Why do life insurance companies care if I’ve been prescribed Lithobid?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Lithobid?

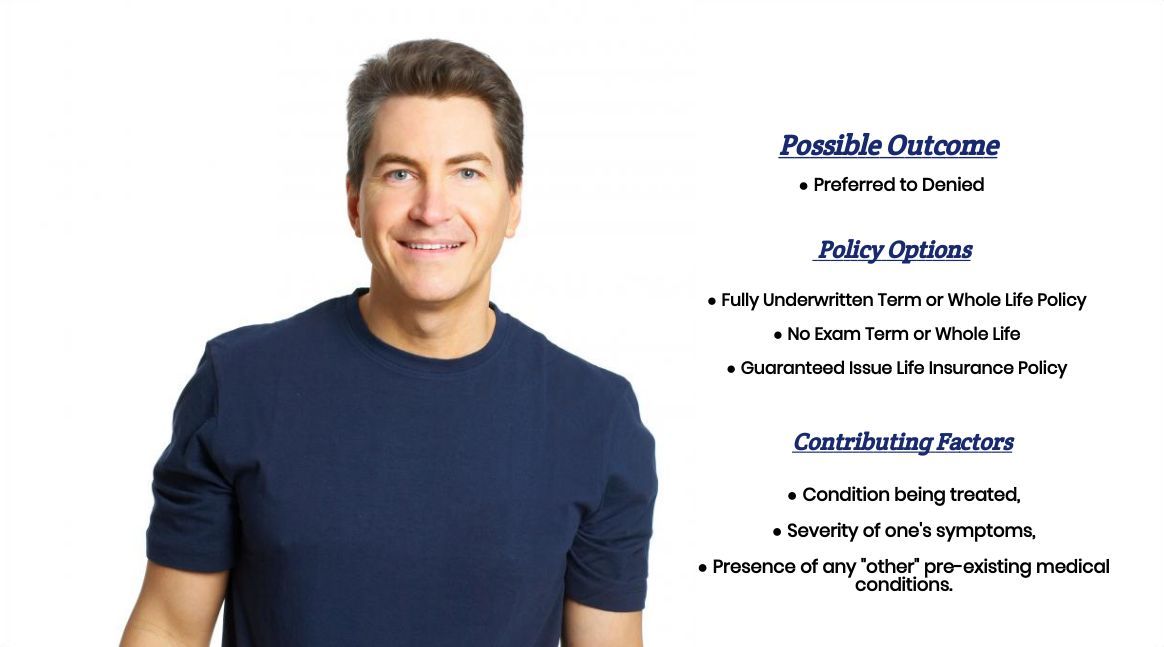

Yes, individuals who have been prescribed Lithobid can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Standard Plus or Standard rate, assuming that their Lithobid is helping them control their symptoms and that they would otherwise be able to qualify for such a rate.

Why do life insurance companies care if I’ve been prescribed Lithobid?

Life insurance companies “care” if an individual has been prescribed Lithobid because it is a prescription medication that is specifically used to help treat a pre-existing medical condition that life insurance companies are definitely interested in, which is Manic-depressive disorder and/or bipolar disorder.

Now, you may be thinking to yourself…

“Why do life insurance companies care if I’ve been diagnosed with bipolar disorder? It’s not like bipolar disorder is a “life-threatening” disease like heart disease or cancer?”

Which is true. And you’re not going to find us here at IBUSA arguing with you about that; all we can tell you is that they (the life insurance companies) do! In fact, life insurance companies “care” about a ton of different factors, some of which will be directly related to your manic-depressive diagnosis. In contrast, others won’t have anything to do with it, which is why before we start talking about what kind of “rates” you might be able to qualify for we wanted to take a moment and actually list some of the questions you might be asked during a traditional life insurance application.

What kind of information will the insurance companies ask me or be interested in?

- When were you first prescribed Lithobid?

- Who prescribed your Lithobid? A general practitioner or a psychiatrist?

- Why have you been prescribed Lithobid?

- Have you been given a definitive diagnosis?

- What symptoms led you to become prescribed Lithobid?

- When was the last time you suffered from a manic “episode”?

- How well is your Lithobid helping you manage your disorder?

- Is Lithobid the only prescription medication that you’re currently taking?

- Have any of your prescription medications changed in the past 12 months?

- In the past 12 months, have you been admitted to a hospital for any reason?

- Do you have any “history” of drug or alcohol abuse?

- Have you ever attempted or contemplated suicide?

- Do you actively participate or plan on participating in any dangerous hobbies or activities? Activities such as bungee jumping, hang gliding, or skydiving?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

Now, as you can see, many factors can come into play when trying to determine what kind of “rate” an individual may or may not be able to qualify for. This is why it’s pretty much impossible to know for “sure” what kind of rate you might be able to qualify for without first speaking with you and learning more about your specific situation.

That said, however…

There are some “assumptions” that we can make based on what we know about “most” life insurance companies, the fact that you have been prescribing Lithobid to treat your bipolar disorder. For example, it’s safe to say that if you’ve been diagnosed with a pre-existing medical condition like manic-depressive disorder or bipolar disorder, you’re probably not going to be able to qualify for a Preferred rate.

But that’s alright…

After all, the vast majority of individuals applying for a traditional term or whole life insurance policy aren’t going to be able to qualify for these kinds of “rates” either. And that’s because it’s really hard to qualify for a preferred rate even if you haven’t been prescribed for any kind of pre-existing medical condition.

So, this then means that you’re probably only going to be able to qualify for a Standard (or possibly Standard Plus) rate assuming that your disorder is very well controlled and it doesn’t appear like your “condition” is affecting your life too “severely.”

And if you’re thinking to yourself…

“Wow, that sounds really vague?”

Guess what, you’re right! This is because there really isn’t any kind of “test” a life insurance company can use to determine how “manic-depressed” you are. Or how “severe” your bipolar disorder is. Instead, they have to use other factors like:

- Have you been hospitalized for your condition before? If so, why? When? How many times?

- Has your condition impacted your career or employment history?

- Has your condition led to or contributed to any “legal issues”?

But the problem is that when an insurance company has to rely on questions like these to determine the “severity” of your condition, it leads to a lot of potential “subjectivity” during the underwriting process. Subjectivity that may or may not benefit you in your search for a traditional life insurance policy.

This is why…

Before “officially” applying for a life insurance policy, you’re going to want to make sure that you’re working with a life insurance agent who is not only familiar with your medical condition but also how different life insurance companies “underwrite” for your condition. This brings us to the last topic that we wanted to take a moment and discuss with you here in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance profession who will work as an advocate for you. Such an agent can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, you’ll want to ensure you’re completely honest with your life insurance agent before applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best.” So, what are you waiting for? Give us a call today and see what we can do for you!