In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Flomax or its generic form, Tamsulosin, to help treat an enlarged prostate (benign prostatic hyperplasia).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Flomax?

- Why do life insurance companies care if I’ve been prescribed Flomax?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Flomax?

Yes, individuals who have been prescribed Flomax can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred Plus rate! That said, however, most prostate cancer. are going to want to ask an applicant about their Flomax prescription prior to approving them for an insurance policy just so that they can fully understand why Flomax has been prescribed and rule out any possibility that the individual may also be suffering from prostate cancer.

Why do life insurance companies care if I’ve been prescribed Flomax?

In general, what we here at IBUSA have found to be true is that most life insurance companies aren’t all that interested in the fact that an individual has been prescribed Flomax beyond the fact that since it is used to help treat those who have been diagnosed with an enlarged prostate.

This is why even though Flomax is not a medication that is necessarily going to have an effect on the outcome of an individual’s life insurance application, it will be something that will likely be asked about so that a life insurance underwriter can be certain that there isn’t any risk of insuring someone who is currently undergoing prostate cancer treatment.

To make sure…

That this isn’t the case, most (if not all) life insurance companies will ask applicants a series of questions designed to learn about one’s Flomax prescription and, more specifically, if there is any reason to worry about the possibility of prostate cancer also being a risk.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll be asked about your Propecia prescription will likely include:

- When were you first prescribed Flomax?

- Who prescribed your Flomax? A general practitioner or a specialist?

- Why have you been prescribed Flomax?

- Was it to help treat an enlarged prostate?

- If so, have you had a PSA test performed? If so, what was the score?

- Have you been diagnosed with any serious pre-existing medical conditions?

- Are you currently taking any other prescription medications in addition to Flomax?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

- Was it to help treat an enlarged prostate?

What rate (or price) can I qualify for?

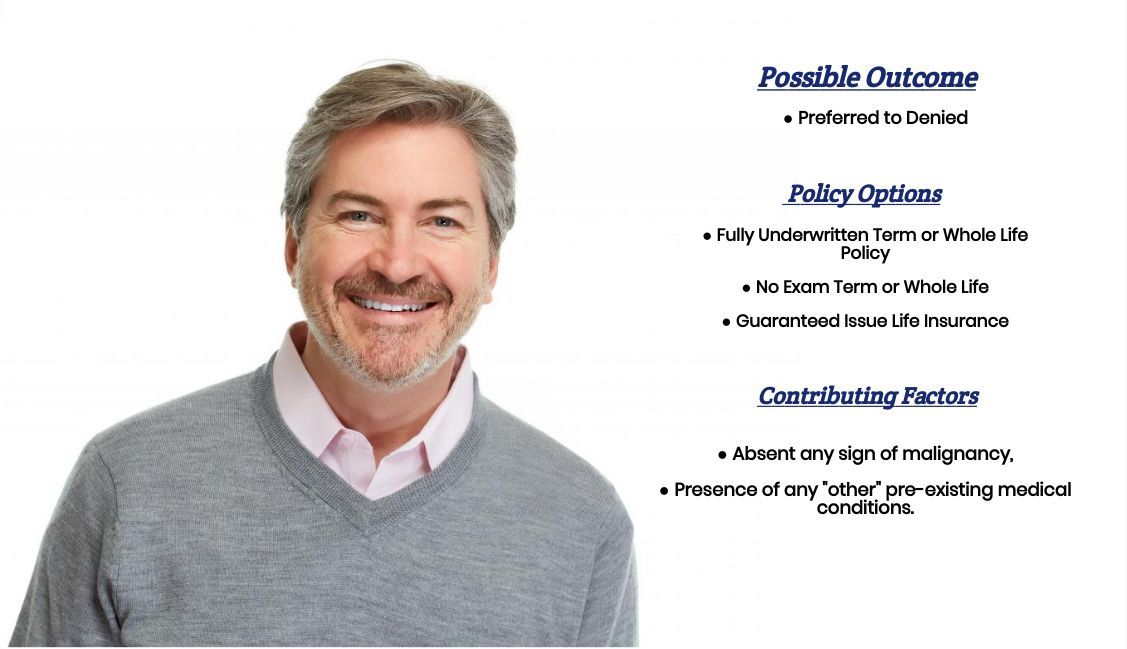

What we have found to hold true is that for the most part, if one is simply using their Flomax to treat an enlarged prostate. There isn’t any sign of an individual also suffering from prostate cancer, what you’re going to find is that having been prescribed Flomax isn’t going to affect the outcome of one’s life insurance application.

Or, to put it another way…

The “rate” that an individual would have been able to qualify for PRIOR to being prescribed Flomax should be the same rate that an individual would be able to qualify for AFTER being prescribed Flomax.

“Which is a good thing!”

But don’t let the fact that having been prescribed Flomax isn’t going to affect the outcome of your life insurance application lead you to believe that there aren’t a whole lot of other factors that could potentially affect the “rate” that you might be able to qualify for.

Factors such as your:

- Family medical history,

- Driving record,

- Travel plans,

- Hobbies,

- Etc, etc…

This is why we wanted to take a moment and discuss what you can do to help you find the “best” life insurance policy that you can qualify for.

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients are able to find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see, by only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBUSA truly do offer a one-stop shop for folks looking to protect their family.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So what are you waiting for? Give us a call today, and let us earn the right to protect your family today!