In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Focalin or its generic form Dexmethylphenidate Hydrochloride to help treat Attention Deficit Hyperactivity Disorder (ADHD).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Focalin?

- Why do life insurance companies care if I’ve been prescribed Focalin?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Focalin?

Yes, individuals who have been prescribed Focalin can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a no-exam life insurance policy!

The only problem is…

There really isn’t any kind of “test” that an individual can take to demonstrate that their ADHD isn’t something that a life insurance underwriter needs to worry about. This is why you ought not be surprised if your IBISA insurance agent decides to ask you a lot of questions about your Focalin prescription and about your ADHD so that they can use this information to determine “which” life insurance company is most likely going to give you the “best” opportunity for success.

Why do life insurance companies care if I’ve been prescribed Focalin?

Life insurance companies “care” if an individual has been prescribed Focalin because, unlike many other “modern” medications, there really is only one reason why an individual might be prescribed Focalin, which is because they have been diagnosed with ADHD.

So, once an insurance underwriter sees Focalin on one’s prescription record, they can reasonably assume that you have been diagnosed with ADHD. Additionally, knowing when you were prescribed Focalin and how long you have been taking it can also give them some “concrete” data about how you are treating your disorder and how well you adhere to your treatment program.

But…

As we said before, trying to determine how “severe” or “mild” an individual’s case may be can oftentimes be quite difficult, which is why you’re likely going to be asked quite a few questions about your ADHD before an insurance company will be willing to approve your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked can and often will include the following:

- When were you first diagnosed with Attention Deficit Hyperactivity Disorder (ADHD)?

- Who diagnosed your ADHD? A general practitioner or a psychiatrist?

- When were you first prescribed Focalin?

- Is Focalin the only medication that you take to help you manage your ADHD?

- In the past 12 months, have any of your prescription medications changed in any way?

- Do you have any history of drug or alcohol abuse?

- Do you actively participate in any hazardous or dangerous hobbies?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have any issues with your driving record, such as multiple moving violations, a DUI, or a suspended license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

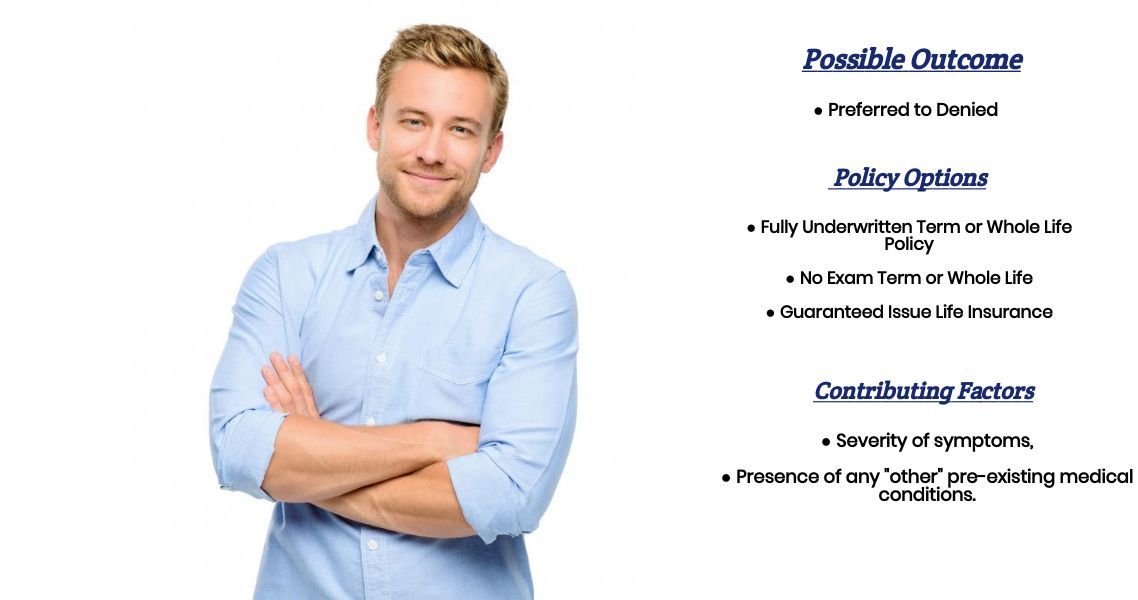

What rate (or price) can I qualify for?

Now, with the answers to these questions in hand, we’ll usually have enough information to have a pretty good idea of what “kind” of life insurance you’ll be able to qualify for, as well as what kind of “rate” you may be eligible for.

Generally, what we have found is that if your ADHD isn’t really “affecting” the overall qualify of your life and you don’t have any issues with the law, the DMV, or substance abuse, your ADHD really shouldn’t affect the outcome of your life insurance application all that much. While it may prevent you from being able to qualify for a Preferred Plus, we have to be honest with you; not all that many folks can qualify for a Preferred Plus anyway.

Where things can get…

Complicated is when an individual has been diagnosed with ADHD and does have issues with their driving record, has been convicted of a felony or misdemeanor in the past, or does seem to have a difficult time maintaining steady employment. In cases like these, where one’s ADHD might be viewed as playing a contributing factor in an applicant’s “troublesome” past, some life insurance companies will certainly use this to either “discriminate” against an applicant and force them to pay a higher rate for their insurance or could simply decide to deny one coverage entirely!

This brings us to the last topic that we wanted to take a moment and discuss with you today, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance profession who will work as an advocate for you. Such an agent who can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now does it?

Lastly, you’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”

Now, will we be able to help out everyone who has been prescribed Focalin?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well. This way if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, just give us a call!